In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/08 Report--

A few days ago, the China Automobile Circulation Association released the "2022 National Automobile Dealers Survival Survey report", the difficulties and pressures of the automobile back-end market have been put on the surface. 2022 was the most difficult year for car dealers in the past three to five years, with car dealers declining in terms of satisfaction with mainframe factories, annual sales target completion rates and profitability, the report said. In addition, the decline in passenger flow, financial pressure, increased cost of customer collection, inventory pressure is still the main theme of car dealers.

With the rapid growth of new energy vehicles, China's automobile development in 2022 has still achieved good market performance. According to data from the Federation of passengers, a total of 20.543 million narrow passenger cars were sold in China in 2022, an increase of 1.9 percent over the same period last year, of which 5.674 million new energy passenger vehicles were sold, an increase of 90.0 percent over the same period last year.

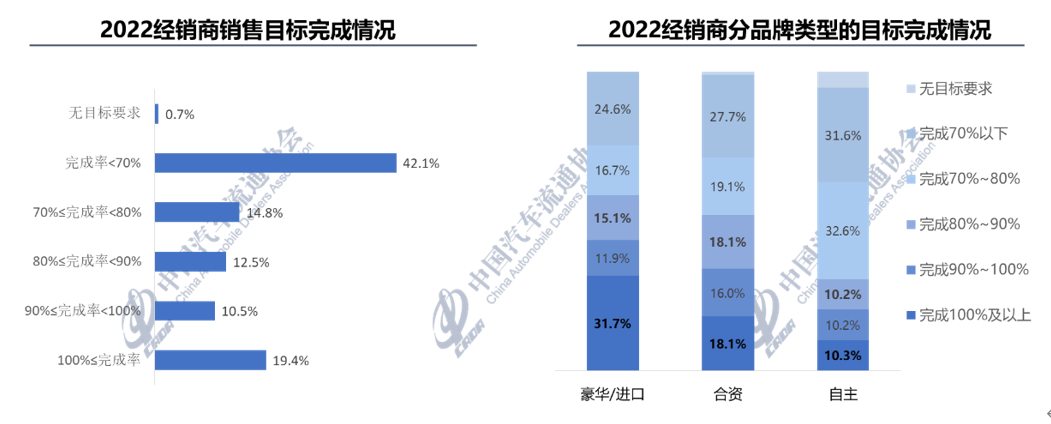

However, due to the impact of the epidemic, especially in the fourth quarter, the epidemic developed rapidly and the scope of the epidemic continued to expand, auto shows and marketing activities around the country could not be carried out smoothly, the automobile market showed a relatively quiet state, passenger flow inevitably declined sharply, and the release of consumer demand for cars was blocked, resulting in a surge in business pressure on dealers. According to data released by the China Automobile Circulation Association, only 19.4% of dealers achieved their annual sales targets in 2022, and only 42.2% achieved more than 80% of their annual sales targets. Among them, the sales performance of luxury / import brand dealers is better, with a full annual target of 31.7%, while the annual target completion rates of joint venture brand and independent brand dealers are 18.1% and 10.3%, respectively.

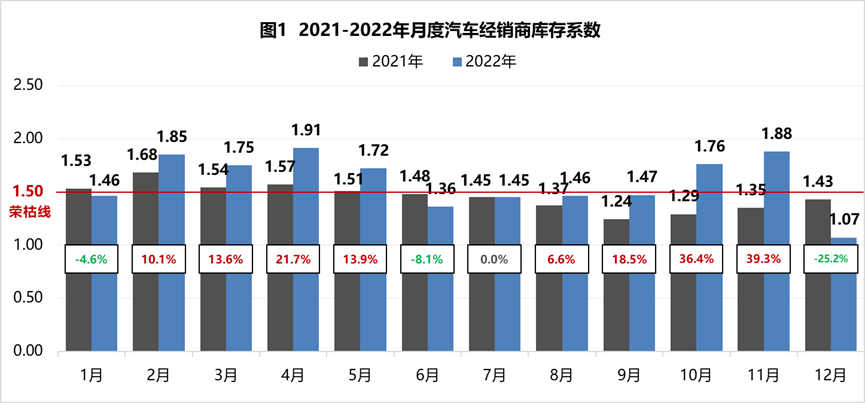

The sales performance of most car dealers fell short of expectations. On the one hand, affected by the new epidemic in various places, many dealers are unable to carry out promotional activities, showing the current situation of "peak season is not prosperous" and "off-season is bleak". On the other hand, due to the purchase tax reduction policy, the consumer demand for cars has been basically released from June to September, and the market demand is relatively low after being overdrawn. The data show that the inventory early warning index for 11 months in 2022 is above the rise and fall line. Fan Yu, director of the Industry Coordination Department of the China Automobile Circulation Association, said that outstanding problems such as declining passenger flow, high cost of clue conversion, delayed order conversion and lack of purchasing power have led to lower-than-expected performance of car sales and increased inventory pressure on dealers.

Take November 2022 as an example, the epidemic broke out again in many provinces and cities in China, resulting in a sharp decline in sales. In that month, the inventory early warning index of Chinese car dealers was 65.3%, up 9.9% from the same period last year, and 6.3% higher than the previous month. The inventory early warning index is above the rise and fall line. The association said that affected by the epidemic and control, 41% of dealers closed their shops, most of which were closed for more than two weeks. In addition, 73% of dealers are unable to complete sales tasks, and 61% of them have a task completion rate of less than 80%.

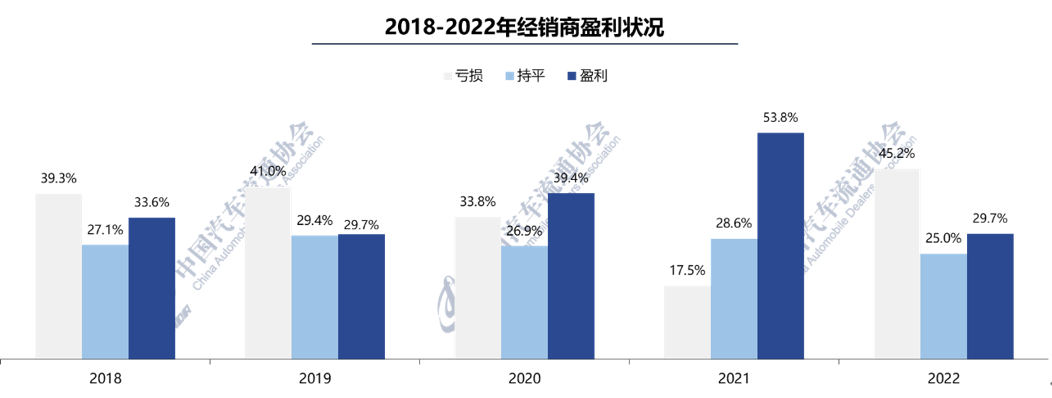

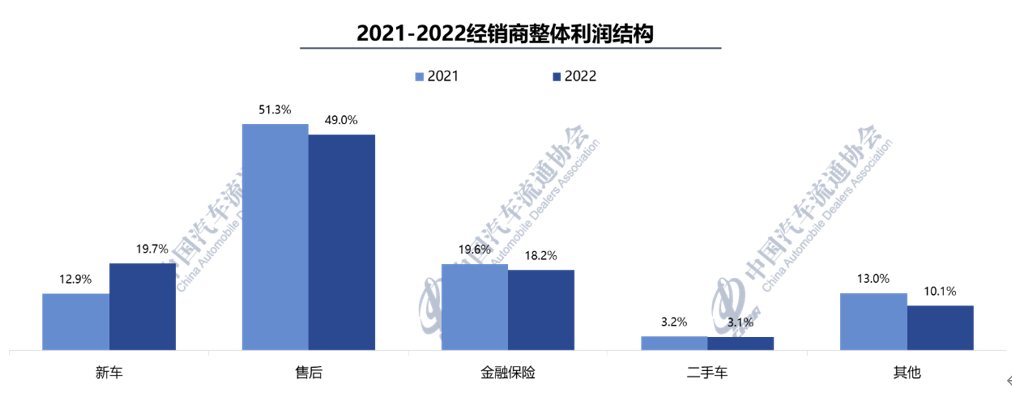

In addition to the fact that most dealers failed to meet their annual sales targets, large-scale losses have also become the status quo of dealers in 2022. According to a survey conducted by the association, in 2022, dealers lost, remained flat and made a profit of 45.2%, 25.0% and 29.7%, respectively, while unprofitable dealers accounted for more than 70%, which may be the worst year since 2018. In terms of brands, the overall profit of luxury / imported brands is better, 45.9% of the dealers are profitable, and the profitable dealers of joint venture brands and independent brands account for 30.3% and 23.8%, respectively. As for losses, super-five-tier joint venture brand dealers suffered losses, independent brand dealers accounted for 46.2%, and luxury / imported brands accounted for 38.1% of the loss.

According to the breakdown of national brands, German brand dealers are more profitable in 2022, reaching 45.4%, followed by Japanese brands, with 35.8% of dealers making profits, while independent brands are only 23.8%. Generally speaking, the rapid rise of independent brands has further eroded the market of mainstream joint venture brands, but the profit level of independent brands is not high.

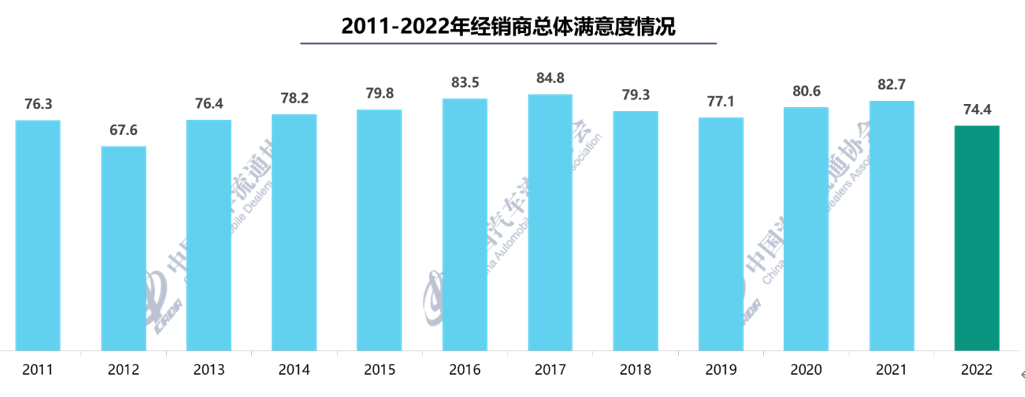

Business pressure has soared, and dealers' satisfaction with the mainframe factory has reached a 10-year low. According to the association, the overall satisfaction score of automobile dealers to the mainframe factory in 2022 is 74.4, which is the lowest since 2013, including 79.2 for luxury / imported brands, 68.9 for joint venture brands and 71.0 for independent brands.

However, with the full release of epidemic restrictions and the implementation of a new round of policies to promote automobile consumption, car dealers remain optimistic about the state of operation this year. According to the association's survey, 62.3% of dealers said their sales targets had improved this year. The Circulation Association believes that at present, the automobile industry is facing difficult challenges, and the government, associations, and enterprises are all working hard to promote the recovery of the market, and many consumption policies, such as state tax cuts, local government subsidies, factory subsidies, dealer promotions, and so on, have been implemented, which have a strong pulling effect on the consumer side and will accelerate the recovery of the automobile market.

However, for 2023, most dealers still need policy support to jointly promote the growth of the auto market. The survey shows that dealers generally hope that manufacturers will appropriately adjust their business policies, reduce or reduce the assessment of stores, and help dealers operate stably. At the same time, some dealers hope that the state will continue the policy of promoting automobile consumption, reduce the purchase tax on fuel vehicles, continue the subsidy policy for the purchase of new energy vehicles, and also hope that various localities will introduce corresponding policies and issue more car consumption coupons to stabilize and promote automobile consumption.

At the press conference of the State News Office in February this year, Xu Xingfeng, director of the Department of Market Operation and consumption Promotion of the Ministry of Commerce, said that the Ministry of Commerce will continue to stabilize and expand automobile consumption, focusing on the following four aspects: stabilizing new car consumption, supporting new energy vehicle consumption, expanding the circulation of used cars, and unblocking automobile scrapping and renewal. At the same time, local governments have also spent "real money" to promote car consumption. Since January this year, Henan, Zhejiang, Jilin, Wuxi, Hainan and Guizhou have issued relevant policies or issued subsidies and vouchers for new energy consumption, with subsidies ranging from 1,000 yuan to 10,000 yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.