In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-25 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/08 Report--

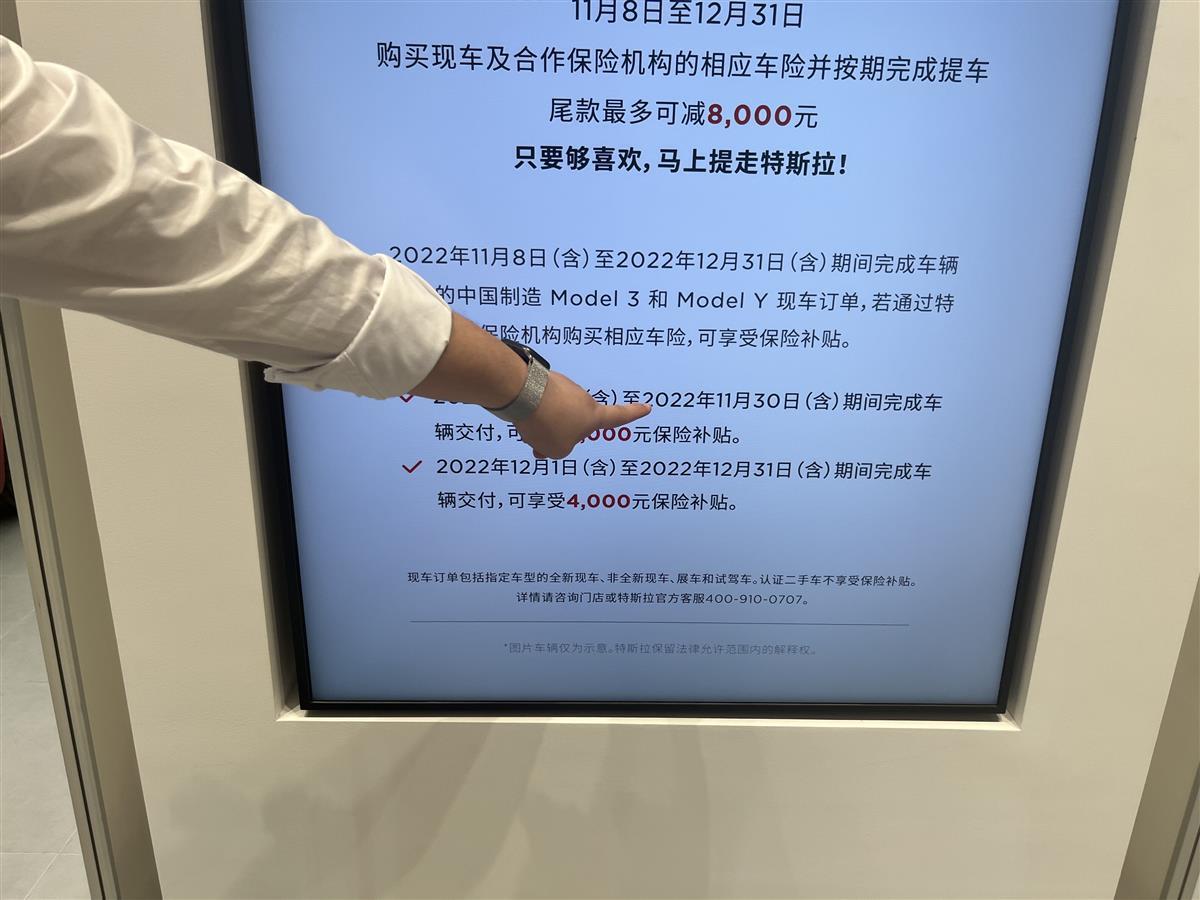

After the official announcement cut prices on October 24th, Tesla launched an insurance subsidy program again, which was interpreted by the industry as another "disguised price reduction". Tesla China released a poster saying that from November 8 to November 30, the final payment will be reduced by 8000 yuan if you buy the car insurance portfolio of existing cars and cooperative insurance institutions and complete the pick-up on schedule, and from December 1 to December 31, the final payment can be reduced by 4000 yuan.

According to the latest data released by the Federation of passengers, Tesla sold 71704 vehicles wholesale in China in October, including 54504 for export and 17200 for domestic retail. For reference, Tesla sold 83135 vehicles wholesale in China in September, including 5522 for export and 77613 for domestic retail. According to the rules, the vehicles produced by Tesla's Shanghai factory in the first two months of each quarter will be mainly sold to overseas markets, and Chinese mainland will be mainly supplied in the third month, which is the main reason for the contrast between Tesla's domestic sales and external supply in China in September and October.

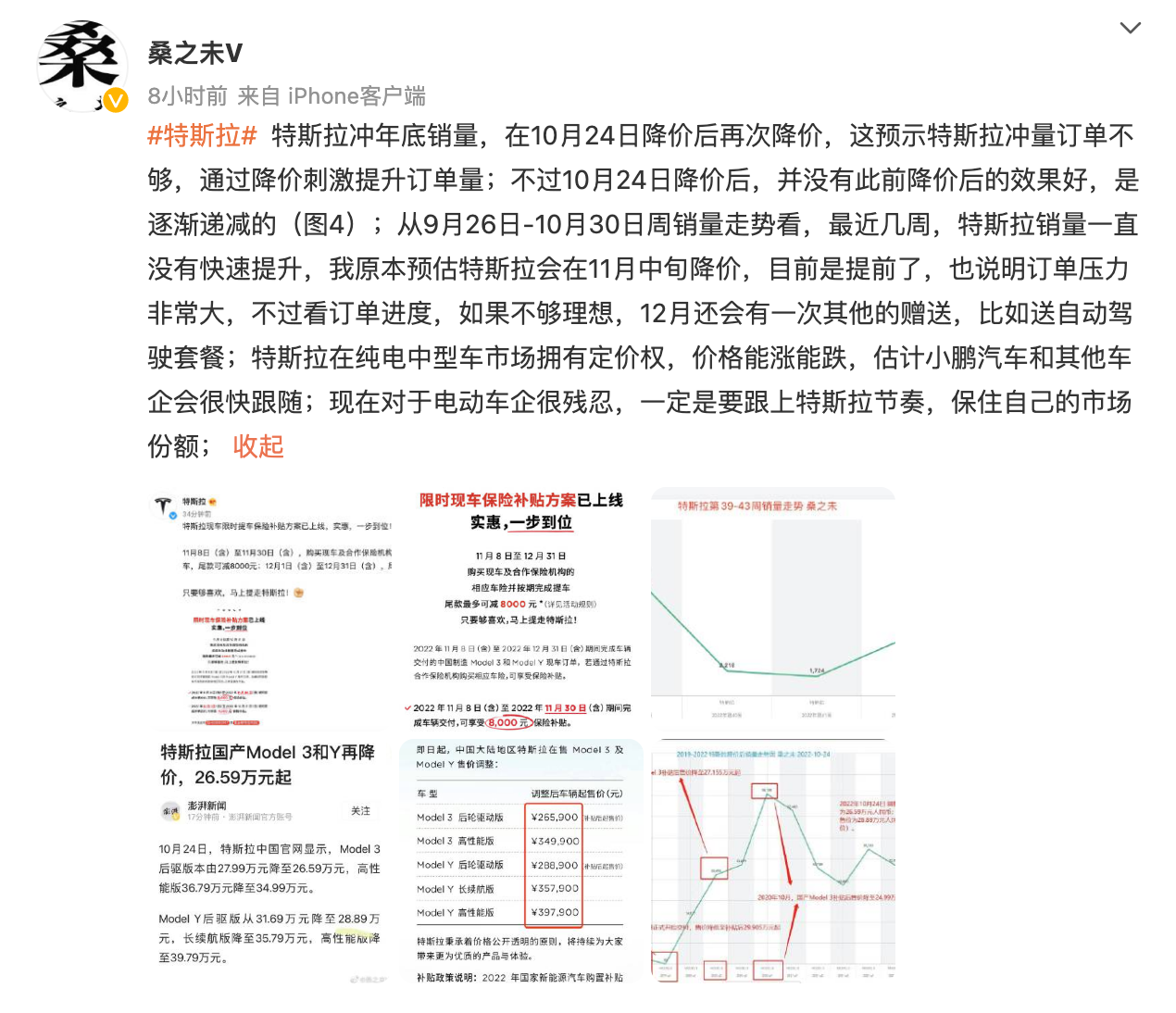

Tesla announced a price reduction on October 24th, the first time Tesla has cut prices this year. Specifically, Model 3 dropped 1.4-18000 yuan and Model Y dropped 2.0-37000 yuan. Among them, the rear drive version of Model 3 decreased from 279900 yuan to 265900 yuan, a direct drop of 14000 yuan; the high performance version of Model 3 dropped from 367900 yuan to 349900 yuan, a direct drop of 18000 yuan; Model Y rear wheel drive version dropped from 369 900 yuan to 2889 thousand yuan, a direct drop of 28,800 yuan; and Model Y long-lasting version dropped from 394,900 yuan to 357,900 yuan, a direct drop of 37,000 yuan The Model Y high-performance version dropped from 417900 yuan to 397900 yuan, a drop of 20000 yuan.

It is worth mentioning that it is not the first time for Tesla to "reduce the price in a disguised form" through the time-limited car pick-up insurance subsidy program. In mid-September this year, Tesla exposed this plan to provide 8000 yuan insurance subsidy to car owners who finished picking up their cars and chose to buy insurance in Tesla's store from September 16 to September 30, which can be directly used to reduce car prices. Subsequently, Tesla launched an insurance subsidy activity again on October 1st. consumers buy cars between October 1 and December 31, and if they choose to purchase corresponding car insurance through Tesla's cooperative insurance institutions, they can enjoy insurance subsidies through a reduction of 7000 yuan in the final payment.

In addition to stimulating sales through the insurance subsidy program, Tesla also launched the "Tesla Treasure Box points Award" activity when he announced the official downgrade on October 24. According to Tesla, after users successfully recommended a friend to buy Tesla, both of them can earn points and exchange for gifts.

Members of the expert committee of the China Automobile Circulation Association analyzed that Tesla cut prices again after the price cut on October 24, which indicates that Tesla's impulse orders are not enough, hoping to stimulate an increase in order volume through price cuts. However, Tesla's price reduction did not achieve the desired results. Judging from the weekly sales trend from September 26 to October 30, Tesla's sales have not increased rapidly in recent weeks. Tesla was originally expected to reduce prices in mid-November, which also shows that the order pressure is very high.

In the view of Cui Dongshu, secretary of the Federation of passengers, at present, the automobile market is affected by the epidemic, and Tesla has to cut prices to stimulate sales in his terminal market. After Tesla announced the price reduction, the market was worried that his behavior might trigger a new round of price reduction, but due to the impact of the continuous rise in the price of upstream raw materials and the complete withdrawal of the subsidy policy for new energy vehicles at the end of the year, in addition to Ford Electric Ma Guan Xuan to follow up on the price reduction, other car companies, including BYD, Ulai, ideal, and other car companies have not publicly reduced their prices.

At present, Tesla is the world's largest car company by market capitalization, and its profitability is evident. According to the financial report, Tesla's operating income in the third quarter of 2022 was 21.454 billion US dollars, an increase of 55.95 percent over the same period last year. Net profit attributable to common shareholders was $3.292 billion, up 103 per cent from a year earlier. In addition, the gross profit margin for cars in the third quarter was 27.9%, down from 30.5% in the same period in 2021, but much higher than traditional luxury brands such as Mercedes-Benz and BMW.

Industry insiders believe that Tesla has a huge advantage in the supply chain and that being able to set prices freely according to the market is only a matter of earning more and making less. We do not rule out the possibility that Tesla adopts more aggressive price reduction measures in order to gain more market share. The current market situation is very cruel to other electric car companies. We must keep up with Tesla's pace and keep our market share.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.