In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/25 Report--

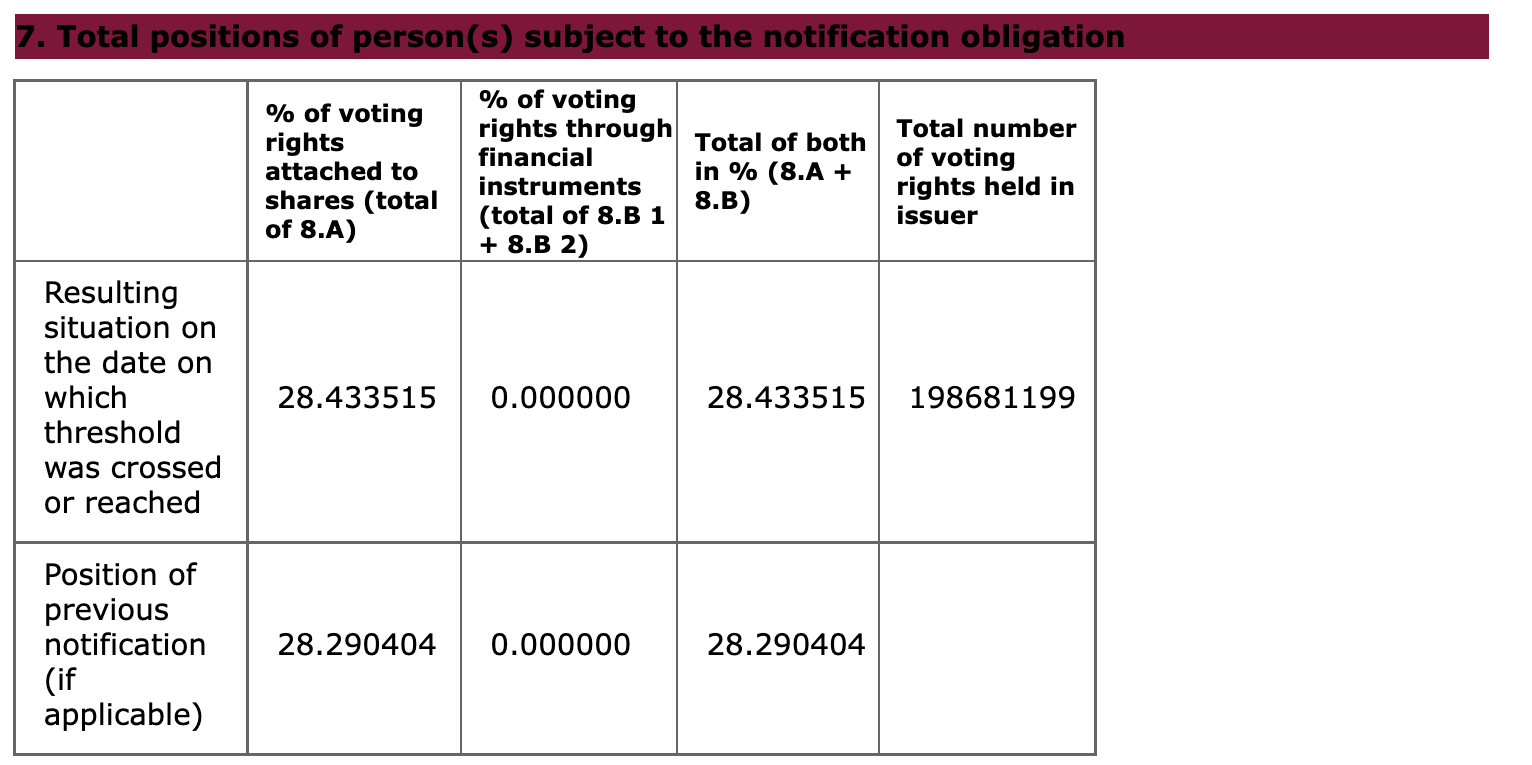

Lawrence Stroll, executive chairman of Aston Martin, and his Yew Tree investment group have invested about 50 million pounds in recent months, significantly increasing their stake in Aston Martin to 28.29%, or 9.29%, from about 19% earlier this year.

Industry insiders say the move is a counteraction against Geely Holdings's acquisition of Aston Martin. Zhejiang Geely Holdings Group Co., Ltd. (hereinafter referred to as "Geely Holdings") announced that it had completed the acquisition of 7.6% of the shares of British ultra-luxury performance brand Aston Martin Lagunda International Holdings (hereinafter referred to as "Aston Martin"). Although the stake is only 7.6%, it becomes the fourth largest shareholder after Canadian billionaire Lawrence Stroll, Saudi sovereign fund PIF and Mercedes-Benz. Of course, Geely Holdings doesn't have much control. Since then, it has emerged that Geely intends to increase its stake to more than 10 per cent.

According to the data, Aston Martin is a well-known sports car manufacturer, founded in March 1913 by Lionel Martin (Lionel Martin) and Robert Bamford (Robert Banford), originally called Benford and Martin Co., Ltd. (Bamford & Martin Ltd.). In 1947, British entrepreneur David Brown (David Brown) acquired Aston Martin. In 1994, David Brown sold Aston Martin to Ford Motor and became a wholly owned subsidiary of Ford. In 2007, Ford sold most of its stake to a consortium led by Prodrive, a British racing company. In December 2012, Italian private equity fund Investindustrial announced a £150 million investment to acquire a 37.5% stake in Aston Martin. In October 2018, Aston Martin was listed on the London Stock Exchange.

Since the listing on the London Stock Exchange, Aston Martin has had a hard time, with its share price falling by 90% because of poor sales and even a quagmire of losses, forcing it to issue bonds to raise funds. Affected by the blockade of the epidemic in China, the escalation of the situation in Russia and Ukraine and soaring costs, Aston Martin's supply chain and logistics problems have become more serious, leading to increased losses. According to the financial report, the operating loss of Aston Martin widened to 58.5 million pounds in the third quarter of 2022 from 32 million pounds in the same period last year. In response, Aston Martin cut its delivery in 2022 and expects to deliver 6200 to 6500 vehicles this year, down from a previous forecast of more than 6600. At the same time, Aston Martin also cut his profit margin forecast for 2022, which had been forecast to increase by about 350 to 450 basis points and is now about 100 to 300 basis points higher.

Geely Holdings twice offered an olive branch to Aston Martin, but Aston Martin was unimpressed. Geely Holdings is seeking to invest in Aston Martin and has held talks with investors and management of the company, but to no avail, the Financial Times reported on January 11, citing people familiar with the matter. After that, Aston Martin issued a statement that Aston Martin and Canadian billionaire Lawrence Straw (Lawrence Stroll) reached an agreement that the consortium led by Lawrence Straw will buy its 16.7% stake for 182 million pounds (about 1.658 billion yuan), while the subsequent rights issue supported by Stroll and other major shareholders will raise a further 318 million pounds (about 2.897 billion yuan).

In mid-July, Aston Martin revealed that it would bring in new strategic investors, along with news that Atlas, a consortium of Geely and Italy's InvestIndustrial, had invested 1.3 billion pounds in the British sports car maker. However, the board of directors of Aston Martin rejected the proposal, and the Saudi Public Investment Fund, which holds a stake in McLaren, eventually became the new major investor and the second largest shareholder, which will invest 78 million pounds in Aston Martin. And an additional rights issue of 575 million pounds, raising a total of 653.8 million pounds.

In September, Geely Holdings announced without warning that it had acquired a 7.6 per cent stake in British ultra-luxury performance brand Aston Martin Lagunda International Holdings (hereinafter referred to as "Aston Martin"). Li Donghui, CEO of Geely holding Group, said: "We are very pleased to be officially an investor in Aston Martin. Geely Holdings has extensive experience in supporting the transformation of shareholding companies and has a deep technology accumulation in the areas of super electric and intelligent Internet connection, which will help Aston Martin achieve greater success in the future. Looking forward to exploring collaborative cooperation opportunities with Aston Martin, Aston Martin will continue to adhere to its development strategy and is committed to achieving long-term sustainable growth and improving profitability. "

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.