In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/22 Report--

A "bankruptcy review application" message once again pulled Jiangling Holdings, which had been silent for a long time, back to public view. According to Tianyan check App information, on November 21, Jiangling Holdings Co., Ltd. (hereinafter referred to as "Jiangling Holdings") added a bankruptcy review case to Shanghai Demeike Automotive equipment Manufacturing Co., Ltd., and the handling court was the Intermediate people's Court of Nanchang City, Jiangxi Province. "bankruptcy review case" refers to the examination of whether the enterprise applying for bankruptcy is qualified for bankruptcy, in other words, once the enterprise is qualified for bankruptcy, it means that it can apply for bankruptcy reorganization. So far, Jiangling Holdings Limited (hereinafter referred to as "Jiangling Holdings") on the new bankruptcy review case, Jiangling Holdings official has not responded.

At present, Jiangling Holdings is jointly owned by Jiangxi State-controlled Automobile Investment Company, Chongqing Changan Automobile Co., Ltd., and Jiangling Automobile Group Co., Ltd., with a tripartite shareholding ratio of 50:25:25, and its business scope includes the production of automobiles, auto parts, and so on. The auto industry has noticed that Tianyancha equity penetration shows that Jiangling Holdings controls six subsidiaries, but five of the six subsidiaries have been "cancelled", leaving only Nanchang Lufeng Automobile Marketing Co., Ltd. the company has also been included in the list of people who have broken their promises. In addition, risk information shows that at present, Jiangling Holdings has a number of information about the person subject to execution, with a total amount of more than 48.91 million yuan.

Reviewing the development history of Jiangling Holdings, the early Jiangling Holdings is not in jeopardy in the automobile industry. Jiangling Holdings was established in November 2004. it was first funded by Jiangling Automobile Group and Changan Automobile, each injected 1 billion yuan, and the shareholding ratio of both sides was 50:50. The Lufeng brand incubated by both sides also had a short highlight moment. At that time, Jiangling Holdings mainly focused on SUV business, and its Lufeng X7, Lufeng Rongyao, Lufeng Xiaoyao, Lufeng X2, Lufeng X5, Lufeng X8 products, covering non-load-bearing and load-bearing SUV, compact and small SUV markets, among which the Lufeng X7 has become an "online celebrity" model since it was launched in 2014.

Data show that Lufeng X7 sold more than 80, 000 vehicles in 2016, with an average monthly sales of nearly 7000, making it the main model of Lufeng. However, the good times did not last long. After entering 2017, the sales of the Lufeng X7 suffered a cliff decline. By 2018, the sales of the Lufeng X7 was only 5611, with an average monthly sales of less than 500. In 2019, the Lufeng X7 was still mired in plagiarism and was about to stop production. in March of that year, the Beijing Chaoyang District Court ruled that the appearance of the Lufeng X7 model copied the range Rover Aurora and asked Jiangling Holdings to immediately stop all sales, manufacturing and marketing of the Lufeng X7. And pay compensation to Jaguar Land Rover. It was also from this year that Land Wind Motor gradually disappeared. According to disclosed data, from January to July 2019, Lufeng production fell 23.7% year-on-year to 154000 vehicles; sales fell 21.1% year-on-year to 157000 vehicles. Lufeng has not released production and sales figures since then. At that time, Jiangling Holdings had total assets of 4.81 billion yuan, total liabilities of 3.059 billion yuan, and a debt ratio of 63.6%.

In this context, Jiangling Holdings also tried to increase capital and shares and transformation to carry out "self-rescue", but still unable to pull Jiangling Holdings out of the quagmire after a series of measures. In July 2019, Jiangling Holdings introduced the new car-building power Aichi Motor as a strategic investor to increase its capital. Aichi Motor invested 1.747 billion yuan to take a 50% stake in Jiangling Holdings, becoming the largest shareholder. The shares of Jiangling Motor and Changan Automobile were diluted from 50% to 25% respectively. At this point, Jiangling Holdings has been reborn and started a tripartite pilot project of mixed reform of central enterprises, local state-owned enterprises and private enterprises dominated by the new power of car-building, and transformed to the direction of new energy and intelligence at the same time.

A month later, the three parties issued a strategic cooperation plan. According to the plan, the mixed Jiangling Holdings will form a dual-brand and dual-manufacturing base drive model of Aichi and Lufeng, in which Aichi brand focuses on new energy models. Lufeng brand gradually transformed from traditional fuel vehicles to plug-in hybrid and add-on vehicles.

For Aichi, the problem of manufacturing qualification and follow-up financial guarantee can be solved in one fell swoop by taking a stake in Jiangling Control. Fu Qiang, then co-founder and chairman of Aichi Automobile and vice chairman of Jiangling Holdings, also had great hope for the original brand Lufeng Motor of Jiangling Holdings, hoping to rebirth Lufeng Motor through the "dual-brand" strategy. However, the ideal is very plump and realistic. The entry of the "young car-building new force" Aichi not only failed to save Lufeng Motor, but also failed to prosper. Aichi Automobile, founded in 2017, is one of the early new car-building brands in China. Aichi U5, its first model, was officially launched in December 2019. The sales performance of the new car is not satisfactory, with only 2600 cars sold in 2020. In this year, Land Wind car completely disappeared, and then stopped production, pay cut news was also exposed.

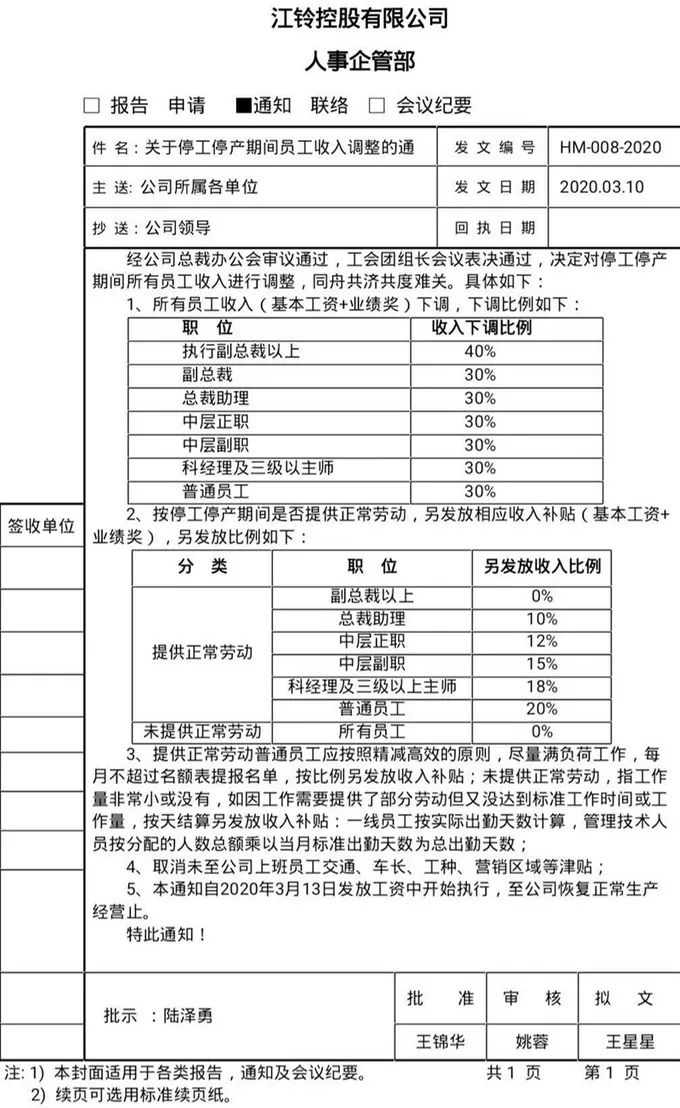

The news of the total shutdown of Jiangling Holdings in early 2020 spread like wildfire, and a document named "personnel Management Department of Jiangling Holdings Co., Ltd." (hereinafter referred to as "document") was also widely circulated online. According to the contents of the document, the income of all employees (base salary + performance award) will be reduced during the shutdown period, of which the executive vice president and above will be reduced by 40%, and the rest of the employees will be reduced by 30%. In addition, a certain proportion of income subsidies will be paid to employees who provide normal work during the shutdown period, and the transportation, type of work, marketing area and other allowances for employees who do not come to work in the company will be cancelled.

Two years after finally taking a stake in Jiangling Holdings, Aichi had to divest Jiangling Holdings. On June 22nd, Aichi withdrew from Jiangling Holdings and sold its 50 per cent stake to Jiangxi State-controlled Automobile Investment Co., Ltd., thus forming the ownership structure mentioned at the beginning. That is, Jiangling Holdings is jointly owned by Jiangxi State-controlled Automobile Investment Company, Chongqing Changan Automobile Co., Ltd., and Jiangling Automobile Group Co., Ltd., with a shareholding ratio of 50:25:25 respectively. As for why Aichi withdrew from Jiangling Holdings, the official did not give an explanation. Some people in the industry said that it might be related to the intricate shareholder relationship of Jiangling Holdings. Of course, Aichi itself is not large, and its sales volume has not changed qualitatively after the divestiture of Jiangling Holdings. According to the data, the annual sales of Aichi cars in 2021 is 3011, and the cumulative sales from January to September in 2022 is only 3208, which is a huge gap compared with the current mainstream new car-building forces in China.

In contrast, Jiangling Holdings, Jiangling Holdings is also a small car company, in the ever-changing environment of the car market, Jiangling Holdings has poor performance in response to market changes and new product investment, and it is expected that it will eventually fail. At present, Jiangling Holdings has been gradually marginalized or even on the brink of bankruptcy, and the models under the Lufeng brand are currently in a state of suspension. Under such circumstances, the possibility of Jiangling Holdings wanting to "come back to life" again is slim. Of course, where will Jiangling Holdings go in the future? we'd better wait for the official announcement of the results.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.