In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/05 Report--

A year and a half later, brilliance China finally resumed trading. However, under the influence of adverse factors such as the bankruptcy of the parent company, brilliance's share price fell more than 70% after the resumption of trading in China. As of the close of the day, brilliance China fell 63.01% to HK $2.70, with a total market capitalization of HK $13.622 billion.

In fact, brilliance China had no choice but to resume trading, which has been suspended for 18 months from March 31, 2021 to September 30, 2022. Under HKEx rules, it has the right to delist any securities that have been suspended for 18 months in a row.

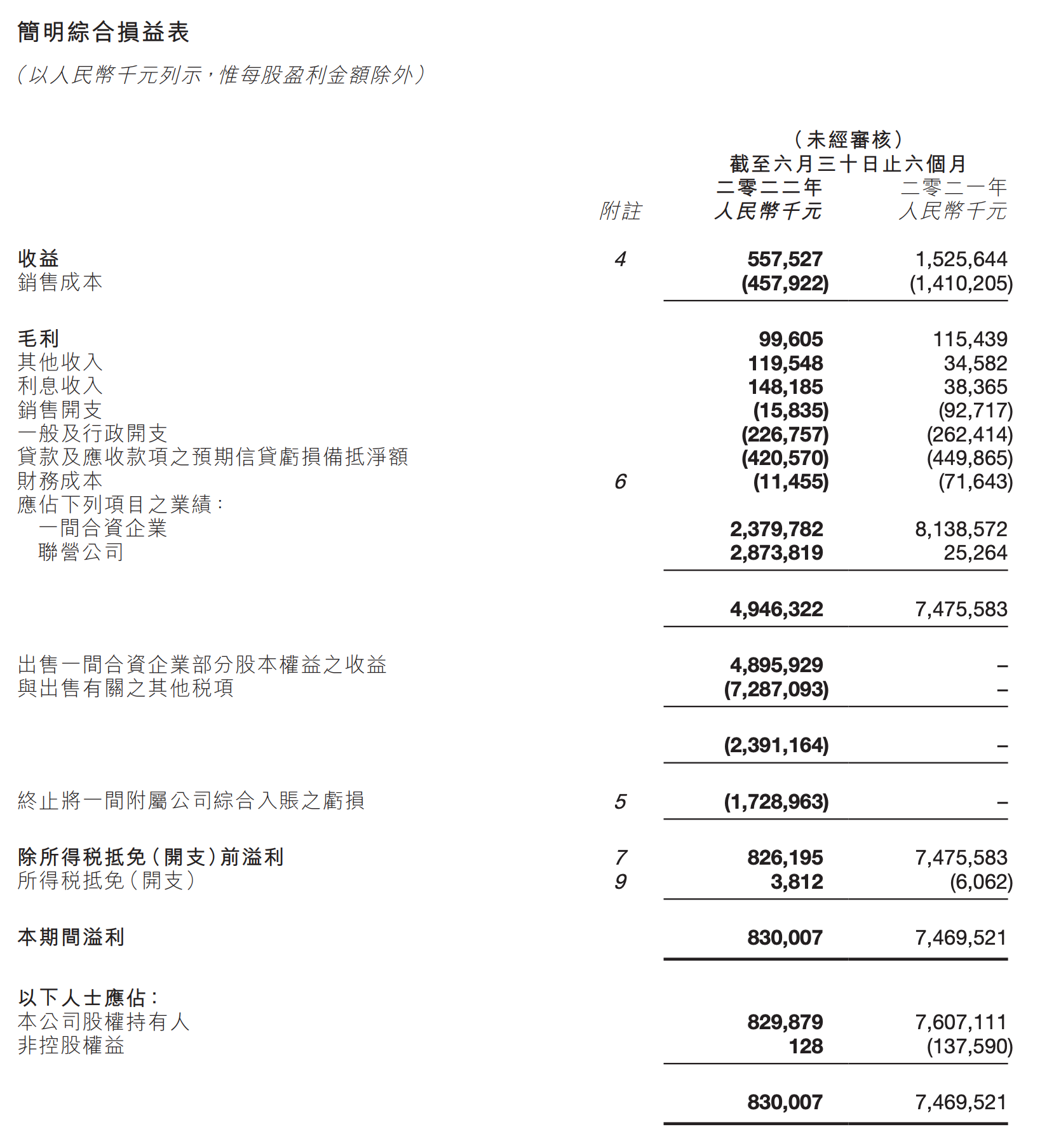

In order to meet the conditions for resumption of trading, brilliance China continuously issued its interim report of 2021, annual financial report of 2021 and interim report of 2022 in mid-September. According to the financial report, brilliance China achieved operating income of 3.123 billion yuan in 2020, down 19.13% from the same period last year, and profit attributable to shareholders was 11 million yuan, down 99.99% from the same period last year. Brilliance China realized operating income of 2.142 billion yuan in 2021, down 31.42% from the same period last year, and profit attributable to shareholders was 11.961 billion yuan, an increase of 106509.55%. Brilliance China realized operating income of 558 million yuan in the first half of 2022, down 63.46% from the same period last year. The profit attributable to shareholders was 830 million yuan, down 89.09% from the same period last year.

According to data obtained by the Securities Times, as of June 1, 2022, a total of 6029 creditors had declared their claims to the manager of brilliance Group, totaling 57.718 billion yuan; in addition, there were undeclared claims (recorded in the account book), totaling 13.294 billion yuan; and undeclared employee claims, totaling 786 million yuan. The three add up to 71.798 billion yuan.

Shrinking performance and debt are only superficial and, more importantly, internal corruption. It has been revealed that Qi Yumin, former party committee secretary and chairman of brilliance Group, sought benefits for others and received more than 133 million yuan in property during his tenure, directly or indirectly causing brilliance to miss several key transition points.

Data show that brilliance Automobile Group holding Co., Ltd. is a large vehicle manufacturing enterprise controlled by Liaoning SASAC, directly or indirectly holding and participating in four listed companies. and through its listed company brilliance China and BMW joint venture to establish brilliance BMW. At present, brilliance Group has three independent brands of China, Golden Cup and Huasong and two joint venture brands of brilliance BMW and Huachen Renault. This year in 2022, brilliance will be left with only brilliance BMW.

On December 30, 2021, according to the information of the national enterprise bankruptcy reorganization case information network, brilliance Renault Gold Cup Co., Ltd. filed for bankruptcy, the case number is (2021) Liao 01 Breaking Shen 24, and the handling court is the Shenyang Intermediate people's Court of Liaoning Province. both the applicant and the applicant are brilliance Renault Gold Cup. On January 12, brilliance China announced that brilliance Renault's application for reorganization had been accepted by the Shenyang Intermediate people's Court. The Huachen Renault liquidation team, led by Gao Wei, director of the Comprehensive laws and regulations Department of the State-owned assets Supervision and Administration Commission of the Liaoning Provincial people's Government, has been appointed by the Shenyang Intermediate people's Court as the manager of the reorganization. As of press time, brilliance Renault restructuring plan has not been announced.

At present, brilliance Group's profit source is supported by BMW. In May 2003, brilliance China and BMW Group jointly established brilliance BMW Co., Ltd., each holding 50% of the shares. According to the financial report, brilliance BMW contributed 2.38 billion yuan in profit in the first half of 2022, while brilliance China's net profit was only 830 million yuan. If you subtract brilliance BMW's profit, brilliance China has a net loss of 1.55 billion yuan.

On February 11, 2022, BMW Group's shareholding in brilliance BMW increased from 50% to 75%, and brilliance Group continued to own 25% of brilliance BMW. From February 11, brilliance's interest in BMW will be included in the BMW Group's financial results. According to the 2021 report released by BMW Group, the total income of BMW Group in 2021 reached 111.239 billion euros, an increase of 12.4% over the same period last year; the group's pre-tax income reached 16.06 billion euros, an increase of 207.5% over the same period last year, a record high; the group's net profit reached 12.463 billion euros, an increase of 223.1% over the same period last year, setting a new record

The equity change means losing control of brilliance BMW, and the road ahead will become more and more difficult. Of course, for brilliance, survival may be more important than anything else.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.