In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/07 Report--

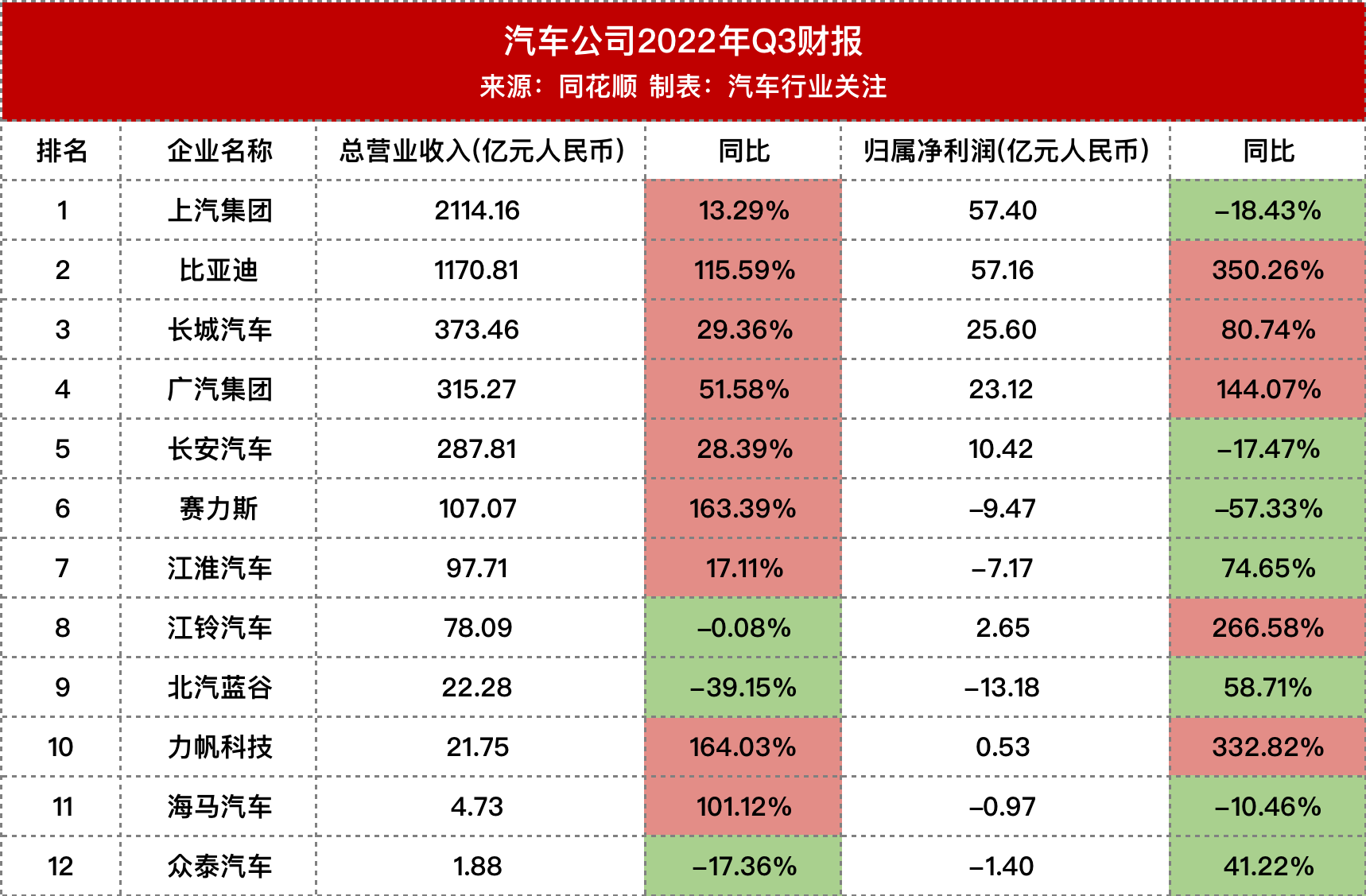

Recently, domestic automobile listed companies have released Q3 financial reports for 2022 for the sixth time. Among the Q3 financial reports of 12 A-share listed automobile enterprises counted in "Automobile Industry Concern," only BYD, GAC Group, Great Wall Motor and Lifan Technology have achieved double growth in revenue and net profit. The net profits of SAIC Group, Chang 'an Automobile and Beiqi Blue Valley have declined significantly, while the loss range of Celis has narrowed.

From Q3 financial report to see, each big car enterprise performance mixed. As the largest automobile manufacturer in China, SAIC Group's operating revenue increased by 13.29% year-on-year to 211.416 billion yuan in the third quarter of 2022, and its net profit declined by 18.43% year-on-year to 5.740 billion yuan. SAIC Group said that due to the epidemic situation, tight supply of parts, rising raw material prices and other impacts, as well as the improvement of production and marketing structure and the recovery of gross profit margin of products are still lagging behind, resulting in significant pressure on the company's profit level.

The decrease in revenue of associates was mainly due to the decrease in SAIC's net profit. The financial report shows that the investment income of SAIC in the third quarter was 4.06 billion yuan, down 50.3% year-on-year. Among them, the investment income from associates and joint ventures was 3.05 billion yuan, down 27.4% year-on-year.

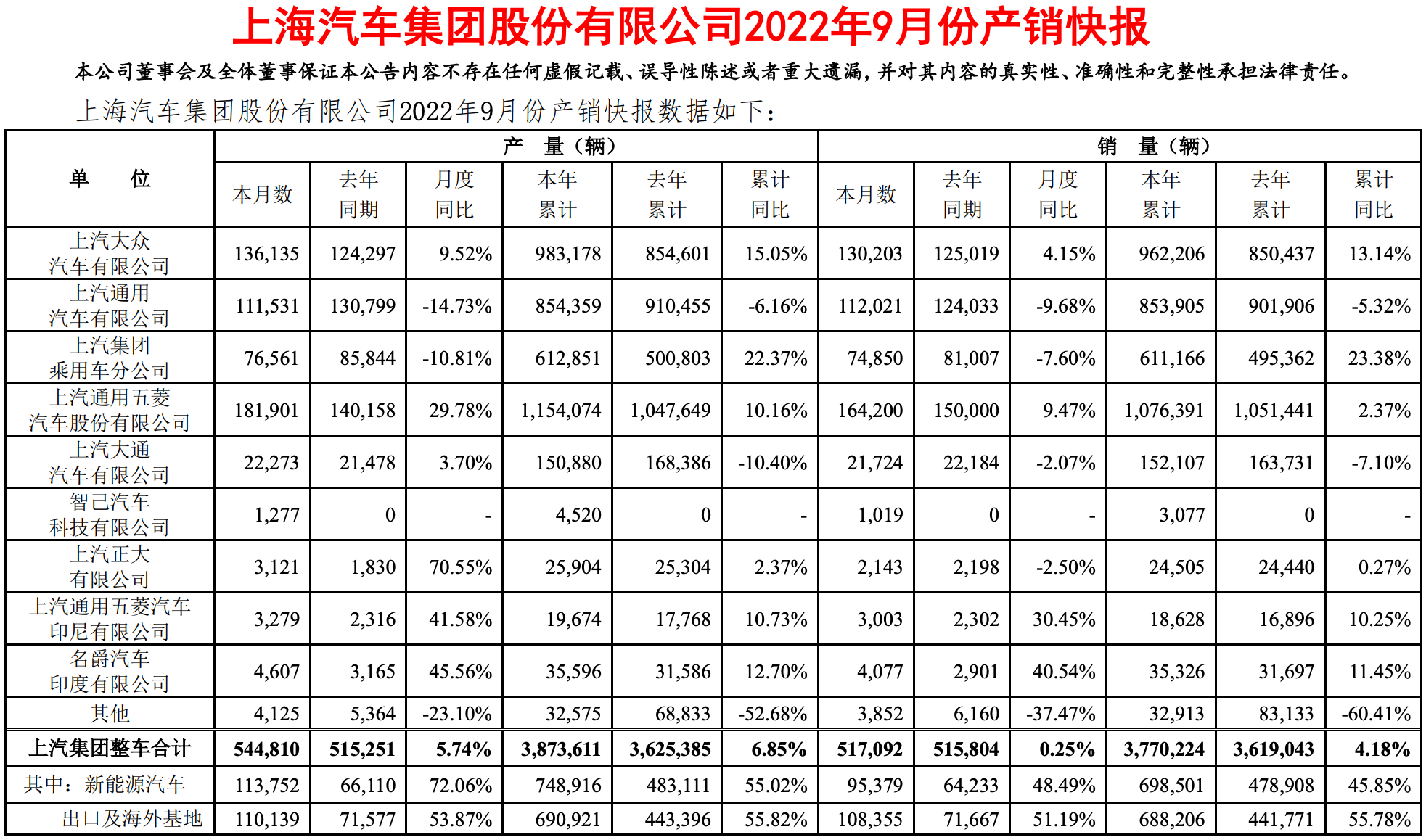

The monthly decline is greater than the cumulative decline, and the decline speed of SAIC GM is accelerating. Data show that SAIC GM sold 112,000 vehicles in September, down 9.68% year-on-year. In the first three quarters, SAIC GM sold 853,900 vehicles, down 5.32% year-on-year. Compared with the top ten manufacturers, SAIC GM in the "Golden Nine" month, single month and cumulative sales all showed a year-on-year decline slightly embarrassing. At this stage, SAIC's independent brand is developing rapidly, which can offset the adverse impact of some joint venture brands.

As net profit fell again, SAIC Group was overtaken by BYD. According to the financial report, BYD's operating income in Q3 of 2022 increased by 115.59% year-on-year to 117.081 billion yuan, and net profit increased by 350.26% year-on-year to 5.716 billion yuan. That is to say, although BYD's operating income is only half of SAIC's, its net profit is not much different from SAIC's. In addition, the net profit of SAIC Group in the first three quarters was 12.649 billion yuan, while BYD was 9.311 billion yuan. If SAIC Group's net profit in the fourth quarter did not improve well, it might be overtaken by BYD and become the most profitable automobile enterprise in China.

Thanks to the dynasty series Song, Tang, Han, Yuan, as well as the ocean series dolphin, poster, destroyer 05 and other hot sales, BYD in the new energy vehicle market is almost "one big". The latest data show that BYD new energy passenger car sales in October 217,500 vehicles, an increase of 171.89% year-on-year. This is BYD's new monthly sales record. In September, the data was 201,000 vehicles, up 187.0% year-on-year. It has exceeded 200,000 vehicles for two consecutive months. In addition, BYD's cumulative sales volume of new energy passenger vehicles from January to October was 1,392,800, up 239.05% year-on-year.

Guangzhou Automobile Group is also the automobile enterprise that realizes profit double increase. According to the financial report, in the third quarter of 2022, the operating income of GAC Group increased by 51.58% year-on-year to 31.527 billion yuan, and the net profit increased by 144.07% year-on-year to 2.312 billion yuan. As we all know, GAC Group owns joint-venture brands GAC Honda, GAC Toyota, GAC Mitsubishi, self-owned brands GAC Chuanqi and GAC Ai 'an, most of which are sold from Japanese "Liangtian". However, compared with traditional brands, GAC Ai 'an will become the future performance growth point of the Group. In October, GAC Ai' an sold 30,063 vehicles, with a year-on-year growth of 149.20%, and the sales volume exceeded 30,000 vehicles for two consecutive months. It is reported that GAC Ai 'an plans to submit the listing application of Kechuang Board in Q2 of 2023.

Although sales declined, Great Wall Motors also achieved double profit growth. Financial report shows, In the third quarter of 2022 Great Wall Motor operating income 37.346 billion yuan, Year-on-year growth 29.36%; Net profit 2.560 billion yuan, Year-on-year growth 80.74%; Great Wall Motor said, Net profit increase is the company optimization product structure, Single car price rise brought gross profit growth, And exchange rate income increase.

At the beginning of the year, due to the rising cost of power batteries, Euler was forced to stop selling white cats and black cats, followed by the launch of two 200,000-yuan models, ballet cats and lightning cats. In other words, although Great Wall's sales have declined, the profit margin per car has increased. However, at present in front of Great Wall Motors, more critical is the Haval brand sales growth bottleneck, and Wei brand transformation failure.

As the "sales champion" of China's pure electric vehicles for seven consecutive years, Beiqi Blue Valley can be described as "getting up early and catching up with a late set", and the loss has expanded again this year. Financial report shows, The third quarter realized operating income 2.227 billion yuan, Year-on-year decline 39.15%; Belonging to listed company shareholders net loss 1.318 billion yuan, Year-on-year growth 58.71%. That is to say, Beiqi Blue Valley not only operating income decline, net loss is also bigger and bigger. It is understood that BAIC Blue Valley mainly operates two automobile brands,"BEIJING" and "ARCFOX", among which ARCFOX is the main business target, which is the key to whether BAIC Blue Valley can become the public vision. Data show that in the first three quarters, the wholesale sales volume of Polar Fox was only 9829 vehicles, compared with the sales target set at the beginning of the year of 40,000 vehicles, with a completion rate of less than 25%. A few days ago, Wang Qiufeng, deputy general manager of Beiqi New Energy Co., Ltd. and president of Jihu Automobile, resigned due to personal reasons.

As for Celis, it is still in a state of loss after cooperating with Huawei to build a car. Financial report shows, The third quarter of Selis operating income 10.707 billion yuan, Year-on-year increase 163.39%. The net profit attributable to shareholders of listed companies was-947 million yuan, compared with-602 million yuan in the same period; for the growth of operating income, Selis said that during the reporting period, the sales volume of new energy vehicles of the Inquiries series increased significantly. As for the expansion of net profit loss, Selis said that although the sales volume of new energy vehicles of the Interboundary series increased significantly, the expenses and taxes also increased accordingly. At the same time, it was affected by factors such as the continuous rise in the prices of raw materials such as chips and power batteries, and the continuous investment in product research and development and marketing.

2022 is nearing the end, with the joint efforts of the state, car companies and consumers, this year is still expected to achieve growth, but 2023 may be a "cold winter", car companies should reserve "winter food".

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.