In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/14 Report--

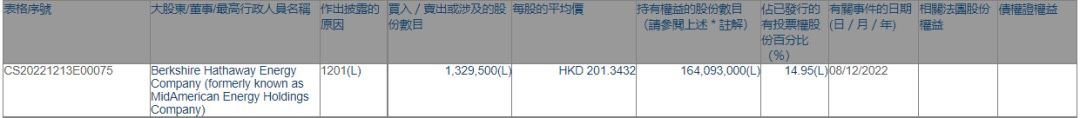

On December 13, according to the disclosure information of the Hong Kong Stock Exchange, on December 8, Buffett's Berkshire reduced its holdings of BYD shares by 1.3295 million shares, with an average trading price of HK $201.3432/share. After the transaction, Berkshire's holding of BYD H shares decreased from 15.07% to 14.95%, and the reduction of trading cash was about HK $268 million. Berkshire currently holds 164.093 million shares in BYD.

It is worth noting that this is Buffett's sixth reduction in BYD shares this year. Since August 24 this year, Berkshire began to reduce its holdings of 1.33 million BYD H shares, with an average price of HK $277.1/share, totaling nearly HK $369 million. On September 1, Buffett's Berkshire Hathaway sold 1.716 million H shares of BYD shares again, with an average selling price of HK $262.72 per share and cash of about HK $451 million. On November 1, Berkshire Hathaway continued to reduce its holdings of 3.297 million shares; on November 8, Berkshire Hathaway reduced its holdings of 5.7825 million shares; on November 17, Berkshire Hathaway reduced its holdings of 3.2255 million shares, with an average trading price of HK $195.42, with a cumulative reduction of 16.68 million shares for six times, with cash of about HK $3.417 billion.

The two sides did not respond to Buffett's reduction. However, when Buffett reduced his stake in BYD in September this year, BYD responded that: the company has learned relevant information from the Hong Kong Stock Exchange, shareholder reduction behavior is shareholder investment decision, the company sales repeatedly record high, the current business situation is healthy, everything is normal. In addition, recently BYD executive vice president Li Ke in an interview with the media also for Buffett to reduce BYD stock said: do not think this shows Buffett will give up BYD, Buffett will "always" BYD's biggest supporter.

It is understood that Buffett bought 225 million shares of BYD H at a price of HK $8/share in 2008, which has been 14 years old and cost HK $1.8 billion. So far, Buffett's return on BYD investment has exceeded 30 times. Judging from Buffett's several reductions in BYD shares, August and September have the most serious impact on BYD. Relevant data show: August 29 to September 2, BYD shares Hong Kong stocks fell 13.81%. But as the sell-off progressed, the panic in the market eased and BYD's share price stabilized, which has not fluctuated much since its three sell-offs in November.

Behind Buffett's continued reduction of BYD is BYD's outstanding production, sales and financial data. According to relevant data, BYD sold 230,400 new energy vehicles in November, up 152.60% year-on-year, a record high; sales of new energy passenger vehicles were 229,900, up 155.14% year-on-year. Among them, the sales volume of plug-in hybrid vehicles was 116,000, and that of pure electric vehicles was 113,900. BYD achieved revenue of 267.7 billion yuan in the first three quarters of this year, up 84.37% year-on-year, and net profit of 9.311 billion yuan, up 281.13% year-on-year, according to the latest three quarterly reports. BYD achieved revenue of 117.1 billion yuan in the third quarter, up 115.59% year-on-year. At the stage of BYD's crazy sales, Buffett's continued reduction of BYD shares naturally caused a lot of discussion. After all, BYD's sales volume and performance in recent years should not have been the reason Buffett reduced his stake.

From Buffett's repeated reduction of BYD shares, or with BYD's current valuation is relatively expensive and asset allocation plan adjustment. Although Buffett has frequently reduced his cash holdings in BYD in the past year, he has also increased his position in Japanese stocks on a large scale. According to relevant data, in late November, Berkshire's wholly-owned subsidiaries increased their holdings of five stocks in the Japanese market, including Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo, all of which increased their holdings by more than 1%. After the increase, they held 6.21%-6.75% of the five stocks. Since the beginning of this year Buffett's Berkshire Hathaway asset allocation situation, Chevron, Occidental oil and other oil giants have obtained Buffett's successive holdings. Chevron became one of Berkshire Hathaway's main holdings, and Occidental Oil held more than 20%.

In response to Buffett's continued reduction of BYD shares, some insiders pointed out that perhaps the valuation is appropriate. At present, BYD's share price reflects more optimistic expectations. After all, value investment is not held forever. There is no need for excessive interpretation. If the valuation is high, it will be sold. It is also an investment for many years, and the income is quite high. However, for Buffett's reduction practice, economist Ren Zeping said: "Although I don't know Buffett recently reduced BYD stock for what purpose, but if it is bearish on the prospects of the new energy industry, then Buffett is wrong this time." It pointed out that new energy is the most promising and explosive industry in the future, with normal short-term adjustment and huge long-term potential.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.