In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/28 Report--

Today, an entry about "Tesla's market value soared by 380 billion overnight" went on the top search list on Weibo.

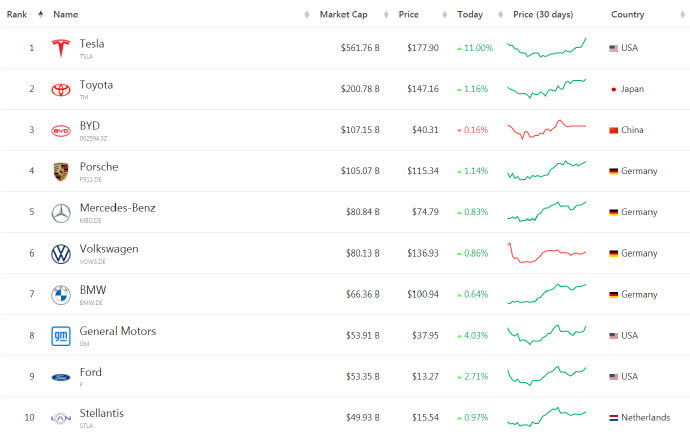

According to secondary market data, by the end of January 27, Tesla shares closed at $177.90 per share, up 12.7% in intraday trading and closing up 11%. The market capitalization rose $56.7 billion, or about 380 billion yuan, on the day. It is worth mentioning that Tesla's share price also rose sharply on January 26th, closing at US $160.27 per share, closing up 10.97%, and the market capitalization returned to above US $500 billion. This is the second straight rise in Tesla's share price and the highest closing price of Tesla since December 9, 2022. Tesla's share price has risen 33% this week, up $240.3 billion, or nearly 1.6342 trillion yuan, from its low in January this year.

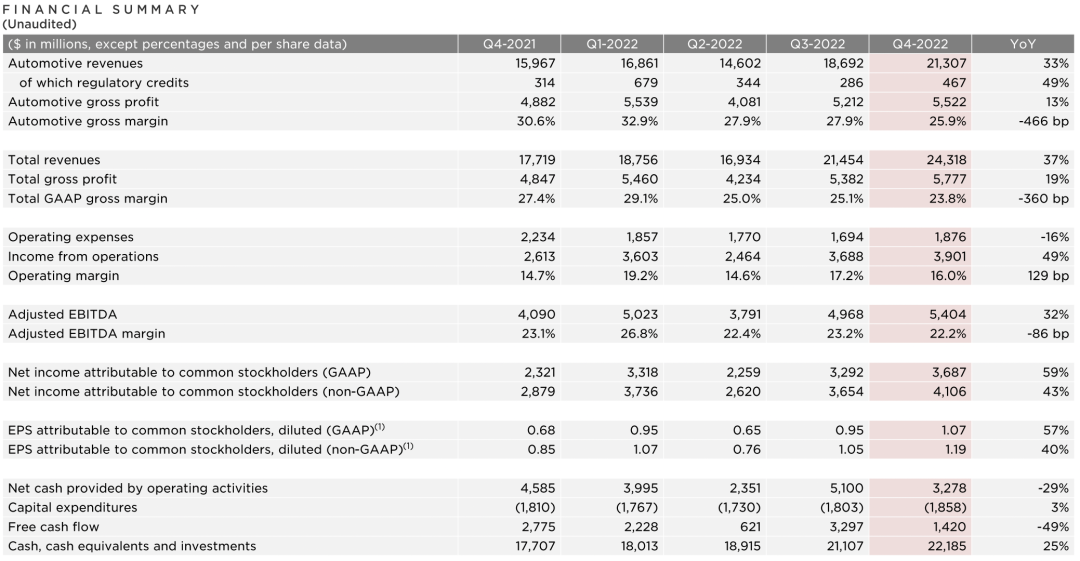

Of course, the sharp rise in Tesla's secondary market in the past two days has something to do with the recent announcement of Tesla's 2022 financial results and global price cuts. On January 26th, Tesla released his financial results for the fourth quarter and the whole year of 2022. According to the financial report, Tesla's income in the fourth quarter of 2022 was 24.318 billion US dollars, an increase of 37 percent over the same period last year and about 13 percent month-on-month. The total income in 2022 was 81.462 billion US dollars, up 51 per cent from 53.823 billion US dollars in 2021. The company made a net profit of $3.687 billion in the fourth quarter of last year and $12.556 billion for the full year.

Tesla's sales have also increased sharply since he announced big price cuts and various promotions in the fourth quarter of last year. Musk also disclosed at the 2022 earnings report that orders reached an all-time high in January 2023 after Tesla cut prices, almost twice the factory's monthly capacity. Relevant data show that Tesla delivered about 405000 vehicles in the fourth quarter of 2022 and about 1.31 million vehicles for the whole year.

It is understood that Tesla's share price rose as much as 2373.7 per cent in the four years from 2018 to 2021. Tesla's market capitalization reached 1.03 trillion US dollars in 2021, making it a trillion-dollar carmaker. The market capitalization of 11 traditional automakers, including Toyota, Volkswagen, General Motors, Ford and Mercedes-Benz combined, has made Tesla CEO Musk the richest man in the world. However, after entering 2022, due to the macroeconomic situation in the United States, Musk's acquisition of Twitter, lower-than-expected growth and other factors, the market value of Tesla lost about $675 billion (4.7 trillion yuan) in 2022. Tesla's share price closed at $123.18 per share as of December 31, 2022, down 88.34% from December 31, 2021.

At present, with the announcement of Tesla's financial results for 2022, it has also given investors confidence. Tesla remains the world's largest car company by market capitalization, with a total market capitalization of $561.76 billion, higher than Toyota's $147.16 billion and BYD's $107.15 billion, according to the latest market capitalization list.

As for the performance in 2022, Tesla Musk said: for Tesla, 2022 is the best year in its history on all levels. Looking ahead to 2023, Mr Musk said: although the overall car market is likely to contract, consumer demand for Tesla will remain good, with annual delivery expected to reach 1.8 million. At the same time, Musk pointed out that if there were no large-scale supply chain disruptions this year, Tesla's production could reach 2 million vehicles.

Bright financial results, double orders in the fourth quarter, so that Tesla shares began to rebound. However, the rebound of Tesla's share price does not necessarily mean that its growth will be the norm. After all, as more and more traditional car companies speed up the process of electrification, it will also have a certain impact on Tesla.

In addition, judging from the stock price fluctuations of Tesla in 2022, Tesla CEO Musk's remarks and actions are also the wind direction that affects investors' confidence. Recently, there are media reports that Tesla Musk has been investigated by US regulators for falsifying self-driving advertisements for Tesla cars. Obviously, it is a bit difficult for Tesla's share price to remain stable all the time. In the face of the influence of many unstable factors, Tesla's share price in 2023 is still variable.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.