In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/25 Report--

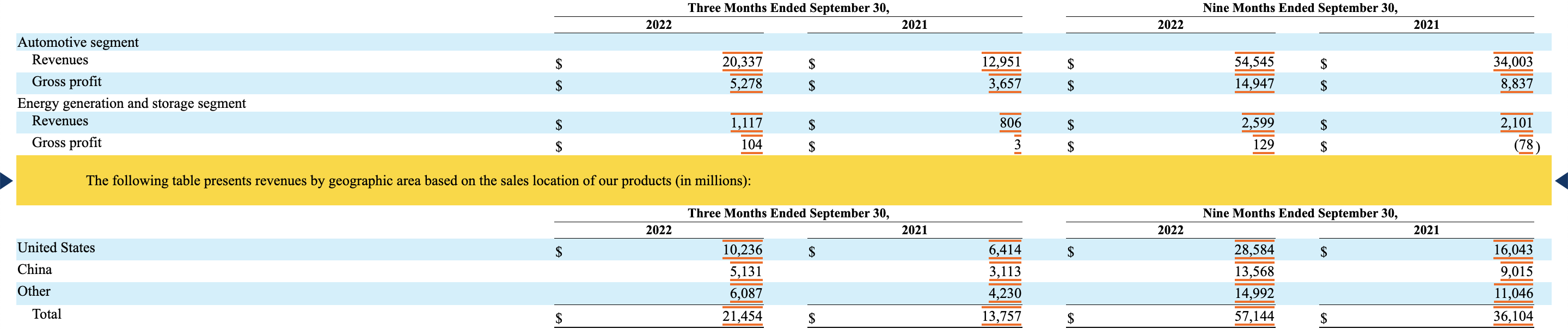

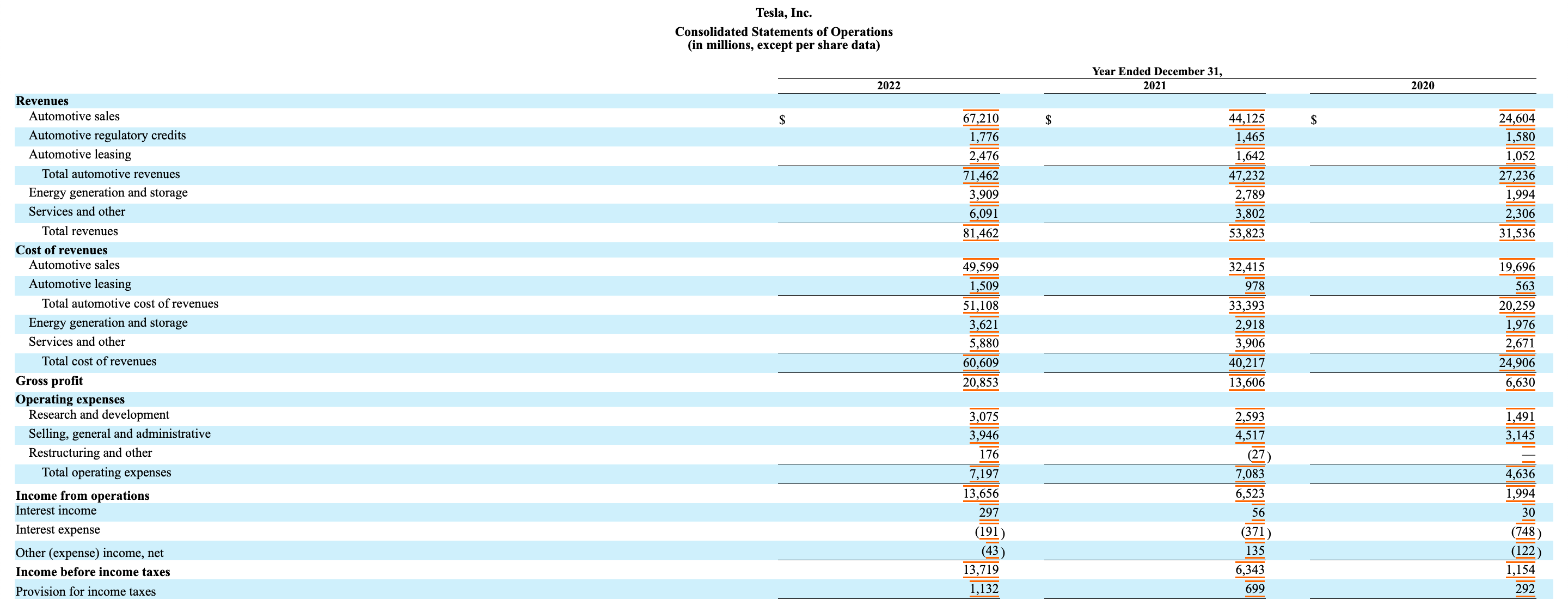

According to Tesla's form 10MuQ filed with the Securities and Exchange Commission (SEC) on October 24th, Tesla achieved an operating income of US $5.131 billion (RMB 37.492 billion) in the Chinese market in the third quarter of 2022, an increase of 64.8% from US $3.113 billion in the same period. In the first three quarters, the Chinese market achieved operating income of US $13.568 billion (about RMB 99.141 billion), an increase of 50.5% from US $9.015 billion in the same period.

China is still Tesla's second largest market, accounting for 23.9% of the company's total revenue. For comparison, Tesla achieved revenue of US $10.236 billion (RMB 77.494 billion) in the US market in the third quarter of 2022, an increase of 59.6% over US $6.414 billion in the same period, and US market operating income of US $28.584 billion (RMB 208.863 billion) in the first three quarters. It increased by 78.2% compared with $16.043 billion in the same period, accounting for 50.0% of Tesla's total revenue.

It is worth mentioning that on the same day, Tesla China announced that it would adjust the price of Chinese mainland's Model 3 and Model Y models, with Model 3 falling by 1.4-18000 yuan and Model Y by 2.0-37000 yuan. Specifically, the rear-drive version of Model 3 dropped from 279900 yuan to 265900 yuan, a direct drop of 14000 yuan; the high-performance version of Model 3 dropped from 367900 yuan to 349900 yuan, a direct drop of 18000 yuan; the rear wheel drive version of Model Y dropped from 369 900 yuan to 2889 thousand yuan, a drop of 28,800 yuan; and the long-lasting version of Model Y dropped from 394,900 yuan to 357,900 yuan, a direct drop of 37,000 yuan. The Model Y high-performance version dropped from 417900 yuan to 397900 yuan, a drop of 20000 yuan.

In response to the price reduction of domestic models, Tesla said in the financial report that lower costs and additional local procurement and manufacturing enable it to implement competitive pricing of vehicles in China.

Tesla's response revealed a little helplessness. According to the official website, except for the Model Y rear wheel drive version, which is expected to be delivered in 1-4 weeks, other versions are expected to be delivered in 4-8 weeks. It can be perceived that Tesla Shanghai factory for Model 3 and Model Y production line adjustment, can effectively reduce the efficiency of domestic sales and external supply, and from Tesla's current delivery cycle in China, it is sufficient to show that Tesla's products are no longer "tight", and their reserve orders may not be much. Therefore, the price reduction promotion can seize more orders, and it is also one of Tesla's killer mace. Not long ago, Tesla announced that he could enjoy an insurance subsidy if he bought a car before the end of 2022, which is equivalent to a price reduction in disguise, but consumers are still not willing to buy, which is one of the reasons for Tesla's price reduction.

In addition, Tesla did not adjust the price in the US domestic market, but only targeted Chinese mainland, but actually felt the pressure from Chinese companies. "Tesla China is facing the biggest competition ever from a local electric car company in China," Morgan Stanley analysts said in a recent report. "

Data show that Tesla delivered 909000 new cars worldwide in the first three quarters, including 310000 in the first quarter, 255000 in the second quarter and 344000 in the third quarter. In the domestic market, Model 3 delivered a total of 99000 vehicles in the first three quarters, down 11.4% from a year earlier, with a cumulative delivery of 219100 vehicles delivered by dome Model Y, an increase of 135.8% over the same period last year. Judging from the data, the Model Y model is much more popular than the Model 3, which is why the price reduction of the Model Y is higher than that of the Model 3.

According to the Federation of Carriage data, Tesla's domestic market share in the first three quarters was 8.2%, while BYD's market share was as high as 29.7%. Although the market share of other new car-building forces was much lower than that of Tesla, it also reached 11.9%. It can be seen that the independent new energy brands led by BYD have begun to seize part of the market share from Tesla.

Of course, the purpose of the price reduction promotion is to complete Musk's Flag as much as possible. During the 2021 earnings call, Tesla CEO Musk said that Tesla should be able to produce 1.5 million cars by 2022. The problem we face is not limited demand, but limited production capacity. Data show that Tesla delivered a total of 908573 new cars worldwide in the first three quarters of 2022. If Tesla wants to achieve his annual target of 1.5 million, it means that 600000 new cars will need to be delivered in the fourth quarter. This is not a small number.

At present, "price reduction promotion" is a card of Tesla, as for how long this card can be used? However, it is rumored that Tesla will launch a low-cost model. In a conference call after Tesla's third-quarter earnings release, Musk revealed an important message, saying that the company is focusing on developing the next generation of cars, which will cost half as much as the Model 3 and will produce as much as Tesla's products combined.

According to Musk's estimate of halving the cost of the new platform, the price of the new model will be half the price of the Model 3, or about 150000 yuan, which is already full of competitors, especially BYD, including Song and Qin. Therefore, even if Tesla launches "half-price Tesla", it may be able to effectively boost sales, but BYD's existence is nothing more than the biggest headache for Tesla.

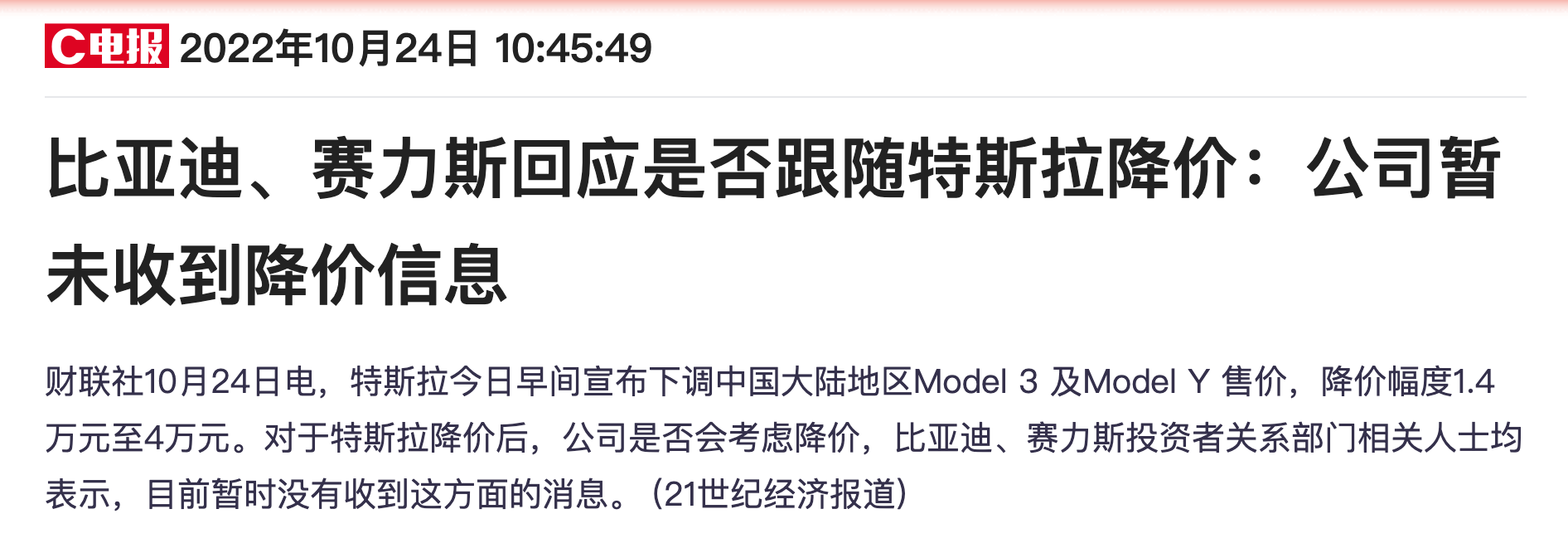

As for Tesla official announced price reduction, whether other car companies will follow, at present, BYD, Cyrus, NIO and other car companies have clearly responded that "there is no price reduction notice." This can also show that with the official downfall of Tesla, China's mainstream manufacturers of new energy vehicles may already have enough ability to cope without being led by the nose by foreign businessmen.

According to data released by Shanghai Nonferrous Network, the price of lithium carbonate recently rose 3000 yuan / ton to 538000 yuan / ton, a new all-time high. Therefore, the rise in raw material prices and the price-for-volume measures that have to be taken will undoubtedly put Tesla's gross profit margin under double pressure.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.