In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/26 Report--

On September 25th, Xiaopeng announced that its controlling shareholder, Simplicity Holding Limited, had purchased a total of 2.2 million American depositary shares on the open market on September 23, 2022, at an average price of $13.58 per American depositary share. SimplicityHolding is wholly owned by he Xiaopeng, founder and chairman of Xiaopeng Motor. After the acquisition, he Xiaopeng held about 327 million Class B common shares and 2.2 million American depositary shares, as well as interests in 21 million Class B common shares held by Respect Holding, equivalent to about 20.5 per cent of the total issued share capital of the company at the date of the announcement, Xiaopeng said.

In response to he Xiaopeng's investment increase, Xiaopeng's board of directors said: the acquisition shows that he Xiaopeng is full of confidence in the company's prospects and growth potential, as well as his long-term commitment to the company.

Or affected by the news, Xiaopeng Motor Hong Kong shares closed today at 56 Hong Kong dollars per share, up 8.74%, with a total market capitalization of HK $96.42 billion. The trend of US stocks was flat, and as of press time, it was last reported at US $13.71 per share, down 0.03%. According to relevant data, Xiaopeng's Hong Kong stock price has fallen for several months this year, with the largest drop of more than 62%, with the lowest share price reaching 51 Hong Kong dollars per share. In the US stock market, referring to yesterday's closing data, Xiaopeng's US shares closed at 13.74 US dollars per share on September 25, down about 73% from this year's high of 50.33 US dollars per share.

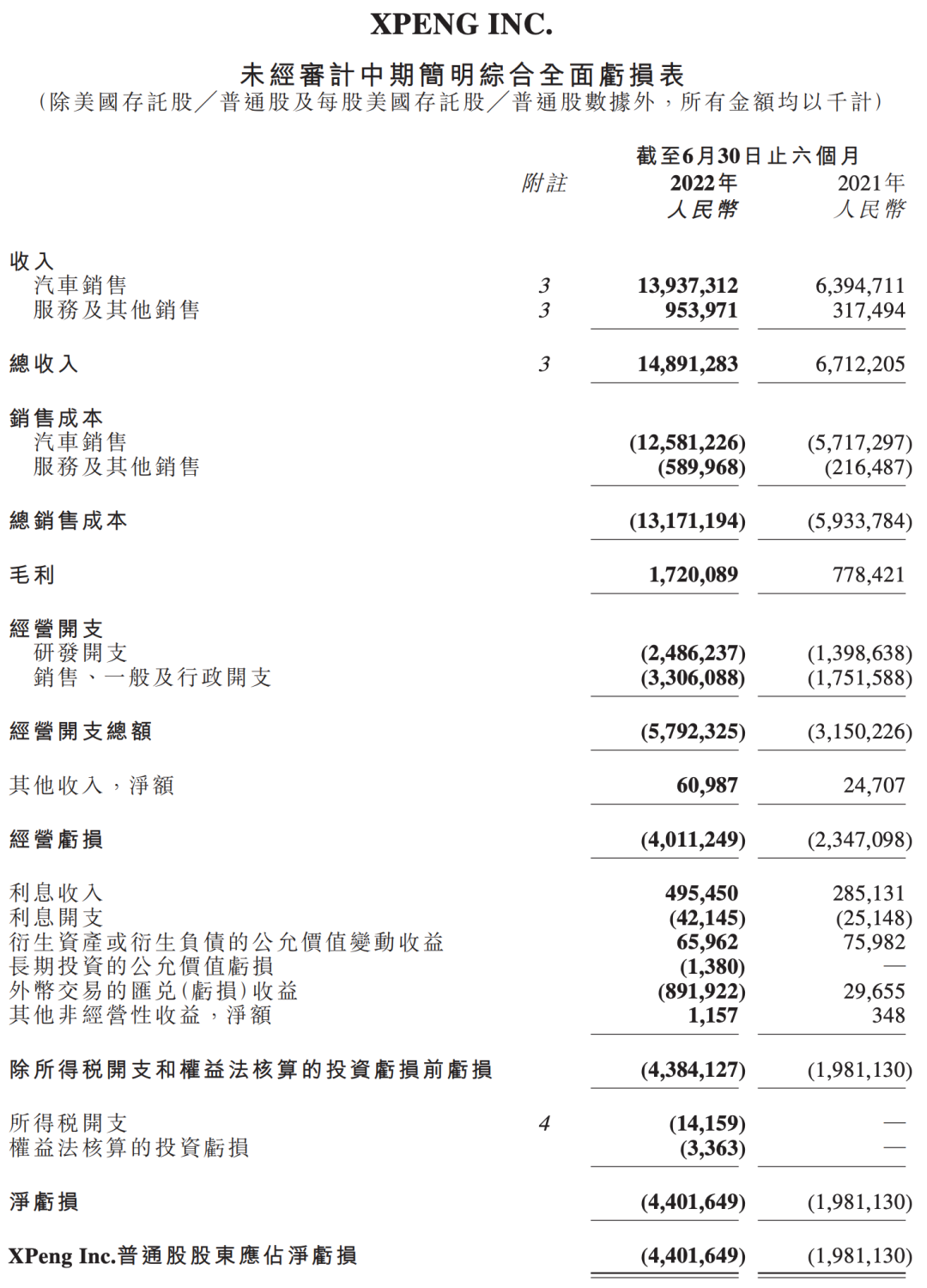

It is worth mentioning that the recent poor performance of Xiaopeng in the secondary market may be related to the weak consumer demand, financial data and epidemic situation. On August 23, Xiaopeng released its results for the second quarter and the first half of the year. According to the report, Xiaopeng's total income in the first half of the year was 14.89 billion yuan, an increase of 121.9% over the same period last year, of which car sales were 13.94 billion yuan, up 118.0% from the same period last year. The net loss in the first half was 4.4 billion yuan, up 122.2% from the same period last year. As of June 30, Xiaopeng Motor cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were 41.34 billion yuan.

This performance report is also the largest loss for half a year since Xiaopeng went public. According to earlier data, Xiaopeng's net loss was 2.08 billion yuan in 2020 and 1.98 billion yuan in 2021. Xiaopeng's net loss in the first half of 2022 reached 4.4 billion yuan, more than double the net loss in 2021. Affected by the news, Xiaopeng's US shares fell 10.81% on the same day to close at $18.73, with a total market capitalization of 16.121 billion yuan.

Earlier, in order to boost sales, Xiaopeng launched a promotion in July. According to many car owners, Xiaopeng Automobile carries out terminal discount activities, the final payment can be reduced from 5000 yuan to 10000 yuan, and some models also offer optional rights and interests of 3000 yuan to 10000 yuan. In addition, a number of offline sales staff of Xiaopeng revealed to the media that the discount activities in Xiaopeng offline stores continued from mid-July to mid-August, with the exception of the P7 Peng wing version, almost all the main models have cash discounts, with a direct discount of 5000 yuan to 10,000 yuan in the form of the final payment. In terms of optional rights and interests, the optional points of up to 10,000 yuan (1 integral = 1 yuan) can be given away, and the cash price reduction and the optional rights and interests can be discounted up to 20,000 yuan.

Of course, the purpose of the promotion is to boost sales. According to Xiaopeng's earlier sales plan, Xiaopeng said its sales target for 2022 is to ensure that full-year sales hit 300000. This figure also means that Xiaopeng will have to achieve an average monthly sales of more than 20,000 vehicles this year in order to meet its target. From the point of view of Xiaopeng's sales in the first half of the year, only 28% of the task has been completed. for Xiaopeng, if you want to achieve the sales target, you have to exchange price for volume. According to relevant data, Xiaopeng delivered 9578 cars in August and 11524 in July.

For Xiaopeng, the most important thing to boost sales is the launch of the new model G9. The Xiaopeng G9 was officially launched on September 21, with a total of 6 models with a price range of 30.99-469900 yuan. However, after the listing of the Xiaopeng G9, it was publicly unsubscribed by many car owners. Xiaopeng had to adjust the price and configuration of the newly listed Xiaopeng G9 on September 23.

In this regard, Xiaopeng said that there are many users feedback that the product portfolio is too complex, and the choice of high cost, can not choose the desired model. It is understood that the Xiaopeng G9 is currently the model with the highest average price of the Xiaopeng car brand, shouldering the important task of raising gross profit margin. Previously, he Xiaopeng said in the second quarter of this year's earnings call that the Xiaopeng G9 will not only help Xiaopeng achieve rapid sales growth, but also help the company's gross profit margin increase. "with the introduction of the G9 and subsequent new platforms and new models, we will structurally improve the gross margin of our models. Our medium-and long-term goal is to increase the company's overall gross profit margin to more than 25%. "

Judging from the various actions of Xiaopeng Automobile at present, it is nothing more than to increase sales and increase the gross profit margin of vehicles. This time, the founder of Xiaopeng invested to increase the holdings, for the secondary market, it does play a positive role. However, whether the follow-up can be maintained or not, it is still possible to deliver gross profit margin.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.