In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/20 Report--

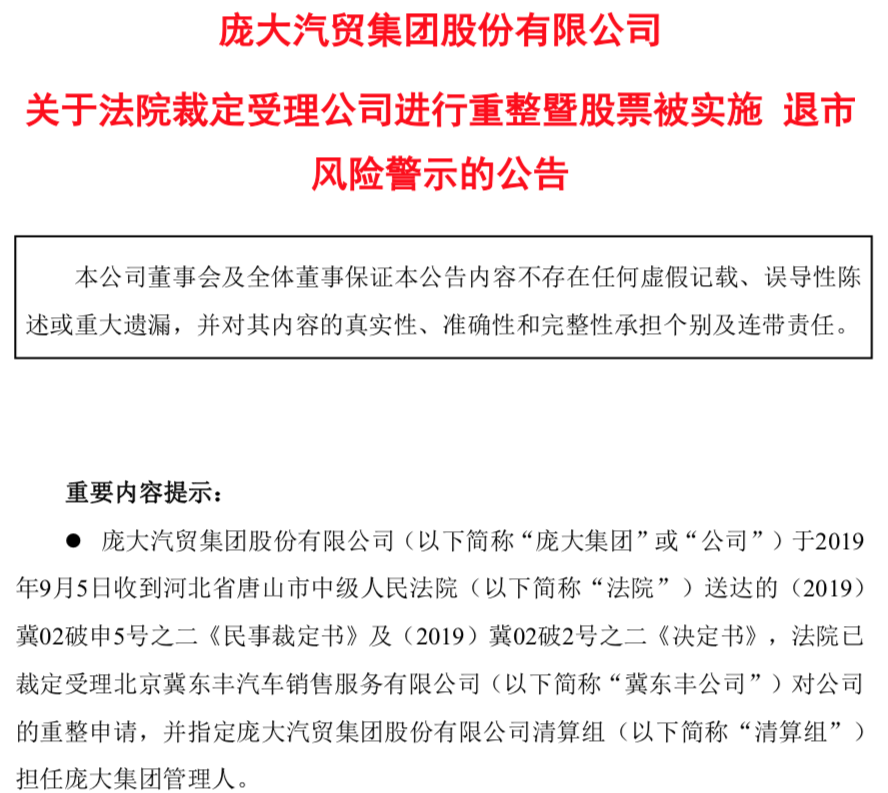

On September 5, 2019, the giant group, once known as the "largest car dealer in China", issued two announcements, pointing out that the court had ruled to accept the reorganization application of the giant group and would implement the delisting risk warning. Subsequently, the huge group carried out restructuring. Pang Qinghua, the founder and former controlling shareholder of the company, sold shares to the three restructuring parties, and Huang Jihong became the new actual controller of the listed company.

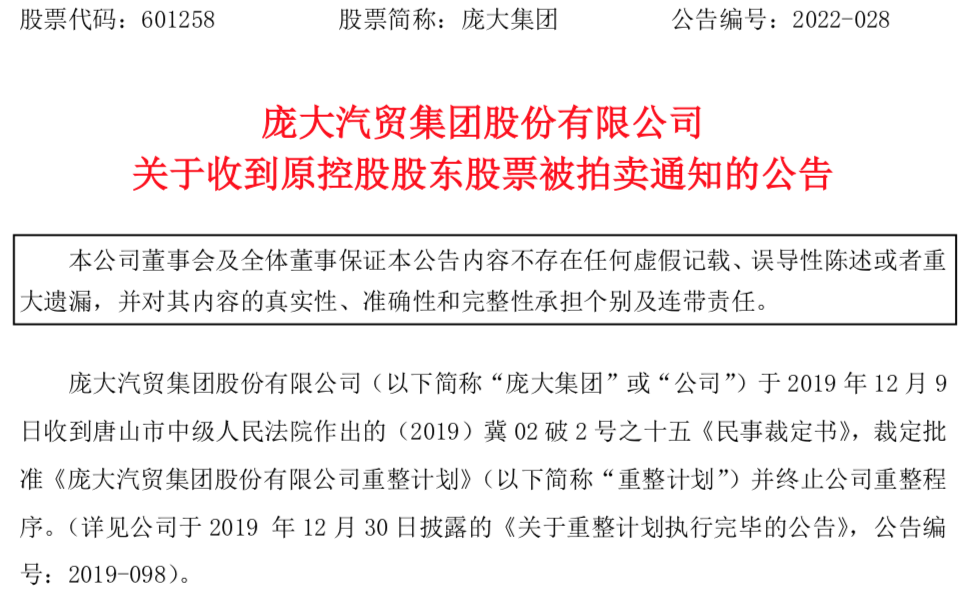

Today, it has been more than two years since the restructuring of the huge group, but its development is still not smooth. On September 2, a "notice that the giant group received the notice of the auction of the shares of the original controlling shareholder" brought the giant group back to public view. According to the announcement, 253 million shares of the huge group held by Pang Qinghua, the former controlling shareholder, will be put up for judicial auction, and the first online judicial auction will be held on Taobao from 10: 00 a.m. to 10: 00 a.m. on September 26th. If the auction is successful, it means that Pang Qinghua or the top 10 shareholders will officially withdraw.

Less than a month later, there were media reports that there had been cracks in the relationship between Pang Qinghua, the founder of the giant group, and Huang Jihong, the current chairman of the company, and that Pang Qinghua had filed a lawsuit in court because the reorganization party had failed to deliver on its previous promises. According to China Business report, a "indictment" signed by Pang Qinghua shows that Pang Qinghua has submitted a complaint to the people's Court of Luanzhou City, Hebei Province, and will sue Huang Jihong, the restructuring party.

According to the above-mentioned "indictment", on April 9, 2019, Pang Qinghua (plaintiff) and Yuanwei assets signed the Cooperation Agreement on the reorganization of Giant Group, numbered PDJT-CZ-201904-01, which includes a joint reorganization composed of Yuanwei assets and financial investors / strategic partners. Financial investors or strategic partners refer to the investors or partners introduced by the restructuring party, including but not limited to national transport capacity, who intend to participate in the reorganization process of large groups, including Shenzhen Merchant Group and national transport capacity.

On April 9, 2019, Pang Qinghua and Yuanwei assets signed a "supplementary agreement". Yuanwei assets agreed to give Pang Qinghua a compensation of RMB 200 million, and the payment time node was within 10 days after the transfer of ownership of the underlying stock agreed in the reorganization Cooperation Agreement. Yuanwei assets or its designated third direction Pang Qinghua pays RMB 50 million If the secondary market price of a listed company reaches more than 4 yuan per share in the future, Pang Qinghua can ask Yuanwei assets to pay him 150 million yuan when the secondary market closing price reaches 4 yuan per share for three consecutive days.

After the signing of the above-mentioned "reorganization Cooperation Agreement" and the "Supplementary Agreement", Pang Qinghua, in accordance with the agreement, cooperated with the restructuring party to promote the bankruptcy restructuring of the huge group. On September 5, 2019, the Tangshan Intermediate people's Law ruled to accept the bankruptcy reorganization case of the giant group, and designated the liquidation team of the giant group as the giant administrator. On September 11, 2019, Yuanwei assets, Shenzhen Merchant Group and National Transport capacity issued a "letter of confirmation". In order to ensure the smooth progress of the reorganization process of the huge Group, the parties guarantee that the effectiveness of the above-mentioned "reorganization Cooperation Agreement", "Supplementary Agreement" and "share transfer Agreement" will not be affected, and the parties confirm that it will be implemented in accordance with the "reorganization Cooperation Agreement", "Supplementary Agreement" and "share transfer Agreement". On September 15, 2019, the manager identified Yuanwei assets, Shenzhen Merchant Group and national transport capacity to form a consortium as the intended investor for the restructuring of the huge group. On December 30, 2019, the Tangshan Intermediate people's Court issued a civil order of (2019) Ji 02 and No. 2, confirming that the implementation of the huge group reorganization plan has been completed.

With regard to the three agreements of the reorganization Cooperation Agreement, the Supplementary Agreement and the letter of confirmation, Pang Qinghua, founder of the giant group, pointed out that the above three agreements are legally binding and should be implemented by all parties. A person familiar with the matter said: "originally, the above-mentioned 'reorganization Cooperation Agreement' and 'Supplementary Agreement' were signed with Pang Qinghua by Yuanwei assets, which is one of the parties to the reorganization, but the above" confirmation letter "shows that Shenzhen Shang Shang Group and National Transport capacity also have responsibility for ensuring the implementation of the agreement. And Huang Jihong, of Shenzhen Merchant Group and national transport capacity, serves as the actual controller of the listed company. Therefore, Pang Qinghua's lawsuit is mainly aimed at the two defendants, the Shenzhen Business Group and the national transport capacity. "

In addition, the indictment shows that "Pang Qinghua cooperated with the transfer of shares in accordance with the contract and fulfilled his contractual obligations; as a restructuring investor, the defendant, through the transfer of shares, has become the actual controller of a large group, enjoying the actual benefits brought about by the status of actual controller, but did not pay 50 million yuan to Pang Qinghua as agreed." Because Pang Qinghua has repeatedly proposed to the defendant to fulfill the obligation of paying RMB 50 million stipulated in the reorganization Cooperation Agreement and the Supplementary Agreement, but so far the defendant has not yet fulfilled it. The 200 million yuan cash compensation promised to Pang Qinghua by restructuring has not yet been completed.

Data show that Pang Qinghua is the founder of the giant group, which was earlier known as the "king of 4S stores" and one of the largest car dealers in China. The giant group was established in Tangshan in March 2003 with a registered capital of 413 million yuan. It was listed on the Shanghai Stock Exchange in April 2011, with a market capitalization of 36 billion yuan at the beginning of the listing, which was also the peak of the development of the giant group at that time, but then. The performance of the huge group also declined quickly due to poor management, and years of operating losses caused the giant car to miss the title of "king of 4S store". The huge group suffered from a shortage of liquidity in 2017 and fell directly into huge losses in 2019. Because it was insolvent, it was finally applied for restructuring by creditors. After that, the huge group carried out the restructuring. at that time, there were a total of three parties, namely, Shenzhen Shenshang holding Group Co., Ltd., Shenzhen Yuanwei Asset Management Co., Ltd., and Shenzhen National Transport Technology Group Co., Ltd., the founder of the huge group, Pang Qinghua, the former controlling shareholder, and his concerted actors sold their shares to the three restructuring parties, while Pang Qinghua surrendered the actual control of the company.

In November 2019, the above three restructurings submitted a "huge 2020-2022 Development Plan" to the Shanghai Stock Exchange, which detailed the development exhibition and business plans for the next three years after the restructuring and listing. Among them, the plan pointed out that in order to boost the large groups, the restructuring parties will focus on both "stock business" and "new business". The "stock business" includes the sales of 202500 vehicles by the giant group in 2020. Among them, there are 192900 passenger vehicles, 2530 commercial vehicles and 7080 new energy vehicles. 303700 vehicles were sold in 2021, including 289300 passenger vehicles, 3795 commercial vehicles and 10620 new energy vehicles. But the giant group's annual report data for 2020 and 2021 show that it sold 141007 vehicles in 2020 and 141359 in 2021, with two-year success rates of 70 per cent and 47 per cent, respectively, falling short of targets and not mentioning new energy vehicle data in two years.

In addition, the above three restructuring parties also promised in the restructuring plan to "adjust the business structure of large groups to ensure their sustainable profitability". Among them, the net profits attributed to the owners of the parent company in the three years from 2020 to 2022 are not less than 700 million yuan, 1.1 billion yuan, 1.7 billion yuan, or a total of 3.5 billion yuan over three years. However, the annual report of the giant group shows that the net profit of the giant group is 580 million yuan in 2020, 898 million yuan in 2021 and only 24.0462 million yuan in the first half of 2022. The above figures all fall short of the expected target. According to the huge group's total net profit of 3.5 billion yuan in three years, it means that the giant group will have to achieve a net profit of nearly 2 billion yuan in the second half of this year before it can fulfill its promise. According to statistics, since the listing, the net profit of the giant group has not exceeded 900 million yuan.

In fact, the early giant group itself had excellent "qualifications". At the beginning of listing, the market value of the giant group had reached 36 billion yuan, and by 2015 it even exceeded 50 billion yuan. As early as 2010, the giant group became the largest car dealer in China. According to statistics, in 2012, the giant group had 1429 operating outlets in 28 provinces, municipalities, autonomous regions and Mongolia, including 754 4S stores. But by 2021, the giant group had only 283 outlets left, and now its market capitalization has shrunk by nearly 80%.

As for Pang Qinghua, founder of the huge group, reports show that up to now, 253 million shares pledged to Guokai Securities (stock pledge repurchase) have been frozen and the transfer of ownership to the restructuring party has not been completed. At the same time, the person familiar with the matter said that Pang Qinghua had given all his equity to the restructuring party, which was supposed to resolve the debt corresponding to Pang Ming's 253 million stake and achieve the full transfer of the equity. "the restructuring party shall pay the amount of mortgage financing of Guokai securities, and it is a necessary obligation to make the shares freely transferred."

A person familiar with the huge group said: "at present, Pang Qinghua and Shenzhen Business Group, national transport capacity are still fighting jurisdiction objections, the lawsuit has not yet been heard." As of press time, the giant group founder Pang Qinghua against the restructuring party of the above lawsuit, the giant group and the current company chairman Huang Jihong did not respond.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.