In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/05 Report--

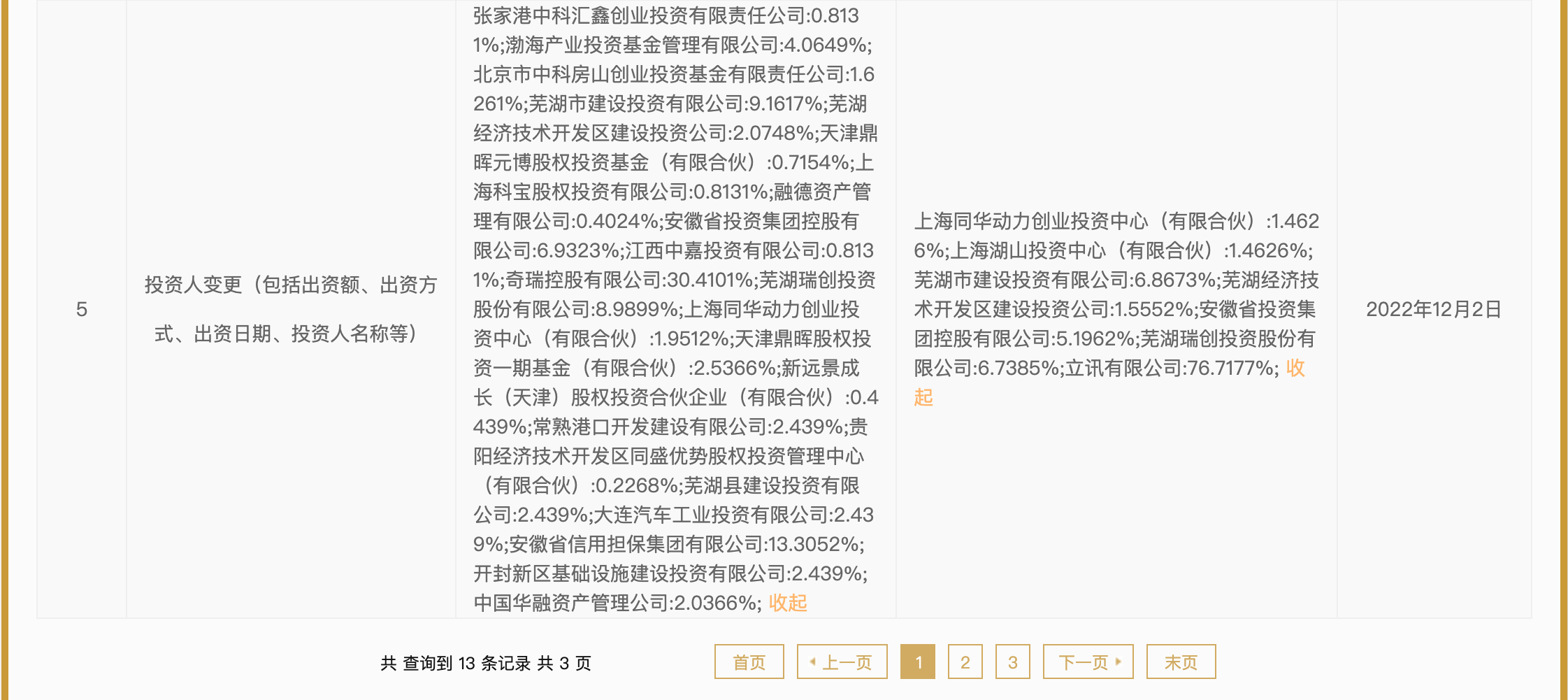

According to the national enterprise credit information publicity system, industrial and commercial changes have taken place in Chery Automobile Co., Ltd. (hereinafter referred to as "Chery Automobile"). More than a dozen companies, including Chery holding Co., Ltd., Anhui Credit financing guarantee Group Co., Ltd., have withdrawn from the ranks of shareholders, and Lixun Co., Ltd. and Shanghai Hushan Investment Center (limited partnership) have been added as shareholders. At present, Chery Automobile is jointly owned by Lixun Co., Ltd., Wuhu Construction Investment Co., Ltd., Wuhu Ruichuang Investment Co., Ltd., Anhui Investment Group holding Co., Ltd., of which Lixun Co., Ltd. holds 76.72%, is the largest shareholder.

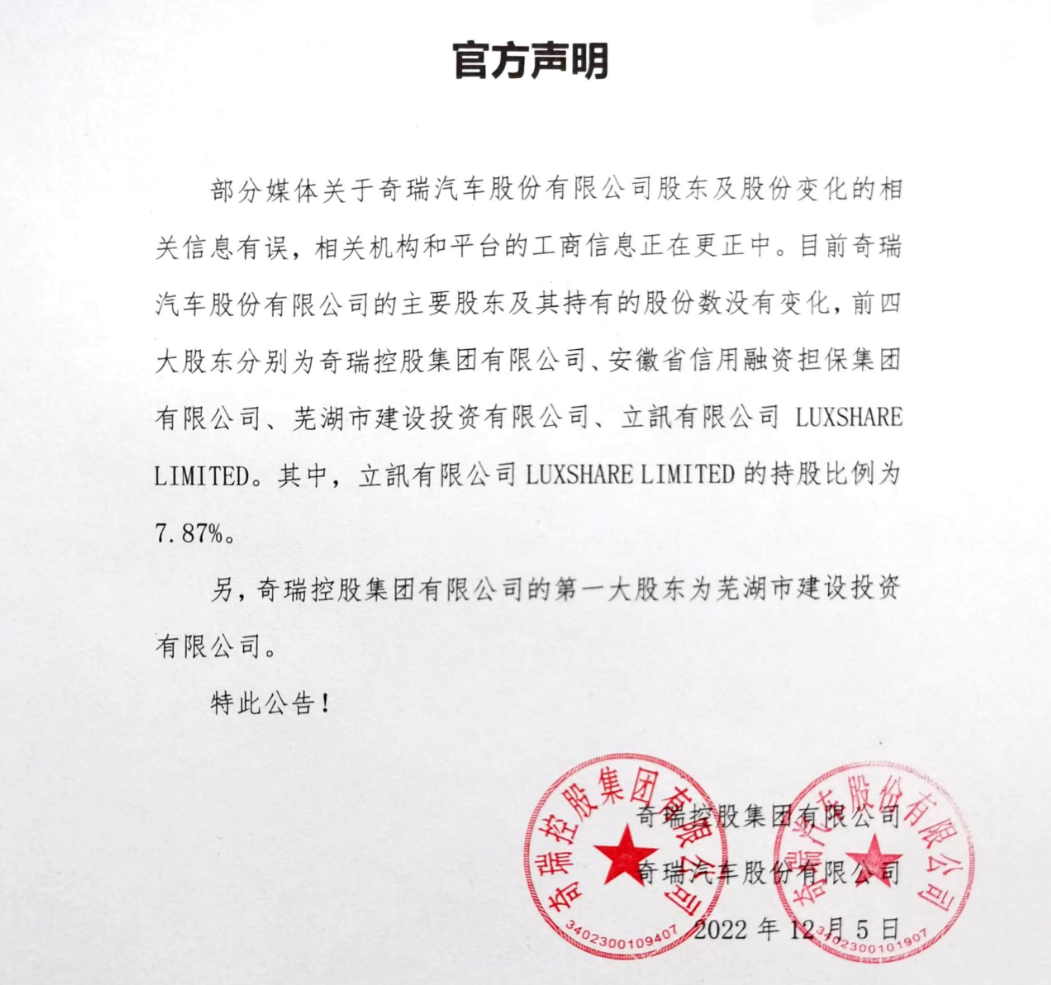

In response to the above industrial and commercial changes, Chery issued a statement in response: some media information about the shareholders and share changes of Chery Automobile Co., Ltd. is wrong, and the industrial and commercial information of relevant institutions and platforms is being corrected. At present, the main shareholders and the number of shares held by Chery Automobile Co., Ltd. have not changed. the top four shareholders are Chery holding Group Co., Ltd., Anhui Credit financing guarantee Group Co., Ltd., Dongguan Lake Construction Investment Co., Ltd., Lixun Co., Ltd. Among them, Lixun Co., Ltd. holds 7.87% of the shares.

Data show that Chery Automobile was founded in January 1997, with a registered capital of 5.47 billion yuan, and the legal representative is Yin Tongyue. According to the official website, Chery currently owns three major brands: Chery, Jetway and Chery New Energy, of which Chery is the main source of sales, with Ruihu series, iRize series and ou Mengda. The insurance figures show that Chery sold a total of 369100 vehicles from January to October 2022, up 14.03% from a year earlier, with Ruihu 8 being the highest, down 15.79% from a year earlier to 83900 vehicles.

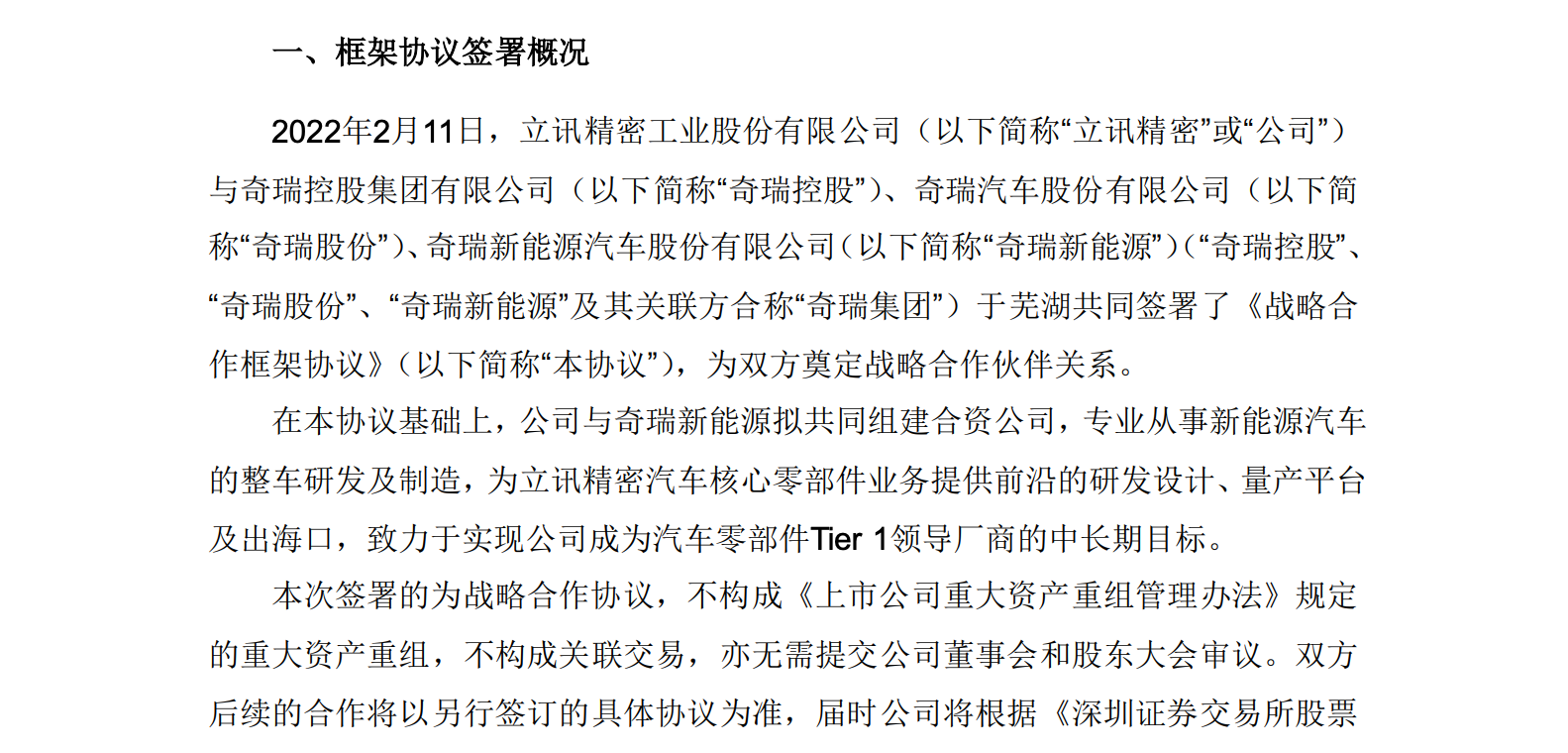

On February 11, Lixun Precision announced that the company and Chery Holdings, Chery shares and Chery New Energy jointly signed the Strategic Cooperation Framework Agreement in Wuhu to establish a strategic partnership for both sides. According to the announcement, the company will jointly set up a joint venture with Chery New Energy, specializing in vehicle R & D and manufacturing of new energy vehicles, providing cutting-edge R & D and design, mass production platform and sea port for Lixun's core auto parts business, and committed to realizing the company's medium-and long-term goal of becoming a leading manufacturer of auto parts Tier 1.

On the same day, the company's controlling shareholder Lixun Co., Ltd. (hereinafter referred to as "Lixun Co., Ltd.") signed the "Equity transfer Framework Agreement" with Qingdao Wudaokou New Energy Automobile Industry Fund (Limited Partnership) (hereinafter referred to as "Qingdao Wudaokou"). The agreement stipulates that Lixun Co., Ltd. will buy 19.88 per cent of Chery Holdings, 7.87 per cent of Chery shares and 6.24 per cent of Chery New Energy held by Qingdao Wudaokou for 10.054 billion yuan. After the completion of the transaction, Lixun Limited does not control Chery Holdings, Chery shares and Chery New Energy.

Lixun Precision said that Chery Holdings and its affiliated subsidiaries have been engaged in the automobile industry for many years and have a complete technology and product research and development system in the vehicle field, especially an independent platform in vehicle manufacturing. It can provide Chery and other brands with comprehensive services from vehicle development to mass production, and has a leading core competitive advantage in the industry. Cooperation can help to realize the diversification and large-scale development of the company's core components.

However, Lixun denied the idea of "building a car" in a conference call with investors the next day. Lixun Precision said that this strategic cooperation with Chery, the company does not build cars, but cooperate with Chery to develop another new industry, that is, the whole vehicle ODM model. On the basis of building a cooperative car manufacturing ODM model, this strategic cooperation will rapidly develop the Tier 1 business of listed companies, realize dynamic entry, and rapidly enhance the comprehensive capability of the company's core components as a Tier 1 manufacturer. In business, Chery is good at vehicle business, the joint venture company will be led by Chery, and Lixun Precision will cooperate in business, customers and other aspects.

The reason why Lixun Precision builds cars by taking a stake in Chery New Energy has a lot to do with its own business development. It is understood that Lixun Precision, which started from connector products, is one of the important components of smartphones, and later continues to expand its production capacity and product line. It successfully entered Apple's supply chain through acquisitions 10 years ago, and now assembles AirPods, iPhone and other products for Apple, which also means that its contract manufacturing level is at the forefront of the industry. In 2020, Apple, as the largest customer of Lixun Precision, accounted for 69% of its revenue, a higher proportion than Gale and Lance Technology.

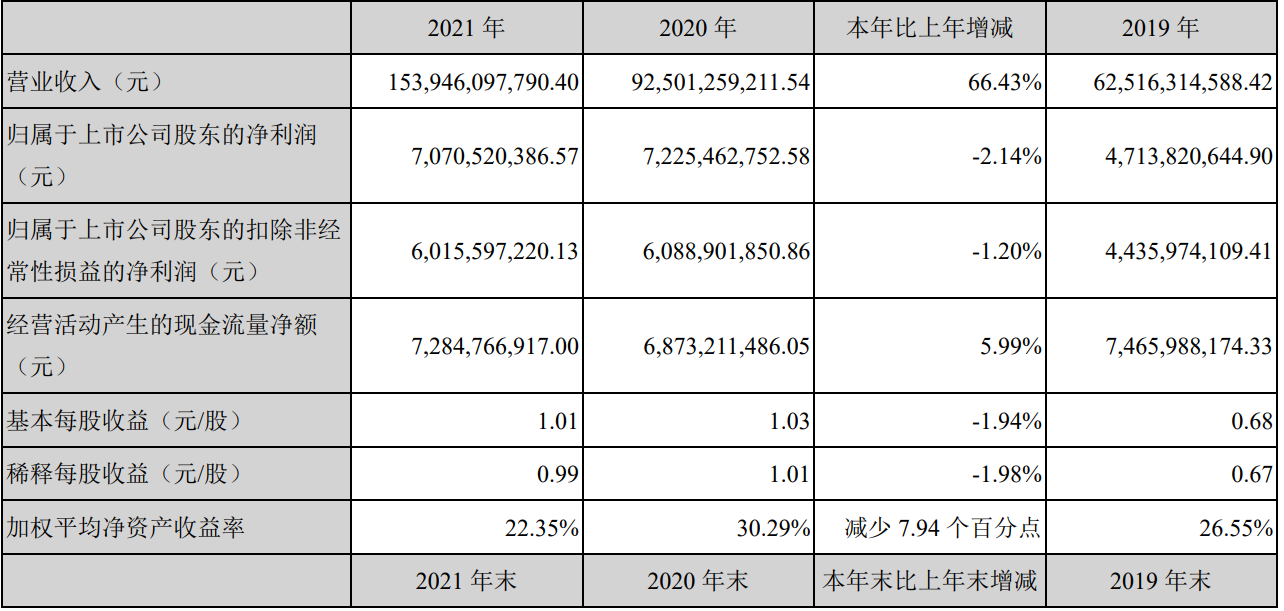

However, due to the epidemic, lack of core in the supply chain, rising prices of raw materials and other effects, the current operating situation of Lixun Precision is not good. According to the financial report, the operating income of Lixun Precision increased by 66.43% to 153.946 billion yuan in 2021 compared with the same period last year. As Lixun Precision is deeply tied to Apple, its profit source mainly depends on businesses such as Apple headphones and watches, and the overall anti-risk ability is not high. Full-year net profit fell 2.14% to 7.071 billion yuan. According to the annual report, the operating income of consumer electronics is 134.638 billion yuan, accounting for 87.46% of the total revenue.

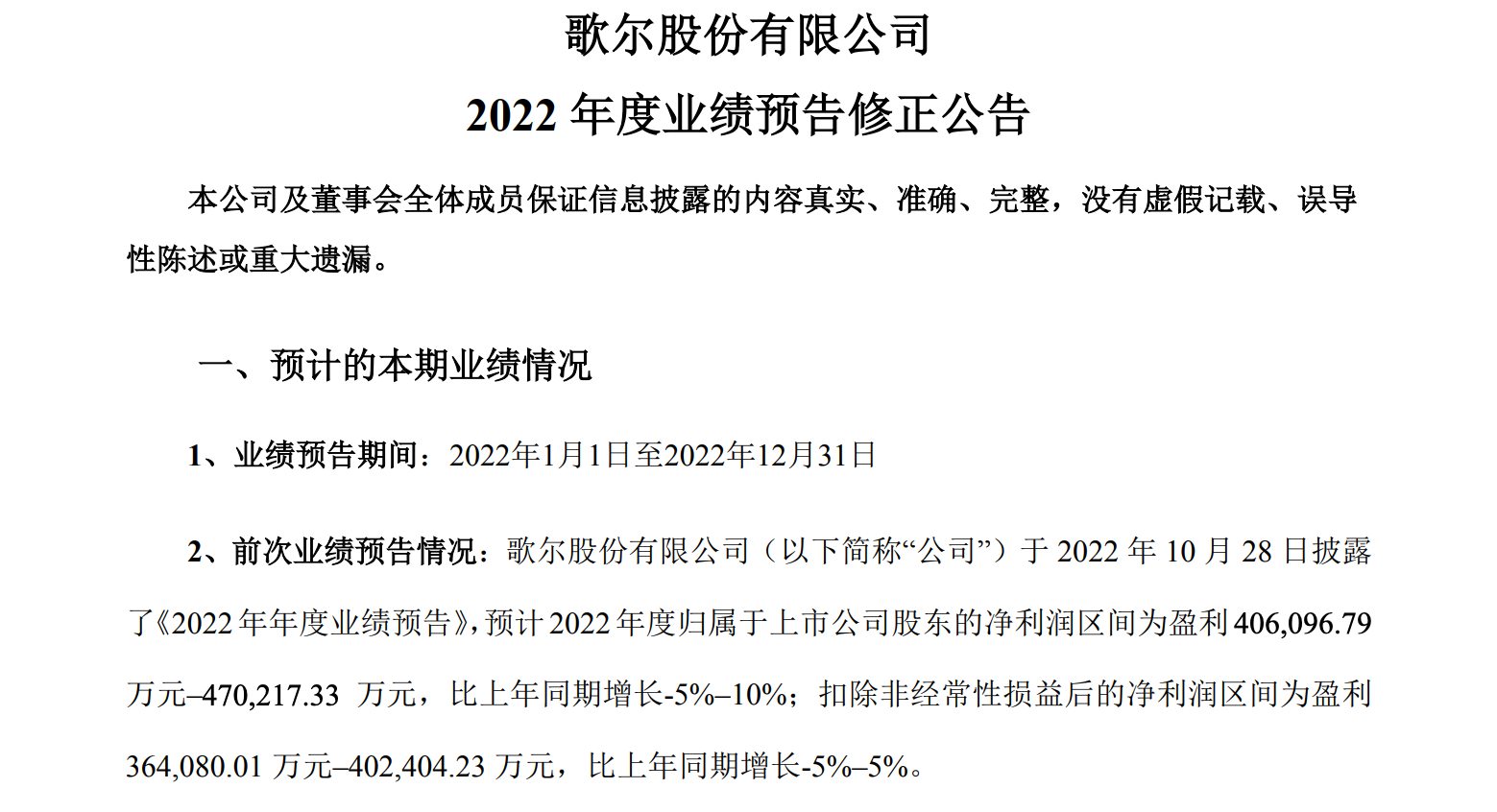

Deeply bound to Apple, the risk is increasing, which is not alarmist talk. Not long ago, Goehl, a representative company in the fruit chain, issued a notice that it had received notice from a major overseas customer to suspend production of its intelligent acoustic complete machine, while Gale was the main supplier of Apple AirPods components, which led to a continuous fall in the stock price by the limit and a sharp reduction in the 2022 performance forecast. The company's direct loss and asset impairment loss is about 20-2.4 billion yuan. There is no doubt that in order to balance risks or find more profit points, it is very necessary for Lixun Precision to gradually break away from the shackles of Apple, and car building is undoubtedly the hottest and best growth point at present.

According to officials, Lixun Precision has been precipitated in the automotive business for more than a decade. In 2012, Lixun acquired 55% of Fujian Yuanguang Denso Co., Ltd., cutting into the Japanese automotive electronics industry chain; in 2013, Lixun acquired SUK of Germany, involved in the field of automotive precision plastic parts. However, compared with the consumer electronics business, Lixun's car business has been lukewarm. According to the annual report, revenue from automotive connected products and precision components is 4.143 billion yuan, accounting for 2.69% of the total revenue.

As for why Chery New Energy is chosen, it may also be a mutually beneficial and win-win result. Data show that Chery New Energy was established in April 2010, and three rounds of financing were completed before Lixun took a stake, but the amount was not disclosed. In the most recent financing, in January 2019, the investor created for Keguo, which means that Chery New Energy has not received financing for three years.

In 2020, SAIC GM Wuling launched a mini electric vehicle called Hongguang MINIEV, and Chery New Energy also launched Chery QQ ice cream against this background. although sales are still considerable, since Hongguang MineV is not making money, so is the high probability of Chery QQ ice cream.

Generally speaking, the emergence of Lixun Precision can not only provide technical support for Chery New Energy, but also ease financial worries. At present, Lixun Precision is more likely to provide Chery with Internet thinking and empower its new cars, while Chery New Energy is responsible for R & D and production. However, the two sides have not yet released more information.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.