In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/07 Report--

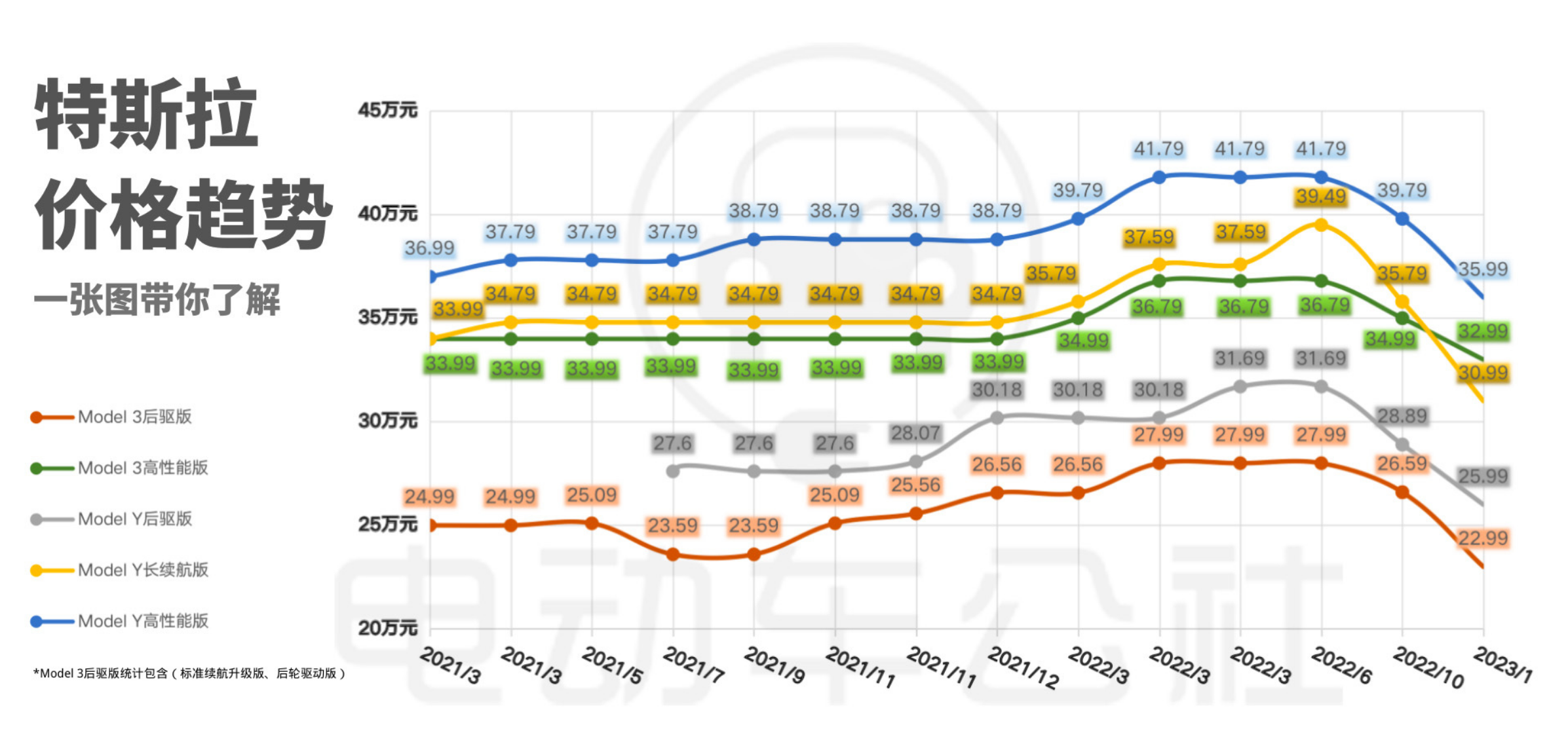

Tesla suddenly announced a price cut on Chinese mainland on Jan. 6, with the starting prices of both domestic models hitting record lows, with Model 3 falling by 2.0-36000 yuan and Model Y by 2.9-48000 yuan. Specifically, the price of Model 3 rear-drive version is reduced by 36000 yuan, the high-performance version by 20000 yuan, the Model Y rear-drive version by 29000 yuan, the long-lasting version by 48000 yuan, and the high-performance version by 38000 yuan.

In addition to Chinese mainland, Tesla has also launched price cuts in Japan, South Korea, Australia and other countries. In the Japanese market, for example, Tesla Model 3 starts at 5.369 million yen and Tesla Model Y starts at 5.799 million yen. The prices of the two models have been reduced by about 10% respectively, which is the first time that Tesla has lowered the price of Japanese cars since 2021. It is understood that at present, models on sale in Japan, South Korea and Australia are all imported and are all produced by Tesla's Shanghai factory. The purpose of this price reduction is to stimulate demand for the capacity of Tesla's Shanghai factory, which is currently Tesla's largest manufacturing center in the world.

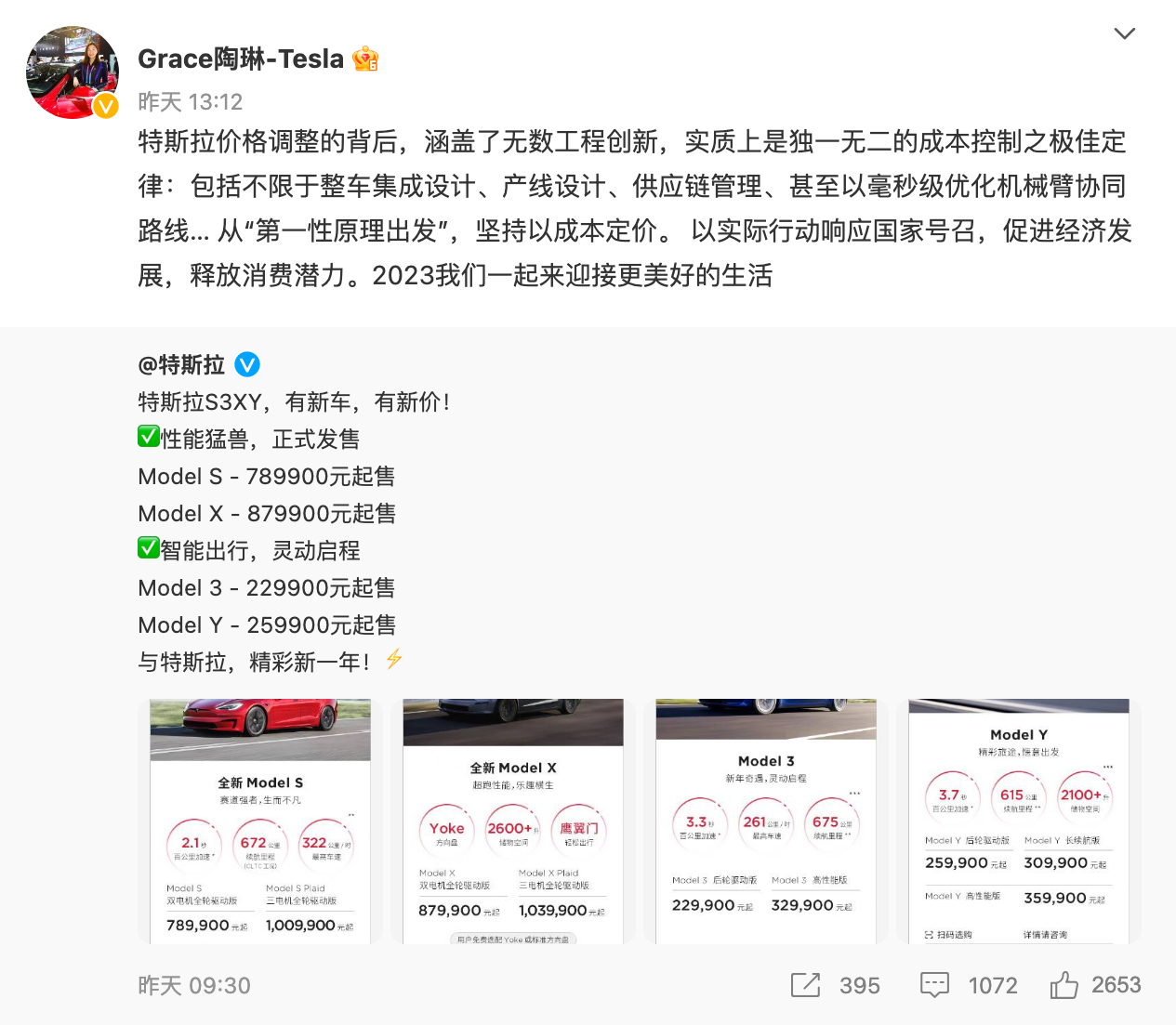

As for the reasons for the price reduction, Tao Lin, vice president of foreign affairs of Tesla, responded on Weibo: "behind Tesla's price adjustment, there are numerous engineering innovations." in essence, it is a unique excellent law for cost control: including not limited to vehicle integrated design, production line design, supply chain management, and even optimizing robotic arm coordination routes in milliseconds … Proceed from the "first principle" and insist on pricing at cost. "

In addition to cost control and price for volume, striving for a higher market position is also one of the main reasons. According to official data released by Tesla, Tesla's annual sales of 1.3139 million vehicles in 2022, although an increase of 40%, but Tesla delivery volume did not meet the expected 1.5 million. What's more, Tesla lost the title of new energy in 2022. Although it is still the world's highest-selling pure electric car company, it has been overtaken by BYD in the new energy vehicle industry, which sold 1.857 million vehicles in 2022. Perhaps Mr Musk did not expect that BYD, which he did not see a decade ago, is now one of Tesla's strongest rivals in the global market.

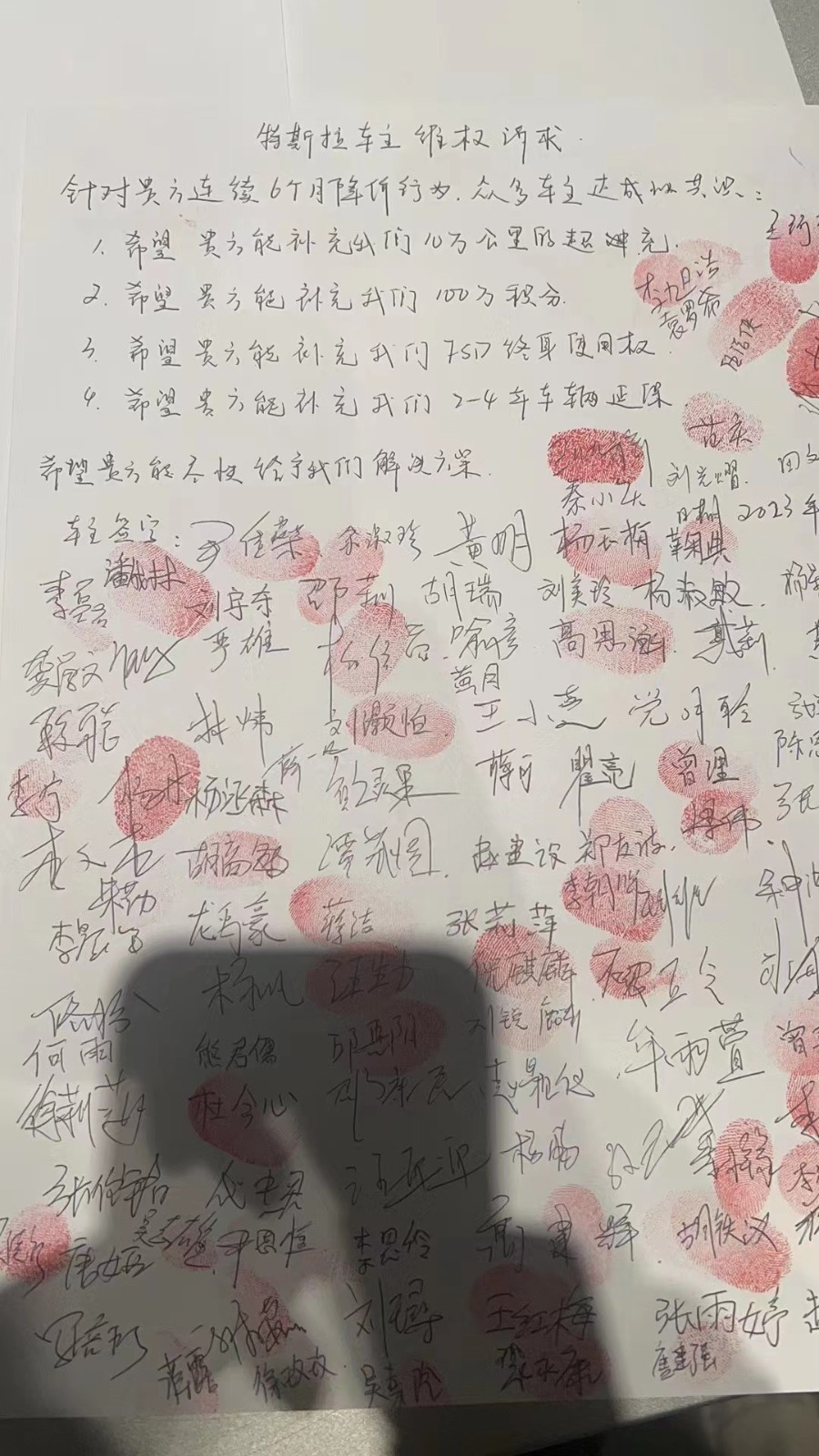

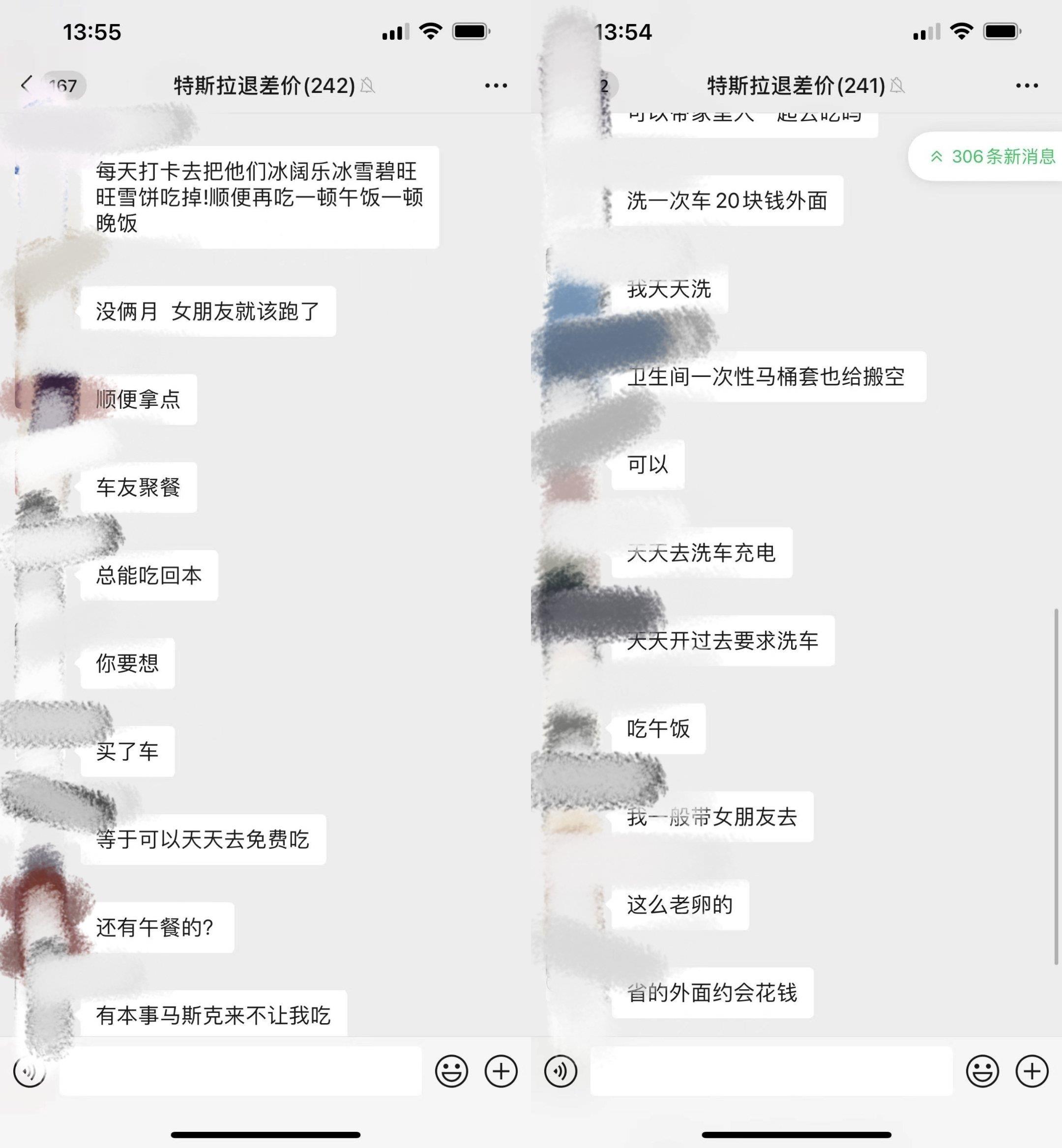

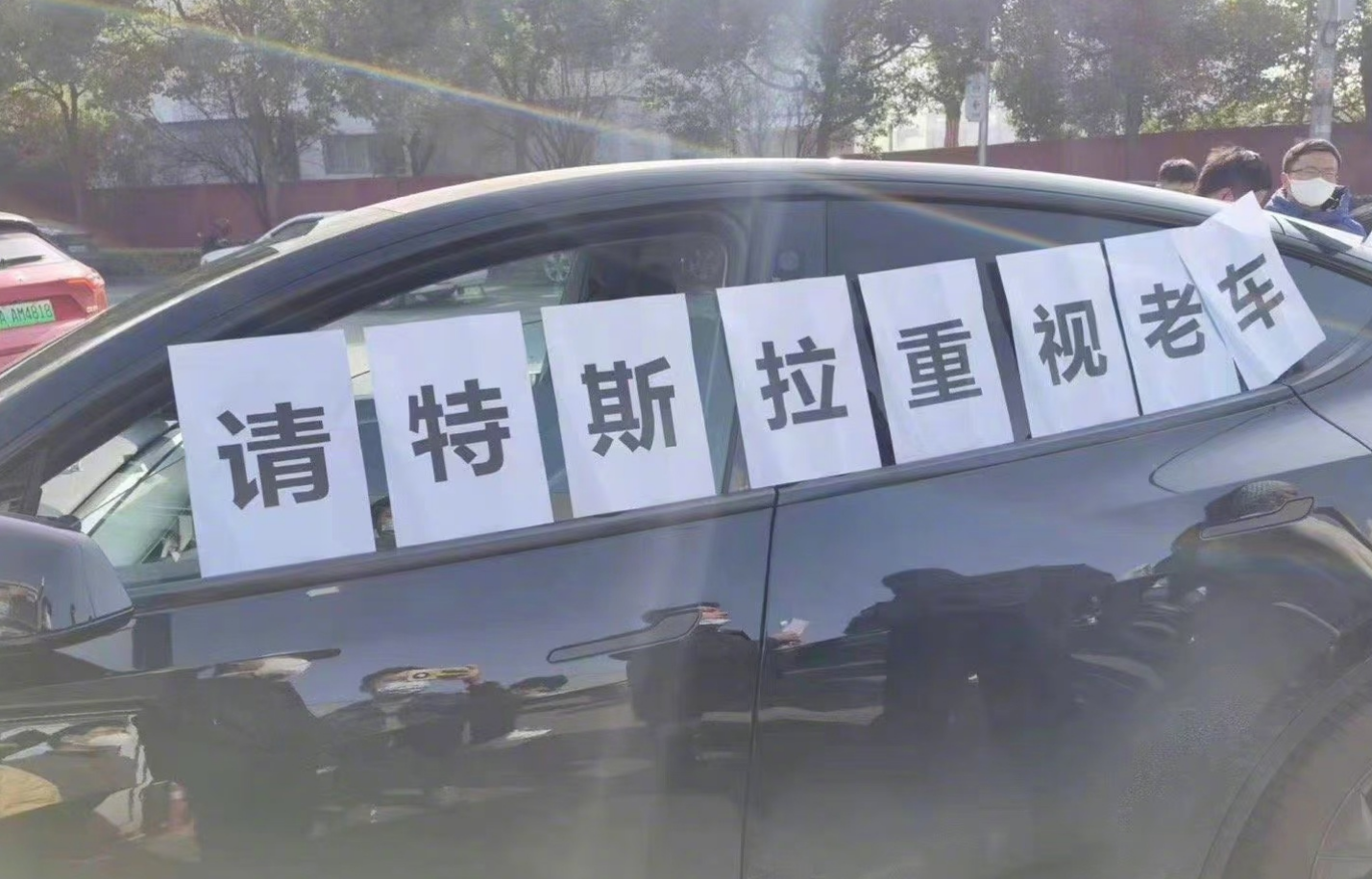

Unlike BYD, Chery New Energy, Changan Deep Blue and other car companies that have announced price increases, Tesla Guanxuan price reduction is indeed unexpected, but the rights protection behavior after the price reduction is expected. After the latest price reduction news was issued, rights protection incidents broke out again in many places across the country, and many car owners began to form "rights protection groups" to link up their respective loss amounts, in order to protect their own rights and interests against the price reduction, while some car owners went directly to the Tesla service center to seek a solution. Angry Tesla car owners even directly occupied a service store, looting gifts, snacks and water around the store. Even a pure electric Cyberquad in the store was damaged. In the rights group, Tesla users said that they would go to the store to recharge and wash the car every day, and eat and drink the snacks and drinks provided by the store.

From the user's point of view, especially the recent car owners, the psychological imbalance is understandable, but this is not the reason to safeguard their rights. For Tesla, who sells directly, the pricing of his products is linked to the cost of production. Under the condition that the cost of production is reduced, it is a problem for Tesla not to reduce the price. Secondly, as a car company, Tesla also has the right to set prices freely, which does not violate market rules, but from the perspective of consumers, Tesla's practice of frequently adjusting prices is indeed inappropriate, which is easy to cause user dissatisfaction and reduce user loyalty. these often turn into rights-safeguarding events. In addition, Tesla price reduction is also sudden, in fact, many service centers do not know in advance, there is no way to predict what kind of price fluctuations will occur in the future. Finally, the price reduction requires Tesla to provide compensation, so will these car owners pay for the price increase? Generally speaking, Tesla's price reduction is reasonable and normal, but it is really improper in the way of handling it.

Of course, based on the demands of the car owners, the Tramway report also asked Tesla about the Chinese customer service as the car owner, and the response was that "there is no compensation measure to respond to it for the time being". The customer service also said that "there may be no way to stop the operation of safeguarding rights, because this is a personal act."

As for whether Tesla will still reduce the price, there is a good probability that it will. In terms of manufacturing costs, Tesla Shanghai Super Factory has achieved more than 90% of the supply chain localization in 2021, and the current localization rate of parts has risen to 95%. The decline in production costs gives Tesla products further room for price reduction. At the same time, Tesla's gross profit margin is much higher than that of the world's major automakers, so Tesla does not rule out the possibility that Tesla breaks the logic of international brand pricing and explores the price range with a cost orientation to gain a higher market share.

After entering 2022, Tesla's "myth" image is constantly weakening. not only the global new energy title has been taken away by BYD, but even the stock price has "plummeted from a height of 3, 000 feet." Tesla's share price has fallen 67.9% over the past year, compared with a market capitalization of $1.18 trillion in April 2022. Tesla's market capitalization is now only $357.015 billion, losing more than $820 billion (5.7 trillion). In other words, the market value of Tesla has already exceeded the "7 BYD" in one year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.