In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/20 Report--

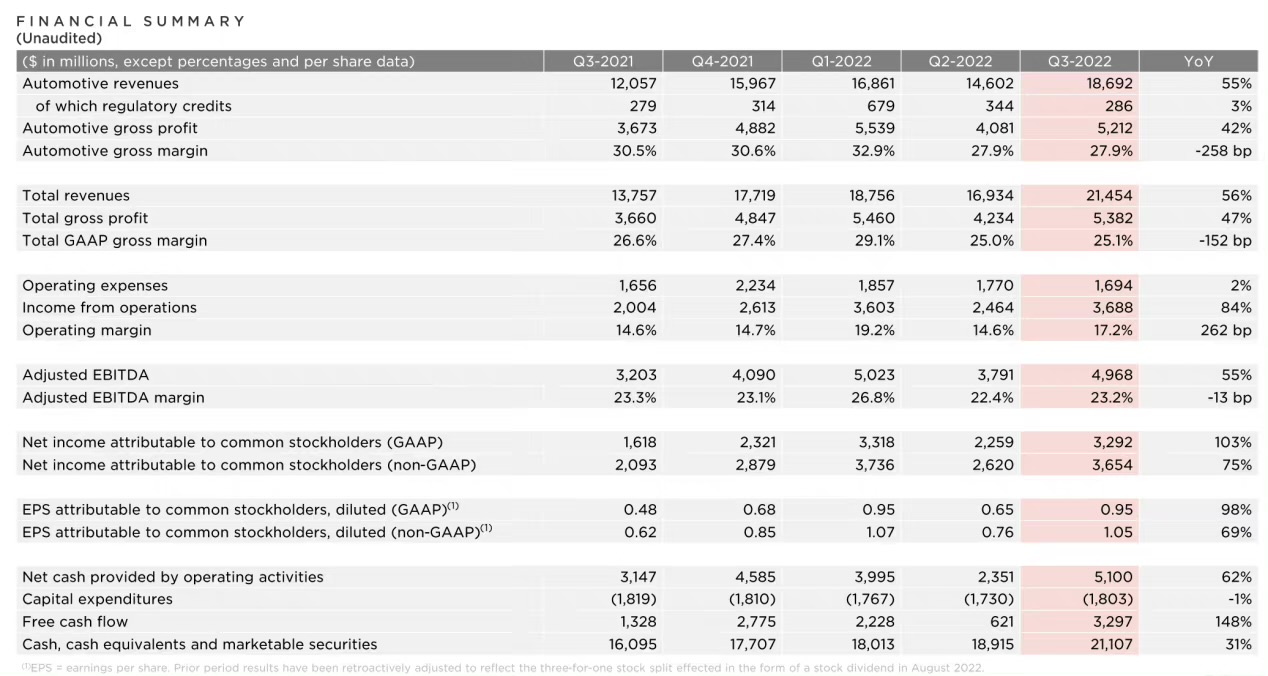

Tesla released its third-quarter financial results on Oct. 19, and the entry was also on the top search site on Weibo. According to the financial report, Tesla's total revenue in the third quarter was $21.454 billion (about 155.112 billion yuan), up 56% from a year earlier, compared with $13.757 billion in the same period last year and $16.934 billion in the previous quarter. Net profit attributable to common shareholders in the third quarter was $3.292 billion (about 23.801 billion yuan), up 103 per cent from a year earlier. Third-quarter operating profit rose to $3.7 billion from a year earlier, with an operating margin of 17.2 per cent. The gross profit margin of cars in the third quarter was 27.9%, down from 30.5% in the same period last year.

With regard to the decline in gross profit margin in the third quarter, Tesla said that the decline in profitability was mainly due to the rising cost of raw materials, the inefficiency of new factories in Berlin and Texas, and the appreciation of the US dollar. At the same time, it said that although logistics fluctuations and supply chain bottlenecks have improved, they are still direct challenges. It pointed out that Tesla's mass delivery in the last few weeks of each quarter has led to an increase in transportation costs and logistics instability. As a result, Tesla said that the transition to a smoother delivery pace will begin, based on which a large number of vehicles will still be in transit at the end of the quarter. Tesla expects that smoother ex-factory logistics during the quarter will be able to reduce transportation costs per vehicle.

The revenue in the third quarter fell short of expectations, or it has something to do with the decline in revenue from selling carbon emissions targets during the reporting period of Tesla. Referring to Tesla's previous financial reports, it is not difficult to see that one of the major sources of his income is through the sale of carbon credits. Tesla's income from selling carbon credits in the third quarter was only $286 million, down 58% from $679 million in the first quarter of this year and 17% from the previous quarter.

Although Tesla's revenue and gross profit in the third quarter were lower than expected, his net profit in the third quarter exceeded expectations. According to the report, Tesla's net profit in the third quarter was $3.29 billion, with an adjusted earnings per share of $1.05 in the third quarter, with market expectations of $1.01. The big increase in net profit brought more abundant cash flow, with Tesla's cash flow of $3.3 billion at the end of the third quarter, up 148 per cent from $1.33 billion in the same period last year. As for profit growth, Tesla said it benefited from the increase in the average selling price of cars, the increase in vehicle delivery and the increase in profits from other spare parts.

Tesla said it would continue to focus on increasing weekly production in Fremont and Shanghai, as well as capacity climbing in Berlin and Texas. It points out that the limited battery supply chain will be the main limiting factor for the medium-and long-term growth of the electric vehicle market. Despite these challenges, we still hope to complete the delivery of each car while maintaining a strong operating profit margin.

Overall, according to Tesla's third-quarter results, Tesla's cumulative revenue in the first three quarters of 2022 was $57.144 billion, compared with $36.104 billion in the same period last year, an increase of 58.27%. Profits in the first three quarters were $8.869 billion, compared with $3.198 billion in the same period last year, an increase of 177.32%. Tesla said: the year-on-year increase in revenue in the third quarter of this year is mainly due to factors such as increased car delivery and increased production capacity. It pointed out in the financial report that Tesla Shanghai Super Factory had limited production capacity in the second quarter of this year, while capacity increased in the third quarter, which played a positive role in promoting automobile production and sales.

It is worth noting that Tesla had previously said that production capacity would increase by 50 per cent a year. This time, in response to the release of the third-quarter results, Tesla also said that he plans to expand manufacturing production as soon as possible, but the growth rate will depend on the capacity of the equipment, the uptime of the factory, the operational efficiency, and the capacity and stability of the supply chain. According to relevant data, Tesla delivered 343830 vehicles worldwide in the third quarter, and Tesla has delivered 908573 vehicles this year by the third quarter. According to Tesla's annual production capacity will increase by 50%, that is, more than 1.4 million cars are planned to be produced in 2022, which means that Tesla needs to deliver more than 500000 vehicles in the fourth quarter, which may be a challenge for Tesla.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.