In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/08 Report--

Tesla has cut prices sharply, but its share price has fallen even more.

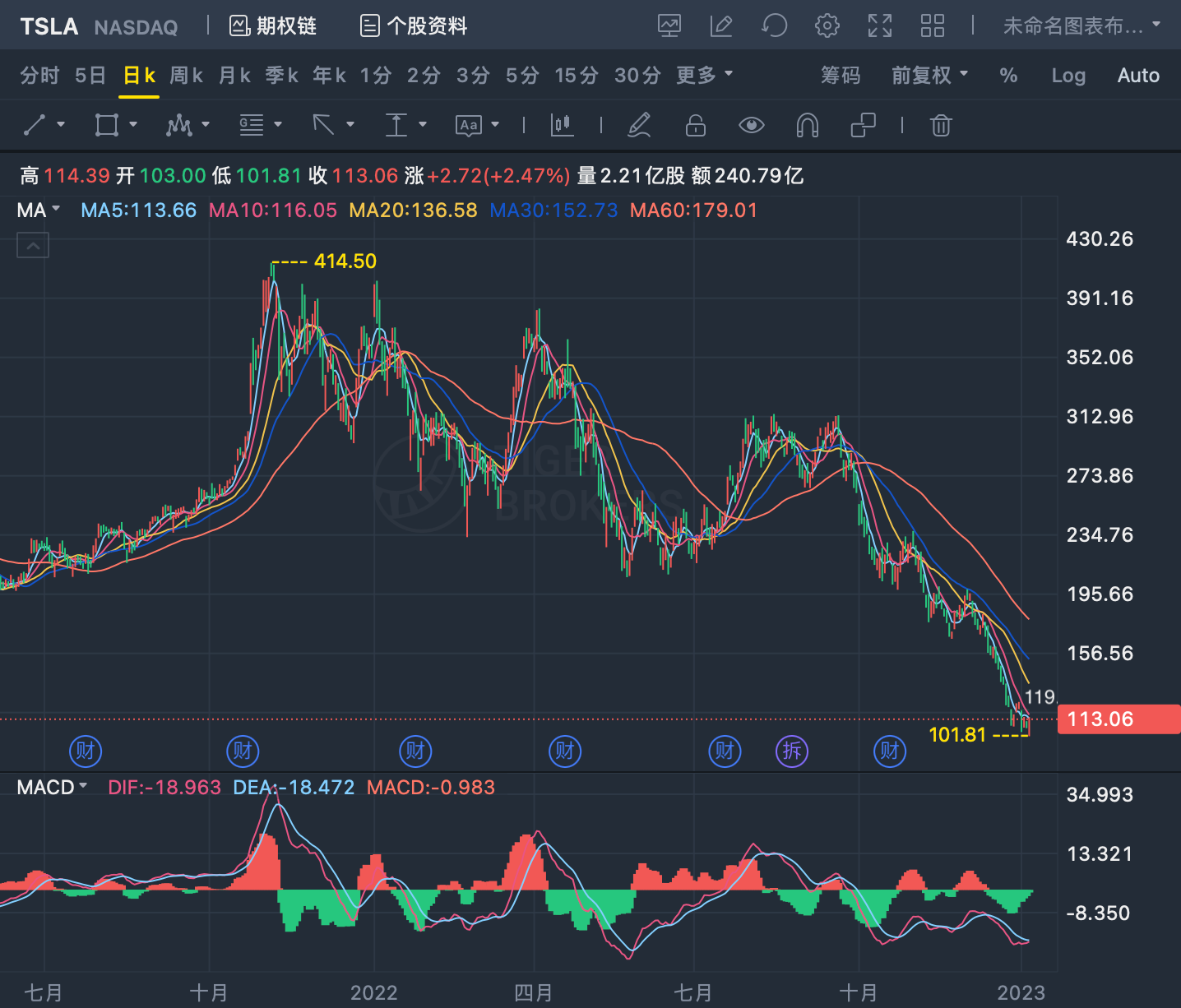

Tesla has lost about $675 billion (4.7 trillion yuan) in market value since 2022, down twice as much as the NASDAQ, the worst-performing technology stock in the United States in 2022, and far more than other carmakers. According to statistics, Tesla's share price was $1056.78 on December 31, 2021, but fell to 123.18 on December 31, 2022, a decline of 88.34%. After entering 2023, Tesla's situation did not improve, plunging 12.24% on the first day of trading, the lowest since August 2020, when the market value lost $47.6 billion (about 328.9 billion yuan). The weekly decline narrowed to 8.22% after three days of shock.

According to the latest market capitalization list, Tesla is still the world's largest car company by market capitalization, with a total market capitalization of US $357.01 billion, much higher than Toyota's US $191.82 billion and BYD's US $98.61 billion, but its decline is also higher than that of major car production companies. According to statistics, Toyota's share price fell 26.29% in 2022, Volkswagen fell 43.69%, General Motors and Ford fell 43.86% and 43.67% respectively. The three companies with similar declines as Tesla are Rivian, Lucid and Xiaopeng Motor. The share prices of these three new power companies fell by 82.23%, 80.08% and 80.25% respectively in 2022.

It is understood that during the period from 2018 to 2021, Tesla's share price rose as high as 2373.7%. Especially in 2021, its market capitalization exceeded trillion yuan, making it one of the world's five largest technology companies with a market capitalization of more than 11 traditional automakers, including Toyota, Volkswagen, GM, Ford, Mercedes-Benz and so on. Tesla CEO Musk became the richest man in the world. Today, Tesla's market capitalization is less than half.

Mr Musk blamed the US macroeconomic situation for the sharp fall in share prices. He said that as guaranteed US bank savings account interest rates began to approach the returns of the US stock market, and stock market returns were volatile, more and more Americans withdrew their money from the stock market, which led to a sharp fall in various stock prices in the US stock market. Earlier, he also said that Tesla's performance is better than ever before! We can't control the Fed, and that's the real problem.

The sharp fall in Tesla's share price is related to the Fed's continued interest rate hike, but it may not be the main reason. The market believes that Tesla's share price plummeted due to "Musk's acquisition of Twitter." Forbes pointed out that Musk's share price has fallen significantly more than other carmakers since it announced its acquisition of Twitter in April 2022. According to statistics, Tesla's share price fell by 65.7% during this period, while Ford fell by 31.2% and GM fell by 23.1%. In the eyes of investors, Musk may not have time to manage Tesla after the acquisition of Twitter, which may be the main reason for investors' loss of confidence in Tesla.

Obviously, Musk is also aware of the problem. On December 18, 2022, Musk launched a vote on Twitter on whether he should resign as Twitter CEO. By the end of voting time, 57.5% of netizens voted for it and 42.5% voted against it. On December 20, 2022, Musk said on Twitter that he would resign after finding a candidate for Twitter CEO to focus on Twitter's software and server business. Musk did not announce the timing of his resignation and the candidate for Twitter's new CEO.

In addition, the sharp fall in Tesla's share price is also linked to its operating conditions. According to the latest financial report, Q3 Tesla's total income in 2022 was 21.454 billion US dollars, up 56 percent from 13.757 billion US dollars in the same period last year, but lower than the 22.09 billion US dollars expected by Wall Street. In terms of net profit, the net profit of common shareholders in the third quarter was $3.292 billion, up 103% from $1.618 billion in the same period last year. The net profit margin rose to 15.5%, but the gross profit margin fell to 27.9%.

In terms of sales volume, Tesla produced a total of 1.3696 million new cars worldwide in 2022, an increase of 47% over the same period last year; a total of 1.3139 million vehicles were delivered for the whole year, an increase of 40% over the same period last year; according to Musk's forecast, the sales target of 1.5 million vehicles will be achieved in 2022, but the actual completion rate is 91.33%. What is different from many car companies is that Tesla's failure to achieve his goal is not due to insufficient production capacity, but the overstocking and market demand falling short of expectations.

Tesla is also aware of this, perhaps under the pressure of year-end KPI, Tesla has been frantically cutting prices and subsidies on Chinese mainland since October 2022. At the end of October, Tesla announced the price adjustment of domestic Model 3 and Model Y, in which the price reduction of Model Y was between 20000 and 37000, and that of Model 3 was between 14000 and 18000, which is not insignificant for cars with a price of only more than 200,000 yuan. Since then, Tesla also announced an insurance subsidy for car owners who buy domestic Tesla, up to a maximum of 8000 yuan. After entering 2023, Tesla went in the opposite direction and announced a big price reduction for domestic models. The starting prices of the two domestic models reached a record low, with Model 3 falling by 2.0-36000 yuan and Model Y by 2.9-48000 yuan.

Turning back to Tesla, Tesla's stock price has fallen one after another this year, which has a lot to do with Musk's repeated twists and turns on the "Twitter" acquisition case, but Tesla's lower-than-expected delivery volume and price reduction promotion have also reduced investor confidence. At the same time, Tesla's difficulty in meeting the KPI standards at the end of the year and the decline in the growth rate of domestic new energy vehicles indicate that market demand is facing a slowdown.

With the expansion of Tesla's Shanghai Super Factory, Tesla has a total annual production capacity of more than 1.9 million vehicles, of which the Shanghai plant has an annual production capacity of more than 750000 vehicles, the California plant has an annual capacity of 650000 vehicles, and the Berlin plant and the Texas plant have an annual capacity of more than 250000 vehicles. Thanks to the continued climbing of production capacity, Tesla's early orders have also been digested quickly, from a peak of 476000 in July to 285000 in October and only 190000 in November. At that time, with the slowdown of overall demand in the industry and the complete digestion of Tesla's accumulated orders, Tesla may have the problem that the current market is worried that the production capacity is far greater than the sales volume.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.