In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/15 Report--

In response to the online exposure of "GAC Fick bankruptcy triggered 26 dealers collective rights protection" incident, today, November 15, GAC Group made a response. GAC Group said that, as a state-owned holding enterprise and one of the shareholders of GAC Fick, GAC Group will actively support its creditor's rights and debts to be handled according to laws and regulations; and according to the marketization principle and the development needs of the company, explore the reorganization measures for utilizing its assets and resources, and try its best to safeguard and protect the legitimate rights and interests of all parties. At that time, relevant disclosure will be made according to the requirements of Xinpai. At the same time, GAC Group will urge GAC FIK to cooperate with the bankruptcy administrator to make arrangements according to laws and regulations such as Measures for the Administration of Automobile Sales and Enterprise Bankruptcy Law.

On October 31, the official website of Stellantis Group released the latest announcement that the shareholders of GAC Fick, GAC Group and Stellantis had approved a resolution agreeing that GAC Fick would file for bankruptcy with the court in case of loss. On the same day, GAC Group also issued an announcement saying that after voting by the directors present at the meeting, the Proposal on Approving the Bankruptcy Application of GAC Fick was deliberated and approved. According to the application of the joint venture GAC Fiat Chrysler Automobile Co., Ltd.(hereinafter referred to as "GAC Fik"), it is agreed to apply to the court for bankruptcy due to insolvency and in accordance with relevant provisions of current laws and regulations.

On November 3, Sky Eye App showed that GAC Fiat Chrysler Automobile Co., Ltd. added bankruptcy review cases. The applicant was the above-mentioned company, and the handling court was Changsha City Intermediate People's Court of Hunan Province. This also means that GAC Fick, a 12-year-old joint venture automobile enterprise established in China, formally applied for bankruptcy reorganization to the Intermediate People's Court of Changsha City, Hunan Province, but GAC Fick, which was deeply involved in bankruptcy reorganization, soon faced collective rights protection by many dealers.

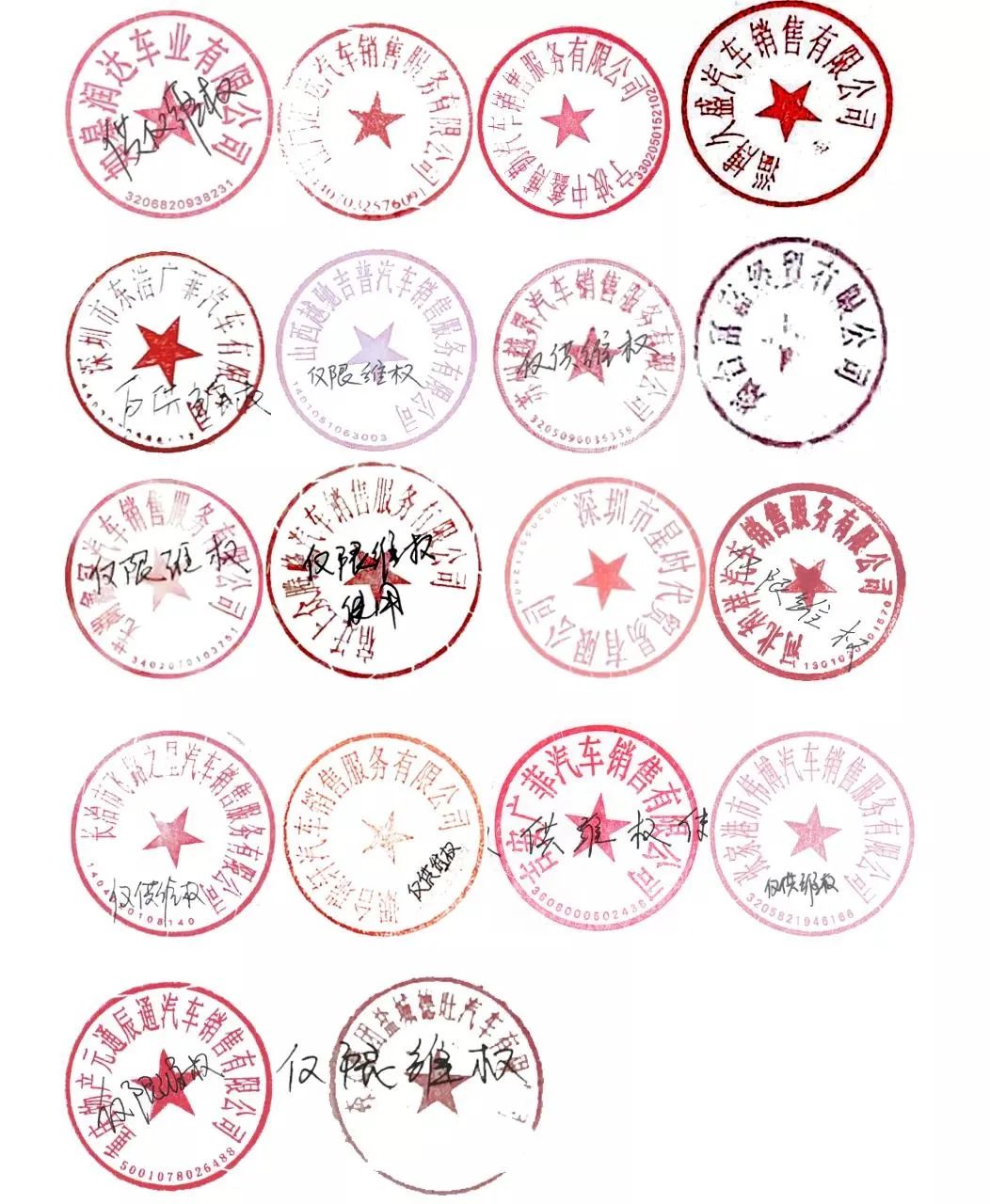

According to a number of media reports, on November 11,26 auto dealers jointly sent a letter to the Letters and Calls Bureau of Guangzhou City and Changsha City People's Government to protect the rights of GAC Fick, which is applying for bankruptcy. In the letter of rights protection, 26 GAC Fick dealers put forward 4 claims in total: one is to resolutely resist bankruptcy liquidation before solving the problems of dealers and customers; Second, the dealer pays the deposit to the manufacturer, and the due rebate is paid in full cash; Third, due to the manufacturer's formalities, the customer cannot complete the licensing within the specified time, resulting in losses, such as inventory backlog vehicles, the manufacturer should repurchase the original price; Fourth, make up for the operating losses caused to the dealer due to the manufacturer's fault.

According to previous reports of automobile industry concern, GAC Fiat Automobile Co., Ltd. was established on March 9,2010. GAC Group and Fiat Group held 50:50 share ratio respectively, with a total investment of about 17 billion yuan. Subsequently, Fiat brand was introduced into domestic Fiat brand models, such as Feixiang and Zhiyue. In January 2014, Fiat Group acquired Chrysler Group and changed its name to Fiat Chrysler Group; in January 2015, GAC Fiat changed its name to GAC Fiat Chrysler, and introduced the localization of Jeep brand. The first model, Free Light, was widely praised after its launch. Since then, Jeep brand six consecutive domestic models such as Freeman, Guide, Big Commander, etc., Jeep brand localization makes GAC Fick usher in a short highlight moment. According to the data, the sales volume of GAC Fick in 2016 was 179,900 vehicles, with a year-on-year growth of 23.57% to 222,300 vehicles in 2017, which is the peak sales volume since the establishment of GAC Fick. The good times are not long. After 2017, the sales volume of GAC Fick shows a cliff-like decline. In 2018, the Fiat brand owned by GAC Fick announced its withdrawal from the Chinese market due to poor sales volume, leaving only Jeep brand for independent development. In the same year, Jeep brand was named by "315 party" due to the problem of "burning engine oil", and GAC Fick also began to decline. According to the data, the sales volume of GAC Fick in 2018 and 2019 was 125,200 and 73,900 respectively.

Influenced by this, GAC Fick also tries to "save itself" by means of capital increase, coach change and new strategy, but after a series of measures, it still cannot change the predicament of GAC Fick. In 2020 and 2021, the sales volume of GAC Fick is 40,500 vehicles and 20,100 vehicles respectively, among which the sales volume in 2021 drops by 50.33% year-on-year, which is the automobile enterprise with the fastest decline in sales volume of GAC Group. After entering 2022, it will directly fall into a shutdown state. According to the data, the output of GAC Fick in the first half of 2022 decreased by 89% year-on-year to 822 vehicles; the sales volume decreased by 84.18% year-on-year to 1861 vehicles, among which the production and sales from March to June were 1 vehicle, 0 vehicle, 1 vehicle and 0 vehicle respectively.

The sharp decline in sales has also led to the gradual emergence of GAC Fick's business problems. According to the financial report of GAC Group, the net assets of GAC Fick reached 4.422 billion yuan in 2017, but by 2020, its net assets dropped to-331 million yuan, and the accumulated losses in three years reached nearly 5 billion yuan, which once became the largest "negative assets" of GAC Group. Since then, there has been no sign of improvement in this situation. In the first half of 2022, the operating income of GAC Fick is RMB 588 million yuan, and in 2021, it is RMB 3.861 billion yuan; the net loss is RMB 649 million yuan, and the net loss of 2021 is RMB 3.169 billion yuan. According to the latest announcement of GAC Group, as of September 30,2022, GAC Fick (unaudited) has total assets of RMB 7.322 billion yuan, total liabilities of RMB 8.113 billion yuan, asset-liability ratio of 110.80%, assets are insufficient to pay off all debts and obviously lack solvency, which is in the situation of "insolvency".

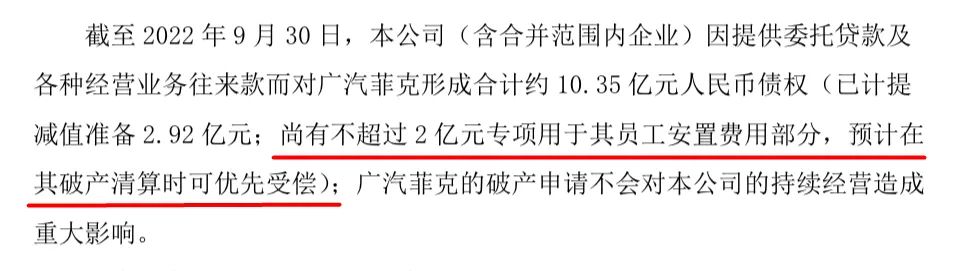

Although it is in an "insolvency" situation, GAC Group emphasizes in its announcement that as of September 30, 2022, the Company (Including the enterprises within the scope of merger) A total of about RMB 1.035 billion of creditor's rights have been formed to GAC FIK due to the provision of entrusted loans and various business transactions (RMB 292 million has been provided for impairment; no more than RMB 200 million has been earmarked for its employee placement expenses, and it is expected that it will be compensated preferentially in bankruptcy liquidation); GAC FIK's bankruptcy application will not have a significant impact on the Company's continuing operation.

For GAC Fick, this situation may not be unexpected, but for the owner may have a little worry, after all, a car enterprise goes bankrupt, facing not only the vehicle maintenance rate drops sharply, follow-up maintenance and quality assurance problems how to deal with also become a big concern of the owner.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.