In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/10 Report--

FAW-Volkswagen, which has won the top spot in the domestic passenger car market for three years in a row, has been overtaken by a Chinese car manufacturing company that has never been seen before.

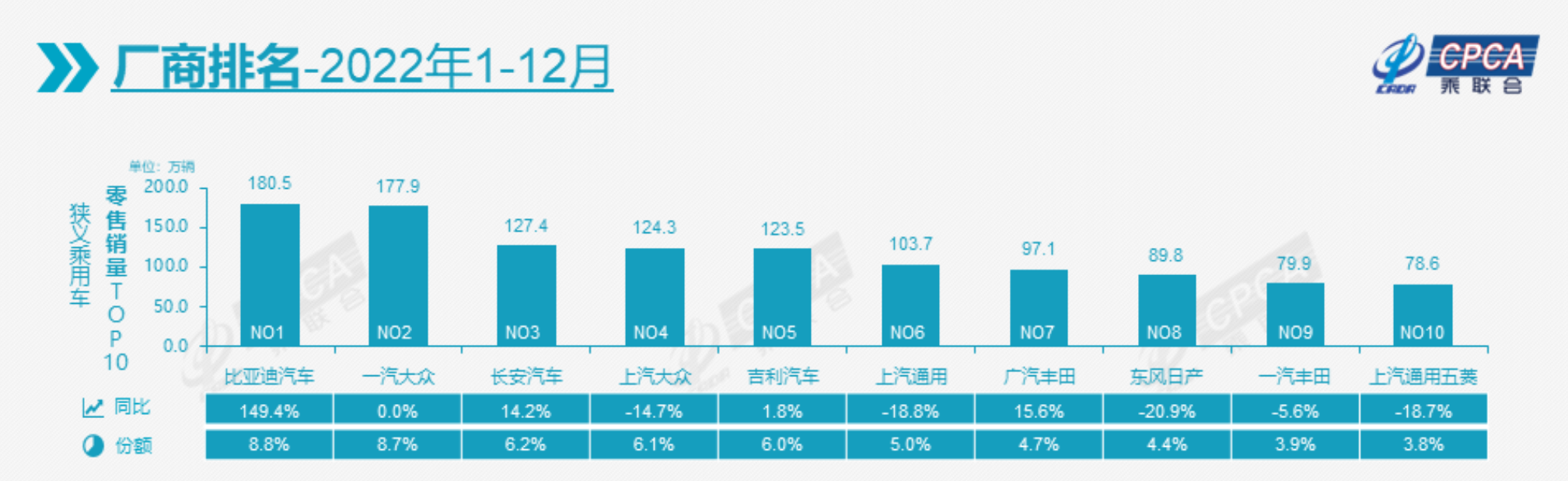

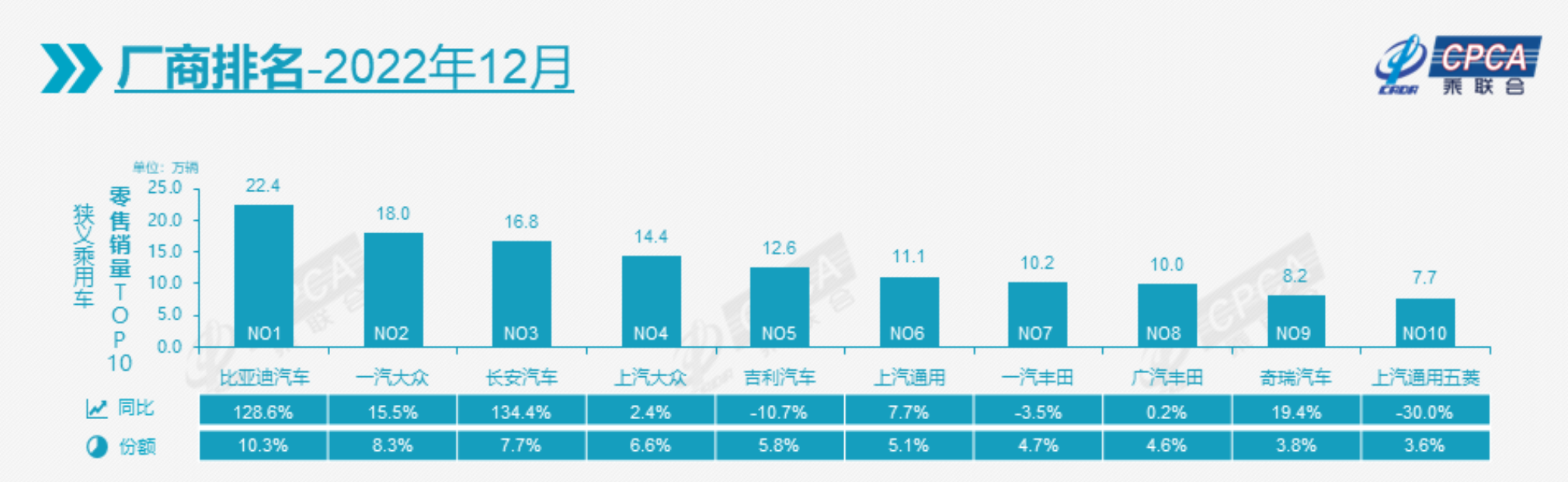

BYD sold 1.805 million narrow passenger cars in 2022, up 149.4 per cent from a year earlier, including 224000 in December 2022, up 126.6 per cent from a year earlier, according to the Federation of passengers. For comparison, FAW-Volkswagen, which ranked second, sold 1.779 million vehicles in 2022, roughly the same as in 2021, with sales of 180000 in December 2022, up 15.5 per cent from a year earlier.

FAW-Volkswagen has won the domestic passenger car sales title for three years in a row. FAW-Volkswagen sold 2.072 million vehicles in 2019, surpassing SAIC-Volkswagen for the first time, rising 1.9% to 2.11 million in 2020 and 15.7% to 1.778 million in 2021, according to FIFA data.

BYD Automobile has become the top seller in China's passenger car market for the first time in the history of BYD, and it is also the first time that a Chinese brand has been in the Chinese automobile market. Fundamentally speaking, BYD surpassed FAW-Volkswagen. On the surface, the goal of FAW-Volkswagen winning the top spot in the passenger car market for four consecutive years was terminated, and its market position began to be loosened. Chinese brands led by BYD began to challenge the status of joint venture brands in the Chinese market and began to disintegrate the status of joint venture brands in the Chinese market.

In 2003, BYD acquired Qinchuan Automobile in Xi'an, becoming another private carmaker after Geely and Chery. At that time, China's automobile market was in a period of rapid development, but it was also monopolized by foreign brands.

It is not easy for private car companies to counterattack, not only without technology and talent, but also facing the situation of being "besieged and suppressed" by joint venture brands. Even Geely and Chery, which entered the game earlier, had to keep their heads down and carry the pressure to "survive in the gap", while BYD, which announced that it was building cars at that time, had no lofty ideals and only took a fancy to the growth potential of cars. Later, BYD took a fancy to Toyota Corolla models, from dismantling, learning, imitating and assembling. Let's get started. In 2005, BYD's first model, the F3, went offline. With its low price and exquisite imitation, the F3 won the attention of many consumers.

The F3 has become the dominant model of the BYD fuel car era, but it is likely to be the only fuel car that BYD has ever really sold. After tasting the benefits of F3, BYD successively launched F0, F3R, G3, L3, F6, M6 and other models, with sales of 448000 vehicles in 2009, ranking first in independent brand sales, of which F3 sales alone reached 291000.

However, BYD's fuel car sales have been on the decline since 2010. Since the launch of the first dynasty series, Qin, in 2013, most of BYD's models have adopted the model of both fuel and new energy vehicles, but sales of fuel vehicles are generally mediocre. In 2018, BYD Song MAX welcomed the best part of the monthly sales of more than 10,000, but it did not last long, falling to less than 10,000 by the end of 2018. In November 2019, BYD launched a Qin fuel version priced between 6.49 yuan and 81900 yuan, but sales have been flat ever since, except for strong attention when it went public. For BYD, the related successful fuel car may be Song Pro, which went on sale in July 2019, which sold more than 10,000 cars in the past few months and became the only BYD model with annual sales exceeding 100000 in 2020. In September 2020, BYD launched the Song PLUS, the last model launched before BYD stopped producing fuel cars, but sales were still poor. It can be said that in the era of fuel cars, BYD has come to an end.

In fact, it is not only BYD, in fact, most of the domestic independent brand fuel vehicle sales are very ordinary. In the era of fuel vehicles, foreign brands' reserves of automotive technology are obviously richer than Chinese brands, including engines, gearboxes and chassis lights, which is the most direct reason why Chinese brands have been unable to surpass joint venture brands for a long time.

On April 3, 2022, BYD announced that it would stop production of fuel-fueled vehicles and focus on pure electric and plug-in hybrid vehicles in the future. For BYD, stopping production of fuel vehicles is not only in line with the global trend of automobile development, but also the necessity of the transformation of BYD cars. Unlike traditional automakers such as Mercedes-Benz, BMW and Audi, before the announcement of the suspension of fuel vehicles, the proportion of BYD fuel vehicle sales is declining, while for other traditional automakers, fuel vehicles are the main source of sales. Abandoning fuel cars means overturning all the accumulated technology, which takes a lot of time and money, which is the main reason why it is difficult for traditional carmakers to give up fuel vehicles.

After the suspension of production of fuel vehicles, more focus on the development of new energy vehicles also confirmed BYD's decision, sales repeatedly hit record highs. Data show that BYD sold 740100 vehicles in 2021, including 603900 fuel vehicles and 136300 new energy vehicles. BYD sold 1.8685 million cars in 2022, up 152.46% from the same period last year, of which 1.8574 million new energy passenger vehicles were sold (pure electric: 911100; plug-in hybrid: 946200), an increase of 212.82% over the same period last year. It is understood that since September 2022, BYD's monthly sales of new energy vehicles began to exceed 200000, reaching a peak of 234600 in December, which is also the peak since BYD was founded.

The deeper significance of BYD's overtaking FAW-Volkswagen is that Chinese brands dominated by BYD are beginning to disintegrate the position of joint venture brands in the Chinese market, and new energy car manufacturers dominated by BYD are promoting drastic changes in the auto industry.

This is not alarmist talk, nor is it hyperbole. Fundamentally speaking, BYD and FAW-Volkswagen represent two major camps in the automobile industry. The former is led by new energy vehicles, and the sales volume of new energy vehicles is the main source of the company's sales. While the latter represents the traditional car leader, traditional fuel vehicles account for more than 90% of the total sales, its new energy vehicle sales are still difficult to change the overall business situation of the enterprise.

Of course, at this stage, the main source of sales in China's automobile market is still fuel vehicles, and it is unlikely that new energy vehicles will completely subvert traditional fuel vehicles, but new energy vehicles are growing at an alarming rate. it shows that the new energy vehicle revolution is promoting the upheaval in the automobile industry, which may be difficult to achieve in the short term, but the long-term goal remains unchanged. Why is it an upheaval in the automobile industry? Because the surge in sales of new energy vehicles affects not only traditional automakers, but also corresponding parts suppliers, when the automobile industry is transformed, companies that layout smart driving, intelligent cockpit, lidar and other racing tracks will have more chances to survive.

Looking back in 2022, the rapid rise of new energy car manufacturers, such as Tesla, Lulai, ideal, Polar Krypton, and the boundary, has also put great pressure on traditional car companies. In order to keep up with the pace of the market, including Mercedes-Benz, BMW, Volkswagen, Toyota, Hyundai, Kia, Volvo, Jaguar and so on have announced a large investment in the layout of electrification. Perhaps, in three or five years' time, the range of fuel car brands and models that consumers can choose will be further narrowed, and the entire auto industry and auto market will accelerate to embrace the era of electrification.

A few days ago, it was reported that Wang Chuanfu, chairman of BYD, put forward the goal of selling 4 million vehicles by 2023. In response, BYD responded that affected by the epidemic, there are many uncertainties in the market, consumer demand and supply chain system, so it is difficult for the company to judge the 2023 sales target.

Just imagine, if BYD's annual sales reach 4 million in 2023, it will affect not only joint venture brands in the Chinese market, but also international carmakers far across the world. Or, if the joint venture brand wants to become the top seller of passenger cars in China, I am afraid it will never be seen again.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.