In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/06 Report--

Apollo, a Hong Kong-listed company, announced on the evening of December 5 that it plans to acquire a company engaged in smart electric vehicles, targeting a range of smart electric vehicles equipped with advanced technology. Apollo Travel pointed out that through potential acquisitions, the company can immediately take advantage of the mature business of the target company in China, including manufacturing facilities, distribution network and technical professionals. However, at the date of this announcement, the potential acquisition is still under negotiation and Apollo Travel has not yet reached a final agreement.

On the day of the announcement, the news that Weimar plans to list Hong Kong shares through backdoor Apollo Smart Travel Group (AFMG) also spread online, saying that Weima has a 28.51% stake in the company, in which Shen Hui serves as co-chairman of the board and non-executive director. The person in charge of Weima Automobile responded: "the above are only market rumors, Weima will not comment on the market rumors, but also please pay attention to the company's official response, the official information is correct information."

The intelligent electric car company in the above announcement is generally believed to be Weima, a new force in domestic carmaking, for which an Apollo travel insider told the media: "I have not heard of the news." Data show that the predecessor of Apollo is a German sports car manufacturer Gumpert, which was once an Audi imperial modification factory. In 2007, Gumpert launched its first model, the Apollo. In 2012, the Gumpert went bankrupt because of a broken capital chain, and was acquired by a Hong Kong investment company and renamed Apollo. Hong Kong Jewelry and Watch Trading and Investment Company announced in March 2020 that it had completed the acquisition of shares in Apollo86.06%, and then changed its name to AFMG and unveiled its first electric supercar ApolloIE at the third Expo held in the same year, with a vehicle of up to 30 million US dollars.

On the same day, a piece of news that Weimar owed money and caused the factory to stop production sparked a heated discussion on the Internet. According to the report, Weima's core parts supply has been cut off due to arrears with suppliers, and the Weima factory has basically stopped production; the project of the first sedan M has also come to a standstill; and Weima will not renew the contracts of many employees in the Chengdu industry and research department after their contracts expire, affecting the R & D system. In response to the news, Shen Hui, founder and CEO of Weima Motor, responded: "how can it be true?"

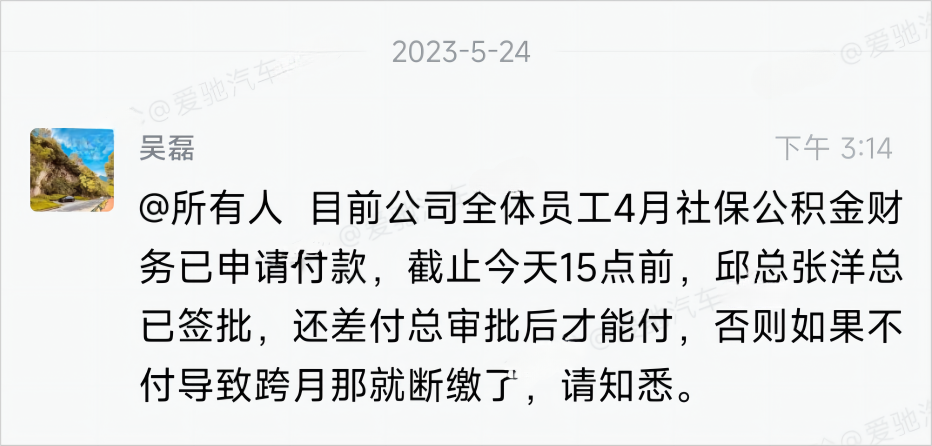

Since October, there has been a lot of negative news about Weimar in the market, including pay cuts, layoffs and shop closures. On November 21, Shen Hui's internal letter showed that in response to financial pressure, the company's management took the lead in taking the initiative to cut salary by half, while the company will reduce operating costs through a series of financial measures. These include managers at the level of M4 and above who take the initiative to cut their salaries and pay 50% of the basic salary; other employees pay 70% of the basic salary; adjust the payday of the company, abolish bonuses such as year-end bonuses, and suspend car subsidies. In response to the pay cut, some Weima people told the media: "this year, supply chain problems, capital market winter and other unfavorable factors continue to haunt the automobile industry. It is easy for the new brands that have been created to develop, and Weima is still trying to get through the cold winter. But it is no longer allowed to sell cars through 'burning money' to compete with other manufacturers for ranking on the list."

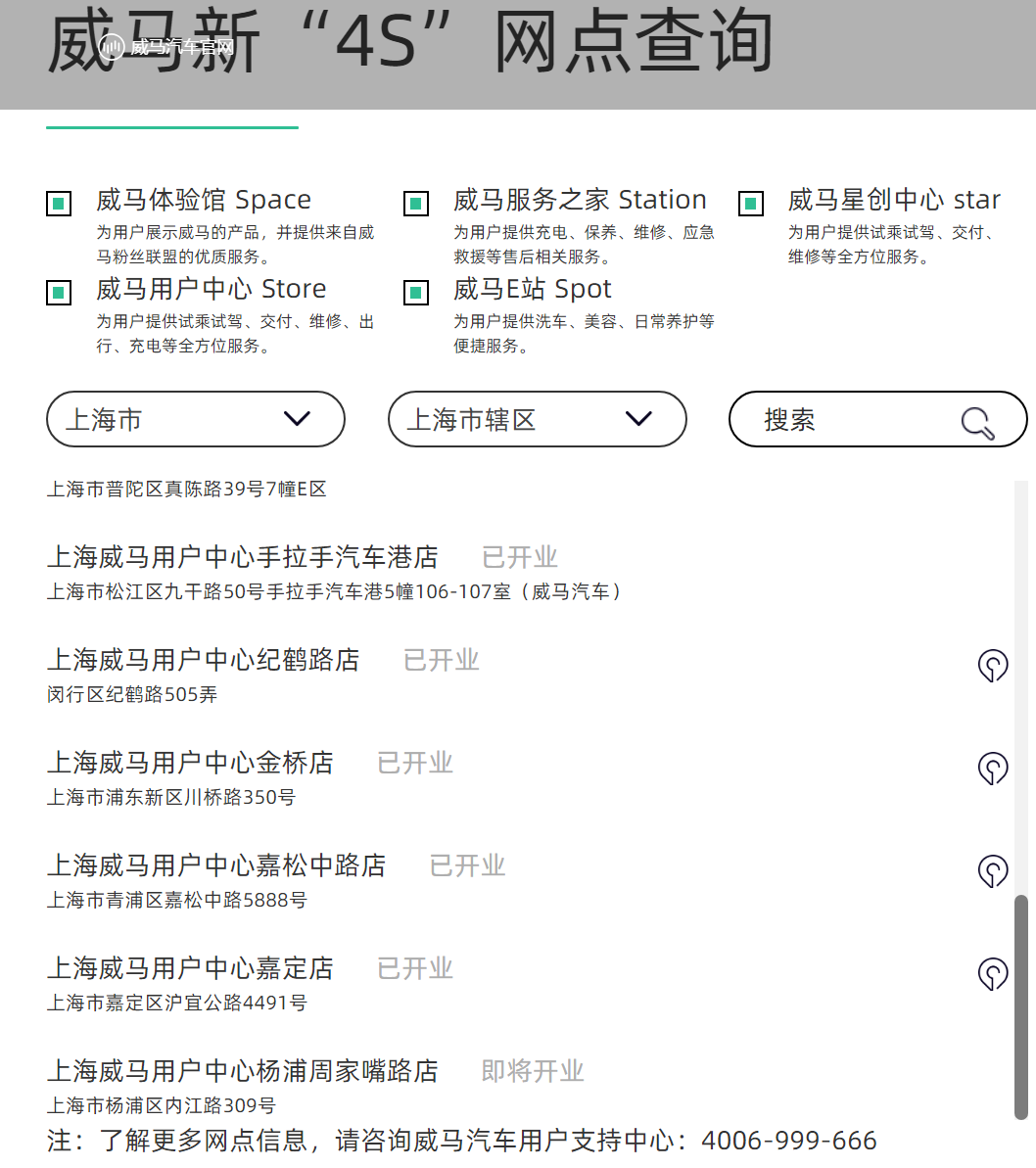

At the end of November, it was also reported that Weimar Automotive Shanghai headquarters had started layoffs, while outsourcing company staff were also leaving on a large scale. It was reported at the time that a number of Weimar stores in Shanghai were closed, which dropped sharply from about 20 to about 12, and many of them are now sold in stock. Among them, there are only five or six pre-and post-sale 4S stores left, and some stores have recently been closed, and the official website has not removed the list in time. Subsequently, "Automotive Industry concern" learned from Weima Automobile's official website that at present, Weima Automobile network inquiry shows that a total of 17 have opened, and one is about to open, of which there are only 8 user centers and Xingchuang centers responsible for sales delivery. the rest only provide display, after-sales and other services.

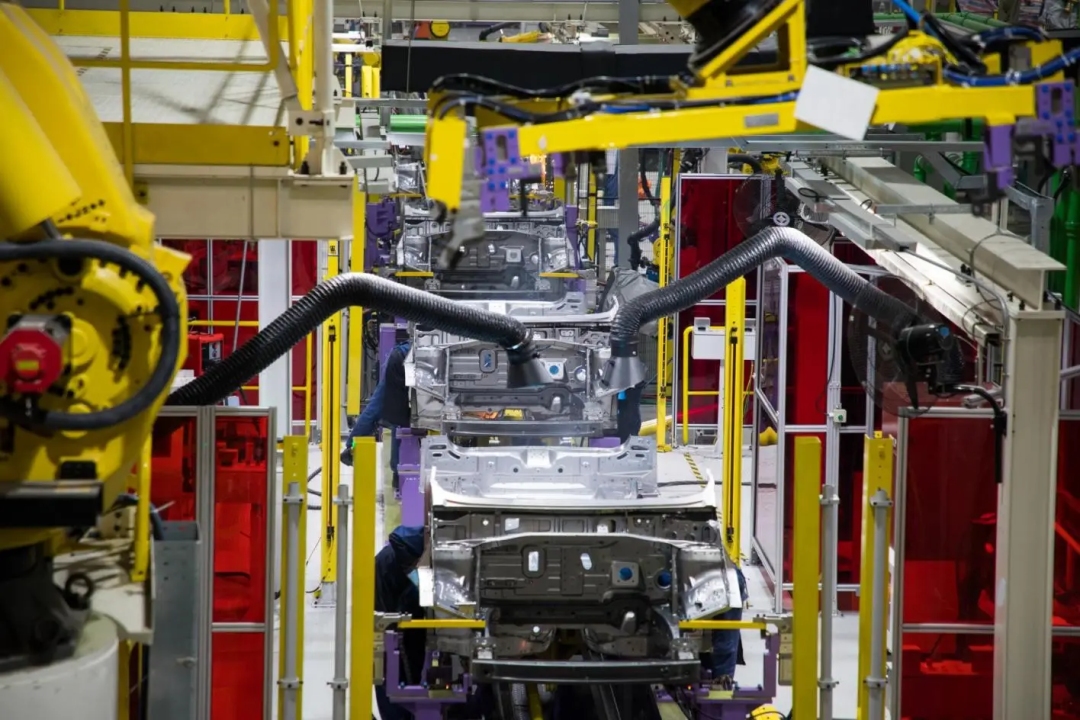

Weima Automobile, founded in 2015, was once one of the new power head car companies, founded by Shen Hui, former vice president of Geely Holdings Group, and headquartered in Shanghai. Compared with the current mainstream "Wei Xiaoli" in the market, Weima has more abundant resources, including two self-built factories with a production capacity of 250000 vehicles, a financing scale of more than 30 billion yuan and more than 600 distribution stores. What is more important is the founder's work experience. Before founding Weimar, Shen Hui held management positions in core auto parts companies such as BergWarner, Fiat, Volvo and Geely. Therefore, compared with Li Bin, he Xiaopeng and Li Xiang, who became a monk halfway, Shen Hui has accumulated a lot of experience in automobile manufacturing. However, the abundant resources and experience can not bring better prospects to Weimar, but are under serious financial and sales pressure. According to the prospectus, the net losses of Weima Motor from 2019 to 2021 were 4.145 billion yuan, 5.084 billion yuan and 8.206 billion yuan respectively, with a cumulative loss of 17.435 billion yuan over three years. The net losses of NIO, Xiaopeng and ideal, both new car-building forces, were 4.016 billion yuan, 4.863 billion yuan and 322 million yuan respectively in 2021. From the data point of view, although these new car-building forces are in a state of loss, Weimar sales are only half of NIO and Xiaopeng, but the loss is twice as high.

In addition, at present, "Wei Xiaoli" has been listed, by contrast, Weima Motor's road to listing is particularly bumpy. On June 1 this year, Weimar formally submitted its application for listing of Hong Kong shares, with Haitong International, China Bank International and Bank of China International as sponsors. According to the official website of the Hong Kong Stock Exchange on December 1, Weimar's prospectus is in a state of "invalidation". Of course, the "invalidation" here does not mean the termination of IPO, as long as the companies that intend to be listed on the stock market finish updating their financial data within three months and resubmit their prospectus, they can still continue their original listing application.

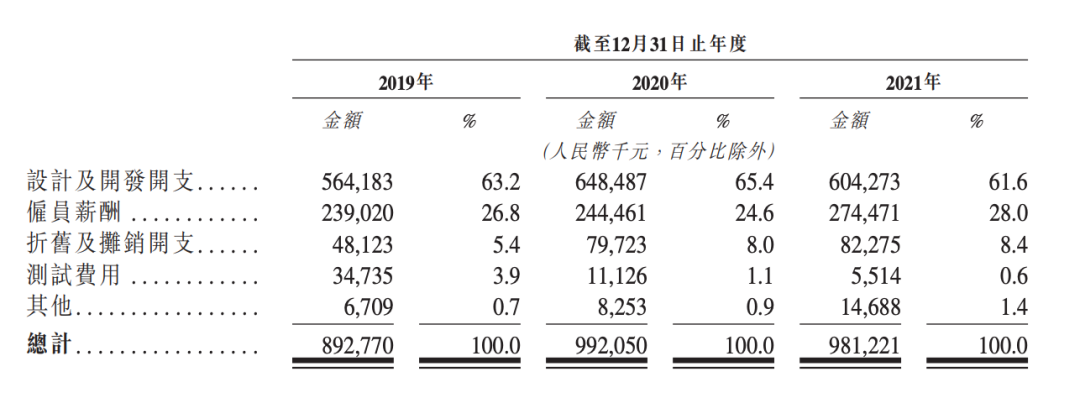

As mentioned earlier, the road to listing of Weima is very bumpy. As early as September 2020, Weima began to prepare to enter the "first share of Science and Technology Innovation Board's New Power". On January 29th, the Shanghai Bureau of Supervision issued an announcement that Weima Wisdom Travel Technology (Shanghai) Co., Ltd. already had the conditions for tutoring and acceptance and Science and Technology Innovation Board's listing application, but it was not long before Weima was exposed to suspend its application in Science and Technology Innovation Board's IPO. The reason is that Weimar's listed materials found a lot of problems in the review. Although the news was denied by Weimar, Weimar failed to go public in the end. Data show that from 2019 to 2021, Weima automobile R & D investment accounted for 50.7%, 37.1% and 20.7% respectively, showing a downward trend year by year.

As one of the former new power head car companies, Weimar Motors also had a highlight moment. At the beginning of its establishment, Weimar stressed the need to produce independently and acquire the qualification of car production by taking a stake in Zhongshun Automobile, an established automobile manufacturing enterprise. Since then, it has been speeding up the development of the car manufacturing industry. EX5, the first model of Weima, was launched in September 2018, and at that time, most of the new forces of domestic car-building were still in the stage of PPT car-building, just like NIO was looking for Jianghuai OEM for a short time, Xiaopeng and ideal's first model were not on the market, and taking the lead in launching the first product also made Weima successfully among the forefront of the new car-building forces. In the following years, Weimar successively launched EX6, W6 and E5 models, covering almost all price points of 15-300000 models, but sales were dismal.

Data show that in 2019, Weimar firmly ranked second in the new power car company with a delivery volume of 16900 vehicles (20600 delivered by Weimar and 16700 delivered by Xiaopeng). This achievement gives Shen Hui hope. At the beginning of 2020, Shen Hui said proudly: "Weimar will certainly be one of the new forces of car-building in China in the future." In 2020, Weimar delivered 22500 vehicles, although it still maintained the growth trend, but that year NIO delivered 43700 vehicles, Xiaopeng delivered 27000 vehicles, ideal delivered 32600 vehicles, Weima fell out of the top three; by 2021, Xiaopeng delivered 98200 vehicles, NIO delivered 91400 vehicles, ideal delivered 90500 vehicles, Nahu delivered 69,700 vehicles, while Weimar delivered only 44, 200 vehicles, which is a huge gap with Wei Xiaoli.

At present, Weimar has a total of EX5, W6, E.5 and M7 models, of which the M7 has not yet been delivered. Weima employees once told the media: "the M7 has been tested in extreme cold and high temperature, but due to the company's cash flow problems, delivery is very difficult this year and may be postponed until official notice." Data show that from January to October 2022, Weimar delivered only 29200 vehicles, and sales were very dismal. Weima Motor has lost more than 10 billion yuan since 2017, and listing may alleviate Weima's urgent financial needs, but if it wants to go far, improving brand product power and market share is the most important thing to be solved. At the same time, the current fierce competition in the car market, there is not much time left for Weima Motor.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.