In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/09 Report--

Renault CEO Luca de Mayo (Luca de Meo) will hold talks with Nissan CEO Makoto Uchida this weekend to discuss Renault's plans to sell its internal combustion engine business to Chinese carmaker Geely Holdings, the Financial Times reported. Nissan opposes Renault's plan to sell its internal combustion engine business because it does not want its technology developed in partnership with Renault to be shared with a Chinese company, according to people familiar with the matter.

Earlier this year, Renault announced plans to split its electric vehicles and internal combustion engine businesses into separate divisions, including working with other companies or as independently listed companies to finance electrification transformation, because Renault shares technology with Nissan. Therefore, Renault's plan to split the business needs to be approved by Nissan. In return for joining Renault in its efforts to develop electric cars, Nissan has demanded, among other things, that Renault sell at least part of its 43 per cent stake in the Japanese carmaker, a long-term goal of Nissan, according to people familiar with the matter. Executives at the two companies will discuss reducing Renault's stake in Nissan to 15%, according to the Wall Street Journal.

Renault's alliance with Nissan dates back to 1999. In 1998, Nissan was mired in a debt crisis because of mismanagement. Ford and Daimler had intended to buy Nissan but hesitated because it was in a debt crisis. Nissan, which had lost money for eight years in a row, finally turned to Renault, hoping to reverse Nissan's plight. In exchange, Renault bought a stake in Nissan, becoming Nissan's largest shareholder and forming a Renault-Nissan alliance with Nissan.

In 2000, Carlos Ghosn, vice president of Renault, became chief executive of Nissan and proposed a "Nissan revival plan" that led Nissan to turn losses into profits. In 2003, Nissan and Dongfeng established Dongfeng Motor Co., Ltd., which officially entered the Chinese market. In the same year, Nissan took a 15 per cent stake in Renault, but the cross-shareholding relationship between Renault and Nissan was not equal. Renault owned 44.4 per cent of Nissan with voting rights, while Nissan owned 15 per cent of Renault only and had no voting rights. As a result, Renault can influence Nissan's related operations, while Nissan's impact on Renault's operations is almost negligible.

After Nissan turned a profit, Renault renewed its plan for Nissan to sell 1 million vehicles a year, achieve zero debt and achieve the highest operating profit margin of 8 per cent for the world's carmakers. In 2005, Nissan not only completed the plan, but also sales continued to grow, in the context of Nissan's rapid development, the relationship with Renault also gradually intensified. In 2011, for example, Nissan sold 4.67 million vehicles worldwide, up 14.4 per cent from a year earlier, while Renault sold only 2.72 million vehicles, up 3.6 per cent from a year earlier. However, the unequal shareholding ratio between partners hurt Nissan's interests and began to resist.

In February 2016, Nissan announced at a press conference in Tokyo that it would buy back some of its shares from Renault, another struggle against its unequal relationship with Renault. In the face of Nissan's proposal to buy back shares, Renault agreed to sell some of its stake in Nissan, but also said it would ensure that its "shareholding ratio within Nissan remains the same".

Who would have thought that six years later, Renault offered to give up some of its shares in Nissan. Renault currently owns about 40 per cent of Nissan, but there is a good chance that Renault will not sell all of it, but will reduce its stake to 15 per cent, balancing each other's holdings as much as possible (15:15). In fact, Renault's sale of Nissan shares is ostensibly to get back the money, but the deeper reason is to ease the strained relationship with Nissan.

Renault's compromise is also for the sake of electrified transformation. In August 2021, Renault and Geely signed a memorandum of understanding to establish a long-term strategic partnership to develop hybrid vehicles in fast-growing markets in China and the world. In January 2022, Renault and Geely announced that they would produce and sell Renault-branded fuel vehicles and smart hybrid vehicles in South Korea based on Geely's CMA architecture and hybrid technology, and export them to markets outside South Korea. The new car will be produced by a factory in Busan, South Korea, and is expected to be mass produced in 2024. In May 2022, Geely issued an announcement on the Hong Kong Stock Exchange, wholly owned subsidiaries CIL and Renault Korea Motors Co., Ltd. Enter into a subscription agreement to subscribe for 34.02% of South Korea's Renault shares at a consideration of 264 billion won. As part of the proposed transaction under the subscription Agreement, CIL entered into a joint venture agreement with Renault BV to clarify the respective rights and obligations of the target company. In addition, Renault plans to spin off the internal combustion engine business from the electric vehicle business, while Geely and Saudi Aramco are in talks to buy a stake in the internal combustion engine business.

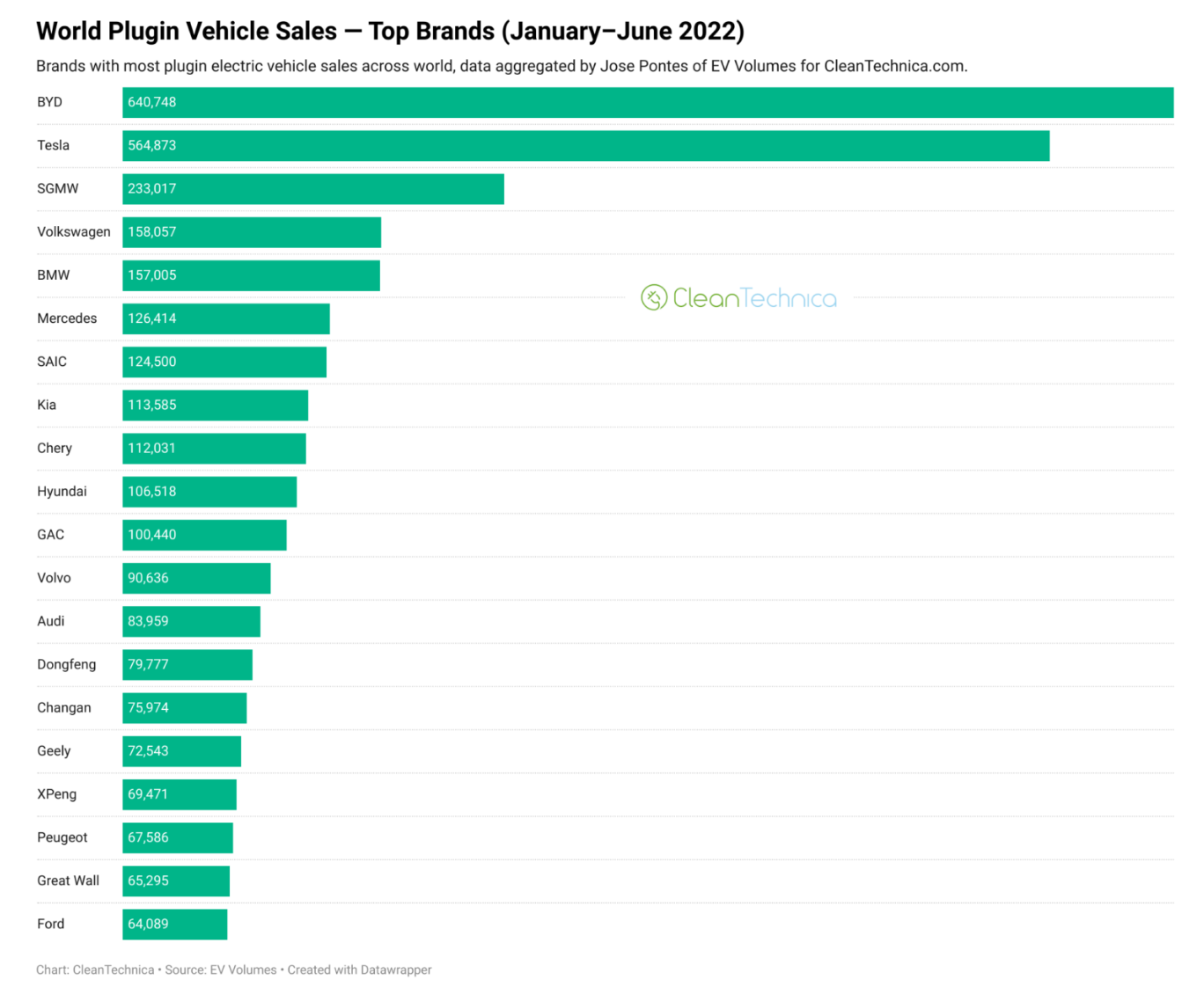

However, Renault is not doing well either in the domestic market or in the global market. According to EV Sales statistics, BYD ranked first with 600700 vehicles in the global new energy vehicle sales ranking in the first half of 2022, followed by Tesla, SAIC GM Wuling, Volkswagen and BMW ranked second to fifth with 564900, 233000, 158100 and 157000 respectively, while Renault missed the top 20.

In the domestic market, the only new energy model currently on sale is Yi. In July 2019, Renault and Jiangling announced the establishment of a joint venture. Renault increased its capital by 1 billion yuan to become the largest shareholder of Jiangling New Energy. The first model, "Yi", a compact electric car, was officially launched on September 26, 2011. the subsidized price range is 13.98-199800 yuan. As the first pure electric car in the joint venture between Jiangling and Renault, "Yi" adopts a brand new "E" logo with the tail label "Renault Jiangling Group". However, since its launch, the car has been in a state of no interest. Data show that from January to August in 2022, the cumulative number of Ling Yi in the Renuo River was 1575.

Renault's performance in the new energy vehicle market, whether in the domestic market or the global market, does not seem to have much advantage. Therefore, after joining forces with Nissan and Geely to accelerate the new energy business, it may also be difficult to break through the existing difficulties, but this may be the last chance for Nissan and Geely to seize advantage in the new energy battlefield.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.