In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/29 Report--

After Xiaopeng, ideal and NIO, Zero cars successfully listed in Hong Kong. On September 29th, Zero was officially listed for trading on the Hong Kong Stock Exchange under the symbol "9863". The final offering price of IPO was set at HK $48 per share, which was broken at the beginning of trading, opening lower at 14.58%. After the opening, the share price continued to fall, falling more than 30% at one point to as low as HK $32.80.

Data show that Zero Automobile was established in December 2015, jointly invested by Zhejiang Dahua Technology Co., Ltd. and its main founders. It is a new energy automobile company focusing on the R & D, design, production and sales of new energy vehicles and auto parts and accessories. At present, Zero has four models on sale: zero running S01, Zero running T03, Zero running C11 and Zero running C01. A total of 76563 new cars were delivered from January to August in 2022, including 44769 T03 and 31174 C11.

This is not a proud figure, because compared with Wei Xiaoli, the majority of zero-running car sales rely on the low-end zero-running T03. It is understood that the Zero run S01 is the first production car launched by Zero running. It was officially launched in January 2019, and the current price is 11.99-150900 yuan. Zero run S01 is not a mature product, official publicity includes low-speed follow, lane maintenance and other functions, but the actual delivery does not carry the relevant functions, resulting in complaints and complaints. After missing the opportunity, the zero-running car quickly launched the second model, the zero-running T03, in May 2010. the current price is 7.95-96500 yuan. This mini electric car has brought good sales performance to zero running. Data show that the zero run T03 delivered 40245 vehicles in 2021, accounting for 92% of the total delivery.

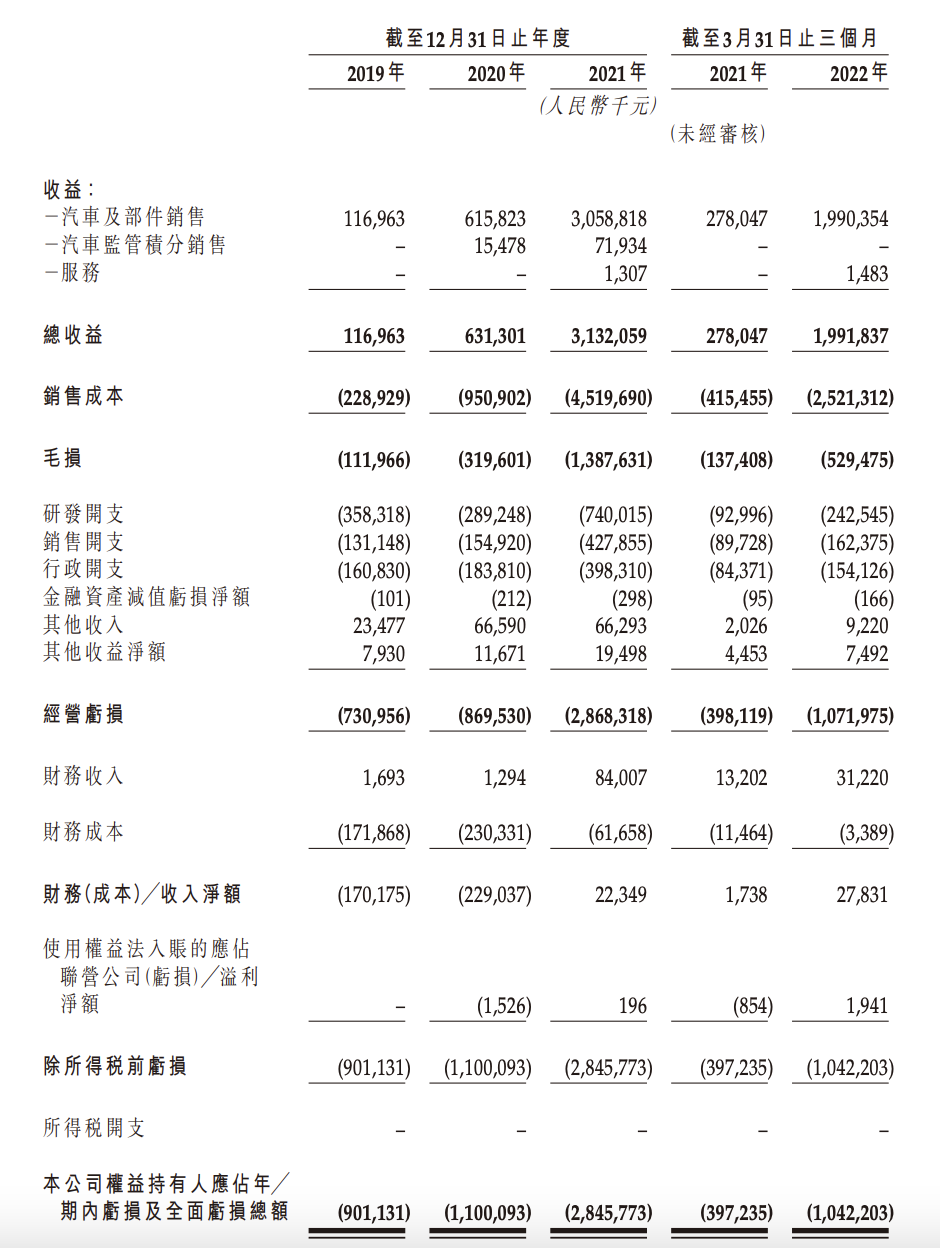

Although it is in the limelight in the new forces, compared with Wei Xiaoli, Zero is still far behind in terms of revenue scale, profitability and R & D investment. The financial report shows that from 2019 to 2021, zero-running cars achieved 117 million, 631 million and 3.132 billion revenue respectively, although the growth momentum is obvious, but it has not yet reached the same order of magnitude as Wei Xiaoli. In terms of gross profit margin, although Wei Xiaoli has not got rid of losses, the gross profit margin has become positive, while the gross profit margins of zero-running cars from 2019 to 2021 are-95.7%,-50.6% and-44.3%, respectively. In addition, in terms of current reserves, as at March 31, 2022, the cash reserves of zero running is 5.2 billion yuan, NIO is 53.3 billion yuan, ideal is 51.2 billion yuan, and Xiaopeng is 36.2 billion yuan. I have to admit that the lack of money is one of the reasons why Zero is eager to go public.

According to the prospectus, the operating losses of Zero Motor from 2019 to 2021 are 730 million yuan, 869 million yuan and 2.868 billion yuan respectively, and the losses attributable to equity holders are about 901 million yuan, 1.1 billion yuan and 2.846 billion yuan respectively, with a total loss of 4.374 billion yuan in three years. Zero said the company expects to continue to incur a net loss in 2022 due to research and development of new models and smart electric vehicle technology, as well as the expansion of production facilities and sales network.

In order to promote brand positioning, Zero Motor launched a new model Zero C01 on Sept. 28, with a subsidised price range of 19.38-286800 yuan for medium and large pure electric cars. In terms of power, the Zero C01 will provide options for single-motor rear drive and dual-motor four-wheel drive, with maximum power of 200kw and peak torque of 360N ·m for rear-drive version; and two same specification drive motors for all-wheel drive version with maximum power 400kw and peak torque of 720N ·m. In terms of mileage, Zero C01 offers four mileage options, rear-drive models 525km, 606km, 717km, and all-wheel drive models 630km.

From the perspective of vehicle positioning, Zero C01 will compete with Biadihan EV (26.98-329800 yuan) and Polar Fox Alpha S (22.38-293300 yuan). Each of the three models has its own characteristics, and BYD will have a certain advantage in brand power. Polar Fox is equipped with Huawei engine system, which has a high "content", while the Zero run C01 has an integrated structure of CTC battery chassis. In terms of price, Zero run C01 will compete with well-known models such as BYD Seal (RMB 20.98-286800), Changan Deep Blue SL03 (RMB18.39-215900), Nezha S (RMB 19.98-338800) and Xiaopeng P7 (RMB 23.99-429900). However, from a comprehensive point of view of price and positioning, zero run C01 is more cost-effective.

Financing and listing has become a ticket for car-building enterprises in the second half, and zero-running cars want to ease the financial pressure through IPO, which is also inevitable. However, although the new energy vehicle market is still hot, the market sentiment will gradually calm down. In addition, there is no shortage of car brands in the auto market, and if zero runs are not competitive enough, it must not be easy to get financial support from the market. It is understood that the Zero car IPO is relatively bleak, in the public offering stage, only about 0.16 times subscribed.

According to a recent research report by Anxin International, compared with the results of Zero, Xiaopeng, ideal and NIO in the first quarter of 2022, the income scale, profitability, R & D investment and bicycle income of zero-running cars are far lower than those of their peers. "so we think that the valuation of zero-running cars should be lower than the industry average."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.