In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/03 Report--

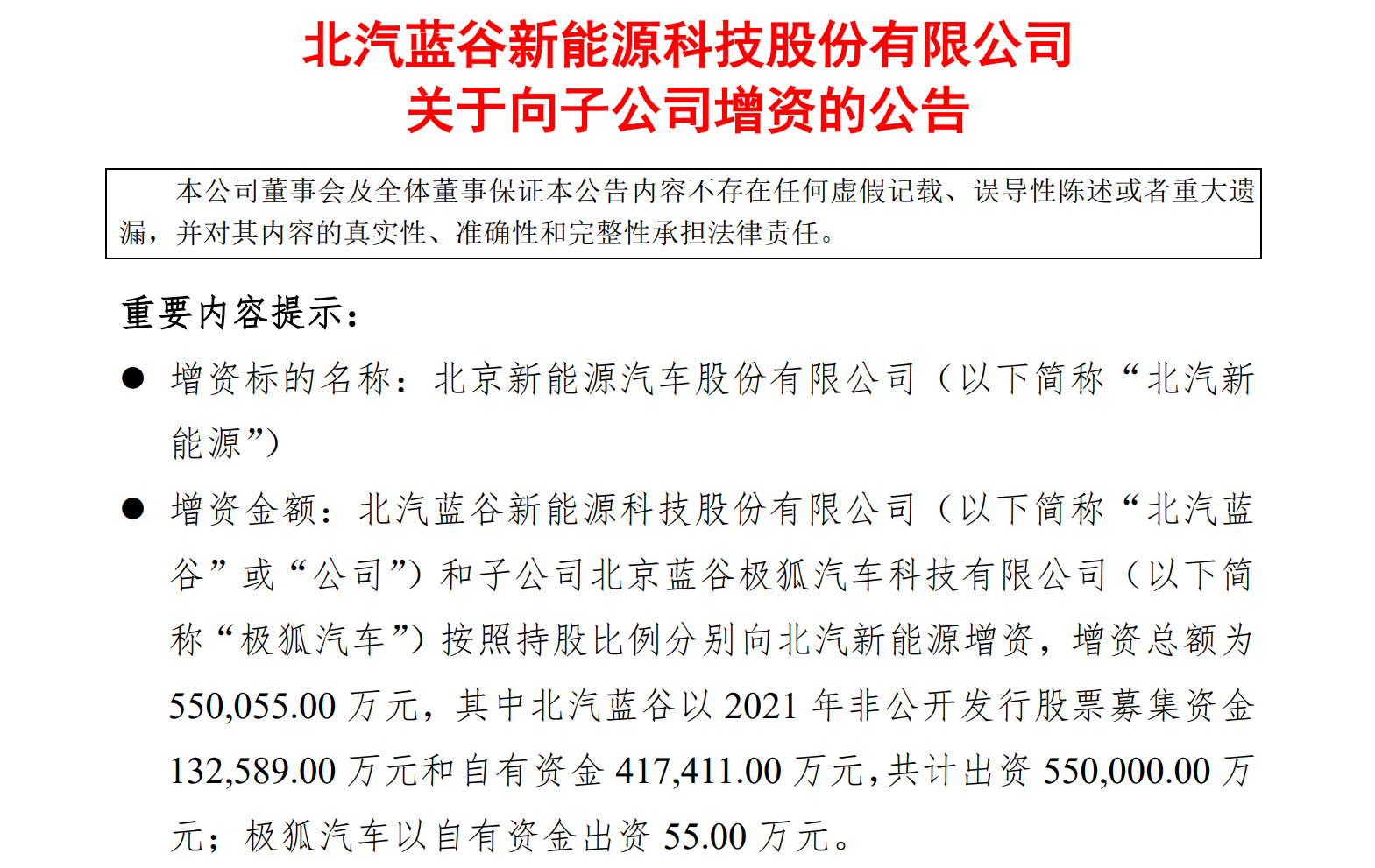

A few days ago, BAIC Blue Valley issued an announcement that BAIC Blue Valley New Energy Technology Co., Ltd. (hereinafter referred to as "BAIC Blue Valley") and its subsidiary Beijing Blue Valley Jihu Automotive Technology Co., Ltd. (hereinafter referred to as "BAIC Jihu") respectively increased capital to Beijing New Energy Automobile Co., Ltd. (hereinafter referred to as "BAIC New Energy") according to the proportion of their shareholdings, with a total capital increase of 5.50055 billion yuan. Among them, BAIC Langu raised 1.326 billion yuan in 2021 non-public offerings and 4.174 billion yuan in its own capital, with a total contribution of 5.5 billion yuan. Polar Fox Motor contributed 550000 yuan with its own funds.

Data show that BAIC Langu directly holds 99.99 shares of BAIC New Energy, and holds 0.01% of BAIC New Energy through BAIC Polar Fox, totaling 100% of BAIC New Energy. After this capital increase, the registered capital of BAIC New Energy has increased from 5.298 billion yuan to 10.798 billion yuan, and the equity ratio remains unchanged.

BAIC Langu said in the announcement that this capital increase is in line with the company's development strategy and is conducive to further optimizing the capital structure of the company and BAIC New Energy and enhancing the comprehensive competitiveness of the company and BAIC New Energy. This capital increase does not change or change the use of the funds raised in disguise, the object of the capital increase is the company's wholly-owned subsidiaries, the risk is controllable, and there is no harm to the interests of the company and shareholders.

BAIC Langu, formerly known as BAIC New Energy, which operated independently in 2009, is the first company in China to obtain the qualification for the production of new energy vehicles. In the early days of its establishment, BAIC New Energy mainly focused on B-end markets such as taxi, car-hailing and car rental industry. relying on cost-effective EU and EX series, BAIC New Energy won the title of domestic new energy sales for seven consecutive years from 2013 to 2019, from 1623 in 2013 to 158000 in 2018.

In September 2018, BAIC New Energy completed its listing through backdoor Vanguard shares and became the first new energy vehicle stock listed in China. Later, the company changed its name to "BAIC Blue Valley New Energy Technology Co., Ltd.". It is precisely from 2018, with the emergence of new car-building forces like bamboo shoots after a spring rain, although it does not pose a threat to BAIC new energy, it has begun to decline.

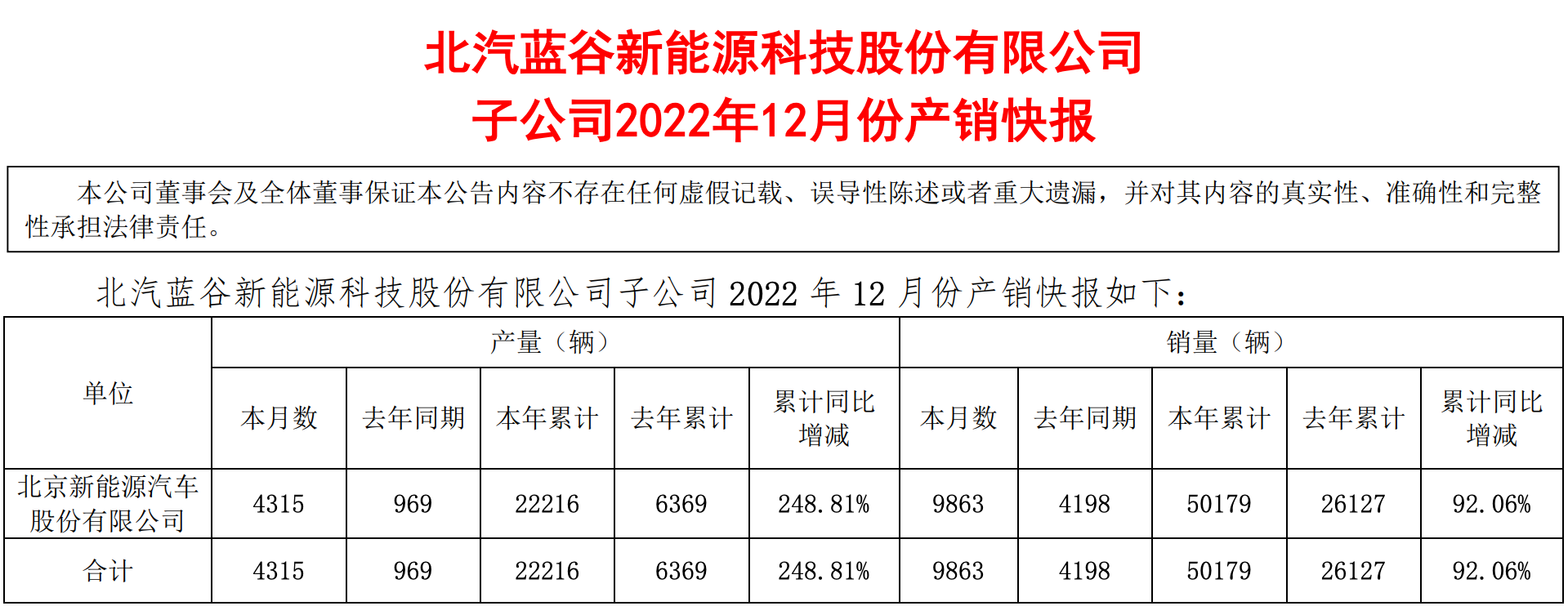

BAIC Langu once again ranked first in domestic pure electric vehicle sales with sales of 150600 vehicles in 2019, down 4.69% from a year earlier. BAIC's new energy sales fell off a cliff in 2020, with annual sales of only 25900 vehicles, down 82.79 per cent from a year earlier. By 2021, BAIC New Energy is still in decline, has not recovered from the failure, sales are even more appalling, as if lost in the market, without the original high-spirited. After entering 2022, BAIC Blue Valley sales improved slightly, but still not optimistic. According to KuaiBao, BAIC's latest production and marketing, sales in 2022 were 50179, up 92.06% from 26127 in 2021, of which 9863 were sold in December, up 134.95% from 4198 in 2021. It is worth mentioning that although BAIC Langu sales soared year-on-year in 2022, the sales target set at the beginning of the year was 100000 vehicles, with a completion rate of only 50 per cent.

Apart from the fact that sales fell short of expectations, BAIC Blue Valley has been losing money in recent years. According to the financial report, BAIC's net loss in 2020 and 2021 was 6.482 billion yuan and 5.244 billion yuan respectively, and the net loss in the first three quarters of 2022 was 3.5 billion yuan, with a cumulative loss of more than 15.2 billion yuan in the past three years. In terms of cash flow, BAIC Blue Valley is also under pressure, with cash and cash equivalents plummeting to 4.302 billion yuan in the third quarter of 2022, compared with 8.324 billion yuan in the second quarter of 2022. In this regard, BAIC Langu explained in the financial report that the decline in net profit was mainly due to the decrease in gross profit and the continuous increase in investment in brand and channel construction.

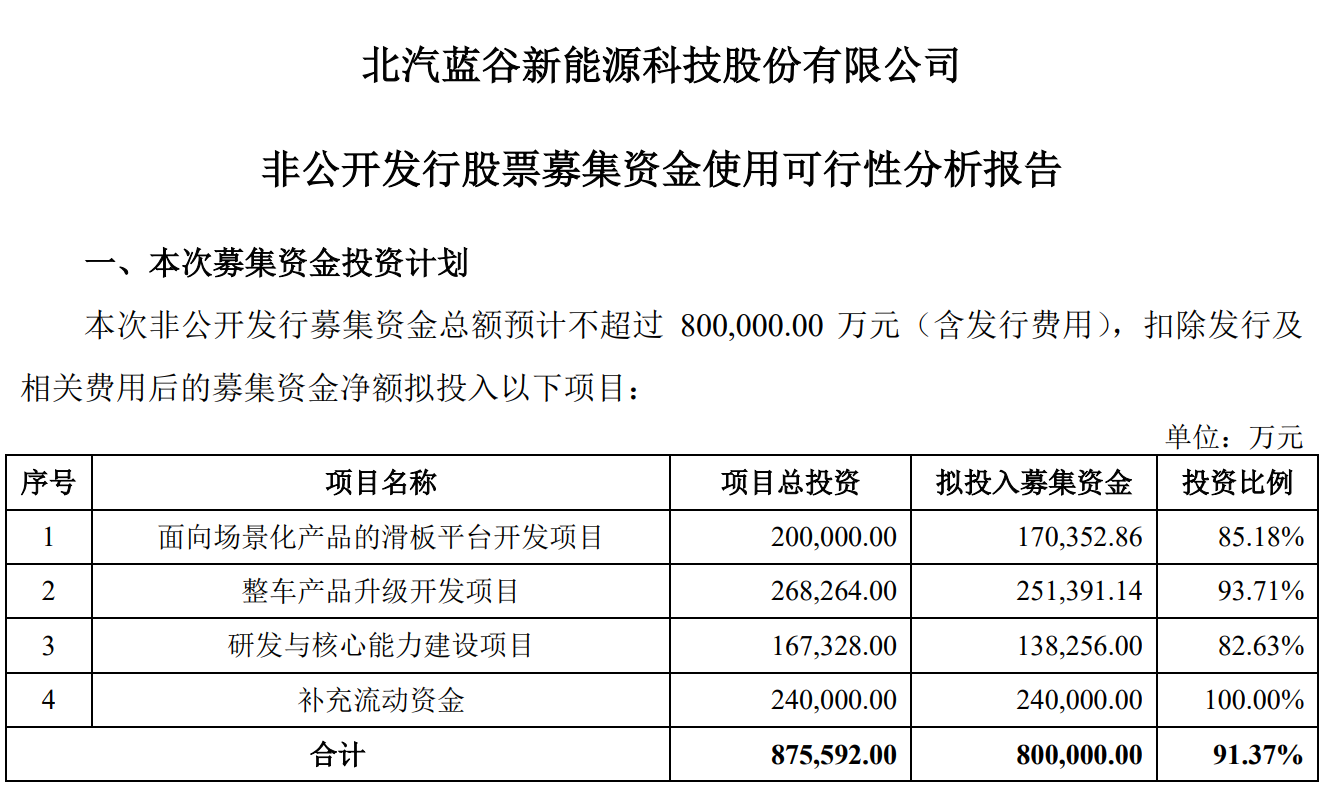

Due to the lack of hematopoietic capacity, BAIC Langu also has to rely on external blood transfusions. It is understood that since the backdoor listing in 2018, BAIC Blue Valley has raised 1.034 billion and 5.45 billion in 2019 and 2021 respectively. In July 2022, BAIC Langu announced again that it intends to raise about 8 billion yuan in a non-public offering. It will be used for skateboard platform development projects for scene-oriented products, vehicle product upgrading and development projects, R & D and core capacity-building projects and supplementary liquidity. However, this fixed increase has not yet finally landed.

At the same time, BAIC Blue Valley spends most of its money on marketing. Data show that BAIC Blue Valley sales expenses in 2021 were 1.671 billion yuan, an increase of 65.83 percent over the same period last year, while R & D expenses were 1.208 billion yuan, an increase of 24.24 percent over the same period last year. In 2022, the sales cost of H1 Beijing Automobile Blue Valley was 890 million yuan, an increase of 67.54% over the same period last year, while the R & D cost was only 370 million yuan, down 8.35% from the same period last year. BAIC Blue Valley blamed the surge in marketing costs on the increase in channel construction and operating costs, but as a result, only three more stores were added to the H1 in 2022.

It is understood that BAIC Blue Valley mainly operates two brands: BEIJING and ARCFOX, of which ARCFOX locates high-end new energy brands. To some extent, ARCFOX can be regarded as a cooperative brand between BAIC Langu and Huawei, which has the blessing of HUAWEI Inside mode to make up for the shortcomings of polar fox in intelligence (car system, autopilot, etc.), especially the polar fox Alpha S Huawei HI version, which caused market popularity as soon as it was debuted. it is the first mass-produced car in the world equipped with three lidar layout, Huawei Hongmeng OS, Huawei high-order self-driving ADS system. Claims to have reached the highest level of Huawei's autopilot. However, in terms of actual market performance, sales of the polar fox brand are dismal, with wholesale sales of only 9829 vehicles in the first three quarters of 2022, compared with a target of 40, 000 at the beginning of the year, less than 25 per cent of the target.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.