In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/18 Report--

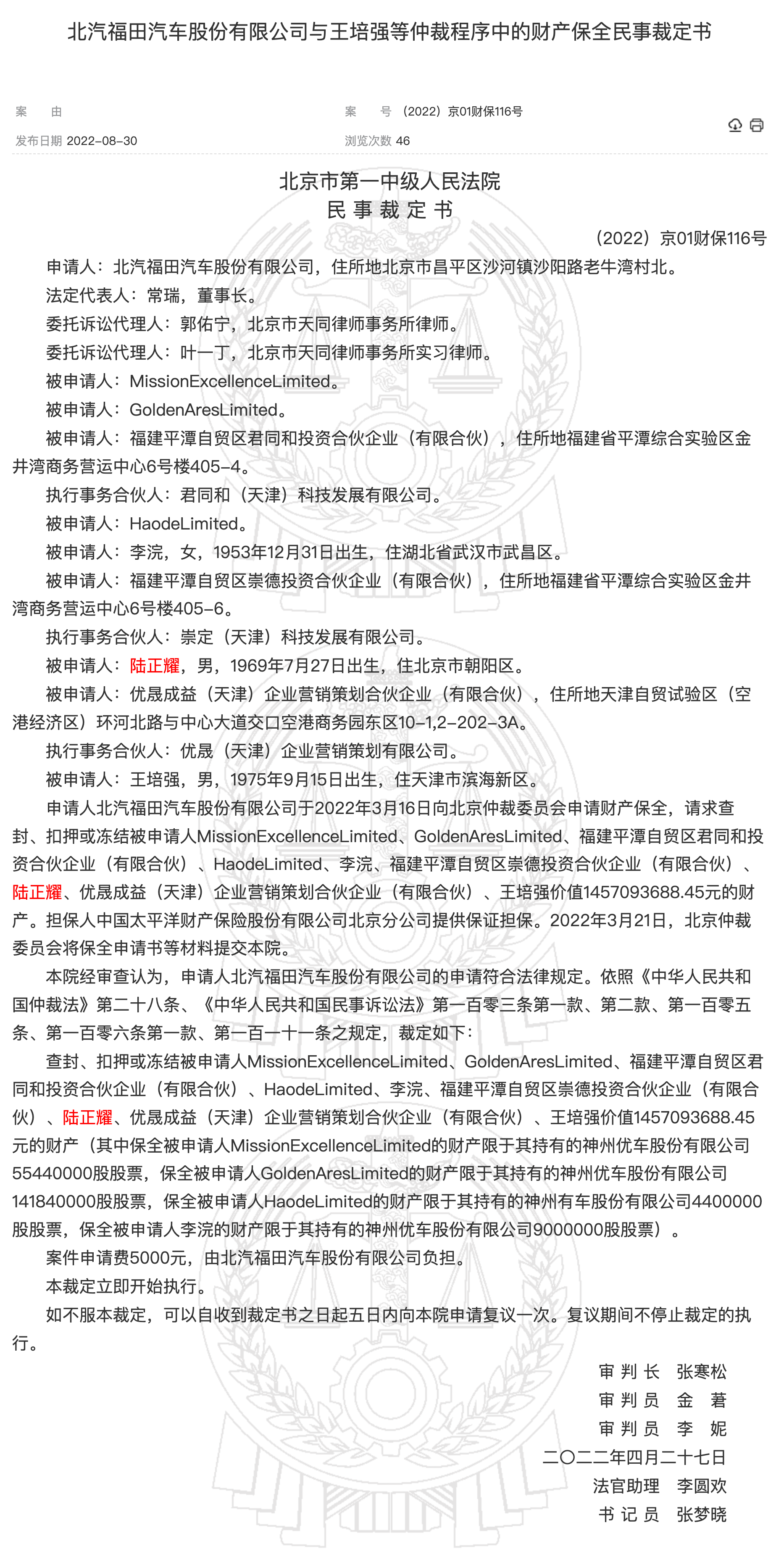

BAIC Foton Motor Co., Ltd. (hereinafter referred to as "BAIC Foton") has applied to freeze 1.4 billion of assets such as Lu Zhengyao, according to the China referee Writing website. According to the judgment documents, the applicant BAIC Foton Motor Co., Ltd. applied for property preservation with the Beijing Arbitration Commission. Request to seal up, detain or freeze the property of the respondent MissionExcellenceLimited, GoldenAresLimited, Fujian Pingtan free trade zone Juntong and investment partnership (limited partnership), HaodeLimited, Li, Fujian Pingtan free trade zone Chongde investment partnership (limited partnership), Lu Zhengyao, Yousheng Chengyi (Tianjin) enterprise marketing planning partnership (limited partnership), Wang so-and-so worth more than 1.4 billion yuan. The court examined and found that the application was in line with the provisions of the law and ruled that it would be enforced. Among them, the property of the applicant MissionExcellenceLimited, GoldenAresLimited, HaodeLimited and Li is limited to the shares of Shenzhou Youche Co., Ltd.

Data show that Lu Zhengyao was born in Pingnan County, Ningde City, Fujian Province in July 1969. he was chairman of Luckin Coffee, and is now chairman and CEO of Shenzhou Youche, and is now chairman of Beijing Baowo Automobile Co., Ltd. BAIC Futian applied to freeze Lu Zhengyao's assets precisely because of Baowo.

With a hundred-year history, Bowo was founded by German engineer Karl Bowo in 1919 and belongs to German luxury brand. Its product line gradually covers cars, sports cars, buses, fire engines, boats, trucks, and even tanks and helicopters. In the first few decades, Bowo developed quite well, and at its peak it was the third largest carmaker in Germany. However, the good times did not last long. In 1963, Bowo declared bankruptcy due to poor management and lay flat for more than half a century until the emergence of BAIC Futian.

BAIC Foton, founded on August 28, 1996, is a well-known commercial vehicle brand in China, producing a full range of commercial vehicles and heavy machinery, such as light trucks, medium and heavy trucks, light buses and medium and large buses. According to the data, BAIC Foton sold a total of 620300 automobile products in 2013, an increase of 7.15% over the same period last year. It has been ranked first in the domestic commercial vehicle market for many years, with a market share of 16.2%.

Although BAIC Foton has achieved the first place in the industry, it has not cultivated much brand awareness in the passenger car market, so it hopes to try to expand the original business with the help of Baowo. In 2014, BAIC Foton bought and revived the brand from Bowo owner BorgwardAG for 5 million euros, and established Beijing Baowo Automobile Co., Ltd. in January 2016. BAIC Foton hopes to continue the German luxury car image of Bowo in the hearts of consumers, not only claiming that Bowo is headquartered in Stuttgart, Germany, and establishing three major R & D centers in the world, but also with slogans such as "German Bowo, derived from 1919" and "New pattern of China's luxury car market: BBBA (Mercedes-Benz, BMW, BMW, Audi)", aiming at the high-end market.

BAIC Foton's marketing brought immediate results. Bowo's first car, the Bowo BX, sold 6000 cars in July, but the effect did not last long. According to the financial report, the net losses of Beijing Baowo from 2016 to 2018 were 484 million yuan, 985 million yuan and 2.54 billion yuan respectively, with a cumulative loss of 4.014 billion yuan over three years. In May 2018, Foton issued a "three-year Action Plan", determined to spin off the loss-making passenger vehicle business and focus on the main business of commercial vehicles.

In BAIC Futian's eyes, Baowo has become a "hot taro", but in Lu Zhengyao's eyes, Baowo is a key pawn to complete the Shenzhou automobile ecological industry chain. In the year when BAIC Foton acquired Bowo, China car Rental became the first listed company in China. The following year, Lu Zhengyao seized the business opportunity to set up a Shenzhou chauffeured car, and then packed it into a Shenzhou excellent car to be listed on the new third board. At this point, the automobile territory of the Department of China has revealed its embryonic form.

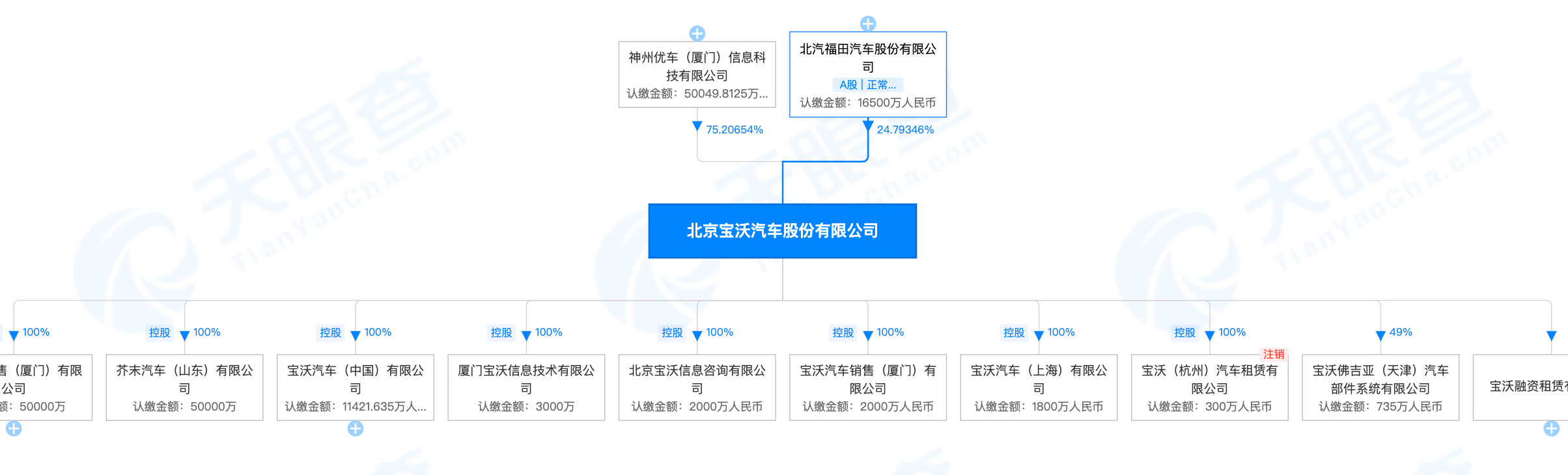

In October 2018, BAIC Foton listed the transfer of 67 per cent of Beijing Baowo to a company called Changsheng Xingye, which needs to repay 4.271 billion yuan in shareholder loans owed to Foton Motor in instalments within three years from the date of completion of the equity transfer. Tianyan survey shows that Changsheng Xingye was founded on December 3, 2018. In fact, the accuser is Wang Baiyin, a classmate of Lu Zhengyao when he was a graduate student at the National Development Institute of Peking University. In March 2019, Shenzhou Youche was granted a 67 per cent stake in Beijing Baowo held by Sheng Xingye, which was transferred at a price of about 4.11 billion yuan. After the completion of the transaction, Shenzhou Youche directly became the largest shareholder in Beijing Baowo.

After the acquisition of Baowo, Lu Zhengyao hopes to copy Luckin Coffee's model. Under his leadership, Bowo not only launched the activity of "drinking luckin to win Bowo" with Luckin Coffee, but also imitated Luckin Coffee's advertising model and put forward the slogan "good is expensive is good". However, since it was acquired by the China Department, Bowo has not launched a new model, and its sales basically rely on internal digestion.

In April 2020, Luckin Coffee was exposed to financial fraud. For a time, the share price of the Department of China plummeted, funds became increasingly tight, and Baowo once again became a "hot taro." In January 2021, BAIC Foton issued an announcement that by the end of 2020, the company still had 671 million yuan (including interest) in the final payment for the transfer of Bowo automobile equity.

Since then, BAIC Foton successively sued Baowo, Shenzhou Youche, and Changsheng Xingye, and repeatedly applied to seize, detain, or freeze property worth nearly 2 billion yuan of Shenzhou Youche, but as the operating situation of Bowo Automobile deteriorated, Futian Automobile had to accept the bitter fruit of a large amount of impairment. In April 2022, BAIC Foton released its annual report showing a net loss of 5.06 billion yuan in 2021, down 3372.75% from the same period last year. BAIC Futian said that the loss in 2021 is mainly due to the impairment of Baowo related matters, which affects the total profit estimated to be-4.656 billion yuan. In addition, it is also considered that the total profit of listed companies is expected to be-5.291 billion yuan due to the total investment income recognized by the company's shareholding in Beijing Baowo. Among the major holding companies, Beijing Baowo is the only company with a net loss of 2.157 billion yuan and net assets of-2.297 billion yuan.

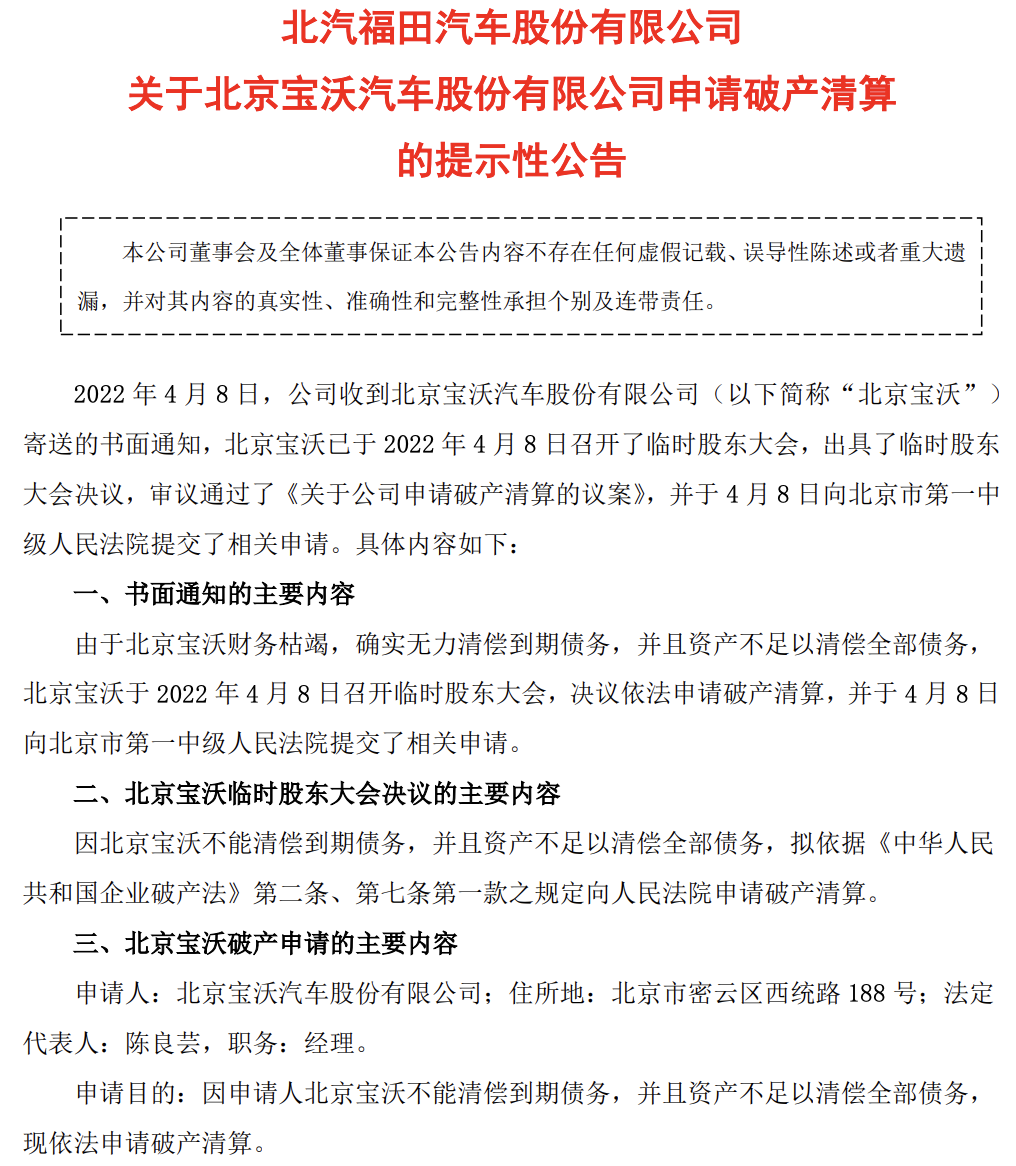

On April 8, due to the financial exhaustion of Beijing Baowo, it was indeed unable to pay off its maturing debts, and its assets were not sufficient to pay off all its debts. Beijing Baowo held an interim shareholders' meeting on April 8, 2022 and decided to file for bankruptcy liquidation in accordance with the law. On April 22, because Beijing Baowo was unable to pay off its maturing debts, and the audit report showed that its assets were insufficient to pay all its liabilities, Beijing Baowo was a qualified bankruptcy subject and already had a reason for bankruptcy, so Beijing Baowo's application for bankruptcy liquidation should be accepted by the Beijing No. 1 Intermediate people's Court.

Compared with Baowo, which is in deep trouble, Luckin Coffee, who completed the delivery with Lu Zhengyao, is a different phenomenon. On April 11, Luckin Coffee announced the completion of debt restructuring and formally ended the bankruptcy protection procedure as a debtor. Luckin Coffee released financial data on Aug. 8 that the total net income of Q2 in 2022 was 3.2987 billion yuan, an increase of 72.4% over the same period last year. By the end of the second quarter, the number of Luckin Coffee stores was 7195, including 4968 self-owned stores and 2227 associated stores.

As for Lu Zhengyao, he is also constantly trying to find his magic in the capital market. It is reported that Lu Zhengyao may return to the coffee industry and is preparing a new coffee brand Cotti Coffee (Kudi Coffee). According to the Beijing News, the Coffee team from Luckin Coffee, China Rental car and China chauffeured car provides not only coffee, but also baked products, light meals, drinks and so on, which is the biggest difference from Luckin Coffee. As for Bowo, it is still in bankruptcy liquidation proceedings, and whether it will be liquidated or not has yet to be announced by the court.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.