In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/15 Report--

According to the Federation of passengers, retail sales in the domestic narrow passenger car market in 2022 were 20.543 million units, an increase of 1.9 percent over the same period last year. According to the data, although the epidemic and the shortage of the supply chain were deeply affected in the first half of 2022, with the help of the national stimulus policy and the countdown to the withdrawal of new energy vehicles in the second half of the year, the car market showed obvious signs of recovery, and the domestic car market as a whole maintained a small growth in 2022.

According to the retail sales list of auto companies combed by "Automotive Industry concern", of the 15 auto companies on the list in 2022, 7 achieved year-on-year growth and 8 declined compared with the same period last year, although the number of car companies with the same increase and decline was about the same as in 2021, but when it comes to the ranking analysis of auto companies, the annual retail sales ranking of manufacturers in 2022 has been reshuffled. In terms of brand attributes, joint ventures account for 9 of the 15 car companies on the list, but there is also a serious year-on-year decline, including SAIC-Volkswagen, SAIC-GM, Dongfeng Nissan, FAW-Toyota, SAIC-GM Wuling, Guangzhou-Honda and Dongfeng-Honda. Instead of the usual strong performance, independent brands are rising rapidly, such as BYD surpassing FAW-Volkswagen for the first time. SAIC-Volkswagen and SAIC-GM, which rank in the top three all the year round, have also been overtaken by Changan Automobile and Geely Motors respectively. In other words, independent brands have occupied three of the top five car companies.

According to the breakdown of automobile enterprises, a total of six car companies sold more than one million vehicles in 2022, the same as in 2021, namely BYD, FAW-Volkswagen, Changan Automobile, SAIC Volkswagen, Geely Automobile and SAIC General Motors. BYD sold 1.8046 million vehicles for the whole year, an increase of 149.4% over the same period last year, leading a group of car companies and the highest growth rate on the list. What has attracted the attention of the industry is that this is the first time that BYD has surpassed FAW-Volkswagen, which has won the top spot in the passenger car market for three years in a row, to become the top seller in the whole year, and it is also the first time that a Chinese car brand has become the top seller in China's passenger car market. This also means that the situation of joint venture brands monopolizing the car market has been completely changed.

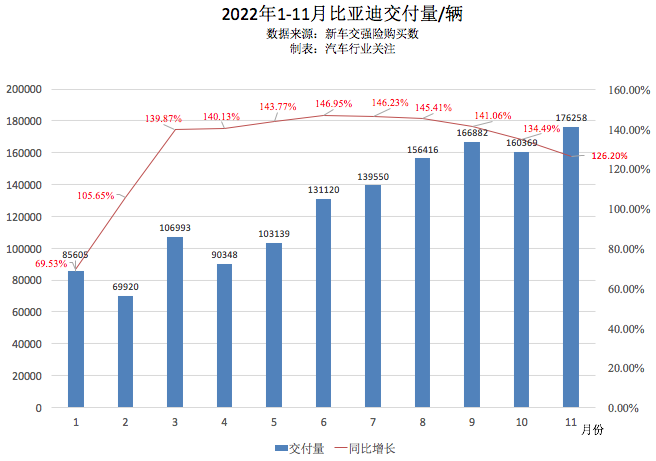

BYD's sales have soared ever since BYD announced its withdrawal from the fuel car market on April 3, 2022, and will focus on pure electric and plug-in hybrid vehicles in the future. According to the number of new car compulsory insurance purchases, BYD's new car sales increased by about 140% year-on-year from April to September in 2022, far exceeding the year-on-year growth rate of other car companies.

At present, BYD product matrix is mainly responsible for dynasty, ocean and Tengli brands. In 2023, BYD will also launch a new high-end brand-- look up and professional personalized brand matrix, covering areas from household to luxury, from public to personalized, to meet the needs of users for multi-faceted and full-scene cars. At that time, BYD's product matrix will be more perfect.

In addition to BYD, independent brands such as Changan, Geely and Chery also rose to varying degrees, with Changan up 14.20% year-on-year to 1.7791 million, Geely up 1.8% to 1.2347 million and Chery up 19.80% to 717700. It is worth noting that Great Wall, one of the leading independent brands, fell 20 per cent year-on-year to 758700 vehicles in 2022, meeting only 56.18 per cent of its annual sales target of 1.9 million vehicles, although overall sales are still higher than most joint venture brands.

Among the joint venture brands, FAW-Volkswagen and SAIC-Volkswagen ranked second and fourth respectively. FAW-Volkswagen sold 1.7791 million vehicles for the whole year, with a market share of 8.7%, a difference of only 1% compared with BYD, but in terms of year-on-year growth, BYD soared 149.40%, while FAW-Volkswagen did not achieve growth, basically the same as last year. In other words, BYD is rising rapidly.

SAIC-Volkswagen ranked fourth, with sales down 14.70% to 14.7% compared with the same period last year. As for the reasons for the decline, it is not difficult to find that sales of old models such as Passat and Tuguan L are not satisfactory in 2022, and SAIC-Volkswagen ID series has also failed to turn things around in the new energy vehicle market. According to the data, the new energy model with the highest sales in December was FAW-Volkswagen ID.4 CROZZ, with 4832 vehicles, followed by ID.4 X with 3901 vehicles and ID.6 CROZZ with 2869 vehicles. Judging from various signs, the decline in SAIC-Volkswagen sales may continue.

Full-year sales of American brand SAIC GM fell 18.80 per cent year-on-year to 1.0369 million vehicles, mainly due to poor performance in key model markets such as Buick Yinglang and Buick Regal. As for Japanese brands, most brands are at a decline in 2022. Among the five joint ventures among the three major Japanese brands Toyota, Honda and Nissan, only Guangzhou Auto Toyota achieved growth, ranking seventh with 971500 vehicles in sales. FAW Toyota also entered the 10th list, but fell 5.60% compared with the same period last year. Dongfeng Nissan, Guangzhou Automobile Honda and Dongfeng Honda fell 20.9%, 6.2% and 17.8% respectively, of which Dongfeng Nissan has fallen out of the list of millions of vehicles sold annually. For comparison, Dongfeng Nissan ranked fifth with sales of 1.1349 million vehicles in 2021, while FAW Toyota, Guangzhou Automobile Toyota, Dongfeng Honda and Guangzhou Automobile Honda respectively ranked 9th and 12th.

In fact, Japanese car companies generally "did not live up to expectations" in the Chinese market after entering 2022. According to Automotive Industry concern, Toyota's new car sales in China fell 0.2% to 1.9406 million vehicles in 2022 compared with the same period last year, the first decline in Toyota's sales in China in 10 years. Toyota said that the main reason for the decline was a sharp decline in the number of people arriving at stores as a result of the epidemic, which affected the performance of new car sales. Coincidentally, sales of Japanese brands, including Honda, Mazda and Nissan, also performed poorly. For example, Nissan's annual sales in China fell 22.1% to 1.045 million vehicles; Changan Mazda dropped 21.43% to 104000 vehicles; and Honda China fell 12.07% to 1.3731 million vehicles for the second year in a row. Statistically speaking, today's Japanese car companies are already in deep trouble in China.

In addition to the above brands, the first-tier luxury brand brilliance BMW also squeezed into the top 15. Data show that brilliance BMW sold 654000 vehicles in 2022, up 0.4% from a year earlier, ahead of Mercedes-Benz and Audi brands. According to the retail data of BMW Federation, BMW 5 Series and BMW 3 Series are the main products of BMW, and their annual performance is better than that of the same class, ranking first and second in annual high-end car sales, respectively. This is also the main reason why BMW is ahead of Mercedes-Benz Audi in sales in China. BMW 5-Series has accumulated sales of 171100 vehicles from January to December in 2022, which is the best performance model among BBA products, followed by BMW 3-Series. Cumulative sales of 163700 vehicles.

According to the data, the cumulative share of retail sales of independent brands in 2022 was 47%, an increase of 6.1% over the same period last year. The reason for the rapid growth of independent-brand passenger cars is mainly related to the current high demand for new energy vehicles and the increase in the export market. By contrast, joint venture brands are obviously lagging behind in 2022. After entering 2022, Guangzhou Auto Fick declared bankruptcy; Jiangsu Yueda Kia's debt ratio of 107% was insolvent; Infiniti sales remained low; DS sales of French cars fell to a freezing point, and after the joint venture brand reshuffle, independent brands such as BYD developed rapidly. Nowadays, subversive changes are taking place in China's auto market, which means that the future of joint venture brands may become more and more difficult. For the annual sales forecast for the new year, according to the Federation of passengers, the total sales of passenger cars in 2023 may reach 23.5 million, of which the sales of new energy passenger vehicles are expected to be 8.5 million, with a penetration rate of 36%.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.