In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/20 Report--

On Oct. 18, BYD was reduced by BlackRock, the world's largest asset regulator, from 6.21% to 5.85%, according to Hong Kong stock exchange filings. In response to the BlackRock sale, BYD said: "the company has tried to communicate with shareholders, but has not learned any substantive information, the reduction is the free choice of shareholders."

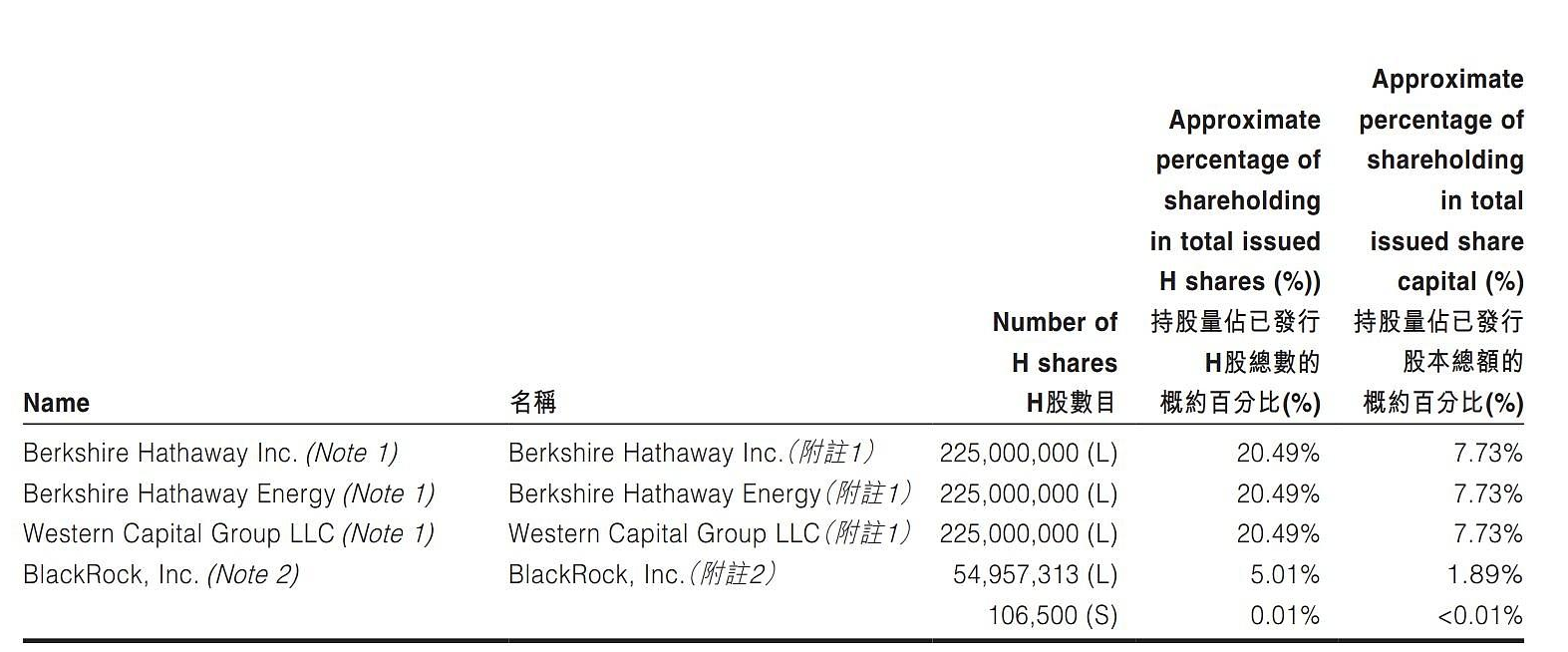

This is not the first time BlackRock has reduced its holdings of BYD's H shares. Since July, BlackRock has increased or reduced its holdings of BYD's H shares many times. During the period from October 11 to 13, BlackRock held 6.21%, 6.17% and 5.85% of its shares respectively, reducing its cumulative holdings of about 3.9 million H shares. It is worth noting that according to the semi-annual report released by BYD earlier, BlackRock held more than 54.95 million shares of BYD on June 30, 2022, accounting for 5.01% of the total H shares issued. According to BlackRock's current shareholding ratio, compared with the data shown in the earlier half-year report, BlackRock already owns 64.23 million shares of YD, more than 900 shares more than earlier.

According to the relevant data: BlackRock, Inc. Also known as Black Rock Group, is the largest listed investment management group in the United States. Headquartered in New York, USA, BlackRock Group manages assets on behalf of individual and institutional investors around the world, providing a wide range of securities, fixed income, cash management and alternative investment products. In addition, BlackRock provides risk management, investment system outsourcing and financial consulting services to a growing number of institutional investors.

Recently, BlackRock has not only reduced its stake in BYD alone, but also reduced its holdings in a number of Hong Kong listed companies. According to data from the Hong Kong Stock Exchange, BlackRock reduced its holdings of Conch cement by 8.62788 million shares at HK $25.3431 each on October 5. The latest number of shares after the reduction is about 77.8872 million shares, with the latest shareholding ratio of 5.99%. On the same day, Xintian Green Energy was also reduced by BlackRock at an average price of HK $2.8511 per share, with a new stake of 5.98 per cent. Prior to this, Angang shares, Kangxinuo Biology, Fosun Pharmaceuticals, Datang New Energy, Aluminum of China, etc., were all reduced by BlackRock, which involved amounts ranging from HK $1 million to HK $10 million.

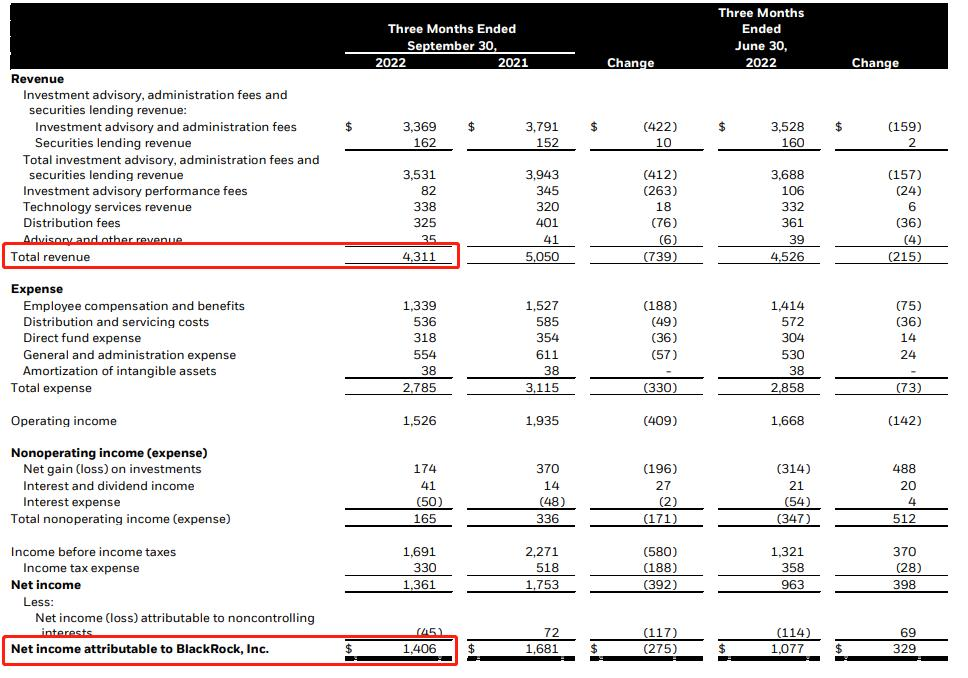

In addition, BlackRock's third-quarter net profit was $1.406 billion, compared with $1.681 billion in the same period last year, down 16% from a year earlier, and revenue was $4.31 billion, down 15% from $5.05 billion in the same period last year, according to BlackRock's third-quarter results. Meanwhile, BlackRock's assets under management fell 16% to $7.96 trillion, compared with $9.46 trillion in the same period last year. In response, BlackRock said the stronger dollar had dampened the value of investment in major European and Asian markets, adding to the pressure. As for the decline in revenue, BlackRock said it was mainly due to the sharp decline in the market, the impact of the appreciation of the dollar on the average size of assets under management and lower performance fees. With reference to BlackRock's $10.01 trillion in assets under management at the end of 2021, it is not hard to see that its assets under management are declining. Its assets under management in the first, second and third quarters of 2022 were $9.57 trillion, $8.49 trillion and $7.96 trillion, respectively.

On October 13, BlackRock also released its table on the group's market outlook for the fourth quarter on its official Wechat account. The risks caused by the recession and the combined impact of interest rate hikes have not yet been reflected in the prices of stock assets, so there is room for share prices to fall further. In view of the current sluggish form of economic growth, the general profit forecast for this year and next year is still too optimistic. It also pointed out that signs of declining risk appetite for the continued strength of the dollar also tightened the global financial environment. With reference to a series of recent operations by BlackRock, the BYD reduction operation may have little to do with BYD itself.

Before BlackRock reduced its stake in BYD, BYD had been reduced by Buffett, the "god of shares". On Aug. 24, Buffett's Berkshire Hathaway sold 1.33 million BYD H shares at an average price of HK $277.1 per share, cashing out nearly HK $369 million. On Sept. 1, Buffett's Berkshire Hathaway sold another 1.716 million shares of BYD H shares, with an average selling price of HK $262.72 per share, cashing out about HK $451 million. Berkshire's stake in BYD fell to 18.87% from 20.49%. With regard to Buffett's reduction of holdings, BYD responded that the company had learned about the situation from the Hong Kong Stock Exchange, that shareholder reduction was a shareholder investment decision, that the company's sales volume had repeatedly reached record highs, and that everything was in good health. However, Buffett's reduction also had an impact on BYD's share price, but as the sell-off went on, the panic in the market eased, and BYD's share price gradually stabilized.

On October 17, BYD released a forecast of its results for the first three quarters of 2022, which estimated that the net profit attributable to shareholders of listed companies in the first three quarters was 9.1 billion yuan to 9.5 billion yuan, an increase of 272.48% Mu 288.85% over the same period last year. Net profit after deducting non-recurrent profits and losses was 8.1 billion yuan to 8.8 billion yuan, an increase of 813.80% RMB892.77% over the same period last year. In the third quarter, the company expects the net profit attributed to shareholders of listed companies to be 5.505 billion yuan to 5.905 billion yuan, an increase of 333.60% to 365.11% over the same period last year, and net profit after deducting non-recurring profits and losses is 5.07 billion yuan to 5.77 billion yuan, an increase of 879.37% to 1014.57% over the same period last year. After the announcement of the performance forecast, it is generally believed that the BYD Q3 performance forecast is better than expected. Anxin Securities pointed out that with the continuous growth of BYD's sales of new energy vehicles, the company's scale advantage is becoming more and more prominent. Depreciation and amortization and expense dilution of bicycles continue to decline, bringing about a continuous decline in bicycle costs. promote the continuous improvement of corporate profitability, bicycle profits continue to hit new highs. Looking forward to the next 3-5 years, the brand upward, technological innovation and economies of scale are expected to continue to drive BYD's high performance growth. Citi also pointed out in a research report that BYD's Q3 earnings were better than expected, and the market is expected to react positively to this, maintaining its "buy" rating, with a target price of HK $640 for Hong Kong stocks.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.