In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/11 Report--

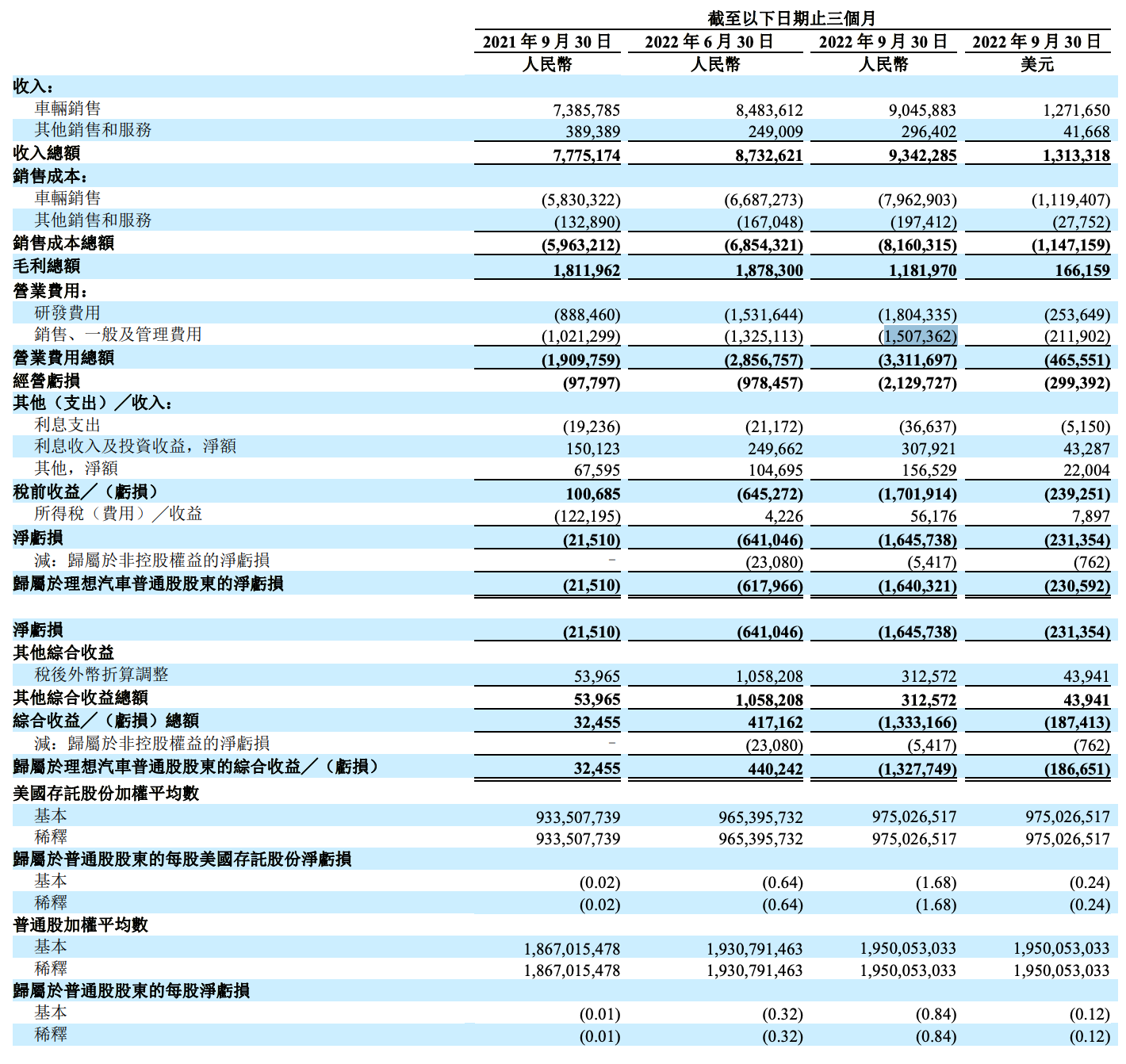

On December 9, Ideal Automobile released the third quarter financial report of 2022, showing that the revenue of Ideal Automobile in the third quarter was 9.34 billion yuan, with a year-on-year growth of 20.2%, among which the vehicle revenue was 9.046 billion yuan, with a year-on-year growth of 22.5% and a month-on-month growth of 6.6%. The net loss was RMB 1.646 billion yuan, an increase of 772.6% compared with the same period in 2021 and an increase of 165.4% compared with the second quarter. A total of 26524 new vehicles were delivered during the quarter, up 5.6% year-on-year. According to the announcement, as of September 30,2022, the company's cash reserves reached 55.83 billion yuan, providing strong support for technology research and development, supply chain and intelligent manufacturing.

Obviously, the report card of the ideal car falls short of expectations! Affected by this, the ideal car stock price plummeted 12.37%!

Operating revenue fell short of expectations, mainly due to model changes and sales promotions resulting in a decline in revenue. Affected by model changes and production stoppages, ideal car deliveries fell below 10,000 vehicles in July and August, with August down 51.5% year-on-year. At the same time, in order to clear inventory, Ideal ONE sells at a reduced price in the end market, which is also a major cause of revenue loss.

The net loss intensified as a result of a significant decline in gross profit margin, an increase in research and development expenses and inventory charges including purchase commitment losses. The financial report shows that the ideal automobile R & D expenditure in the third quarter was 1.804 billion yuan, compared with 1.532 billion yuan in the second quarter and 888 million yuan in the third quarter of 2021. As for the increase in R & D expenses, it is also related to the discontinuation of Ideal ONE and the introduction of replacement models Ideal L8 and Ideal L 9. However, the ideal gross profit margin of automobile vehicles in the third quarter is still above 20%.

According to the guidelines, ideal car sales in the fourth quarter of 45,000 to 48,000 units, meaning December sales of about 20,000 to 23,000 units, this may be the first time the ideal car exceeded 20,000 units. It is understood that the ideal car models on sale at present include ideal L9, ideal L8 and ideal L7. In fact, the three models are basically the same in appearance, but the size is quite different, so as to cope with different consumer groups.

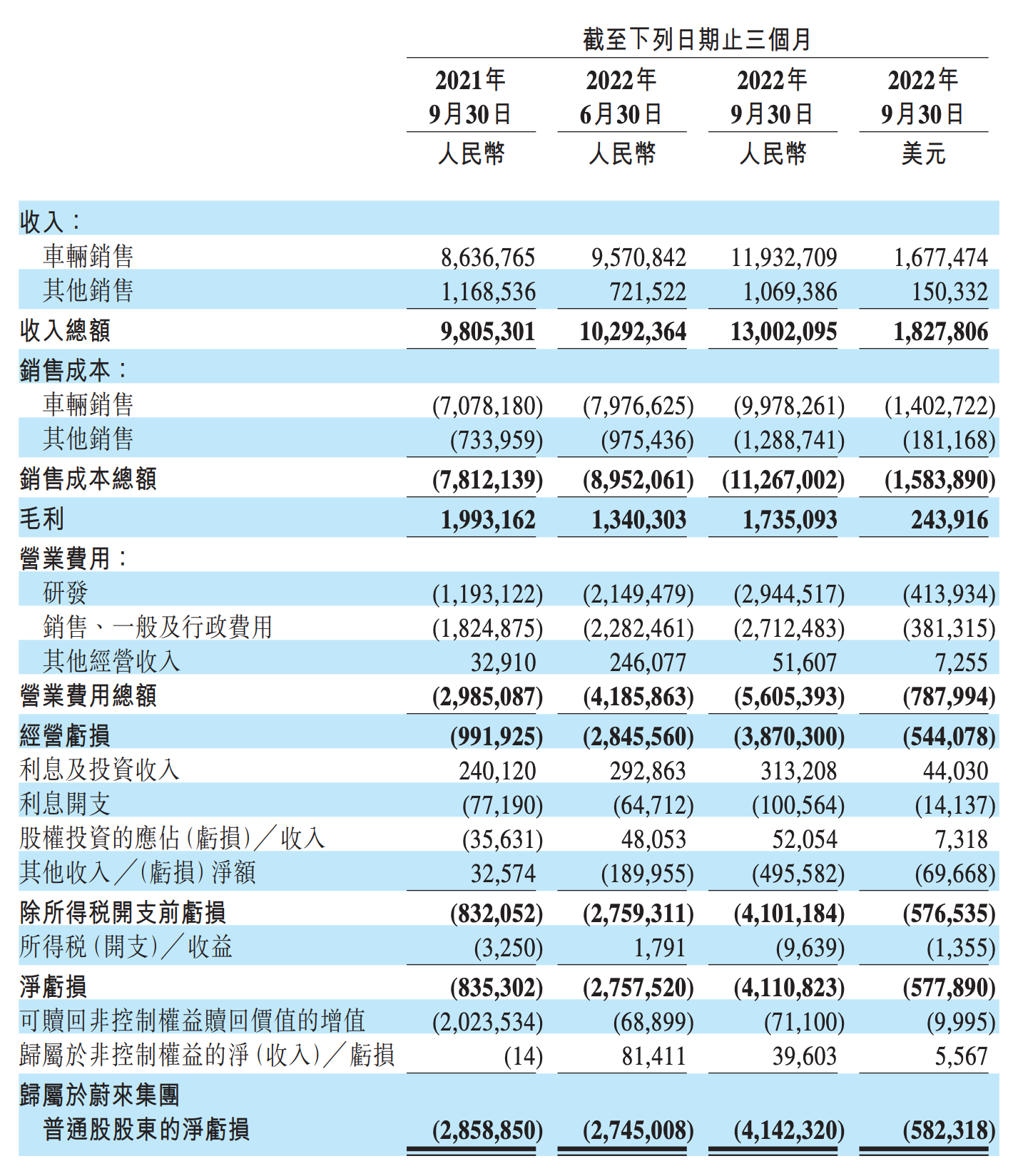

Financial report shows, In the third quarter of 2022 NIO automobile revenue 13.002 billion yuan, Year-on-year growth 32.6%, Annulus growth 26.3%, Among them vehicle sales revenue 11.933 billion yuan, Year-on-year growth 38.2%, Annulus growth 24.7%. The net loss was 4.11 billion yuan, an increase of 392.1% compared with the same period in 2021 and 49.1% compared with the second quarter, and the loss reached a new high. According to the financial report, as of September 30,2022, the company's cash and cash equivalents, restricted cash, short-term investments and long-term time deposits amounted to 51.4 billion yuan.

During the quarter, NIO Automobile delivered 31607 new vehicles accumulatively, an increase of 29.3% compared with the same period in 2021 and 26.1% compared with the second quarter. However, the gross profit margin of NIO vehicle in the third quarter was 16.4%, compared with 18.0% in the same period of 2021 and 16.7% in the second quarter, which was in a downward trend. In addition, the gross profit margin of NIO was 13.3%, compared with 20.3% for the same period in 2021. Both the gross profit margin of NIO vehicle and the gross profit margin of the company have declined, which also implies that NIO may be difficult to turn losses into profits.

NIO is a high-end new energy brand, which is less than the cost in R & D, manufacturing and marketing. The financial report shows that the R & D expenditure of NIO in the third quarter is 2.945 billion yuan, an increase of 146.8% compared with the same period in 2021 and 37.0% compared with the second quarter. In addition, sales, general and administrative expenses were 2.712 billion yuan in the third quarter, compared with 2.282 billion yuan in the second quarter and 1.825 billion yuan in the third quarter of 2021. For Wei Lai, through self-research batteries, chips, master the core technology to occupy a place in the market, but in the face of the current dilemma, it is difficult to find a way to solve the problem.

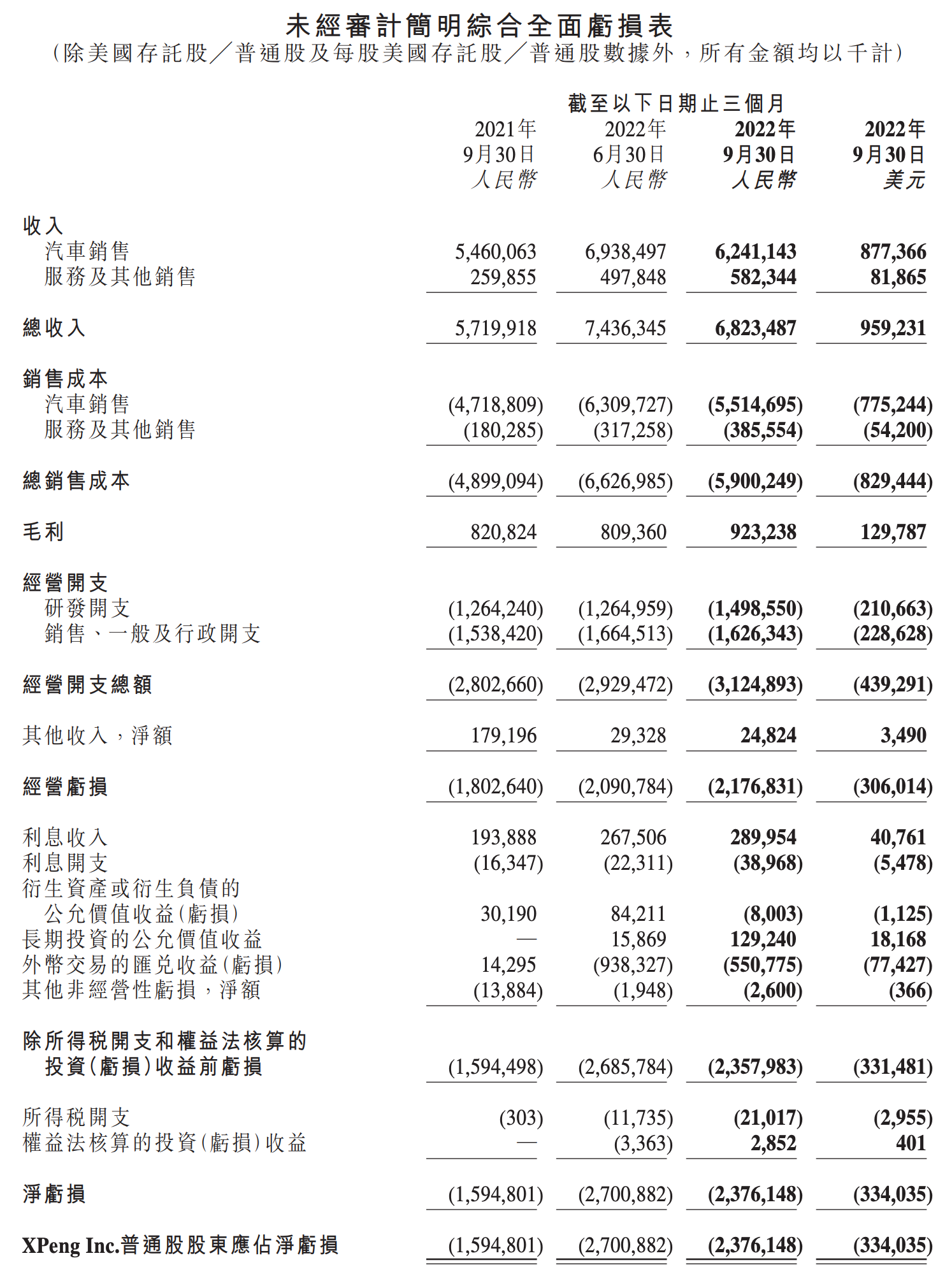

Compared with ideal, Wei Lai, Xiao Peng's current situation is very dangerous. Of course, the third quarter is not yet visible. On November 30, Xiaopeng Automobile released the third quarter financial report of 2022, showing that the operating income in the third quarter was 6.823 billion yuan, with a year-on-year growth of 19.3%, among which the vehicle income was 6.24 billion yuan, with a year-on-year increase of 14.3% and a month-on-month decline of 10.1%. The net loss was RMB 2.376 billion yuan, an increase of 49.0% compared with the same period in 2021. According to the financial report, as of September 30,2022, the company's cash and cash equivalents, restricted cash, short-term investments and long-term time deposits amounted to 40.1 billion yuan.

Although sales in the third quarter rose year-on-year, it did not meet expectations from outside and within the company. Affected by epidemic situation and supply chain in some regions, Xiaopeng Automobile delivered 29,600 vehicles in the third quarter, including 16776 vehicles delivered by P7 and 8703 vehicles delivered by P5.

Performance pressure, sales weak, Xiaopeng car hopes on the G9. On September 21, Xiaopeng G9 was officially listed, with a price range of 309,900 - 469,900 yuan. However, the launch of the G9 was not smooth, with only 623 units delivered in October and 1546 units delivered in November.

It is understood that only two days after the launch of the new car announced the adjustment of SKU, the reason is that different versions of the model configuration is complex, it is difficult to distinguish the relationship between the versions, and Xiaopeng G9 propaganda selling point is not standard, even the beggar version of the model even the opportunity to choose is not given. As a last resort, Xiaopeng announced the adjustment of G9 SKU. According to the official website, Xiaopeng G9 after adjusting SKU is divided into 570,650 and 702 categories according to the mileage as the classification standard. At the same time, the model version is divided into Plus, Pro and Max versions by referring to the naming method of iPhone, which is used as the distinction between the high and low versions. This Xiaopeng official adjustment for the three models, the purpose is to streamline, further optimize the consumer in the choice of difficulty, and perhaps more important is to improve production capacity and overall sales. However, even in response to market feedback, G9 sales prospects are still not optimistic.

According to the financial report, Xiaopeng Automobile is expected to deliver 20,000 ~ 21,000 vehicles in the fourth quarter, while 5101 vehicles will be delivered in October and 5811 vehicles in November. It is expected that the delivery in December may return to 10,000 vehicles. However, the data shows that only 1962 Xiaopeng cars were delivered in the first week. It seems that Xiaopeng cars want to rise to more than 10,000 vehicles again. The pressure is quite high.

Up to now, the cumulative total delivery volume of Xiaopeng Automobile in this year is 109,500 vehicles, which is 140,500 vehicles short of its annual sales target of 250,000, and only 43.8% of the annual target has been achieved. Assuming 20,000 vehicles are delivered as scheduled in the fourth quarter, Xiaopeng Automobile is expected to deliver 118,000 vehicles this year, with a target completion rate of only 47.2%. He Xiaopeng, chairman and CEO of Xiaopeng Automobile, said: Although it faced a low delivery volume in October, short-term delivery fluctuations will not affect Xiaopeng Automobile's long-term strategy.

Who is the most dangerous of the three car companies? Could be Peng. The product structure of NIO and Ideal is relatively clear. Different products have different consumer groups, and the price of products is more than 300,000 yuan. It is natural to explore the middle and high-end market in the future. In contrast, Xiaopeng Automobile still relies on Xiaopeng P7 at present, and it is unknown whether Xiaopeng G9, which the company has high hopes for, can carry the flag. In addition, different from NIO, ideal, Xiaopeng automobile enters the market with low-end model. At present, only Xiaopeng G9 sells for more than 300,000 yuan. It is quite difficult to break through upward. After all, brand recognition has been established.

However, Li Bin said in a recent interview: "I think 'Wei Xiaoli' can live, and can live well." "Maybe Xiaopeng has worked a little harder recently," he said."I think that's the price they have to pay as they grow up."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.