In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/23 Report--

Recently, according to media reports, BYD will take over 100% of Yi 'an Property Insurance's equity. At present, Yi' an Property Insurance's bankruptcy reorganization plan has been basically completed.

According to the "Measures for the Management of Equity of Insurance Companies," the upper limit of the shareholding ratio of a single shareholder of an insurance company is 33.33%, but BYD is a wholly-owned takeover of Yi 'an Property Insurance Company, which is disclosed by informed sources as a special approval. At the same time, it was also revealed that before BYD took over Yi 'an Property Insurance, the responsible person of relevant departments of Shenzhen had gone to Beijing for many times with BYD senior officials to negotiate with China Insurance Regulatory Commission to obtain formal approval and support.

Relevant information shows that Yi 'an Property Insurance was established in February 2016 with a registered capital of 1 billion yuan and registered in Shenzhen. The company's business scope includes: corporate/family property insurance, freight insurance, liability insurance, credit guarantee insurance, short-term health/accident insurance directly related to Internet transactions, etc. Yi 'an Property Insurance Company, as one of the four professional Internet insurance companies approved by China Insurance Regulatory Commission, also had a high light period earlier.

Relevant data show that profits will be realized in the first year of its establishment in 2016, with a net profit of 1.5715 million yuan. In 2017, the net profit of Yi 'an Property Insurance has increased significantly to 7.1105 million yuan. However, in 2018, due to the change of investment environment, Yi 'an Insurance began to aggressively develop guarantee insurance business related to online loan P2P platform, loan assistance platform and other businesses. However, due to the concentrated outbreak of P2P credit risk in 2018, the performance of Yi' an Property Insurance, which relies on Internet to obtain customers, also plummeted. The net profits in 2018 and 2019 were-199 million yuan and-167 million yuan respectively.

In the first quarter of 2020, Yi 'an property insurance losses expanded to 262 million yuan again. According to the solvency report of Yi 'an Property Insurance in the first quarter of 2020, its net assets are 510 million yuan and its net profit is-262 million yuan. In July 2020, in view of the fact that Yi 'an Property Insurance triggered the takeover conditions stipulated in Article 144 of the Insurance Law of the People's Republic of China, the CIRC decided to take over it from July 17,2020 for a period of one year. In July 2021, China Insurance Regulatory Commission decided to extend the takeover period of Yi 'an Property Insurance for one year from July 17,2021 to July 16,2022.

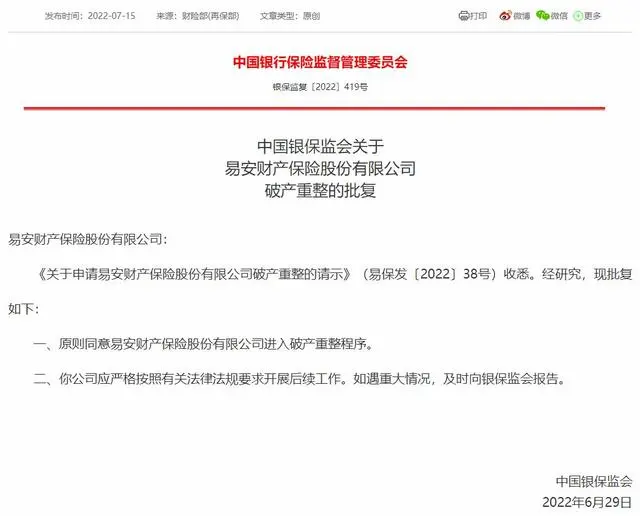

On March 31,2022, according to the special audit report on net assets of Yi 'an Property Insurance Company, the book assets of Yi' an Property Insurance Company are less than liabilities and are in insolvency state. On July 8,2022, Yi 'an Property Insurance applied to Beijing Financial Court for bankruptcy reorganization on the grounds that it could not pay off due debts and obviously lacked solvency. On July 15,2022, Yi 'an Property Insurance Company was approved to enter bankruptcy reorganization procedure, becoming the first property insurance company in bankruptcy reorganization in China. On July 20, Yi 'an Property Insurance Manager issued a reorganization strategic investor recruitment announcement, clarifying recruitment conditions, including giving priority to large and medium-sized financial institutions as strategic investors. For example, if the consortium registers to participate in the reorganization investment, the number of members shall not exceed 5, and large and medium-sized financial institutions shall be the main investment entities, and the shareholding proportion of Yi 'an Property Insurance shall meet the requirements of controlling shareholders. Subsequently, three institutions signed up to participate in the restructuring of Yi 'an Property Insurance, but two withdrew in the process of due diligence, while BYD submitted a restructuring investment plan.

It is understood that BYD will apply to China Insurance Regulatory Commission for automobile insurance business qualification after receiving Yi 'an Property Insurance, mainly focusing on new energy vehicles to carry out insurance business. As for why BYD wants to take over Yi 'an Property Insurance, it has a certain relationship with the current environment. In recent years, due to the stricter supervision and approval of Internet insurance licenses, there has even been a situation of "one photo is difficult to find" in the market. It is very difficult for some Internet companies to get licenses, but Yi 'an Property Insurance owns them, which also makes Yi' an Property Insurance have certain temptation.

In addition, in recent years, with the rapid development of new energy vehicles and the issuance of exclusive clauses (trial) for commercial insurance of new energy vehicles, many automobile enterprises are also accelerating their entry into the insurance market. Earlier, NIO, Xiaopeng, Ideal, Tesla, Geely, GAC, FAW, Dongfeng, SAIC and other automobile enterprises have established or invested in property insurance companies and insurance intermediaries. In fact, BYD established BYD Insurance Brokerage Co., Ltd. as early as March this year, BYD also released a number of recruitment information about insurance positions, including insurance brokerage company vice president, operations director, compliance director and other positions.

For BYD to take over Yi 'an property insurance this matter, it is undeniable that BYD is also interested in new energy automobile insurance this big cake. Since BYD announced the discontinuation of fuel vehicles in April last year, sales of its new energy vehicles have continued to rise, hitting record highs. Relevant data show that BYD's automobile sales volume in 2022 was 1.8685 million, with a year-on-year growth of 152.46%, among which the sales volume of new energy passenger vehicles was 1.8574 million, with a year-on-year growth of 212.82%. In 2021, BYD's sales volume of new energy vehicles was only 136,300. With the rapid growth of BYD's new energy sales, vehicle premiums are also important.

However, in terms of the overall environment, BYD will also face certain difficulties after taking over Yi 'an Property Insurance, such as building five talent teams, service organizations, system construction, etc., which will take at least two or three years to gradually expand the market. In addition, BYD has no experience in the operation of automobile insurance industry, while Yi 'an Property Insurance has less experience in automobile insurance business before, and almost zero experience in new energy automobile insurance. The subsequent BYD will also have difficulties in automobile insurance products, pricing, compliance and other aspects. Buffett, the god of gambling, once said in response to Tesla's entry into the insurance business that it is as difficult for car companies to carry out insurance business as it is for insurance companies to make cars. Car enterprises into the insurance industry, will not be smooth sailing.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.