In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/07 Report--

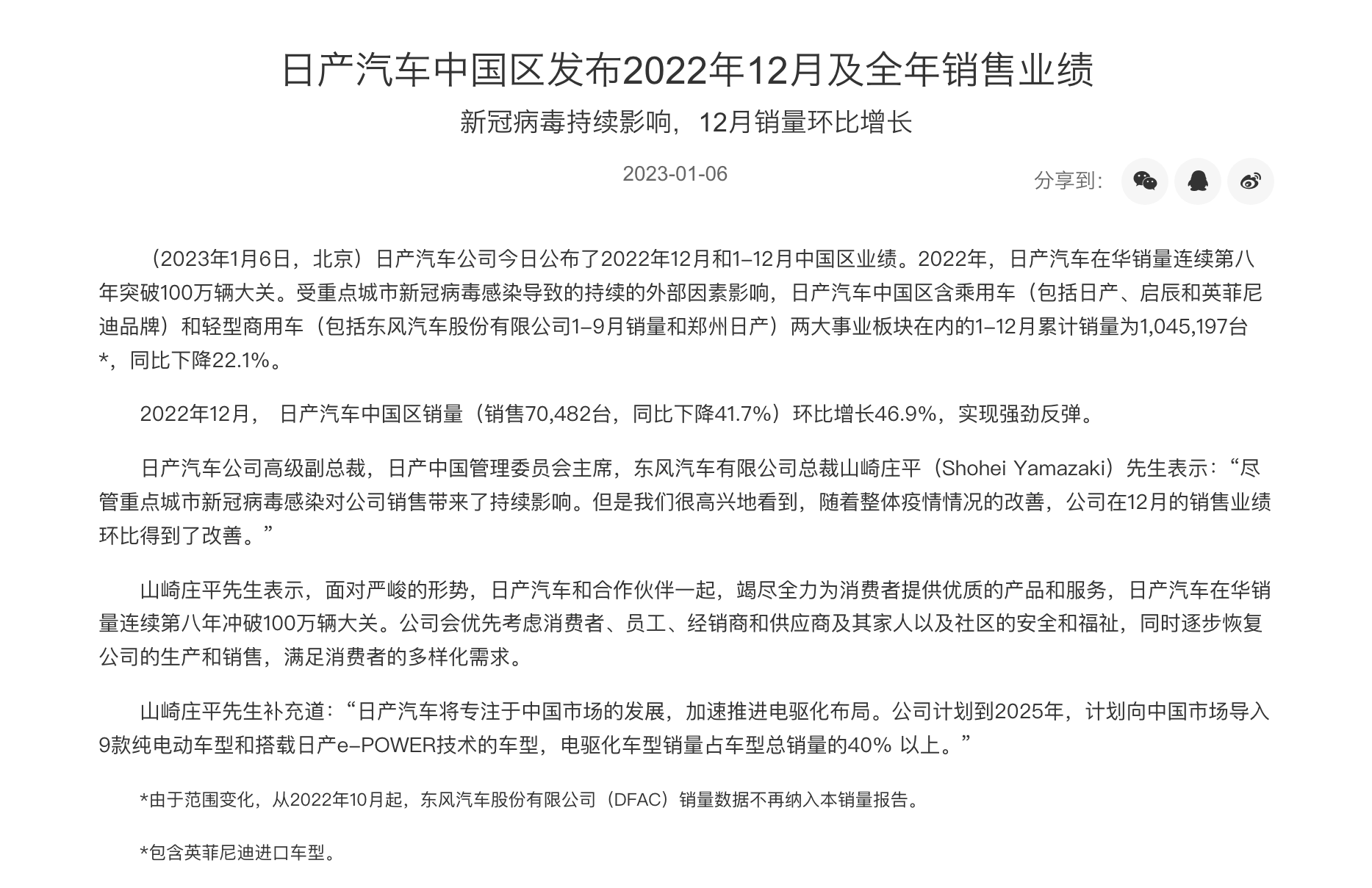

On January 6, Nissan China announced that its sales in China in 2022 exceeded one million for the eighth consecutive year. Data show that in 2022, Nissan China, including passenger vehicles (Nissan, Qichen and Infiniti brands) and light commercial vehicles (Dongfeng Limited January-September sales and Zhengzhou Nissan) accumulated sales of 1.045 million vehicles, down 22.1% from the same period last year, of which Nissan sold 70500 vehicles in China in December 2022, down 41.7% from the same period last year.

Although Nissan's sales in China have exceeded 1 million for eight consecutive years, sales have declined for four consecutive years. Unlike in the past, Nissan China is particularly "low-key" in announcing annual sales, not releasing sales charts in the passenger and commercial vehicle sectors, let alone sales of sub-brands and models.

Relevant data show that Dongfeng Nissan (Nissan, Qichen and Infiniti brands) sold a total of 902000 vehicles in 2022, down 21.4% from the same period last year, of which the Nissan brand, which is the main source of sales, fell 23.6% to 800000 vehicles. Qichen brand grew 8.8% to 96000 vehicles, while Infiniti brand sold only 6391 vehicles for the whole year, which had little impact on Nissan. It is understood that this is the first time that Dongfeng Nissan has fallen below 1 million vehicles since 2014, including 1.133 million in 2020 and 1.135 million in 2021.

Nissan is one of the first foreign brands to enter the Chinese market, exporting the third generation CEDRIC cars to China in 1972. In 1993, Nissan established its first joint venture in China, Zhengzhou Nissan Automobile Co., Ltd., which now produces pickups and SUV Tuda, Qijun Glory and so on. In 1994, Nissan Motor (China) Co., Ltd. was established in Hong Kong, mainly engaged in imported car business.

In 1999, Dongfeng Motor, Jingan Yunbao and Guangzhou Wutian obtained the technical license of Nissan Motor, and then set up a joint venture Fengshen Automobile Co., Ltd., the predecessor of Dongfeng Nissan, to start producing the Fengshen Bluebird based on Nissan Bluebird. In 2002, Fengshen launched the third generation Bluebird, and sales continued to be hot.

In 2003, Nissan and Dongfeng jointly established Dongfeng Motor Co., Ltd., China's largest automobile joint venture, and Dongfeng Nissan passenger car Company to specialize in the passenger car business. In 2004, Dongfeng Motor Co., Ltd. became the controlling shareholder of Zhengzhou Nissan through the acquisition of shares in Zhengzhou Nissan. In the same year, Nissan (China) Investment Co., Ltd. was established to manage its business in China together with the headquarters of Nissan Motor Co., Ltd. to achieve the integration of business in China, development into the fast lane. In 2018, Nissan reached a sales peak in China, with annual sales of 1.564 million vehicles, up 2.9% from a year earlier, surpassing Toyota China and Nissan China. Of this total, Dongfeng Nissan passenger cars (including Nissan / Qichen) sold 1.3011 million vehicles, up 2.8 per cent from the same period last year.

Like many brands, 2018 has become a beautiful scenery for Nissan in China. Starting in 2019, Nissan's sales in China began to decline. Nissan's cumulative sales in China fell from 1.5469 million in 2019 to 1.4567 million in 2020, leaving only 1.3815 million in 2021, according to the data. According to the latest data, Nissan sold 1.045 million vehicles in China in 2022, which also reached the level of one million, but fell 22.1 percent from the same period last year, including 902000 Dongfeng Nissan passenger vehicles, down 21.4 percent from the same period last year.

It is understood that at present, Dongfeng Nissan passenger cars are mainly engaged in Nissan, Infiniti and Qichen brands, among which Nissan brands bear the lion's share of Nissan's sales in China, with only three main selling models: Xuanyi, Teana and Xiaoke. All these three models declined to varying degrees in 2022, including 47.9% year-on-year decline in Xuanyi and 3.9% year-on-year sales in November 2022, while Teana missed the top three joint venture B-class car sales.

Prior to this, Qijun was also the main sales model of Dongfeng Nissan. According to the CAC data, Qijun's annual sales from 2017 to 2020 were 182000, 204000, 212000 and 169000 vehicles respectively, accounting for 14.4%, 15.6%, 16.4% and 13.9% of Dongfeng Nissan's annual sales respectively. Although the sales volume of Qijun is not as good as that of CR-V and RAV4, it can basically be maintained at more than 10,000 vehicles, which can be regarded as a regular result. However, since the replacement, the monthly sales of Qijun with three-cylinder engines have plummeted from 11581 to 1180. At present, the sales of Xinqi Jun has become a mystery. Nissan China no longer announces the sales of Xinqi Jun. although Qijun Glory, produced by Zhengzhou Nissan, uses the old four-cylinder engine, its monthly sales can only be maintained at the level of 2000.

In 2022, Dongfeng Nissan will mainly launch two models, one is the medium-term revamped Teana, and the other is the pure electric SUV ARIYA Aliya. In September 2022, the new Teana officially went on sale, with a price range of 17.98 yuan to 239800 yuan. As a medium-term modified model, the new Teana has made certain adjustments to the appearance and shape, using a new design style, and the power is still equipped with 2.0T/2.0L engines. After the listing, Teana's sales began to decline, from 14447 in September to 6880 in November. Of course, the specific reason is not known, it may be that the terminal discount of the new car is too little, or the shortage of parts leads to limited production capacity, or consumers do not recognize the new products.

As for Ariya, this is Dongfeng Nissan's first pure electric SUV, based on Yuntu intelligent pure electric platform developed by Renault-Nissan-Mitsubishi alliance, with a market guidance price of 27.28-342800 yuan. At the beginning of the listing, Takeshi Yamaguchi, vice president of Dongfeng Motor Co., Ltd. and general manager of Dongfeng Nissan passenger car Company, said that Nissan has once again ushered in the baptism of innovation, and the ARIYA will be the most suitable product for Chinese consumers. However, like other Japanese electric cars, Chinese consumers do not seem to buy it, with ARIYA Aliya selling 456 units in its first month on the market, compared with 387 in November.

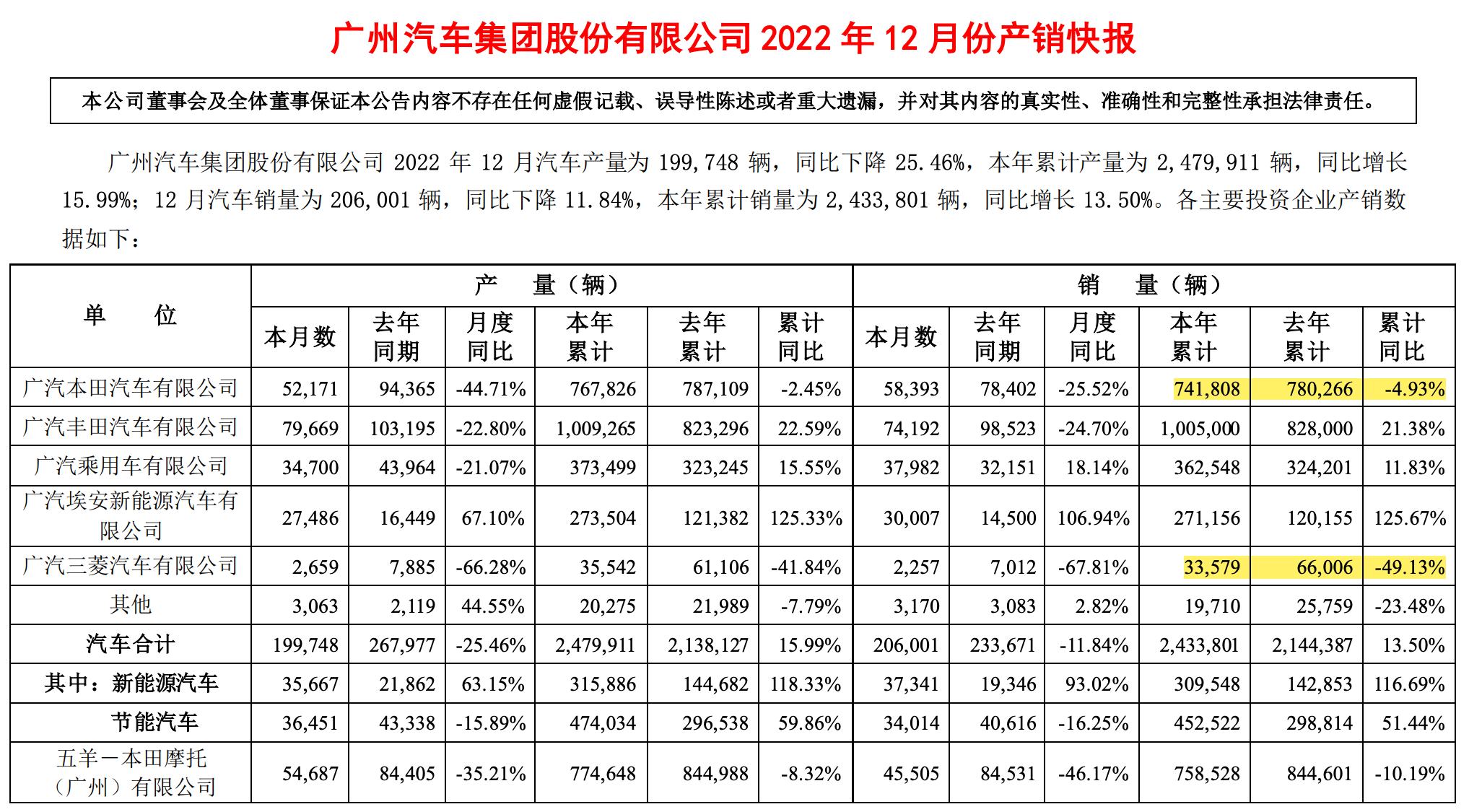

In fact, not only Nissan, but almost all Japanese brands have suffered a collective decline in the Chinese market. On January 5, Honda China released terminal car sales in 2022, showing that Honda's terminal car sales in China totaled 1.3731 million in 2022, down 12.07% from a year earlier, with Guangzhou Auto Honda's cumulative sales down 6.19% to 720700 and Dongfeng Honda down 17.76% to 652400.

Nowadays, with the rapid rise of independent brands and the tuyere of new energy vehicles, the advantages of joint venture brands are becoming less and less obvious. Industry insiders say that the replacement of new energy vehicles to fuel vehicles will accelerate next year. For joint venture brands with fuel vehicles as the main sales force, stimulating policies such as halving purchase tax this year have already overdrawn part of the demand. In addition, once a price war occurs in new energy vehicles next year, it will spill over into the fuel vehicle market, further depressing the profitability of the main joint venture brands in the market.

For Nissan and other Japanese brands, it is very important to stabilize the original basic set of fuel vehicles and at the same time launch new energy products that can support sales growth as soon as possible, but Japanese brands have long been betting on gas-electric hybrid and hydrogen fuel technology. there is a lack of technical reserves in the direction of pure electric, so it is difficult to narrow the gap in the short term.

At present, Chinese independent brands have become the dominant players of new energy vehicles, and consumers' expectations of new energy vehicle products are also affected by the marketing of these brands. even some consumers have formed a backward perception of joint venture brands in the field of new energy vehicles. Once this concept is formed, it will have a far-reaching impact on the brand.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.