In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/31 Report--

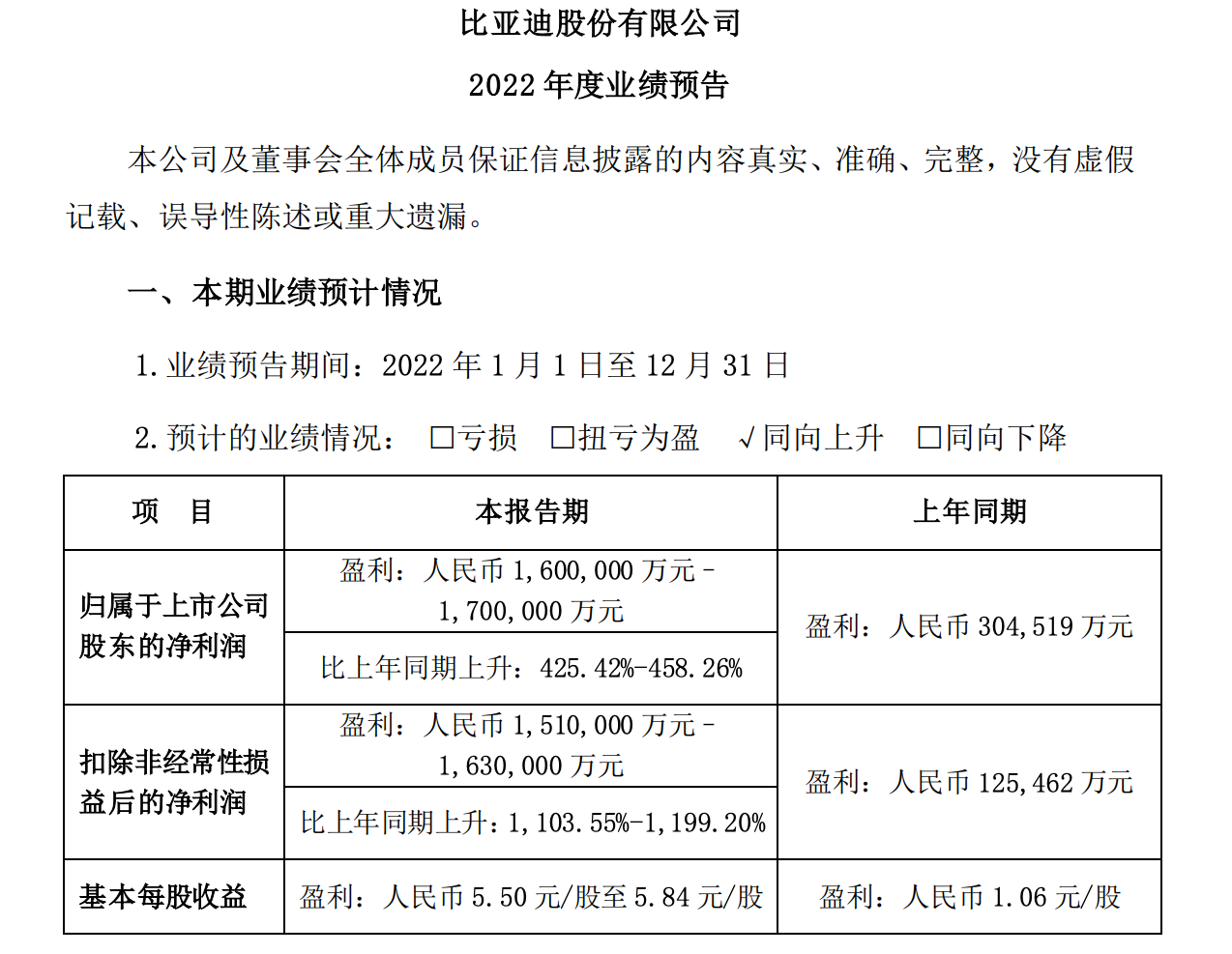

On January 30, BYD Co., Ltd. (hereinafter referred to as "BYD") announced its 2022 performance forecast. According to the announcement, the company's annual net profit is expected to be 16 billion-17 billion yuan, an increase of 425.42%-458.26% over the same period last year, and non-net profit is expected to be 15.1 billion-16.3 billion yuan, an increase of 1103.55%-1199.20% over the same period last year.

It should be noted that BYD's profit comes not only from the car business, but also from the mobile phone parts and assembly business, rechargeable batteries and photovoltaic, but the car business is the source of BYD's profit growth. In April 2022, BYD announced that it would officially stop production of fuel-fueled vehicles and focus on pure electric and plug-in hybrid vehicles in the future. Cui Dongshu, secretary general of the Federation of passengers, said that with the technological breakthrough of blade battery and DMI hybrid technology, coupled with its strong ability of vertical integration, BYD's move will accelerate the effective replacement of international brand fuel vehicles.

According to the CAC data, BYD sold 1.805 million narrow passenger cars in 2022, an increase of 149.4% over the same period last year, surpassing FAW-Volkswagen as the top seller in the domestic passenger car market, which sold 1.779 million vehicles in 2022, basically the same as in 2021. In addition, with its outstanding sales performance, BYD beat Tesla (1.31 million vehicles sold in 2022) to become the top seller of new energy vehicles in the world. Prior to this, Tesla has been the top seller of new energy vehicles in the world for three consecutive years.

It is worth mentioning that the end of subsidies for new energy vehicles in 2023 also means that BYD will face more challenges to its profitability. BYD needs to sell more vehicles to balance the cost suppression caused by the decline of new energy subsidies. Earlier, it was reported that BYD Chairman Wang Chuanfu put forward BYD's goal of selling 4 million vehicles by 2023, but BYD did not give a definite response. Analysts believe that BYD's sales are expected to reach 3.5 million in 2023, or surpass Volkswagen to become the first independent brand in history to win the top spot in the domestic market.

Affected by the sharp rise in the prices of raw materials such as chips and power batteries, Cyrus and BAIC Langu both suffered losses for the year 2022, with Selis losing 3.5 billion to 3.95 billion yuan and BAIC Langu 5.2 billion to 5.8 billion yuan.

Cyrus and Huawei cooperate deeply. At the end of 2021, the two sides launched the AITO brand, and successively launched the M5, M7, M5 EV and other models. According to the data, sales of Selis new energy vehicles in 2022 were 135100, an increase of 225.9% over the same period last year, of which Selis (including Cyrus and AITO) sold 80000 vehicles, an increase of 626.39% over the same period last year.

As for the sharp rise in sales but the expansion of losses, Cyrus said that the sharp rise in the prices of chips, power batteries and other raw materials in 2022 led to a rise in production costs, although sales achieved continuous positive growth in the first and third quarters of 2022. However, due to the multi-point outbreak of the COVID-19 epidemic, it affected the number of customers entering the store and the development of marketing activities, as well as supply, logistics, production and many other links, and the production and sales volume of the products fell short of expectations. The investment in fixed assets in the early stage is larger, and the expenses of depreciation and amortization are higher.

BAIC Blue Valley performance pre-loss reason is basically the same as Selis, which said that in 2022, due to the rise in the price of upstream raw materials, the cost of parts such as power batteries rose, squeezing the company's profit margins and having a great impact on the company's performance. In addition, the company's product sales are still in a period of rapid improvement, and the scale effect is not obvious. at the same time, in order to enhance the core competitiveness of the market, the company continues to invest in technology research and development and brand channel construction. Have an impact on the company's performance. The forecast shows that the net loss is expected to be 52-5.8 billion yuan in 2022 and 56-6.2 billion yuan after deducting non-profit.

It is understood that BAIC Blue Valley mainly operates two brands: BEIJING and ARCFOX, of which ARCFOX locates high-end new energy brands. To some extent, ARCFOX can be regarded as a cooperative brand between BAIC Langu and Huawei, which has the blessing of HUAWEI Inside mode to make up for the shortcomings of polar fox in intelligence (car system, autopilot, etc.), especially the polar fox Alpha S Huawei HI version, which caused market popularity as soon as it was debuted. it is the first mass-produced car in the world equipped with three lidar layout, Huawei Hongmeng OS, Huawei high-order self-driving ADS system. Claims to reach the highest level of Huawei's autopilot. However, the performance of the Jihu brand in the terminal market is extremely dismal.

It is understood that BAIC Blue Valley has been in a state of loss in recent years. According to the financial report, BAIC's net loss in 2020 and 2021 was 6.482 billion yuan and 5.244 billion yuan respectively, and the net loss in the first three quarters of 2022 was 3.5 billion yuan, with a cumulative loss of more than 15.2 billion yuan in the past three years. In terms of cash flow, BAIC Blue Valley is also under pressure, with cash and cash equivalents plummeting to 4.302 billion yuan in the third quarter of 2022, compared with 8.324 billion yuan in the second quarter of 2022. In this regard, BAIC Langu explained in the financial report that the decline in net profit was mainly due to the decrease in gross profit and the continuous increase in investment in brand and channel construction.

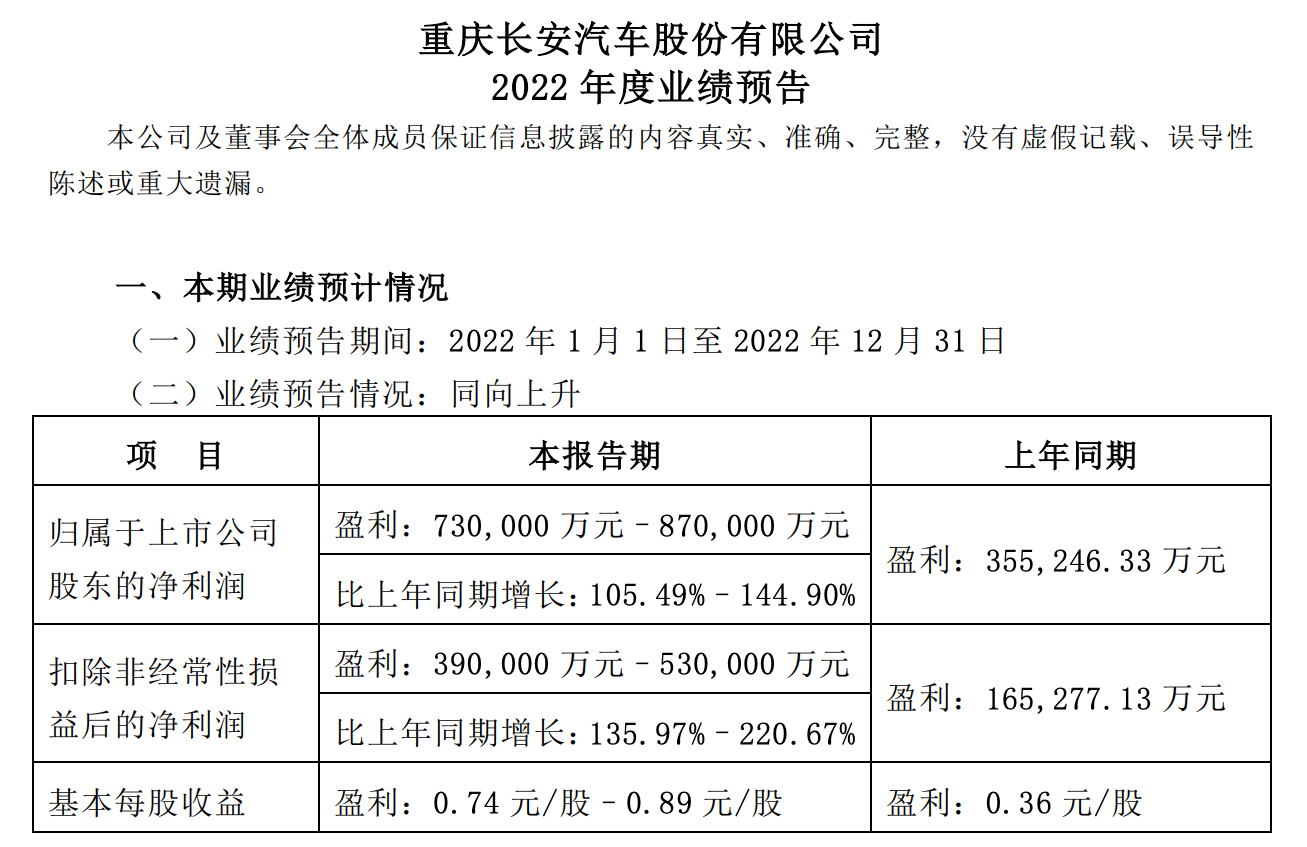

In addition, including Changan Automobile, Haima Automobile, Zhongtai Automobile, Jianghuai Automobile, Lifan Technology, Jiangling Automobile and so on have disclosed the 2022 performance forecast. It is understood that Changan Automobile, Lifan Technology and Jiangling Motor have all increased in advance, of which Changan Automobile is expected to make a profit of 7.3 billion yuan to 8.7 billion yuan, an increase of 105.49% 144.90% over the same period last year. Seahorse Motor, Zhongtai Automobile and Jianghuai Automobile all suffer losses, of which Jianghuai Motor expects an annual net loss of 1.437 billion yuan and a profit of 200 million yuan in the same period in 2021.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.