In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/06 Report--

Tesla rushed to the top of Weibo again. This time it is still a "price reduction".

On January 6, the Tramway report learned from Tesla's official website that the prices of Tesla's two domestic cars fell sharply to a record low, with Model 3 falling by 2.0-36000 yuan and Model Y by 2.9-48000 yuan. Specific to each version of the model, the price of the Model 3 rear-drive version is reduced by 36000 yuan, the high-performance version by 20, 000 yuan, the Model Y rear-drive version by 29000 yuan, the long-lasting version by 48000 yuan, and the high-performance version by 38000 yuan.

Affected by the withdrawal of subsidies for new energy vehicles, car companies including BYD, Chery New Energy and Changan Deep Blue all announced price increases one after another after 2023, while Tesla's choice of "price reduction" is also related to his current situation in the domestic market. At noon today, Tao Lin, Tesla vice president of foreign affairs, said on Weibo in response to the price reduction news: "behind Tesla's price adjustment, there are numerous engineering innovations." in essence, it is a unique excellent law for cost control: including not limited to vehicle integrated design, production line design, supply chain management, and even optimizing robotic arm coordination routes in milliseconds … Proceed from the "first principle" and insist on pricing at cost. " In addition, Cui Dongshu, secretary-general of the National passenger car Market Information Association, also said: "Tesla's price reduction is reasonable." Tesla's first price reduction in 2023 is mainly due to cost reduction. Tesla performed well in 2022 and the market size increased significantly, which led to a reduction in costs, which naturally should be reduced. "

Judging from the above response, Tesla's price reduction is more attributed to the decline in the price of raw materials. According to Tesla's third-quarter financial report, Tesla's gross profit margin reached 27.9%, which is the car company with higher profit margin for bicycles in the automobile industry, which is also the source of the strength that other car companies are raising prices, while Tesla dares to lower prices. According to incomplete statistics, since Tesla made in China, the price of car models has been adjusted more than 15 times, including the adjustment of subsidy policy and the fluctuation of raw material prices, and this price reduction can be called the "lowest price in history". However, Tesla's bicycle profits will remain at a high level.

However, combined with Tesla's market performance in China in recent months, the "Tramway report" believes that in addition to the decline in raw material prices, Tesla's price reduction is also related to the current sharp increase in production at Tesla's Shanghai factory, and the market demand has not met expectations.

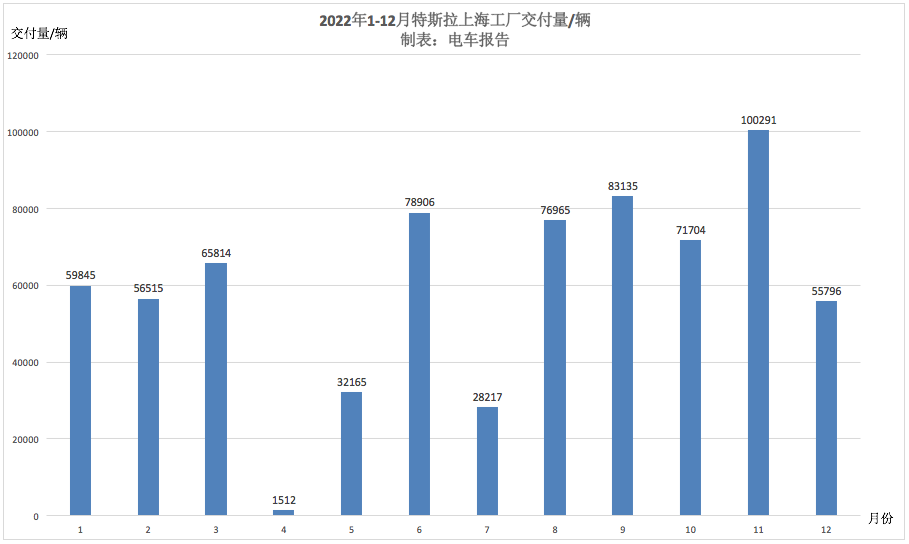

Tesla's development in the domestic market in 2022 is not smooth. Affected by the outbreak of the epidemic, Tesla Shanghai factory was forced to suspend production many times in the first half of 2022. In July, Tesla began to upgrade the production line of the Shanghai factory. After completing the renovation plan in early August, the factory's capacity has climbed to 1.1 million vehicles, an increase of about 127% over the same period last year, making Tesla the super factory with the highest production capacity. Tesla CEO Musk has previously revealed that the Shanghai factory already accounts for 1 / 3 of its total production, which is not only supplied to the Chinese market, but also exported to overseas markets such as Australia, Europe, Japan and Singapore.

Official figures show that in the second quarter of 2022, Tesla produced 258000 vehicles worldwide and delivered 254000 vehicles, with little difference between production and sales. Tesla's production and sales began to exceed demand after the renovation plan of Tesla's Shanghai factory was completed in early August. In the third quarter, Tesla's global output was 365000, and the delivery volume was 343000, with a difference of 22000 between production and sales. In the fourth quarter, Tesla's global production was 439700, and the delivery volume was 405300, and the gap between production and sales widened to more than 34000. The cause of this gap may be related to the failure of domestic market demand to meet expectations.

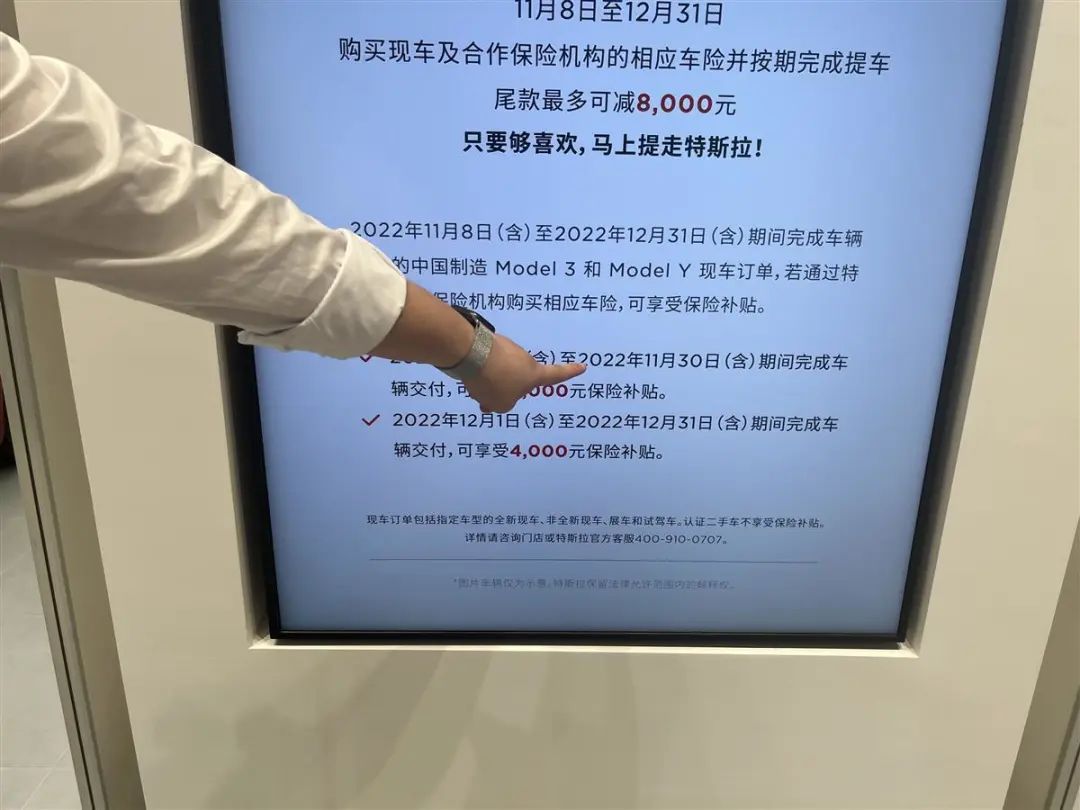

After entering the fourth quarter, Tesla launched a wave of large-scale marketing activities. since September, Tesla has launched many price cuts and promotions in the Chinese market, the largest of which is Tesla China's reduction of the prices of its two models by as much as 37000 yuan, of which Model 3 has dropped by 1.4-18000 yuan and Model Y by 2.0-37000 yuan. Since then, Tesla has also launched a series of preferential promotions in November and December. On November 8th, Tesla China once again announced that the final payment will be reduced by 8000 yuan from November 8 to November 30, when the car insurance portfolio of existing cars and cooperative insurance institutions will be purchased and picked up on schedule, and from December 1 to December 31, the final payment can be reduced by 4000 yuan. Take the purchase of Tesla in Shenzhen as an example, if you pick up Tesla in December, after combining all kinds of subsidies, the cumulative subsidy will eventually reach 33000 yuan.

It is undeniable that, stimulated by a series of price reduction and promotion measures, Tesla has achieved certain results, but not for a long time. According to the Federation of passengers, Tesla's wholesale sales in China in November were 100291, an increase of 89% over the same period last year and 40% from the previous month, setting a new monthly delivery record. But it declined in December. Tesla's wholesale sales in China were 55796 vehicles in December, down 44.4% from the previous month. In other words, Tesla's demand for domestic products has declined.

According to the Chinese market estimates released by the Federation of passengers, Tesla's Shanghai factory delivered more than 710000 vehicles in 2022, an increase of 48 percent over the same period last year, of which Model Y delivered more than 450000 vehicles, almost the same as Tesla's annual delivery volume of 484000 vehicles in 2021. China is Tesla's second market in the world, and the data also highlight the importance of the Shanghai factory to Tesla globally. Although the capacity growth rate of the Shanghai plant has improved, Tesla still failed to meet its annual sales target of 1.5 million vehicles. On January 3rd, Tesla released the 2022 global production and delivery report. According to the data, Tesla's annual production rose 47 per cent year-on-year to 1.37 million vehicles, while new car delivery rose 40 per cent year-on-year to 1.31 million, with a completion rate of 91.33 per cent. Unlike many car companies, Tesla's failure to achieve his goal is not due to insufficient production capacity, but the overstocking of inventory and the failure of new car sales to meet expectations.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.