In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/04 Report--

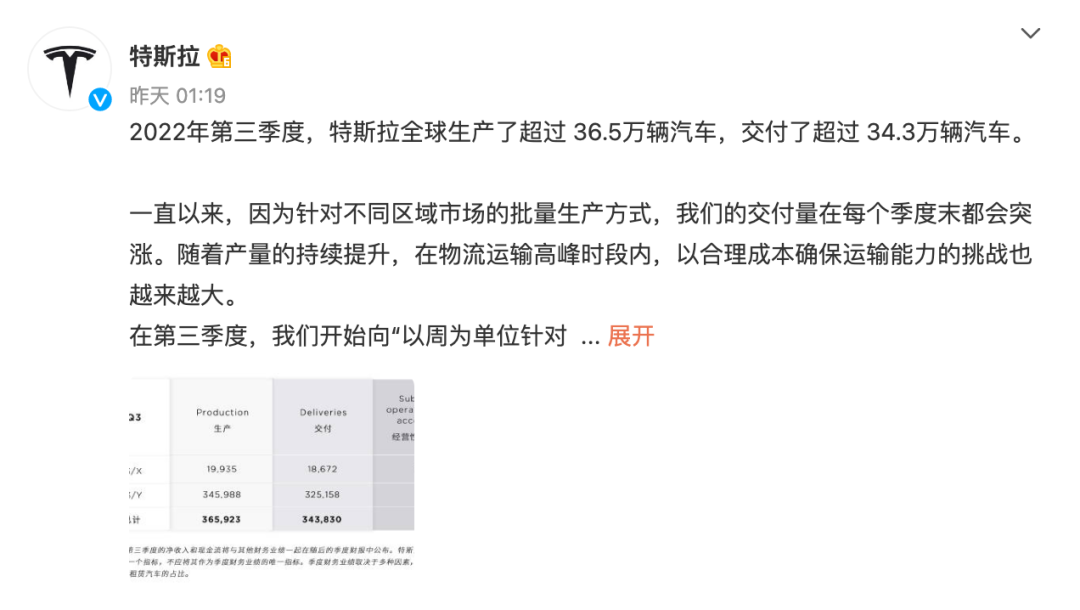

On October 3, Tesla officially released automobile production and sales figures for the third quarter. Data show that Tesla produced 365923 cars and delivered 343830 cars worldwide in the third quarter of 2022. Among them, Tesla's delivery volume of MODEL 3amp Y in the third quarter was 325158 vehicles, with production of 345988 vehicles. In the third quarter, MODEL Sramp X delivered 18672 vehicles and produced 19935 vehicles.

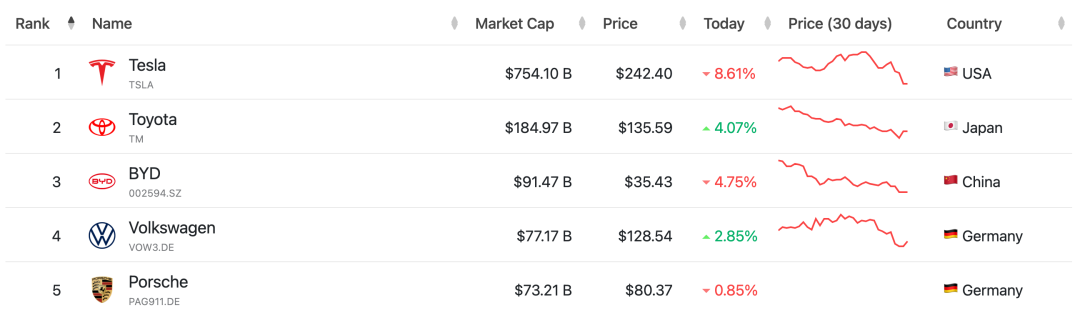

Or the delivery volume in the third quarter was lower than expected, and against the backdrop of the collective surge in the Nasdaq, Dow Jones and S & P indexes, Tesla's share price fell 8.61% to close at $242.4, with a total market capitalization down about $71.5 billion (about 508 billion yuan).

As for the lower-than-expected delivery volume in the third quarter, Tesla said that Tesla's delivery volume has soared at the end of each quarter because of the mode of mass production in different regional markets. With the continuous increase of production, it is becoming more and more challenging to ensure transport capacity at a reasonable cost during the peak period of logistics transportation. In the third quarter, Tesla began the transition to "more balanced mass production on a weekly basis for different regional markets", which led to an increase in the number of cars still in transit at the end of the quarter. These cars on the way have been ordered and will be delivered to the customer upon arrival at the destination.

Although the delivery volume of Tesla in the third quarter was higher than that in the first and second quarter, it was still lower than expected with the 357900 vehicles delivered by Tesla in the third quarter that had been expected by earlier analysts. According to relevant data, Tesla delivered 564743 new cars worldwide in the first half of the year, of which 254695 were delivered in the second quarter and 258580 in the second quarter. In the first quarter of this year, Tesla produced 305407 cars and delivered 310048 cars. From the data point of view, Tesla's production and delivery volume declined in the second quarter. The decline in delivery and production in the second quarter is related to the shutdown of Tesla's Shanghai factory caused by the Shanghai epidemic.

The delivery volume of Tesla in the third quarter is less than expected or there is an early omen. Tesla's Chinese car sales halved in July, with sales of 28217 vehicles in July, down 64.2 per cent from 78906 in June, according to data. The reason for the halving of Tesla's sales in July has a lot to do with the upgrading and transformation of the Shanghai factory. Due to the upgrading of the Shanghai factory, Tesla Shanghai Super Factory will have a holiday from July 1 to 4, which is due to the factory's production increase and transformation. The whole plant has a power outage. The vehicle production workshop of Tesla's Model 3 factory will also stop production from July 18, and workers will have a holiday of more than 15 days. The production workshop of Model Y will also transform the production line and increase production capacity in July.

Why the delivery volume is less than expected will cause fluctuations in the secondary market? perhaps for most capital markets, they focus on a changing state of the market, what the market expectation is, and for the current market as a whole, the estimated quantity of the market is directly related to Tesla's imagination space on top of the market, if the market imagination space is insufficient. Tesla is very likely to have relatively large stock price fluctuations.

"Tesla's third-quarter volume data may not be enough to attract new buyers, especially at a time when global financial markets are volatile and plagued by the dual challenges of inflation and rising interest rates," said Russ mold, an analyst at AJ Bell. Moreover, despite Mr Tesla Musk's pledge that "delivery will be more stable" this quarter, reducing last-minute rush buying, the huge gap between production and delivery of more than 22000 vehicles has alarmed investors. "although Tesla continues to point out that supply constraints limit delivery, the possibility of demand disruption is still high," said Ryan Brinkman, an analyst at JPMorgan Chase.

It is worth mentioning that also on October 3, BYD, a Chinese manufacturer of new energy vehicles, also released the latest production and sales figures. Data show that BYD sold a total of 1.18 million new energy vehicles in the first three quarters of 2022, up 349.56 percent from the same period last year, of which 201300 were sold in September, up 249.56 percent from the same period last year.

Tesla, who is known as the number one electric car in the world, obviously lags behind BYD in data. Tesla delivered 343000 units in the third quarter of this year, an increase of 42.4% over the same period last year and 34.9% month-on-month growth. But it was well below Wall Street's average forecast of 357900.

Without comparison, there is no harm. After BYD announced the suspension of the sale of fuel vehicles, sales of new energy vehicles continued to rise, and one month's sales in China nearly caught up with Tesla's global sales in one quarter. According to the data, BYD sold a total of 1.17 million vehicles in the first three quarters, far exceeding Tesla's 940000 vehicles. It is visible to the naked eye that it can exceed Tesla's annual sales target next month. Of course, Musk doesn't care whether BYD surpasses Tesla. After all, Tesla and BYD are not in the same consumption class at all, and even if they regard Chinese electric car companies as competitors, they are also new power enterprises such as Lulai and ideal. However, as BYD expands the global automobile market and its share in the new energy vehicle market continues to increase, it may compete with Tesla in many European countries and the Asia-Pacific region in the future, which is also a problem that Musk can not ignore.

In addition, as China's independent new energy brands catch up with each other, to a certain extent, it also has an impact on the market segment occupied by Tesla. According to data released by the Federation of passengers, the domestic retail penetration rate of new energy vehicles was 28.3% in August, up 11 percentage points from 17.3% in August 2021. In August, the penetration rate of new energy vehicles in independent brands was 52.8%, that in luxury cars was 17.4%, and that in mainstream joint venture brands was only 4.9%. In terms of monthly domestic retail share, the retail share of mainstream independent brands of new energy vehicles in August was 70%, up 4.2% from the same period last year; the share of joint venture brand new energy vehicles was 6.4%, down 0.64% from the same period last year; and the share of new power was 15.3%, down 3.9% from the same period last year. Tesla's share was 6.5%, up 1.3%.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.