In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/23 Report--

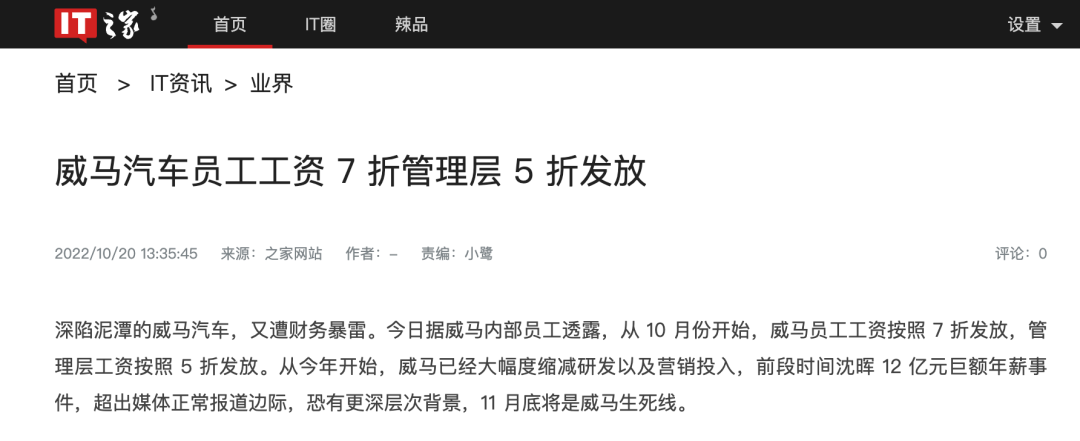

According to a number of media reports, the new power of car-making in China has been hit by financial thunder. According to the report, some Weimar internal employees have revealed that since October, Weima employees have been paid at a 30% discount, while management salaries have been paid at a 50% discount. In addition, according to sources close to Weimar, the company will implement a series of proactive financial policies, including a "voluntary pay cut of 50% for senior executives", in order to survive the capital winter smoothly and achieve better performance in the future competition from the power circle of new cars.

Earlier, the media exposed that Weimar held an online conference call of about 20 minutes for all CTO (all Intelligent Network connection Department), and HR informed all employees to cancel the year-end bonus through an online meeting, on the grounds that "last year's annual KPI was not up to standard."

It is understood that the year-end bonus of Weima Automobile is about 3.5-3.7 months' salary, which fluctuates at the meeting, accounting for 30% of the employee's annual income; coupled with the 13 salary clearly stipulated in the labor contract, it could have received a bonus of 4.5 times the monthly salary at the end of the year. But this time, not only the year-end bonus was cancelled, but the 13 salary was also postponed to June this year.

There has been no official response to rumors of discounted wages for Weima employees.

Data show that Weima Automobile was established in December 2015, which was established in the same year as ideal Automobile, one year later than Ulai Motor and Xiaopeng Motor. However, compared with Wei Xiaoli, the founder of Weimar had worked in Fiat, Volvo and other car companies before establishing Weimar, and the former position was vice president of Geely Holdings Group. According to Tianyan investigation, since its establishment, Weimar has gone through 12 times of financing, with a cumulative financing of more than 35 billion yuan, including SAIC, Sequoia Capital China, Baidu and so on. In January 2018, Weimar acquired Zhongshun Automobile holding Co., Ltd., and obtained the production qualification. In September 2018, Weima's first production car, EX5, was officially put on the market with a price of 14.68-198800 yuan, positioning as a compact pure electric SUV.

In 2019, Weimar delivered a total of 16900 new cars, ranking second in the sales of New Power car companies. In early 2020, when Wang Xing said that he was optimistic about the ideal car, Shen Hui shouted, "Weima will definitely be one of the Top3." However, after that, Weima car sales began to decline, in addition to being overtaken by Xiaopeng and ideal, but also by Nezha, Zero and other new second-line car-building brands. Taking the first half of the year as an example, Weima delivered a total of 21700 vehicles in the first half of 2022, while Xiaopeng, Nezha, ideal and NIO were 69000, 63100, 60400 and 50800 respectively.

The decline of Weimar is related to its positioning. At the beginning of its establishment, Shen Hui positioned Weima as a "Volkswagen of electric vehicles", focusing on the low-and middle-end market of 10-200000 yuan. However, the story of Volkswagen electric cars is not easy to tell. Weima's products are not as high-end as NIO, nor do they want to focus on the low end, but happen to be stuck in the price range of 10-200000 yuan. at present, this price range is still dominated by the consumption of fuel vehicles, and even the sales of the G3 models under Xiaopeng are general, and most pure electric models are difficult to achieve excellent results in this price range. Of course, Weima is also aware of this, followed by the launch of the Weima EX6, the price of the bike is close to 300000 yuan, but the model has not been recognized by consumers.

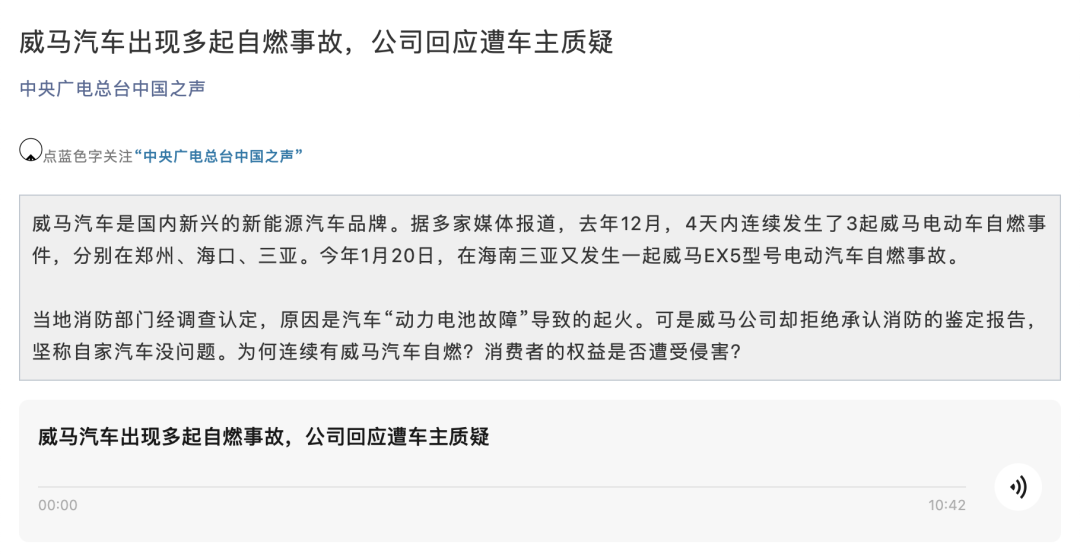

In addition to product positioning, product quality is also a key factor affecting its market performance. In October 2020, Weimar had to recall 1282 problematic vehicles after a number of vehicle fires broke out in Weima. After entering 2021, Weima cars are often exposed about vehicle fires and even named by CCTV, but since then Weima rarely responded to the fire accidents, and then Weima seems to reduce the occurrence of fire accidents by "locking electricity", causing market controversy, but the authorities have never responded directly to the relevant problems and refused to give solutions.

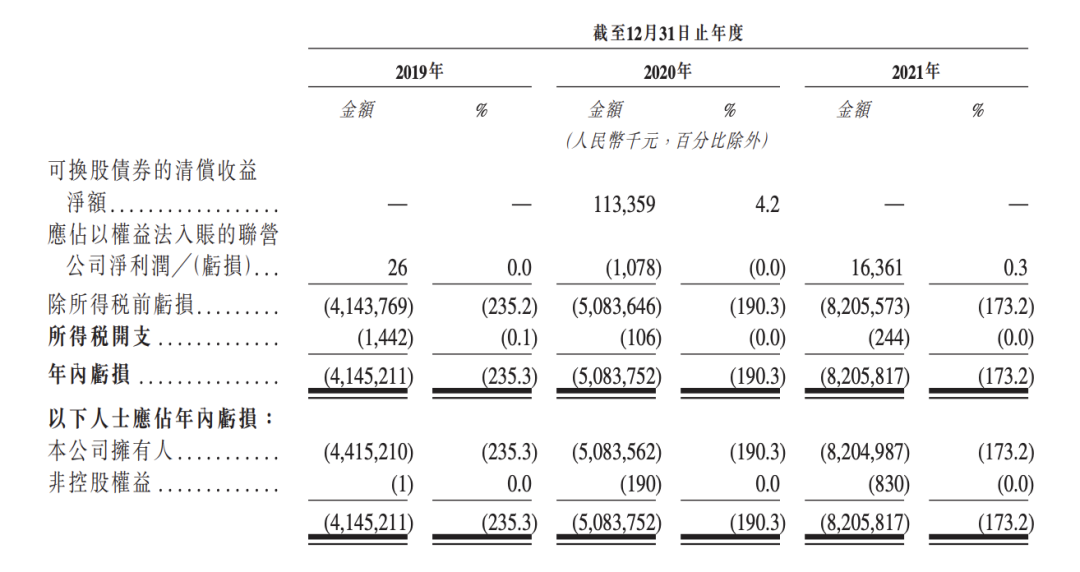

The loss continued to increase due to poor sales. On June 1, 2022, according to documents issued by the Hong Kong Stock Exchange, Weima Motor has submitted an application for listing, with co-sponsors Haitong International, China Bank International and Bank of China International, but there has been no further progress. According to the prospectus, Weima's total revenue from 2019 to 2021 was 1.762 billion yuan, 2.671 billion yuan and 4.773 billion yuan respectively, and the adjusted net profit was-4.04 billion yuan,-4.225 billion yuan and-5.363 billion yuan respectively. In addition, Weima's three-year gross profit margin is-58.3%,-43.5% and-41.1%, respectively.

By the end of 2021, Weimar's interest-bearing debt was close to 10 billion yuan, with only 4.156 billion yuan in cash on hand. At present, the financing scale of Weima Automobile is not considerable. At this stage, it is facing a series of life and death problems, such as tight cash flow, weak hematopoietic ability, serious blood loss and so on. Listing in Hong Kong seems to be the only way for Weima Motor to survive.

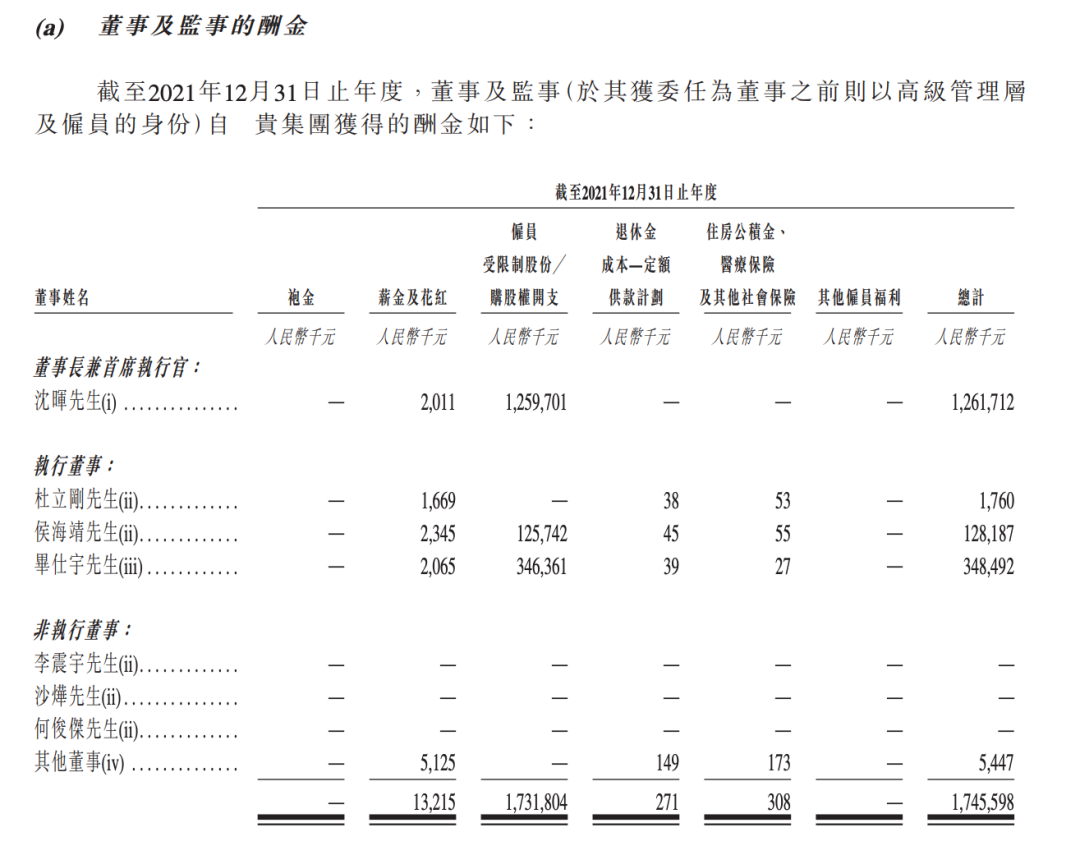

It is worth noting that in the context of low sales and huge losses, Shen Hui, chairman of Weima Automobile, was paid as much as 1.26 billion yuan in 2021. In addition, Weimar paid a total of 1.75 billion yuan to key management, with Shen Hui accounting for 72 per cent of the main management salary. In response to the news, Weima Shenhui also posted on moments, "some things, toes can tell whether they are true or false, it is not worth taking the time to explain." Let's tell the truth. "

It is understood that at present, Shen Hui's annual salary is composed of ordinary salary and restricted shares, of which the actual salary is only 2.01 million yuan, and the rest is distributed in the form of restricted shares, and this part of the money can only be included in the bag after Weimar Motor goes public. In other words, if the listing of Weima Motor is not ideal, Shen Hui will not get this part of the money, which should not be available now.

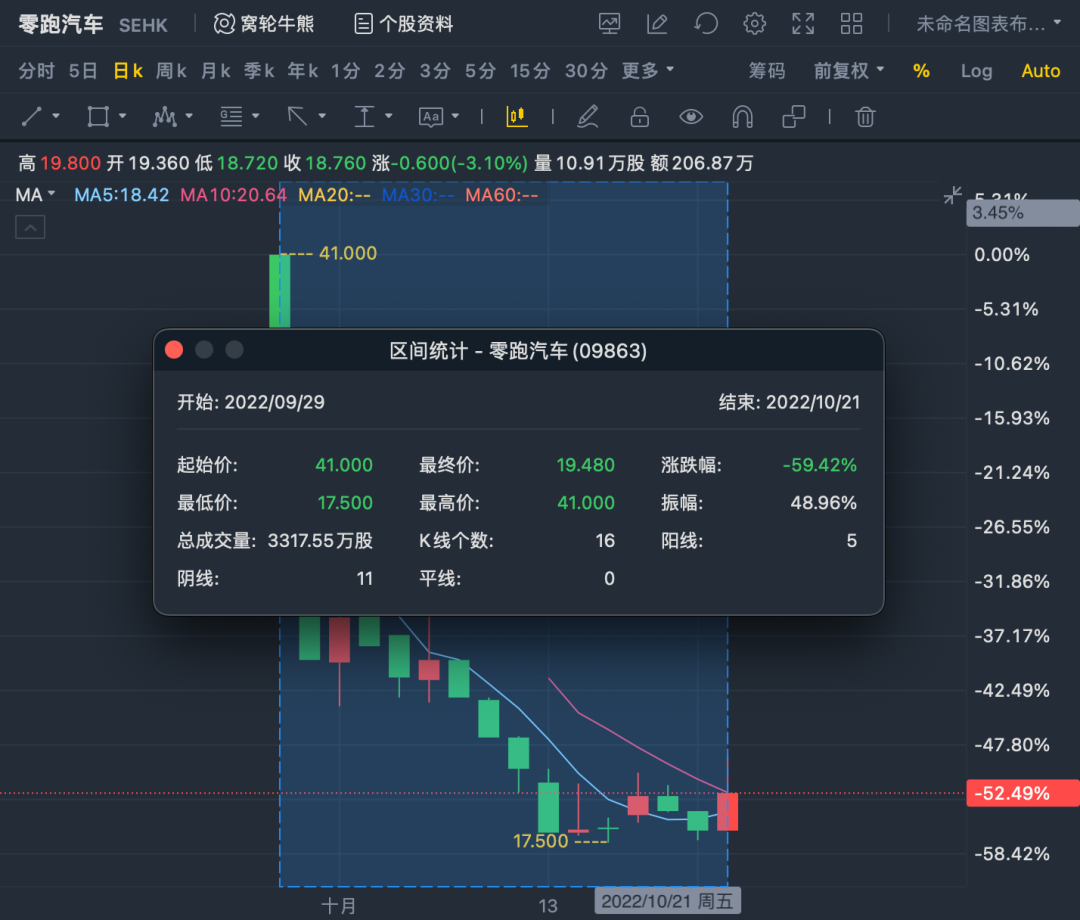

In fact, even if Weimar goes public in Hong Kong smoothly, it will be difficult to solve the urgent need. Take zero-running cars as an example, its monthly delivery volume is basically stable at more than 10,000, which is also a good result in the new energy vehicle industry, but after listing in Hong Kong, the performance of zero-running cars has also been greatly surprised, and its share price has plummeted 33.54% on the day of listing. The market capitalization has lost 24 billion overnight, and the stock price has fallen by 59.24% so far. From the perspective of the current market, although new energy vehicles are the investment direction in the future, after the stock prices of mainstream electric vehicle manufacturers such as Tesla, Lailai, ideal and Xiaopeng have suffered a sharp pullback, the capital market is still more cautious about the investment in new energy vehicles, especially the second-line car brands that mainly sell low-cost products, and Weima Automobile is also the case, if it lacks enough competitiveness. It may be difficult to get financial support from the market.

Of course, as mentioned earlier, listing in Hong Kong is the only way for Weimar to survive. Before that, Weimar may have to take some measures to reduce its expenses. After all, survival is the most important thing. As early as 2019, Shen Hui, founder of Weima, said, "Weima's goal is to become the first profitable new car-building force in the world. We hope to run ahead of Tesla and firmly believe that we can do it." Do not underestimate Weima's determination to make a profit, we must show the determination of a strong man with a broken arm, reduce unnecessary expenses, and concentrate on the development of new energy vehicles. " However, from the current point of view, Weima not only did not run in front of Tesla, but even walked on the way to the crossroads of life and death.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.