In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/01 Report--

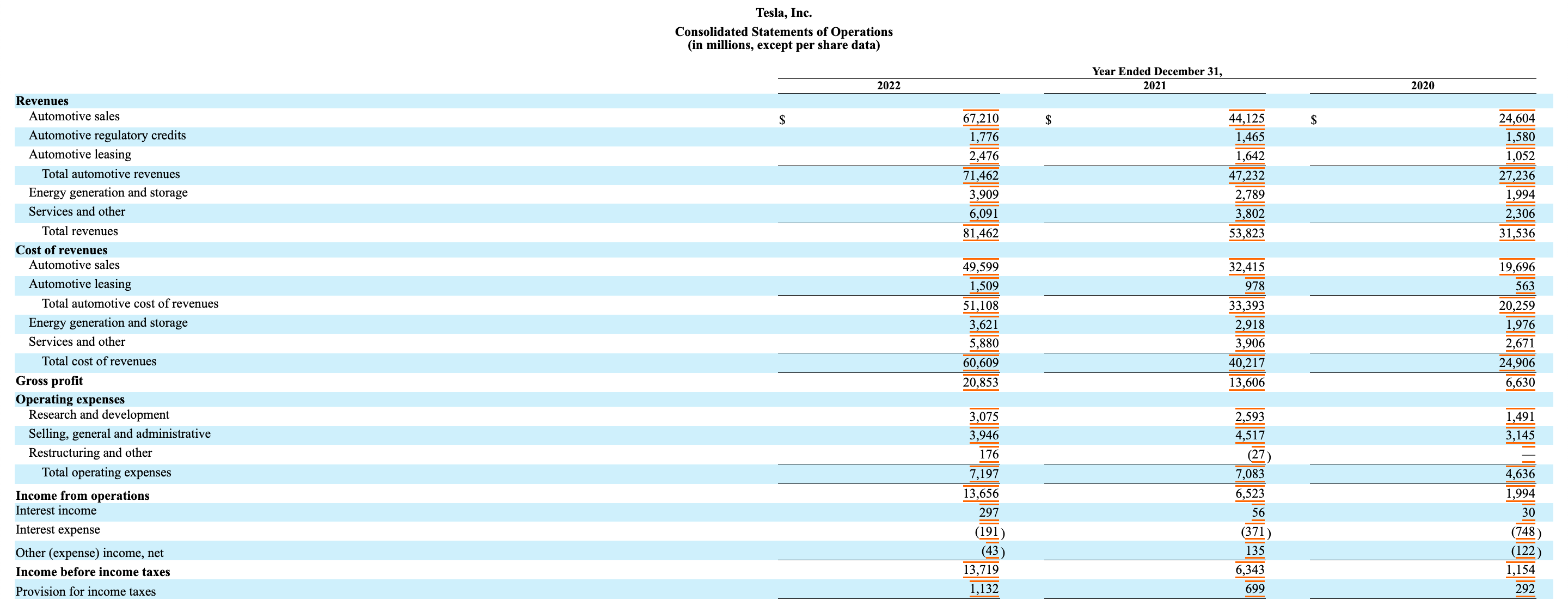

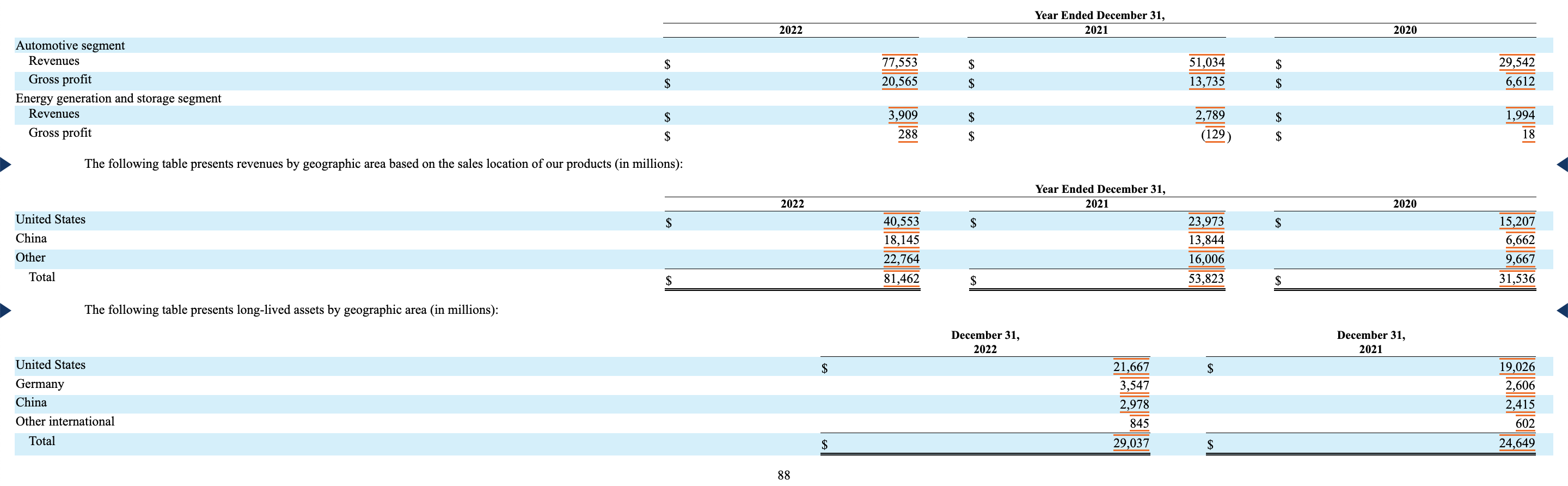

On the evening of January 31st, Tesla submitted the 10murk annual report to the US Securities and Exchange Commission (SEC), disclosing the company's operation in 2022. According to the documents, Tesla's total revenue in 2022 was 81.462 billion US dollars, an increase of 51.35 percent over the same period last year, of which auto sales revenue was 67.21 billion US dollars, up 52.32 percent from the same period last year. Net profit was US $12.583 billion, an increase of 127.79% over the same period last year. Tesla said that 2022 is a record year.

In terms of regions, the United States is still Tesla's largest market in the world. Tesla's revenue in the US market in 2022 was US $40.553 billion, an increase of 69.16% over the same period last year, accounting for 49.76% of the company's total revenue, while the Chinese market's annual operating income in 2022 was US $18.445 billion, which increased by 33.23% compared with the same period last year, but its share fell to 22.27% from 25.72% in 2021. Overall, although Tesla achieved growth in the Chinese market in 2022, it fell short of market expectations, after two consecutive years of year-on-year growth of more than 100%. Tesla's revenue in the Chinese market was $2.979 billion in 2019 and $6.662 billion in 2020.

The sharp decline in the growth rate of Tesla in the Chinese market, on the one hand, is caused by the epidemic and the impact of spare parts supply, on the other hand, the rapid rise of new power brands, domestic new energy models blowout to the market, Tesla faces the competitive pressure of many competitors.

The epidemic situation and the impact of spare parts supply are regarded as one of the important reasons for the impact of production and operation by many domestic automobile manufacturers, and Tesla is not surprised. The Shanghai factory is Tesla's first overseas factory, located in Shanghai's port area, including vehicle production area, test area, parts production area and joint plant (maintenance workshop). It mainly produces Model 3 and Model Y models, while the Shanghai factory undertakes the important task of Tesla's domestic sales and external supply. About 60% of Tesla's electric cars produced in China are sold in China. The rest is exported to overseas markets such as Australia, Europe, Japan and Singapore. After entering 2022, the factory was affected by the outbreak in the first half of the year and was forced to suspend production for many times, and then the production line was upgraded, which had a great impact on automobile production and delivery. Tesla retail 439800 vehicles in the Chinese market in 2022, an increase of 37.1% over the same period last year, according to the Federation of passengers.

In fact, Tesla took great pains to achieve a year-on-year growth of 37.1% in the Chinese market. Tesla has slashed prices and subsidies on Chinese mainland since October 2022, and has since announced insurance subsidies for car owners who buy domestically made Tesla, up to 8000 yuan. After entering 2023, Tesla sharply reduced the starting prices of two domestic models, including Model 3 by 2.0-36000 yuan and Model Y by 2.9-48000 yuan.

Tesla has been accused of being "unable to sell" because of sharp price cuts in the Chinese market, while the background is the rapid rise of new power brands led by NIO and ideal, and the rapid layout of new models by domestic new energy brands dominated by BYD, resulting in a sharp increase in competitive pressure on Model 3 and Model Y models. Of course, Tesla's gross profit margin is much higher than that of other automakers, so Tesla can keep cutting prices to improve the competitiveness of Model 3 and Model Y products and counter car brands, but this is not a long-term solution. For Tesla, the introduction of new models is the oldest. After all, Model 3 and Model Y have been on the market for a long time, and the core advantages of the two models have become less and less obvious. Tesla either launches the Model 3/Model Y replacement model or launches a new model, while it is rumored that the Model Q with less than 200000 yuan is expected to be announced in March.

Apart from the fact that sales fell short of expectations, Tesla's share price plummeted. Tesla's share price fell by 65.03% in 2022, far more than other car companies. Tesla's share price is now $173.22, with a total market capitalization of $546.986 billion. It is understood that Tesla's market capitalization at its peak exceeded US $1,000bn, more than the combined market capitalization of the 12 largest automakers in the world. Of course, Tesla is still the world's largest car company by market capitalization, but it has shrunk sharply than before.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.