In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/14 Report--

According to domestic media reports, Weimar will launch a new round of pay cuts internally to reduce expenses. 25% of employees will be paid as soon as March, and 25% of the salary will not be available to everyone. It should be noted that the 25% salary paid this time is not based on the original normal salary, but only 25% after a 30% discount. In addition, some suspected Weimar internal employees revealed that the company has implemented the policy of withholding all staff without pay. At present, the marketing department has been told that they do not work at home, without any compensation, let alone the so-called Nintendo 1.

In response to the above situation, Weimar has not yet made a clear response. However, some Weimar insiders said, "there is no movement in the company yet, and I am eager to know the news I saw yesterday." According to the insider, "there is no notice within the company to work from home, and it is still normal to clock in, but because there is nothing to do, some colleagues choose not to enter the company."

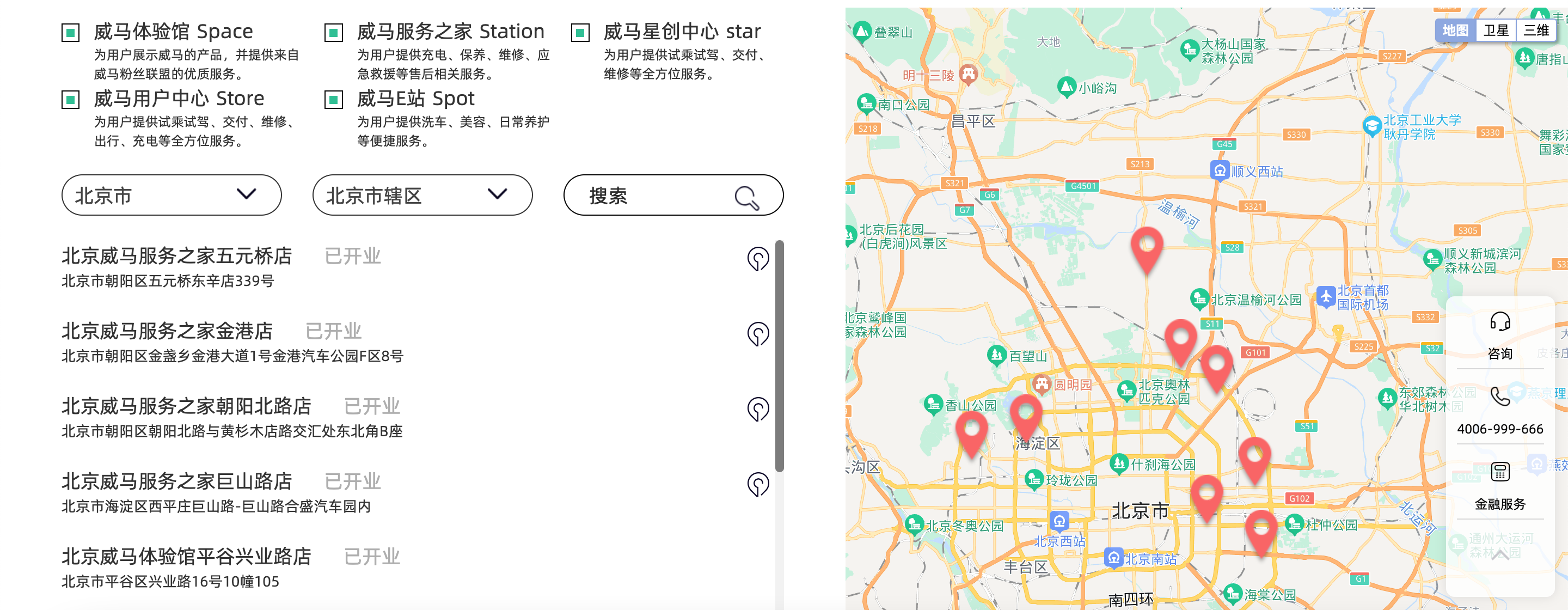

Weima is "in danger", and the chance of survival is very slim! Since October 2022, most of Weimar's stores in Shanghai, Beijing, Chengdu and other cities have been closed, especially in Beijing. According to the official website, a total of 13 exhibition halls have opened in the Beijing area, but all of them have been found empty. At the same time, vehicle production at the Weimar Wenzhou factory has come to a standstill, and the departure of the security guard can only be replaced by the factory staff, and the on-the-job employees can barely survive because they can only get a basic salary because of no performance.

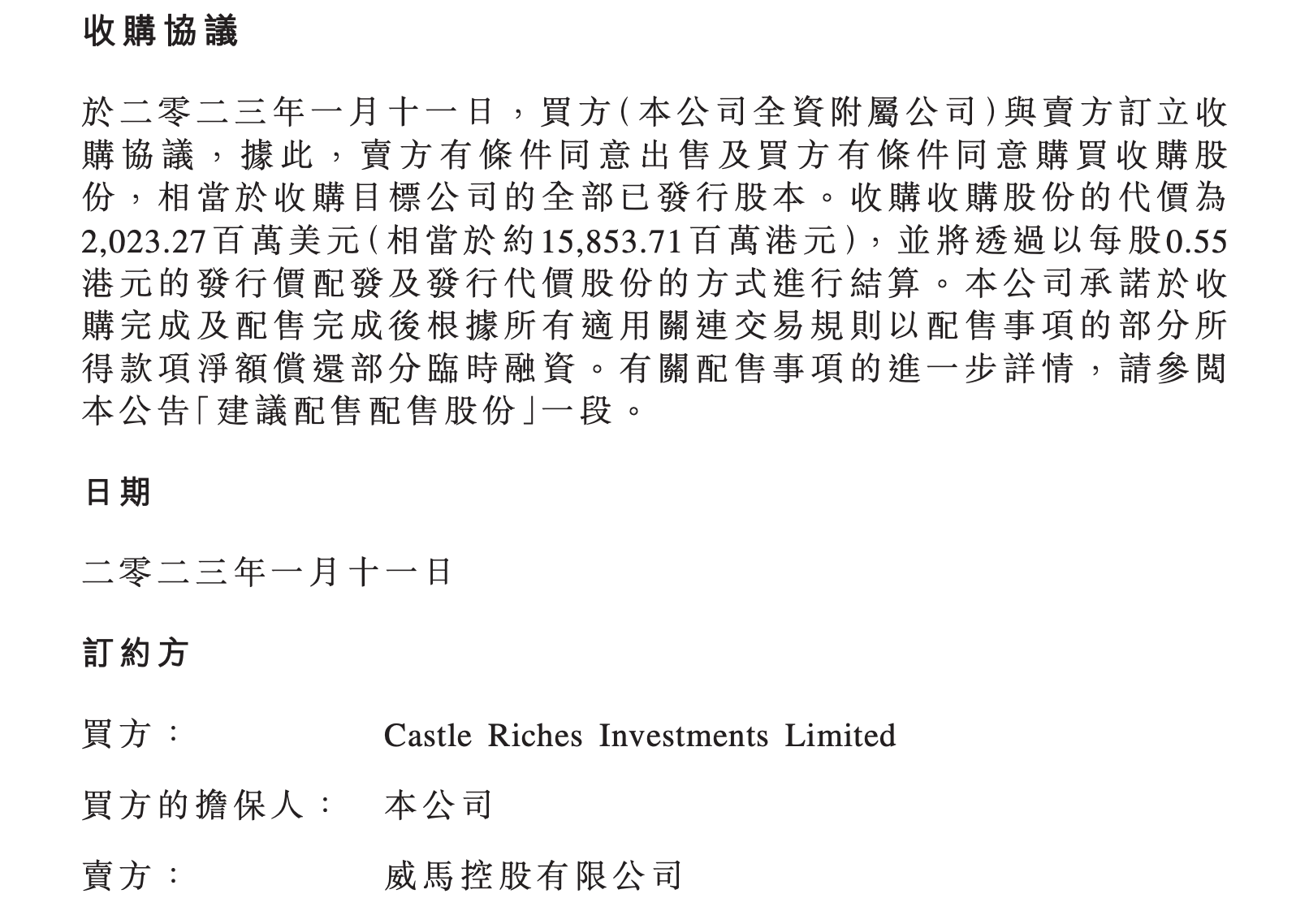

The good news is that Weimar has more chances of "surviving" as it enters 2023. Apollo, a Hong Kong-listed company, announced on January 12 that it planned to buy Weima Motor's subsidiary for US $2.023 billion, which would be settled by allocating and issuing consideration shares. On the same day, Weimar announced a conditional sale and purchase agreement with Apollo.

Weima is listed backdoor by reverse takeover, which is a common mode of operation in the capital market. Shareholders of non-listed companies control the company by purchasing shares of a listed company, so as to achieve the purpose of indirect listing. Previously, Weimar has tried to land on the Kechuang Board and the Hong Kong Stock Exchange, but both failed to inform them that they now plan to go public through reverse takeovers of Apollo, which may be one of the few ways Weimar can save itself. According to reports, the follow-up Apollo trip will carry out due diligence on Weima, and it is optimistically estimated that Weima may complete the listing of Hong Kong stocks in the second quarter of this year.

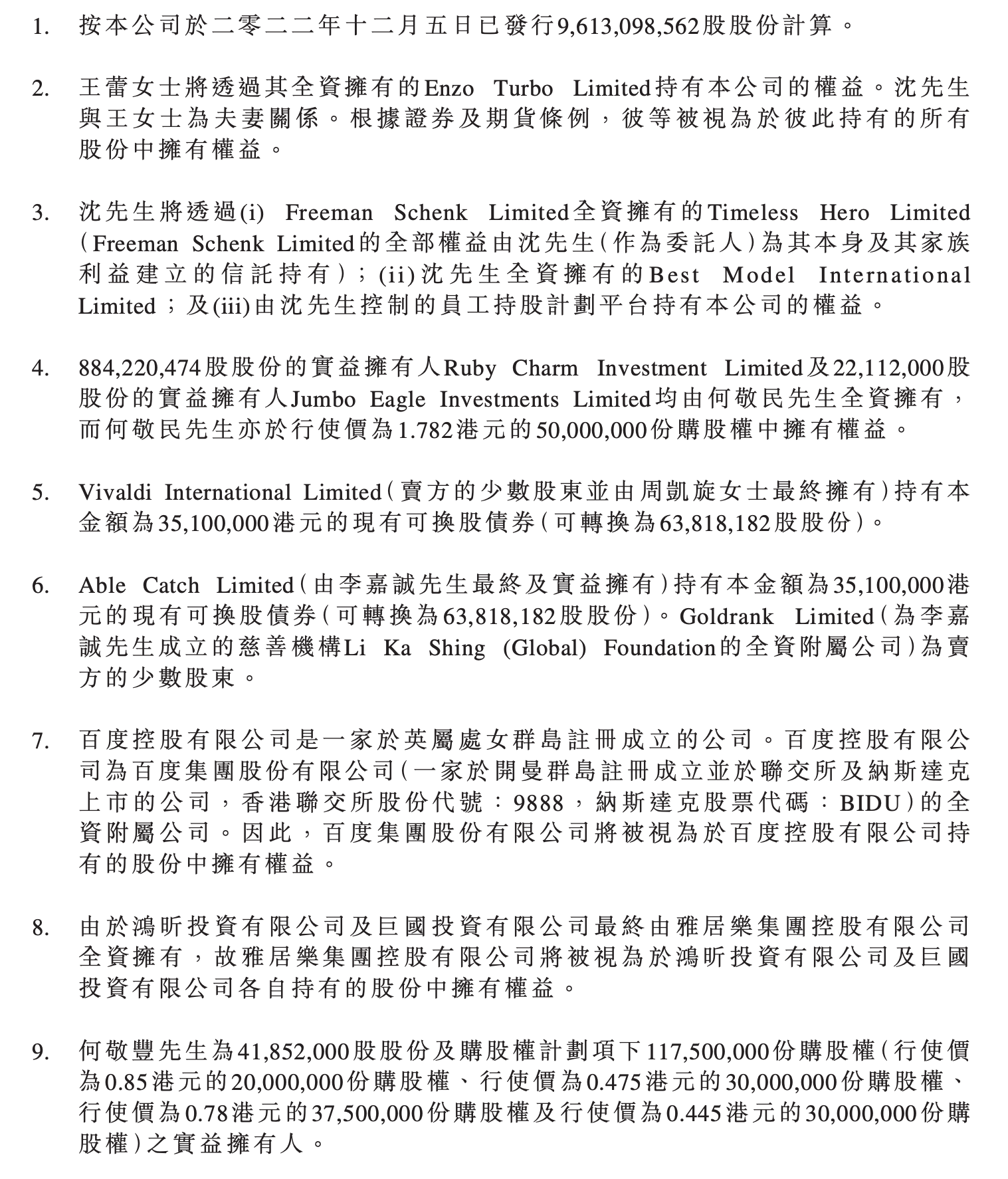

Apollo, formerly known as Gumpert, a German niche supercar maker, was acquired by Hong Kong jewelry and watch trading and investment company Lixie Co., Ltd. in 2020 and later renamed Apollo Smart Travel Group Co., Ltd. Apollo's market capitalization is not high, just HK $1.9 billion, but it has a deep background. According to the shareholding structure, Weima Motor holds a 28.5 per cent stake in the company, making it the largest shareholder, while Edmund Ho Hau Wah is its second largest shareholder, and the third shareholder is Li Ka-shing, Hong Kong's richest man.

It is understood that Ho King Fung is now co-chairman of Power Century Co., Ltd., and he is a member of the Ho family in Macao. The most famous member of this family is Edmund Ho, the former Chief Executive of the Macao Special Administrative region. Ho King Fung is Ho Hau Wah's nephew. Ho King Fung's father, he Houzhao, is a director of the Macao Chinese General Chamber of Commerce. As of the end of March 2022, the Edmund Ho family owned 11.35 per cent of Apollo, while Li Ka-shing and his friend Zhou Kaixuan held a cumulative 9.86 per cent. The market believes that Apollo backed by a deep background of Hong Kong and Macao consortia, Weima may open the "no shortage of money" model.

Of course, how to get out of the predicament of Weima after backdoor listing is another matter. According to the insurance figures, Weima sold 34600 vehicles in 2022, down 2.83% from the same period last year, with the highest sales of a model called Weimar E.5, which sold 20300 vehicles, up 328.96% from the same period last year. It should be noted that this is a model that focuses on the travel market, that is, online car-hailing. In fact, individual users buy very little, while sales of the other two models are pitifully small. In other words, Weimar's products are not competitive, even if it is to ease the cash flow crisis after backdoor listing, but if there is a lack of popular products, the outcome will probably not change.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.