In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/09 Report--

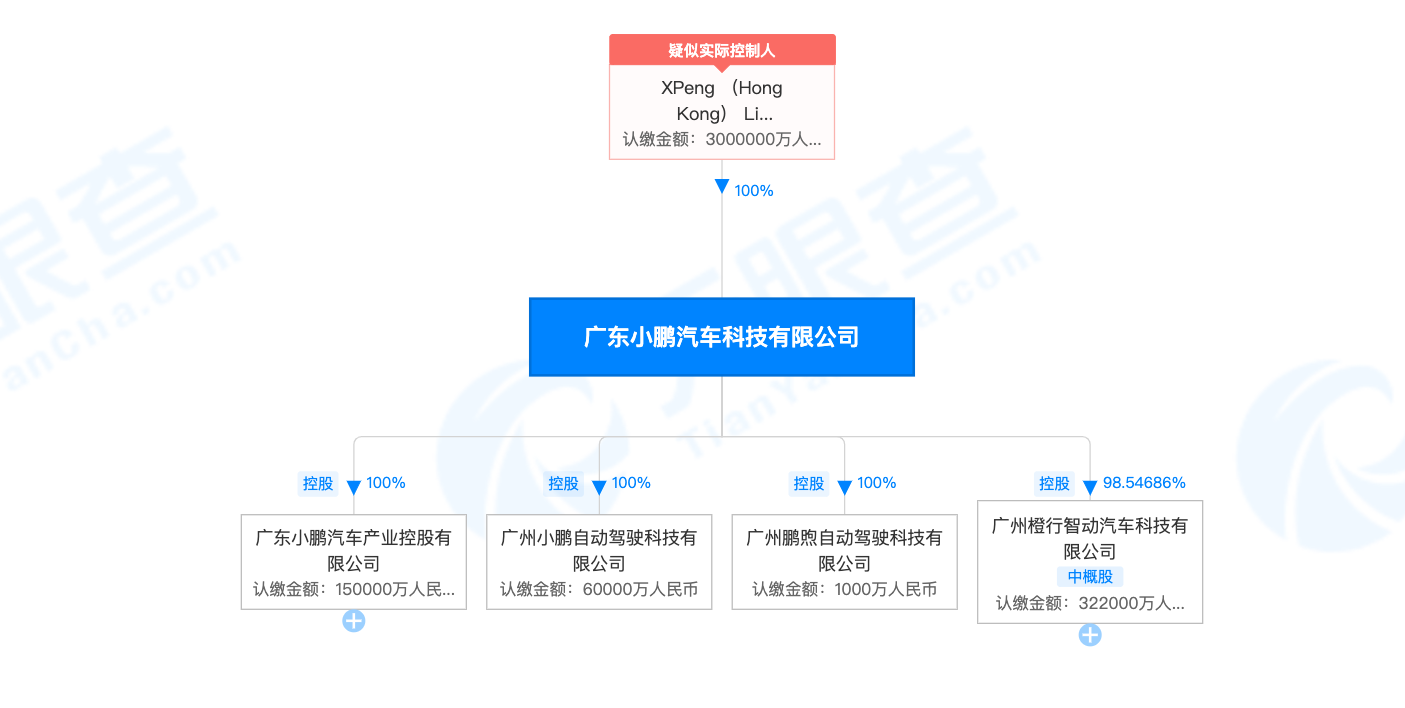

Recently, Guangdong Xiaopeng Automotive Technology Co., Ltd. has undergone industrial and commercial changes, and its registered capital has increased from 20 billion yuan to 30 billion yuan. Data show that the company was established in June 2019, the legal representative Xia Heng, wholly owned by XPeng (Hong Kong) Limited. Equity penetration shows that the company's holding companies include Guangdong Xiaopeng Automobile Industry holding Co., Ltd., Guangzhou Orange Bank Zhi Zhi Automotive Technology Co., Ltd., Guangzhou Xiaopeng self-driving Technology Co., Ltd., among them, Guangzhou Orange Bank Zhi Zhi Automotive Technology Co., Ltd. is the main company of Xiaopeng Automobile, established in January 2015, with a registered capital of 3.267 billion yuan.

Among the three new car manufacturers of "Wei Xiaoli", Xiaopeng's registered capital has exceeded that of NIO and ideal, of which the registered capital of Shanghai Lulai Automobile Co., Ltd. is 3 billion US dollars, while that of Beijing che Hejia Information Technology Co., Ltd. is only 295 million yuan.

There are three main reasons for increasing registered capital: first, to improve the credit of the company. The higher the registered capital, the larger the company's asset strength and operation scale, which can improve the company's commercial credit and be in a dominant position in the competition; second, increasing the company's working capital will help the company to open up new investment projects. expand the company's existing business scale; third, adjust the shareholder structure and shareholding ratio, change the composition of the company's management organization, absorb new shareholders can change the shareholder composition and structure.

Recently, Xiaopeng's life has not been easy. First of all, the delivery volume. The latest data show that Xiaopeng delivered a total of 8468 new cars in September 2022, down 18.7% from the same period last year and 11.6% from the previous month. In the first three quarters of 2022, a total of 98553 new cars were delivered, an increase of 74.7% over the same period last year, surpassing Ullai and ideal. In other words, Xiaopeng's performance in the first three quarters was quite eye-catching, but the market performance in September was obviously somewhat weak.

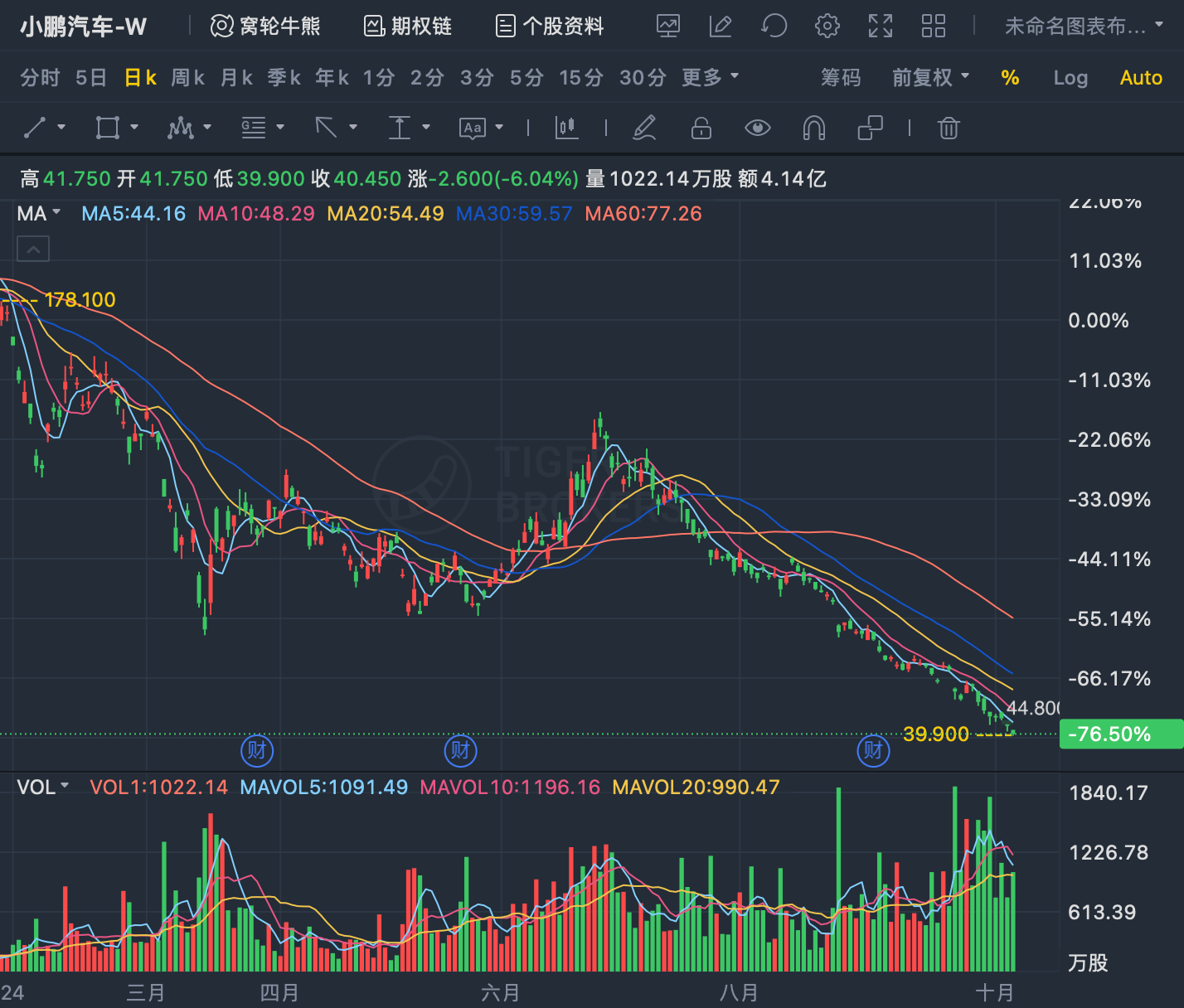

In addition, Xiaopeng car has been reduced many times by the agency. On June 22nd, Xiaopeng was sold 3.0208 million shares by JPMorgan Chase at an average price of HK $120.7484 per share, involving about HK $365 million. After the reduction, the number of shares held by JPMorgan fell from 5.19 per cent to 4.96 per cent to 64.7489 million shares. On Sept. 27, Citigroup (an investment agency) reduced its stake in Xiaopeng Motor by 563700 shares to less than 5%. There is no need to announce any reduction thereafter.

Since the beginning of this year, the market capitalization of the new forces of car building has declined collectively, of which Xiaopeng Motor has shrunk the most. As of the close of Hong Kong stocks on October 7, Xiaopeng's market capitalization was HK $69.726 billion, down 80.07% from its peak of HK $220.00, and its market capitalization fell by more than HK $300 billion. By contrast, the share prices of the other two car-building newcomers have not changed so much. Ideal Motor currently has a total market capitalization of HK $168.121 billion, which is 47.70% lower than the maximum market value, while NIO's current total market capitalization is HK $189.538 billion, which is 40.58% lower than the maximum market capitalization.

On September 23rd, SimpLIcity Holding Limited, Xiaopeng's controlling shareholder, informed that it had purchased a total of 2.2 million American depositary shares on the open market at an average price of $13.58 per share. It is understood that Simplicity Holding is wholly owned by he Xiaopeng, the chairman of the company. According to this calculation, the increase of he Xiaopeng's holdings will cost about $29.88 million (about 210 million yuan). However, Xiaopeng's downward trend has not stopped, and its share price has continued to fall in the last five trading days, with the biggest drop of 9.72% in a single day.

Prior to this, Xiaopeng released financial results showing that in the first half of the year, Xiaopeng delivered a total of 68983 vehicles, of which P7 was 35410, P5 was 23334, and G3 was 10239. Xiaopeng's total revenue in the first half of the year was 14.89 billion yuan, an increase of 121.9% over the same period last year. Of this total, automobile sales revenue was 13.94 billion yuan, an increase of 118.0% over the same period last year. However, these figures did not help it change the status quo of huge losses. Xiaopeng made a net loss of 4.4 billion yuan in the first half of the year, an increase of 122.2% over the same period last year.

If Tesla's "collapse" of new energy car companies is the incentive, then car-building new power enterprises in the market heat decline, the "not beautiful" data surfaced is the main factor. Data show that ideal automobile revenue in the first half of 2022 was 18.295 billion yuan, an increase of 112.4 percent over the same period last year, with a net loss of 650 million yuan, an increase of 9.5 percent over the same period last year. Xilai Motor lost the most, reaching 4.57 billion yuan. In terms of bicycle losses, each car sold by NIO has a loss of 89900 yuan, Xiaopeng 63800 yuan, and the ideal loss is 10400 yuan.

A senior analyst in the auto industry of a brokerage said that compared with traditional car companies, there is actually a certain bubble in the valuation of the new power of car building. In the long run, the valuation of the new power of car building will return to the industry average, and now the decline in stock prices is also the process of squeezing the bubble after the market tends to be rational. In addition, since the beginning of this year, with the efforts of traditional car companies such as BYD, Guangzhou Automobile and Geely Automobile, the market space of new forces in car-building has been greatly squeezed, and the overall sales situation is also facing a test.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.