In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/22 Report--

Every time the tuyere comes, it will inevitably attract a large number of followers, among which there may be subverters, but more of them will become the runners of this era, and Junyao Group would prefer to become the former.

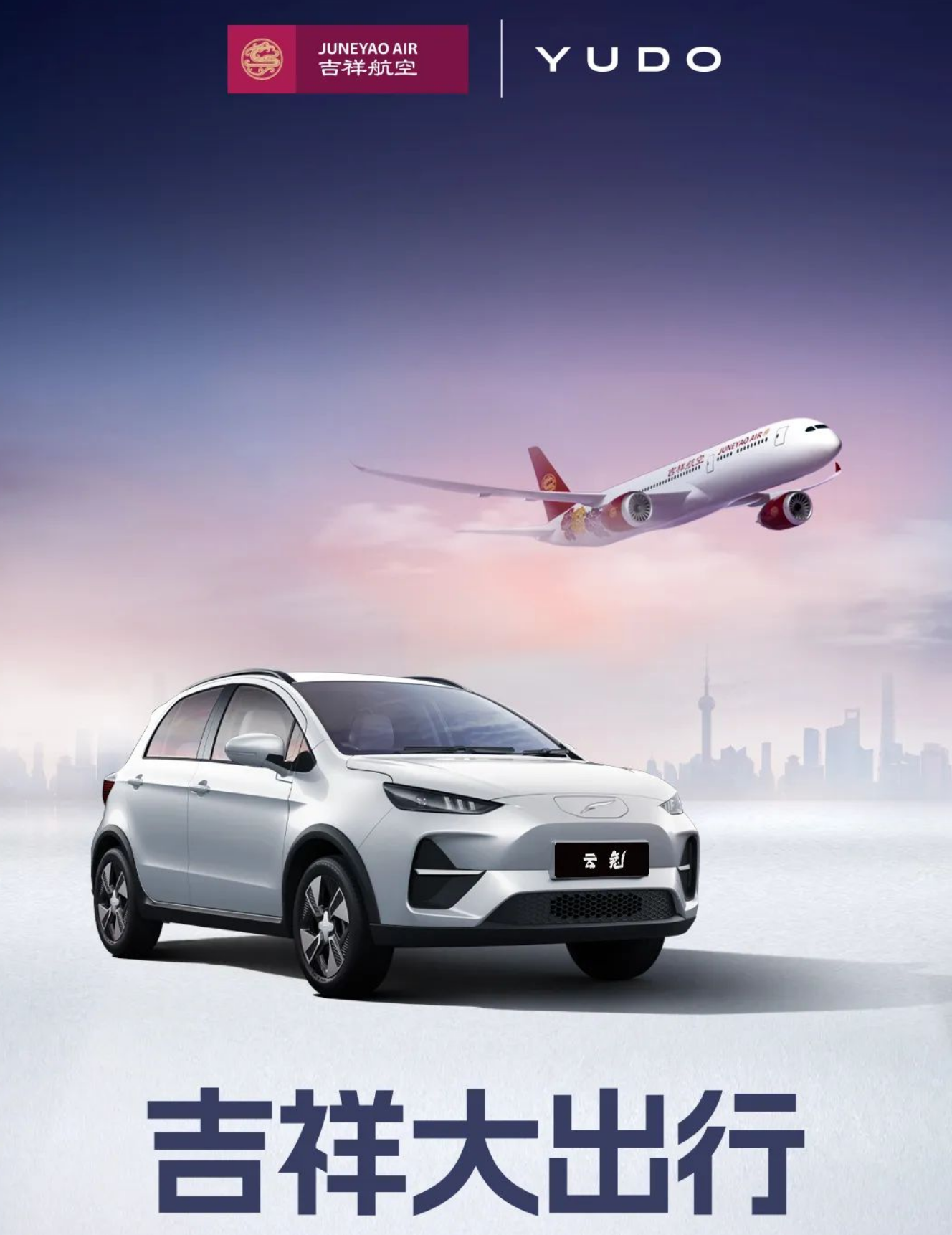

On February 21, the official official of Junyao Group announced the construction of the car and released the strategic concept of "auspicious Great Travel" to provide users with integrated land and air service experience from the three dimensions of hardware, software and service through auspicious Airlines and Yundu Automobile. Wang Junjin, chairman of Junyao Group, said, "for a big trip, the ground is a matter of clouds, and the air is an auspicious thing. After booking (auspicious Airlines) air tickets, we will be able to arrange for passengers to pick up and pick up immediately."

According to the auspicious travel strategy, auspicious Airlines and Yundu Automobile will work together to build an auspicious travel membership system, and integrate the mutually beneficial rights and interests of air travel and automobile. In the future, Junyao Group will also be in more areas of travel layout, through chauffeured car services, short-term rental services, time-sharing rental and other businesses. In the face of the industry's doubts about Junyao Group's entry into the bureau to build cars, Wang Junjin believes that it is not too late for Junyao to enter the new energy vehicle market. According to Wang Junjin, the layout of talent, research and development began in early 2021, and the establishment of the automotive plate and R & D center of Junyao Group was launched. In the whole vehicle, three electricity, global safety, intelligent cockpit, self-driving and other technical fields have varying degrees of deep ploughing.

Yundu Automobile is a new energy brand of Fujian Automotive Industry Group, which was registered and established in Putian Administration for Industry and Commerce of Fujian Province on December 4, 2015. the company's business scope includes the research and development, production and processing of new energy vehicles and auto parts. The establishment of Yundu Automobile is actually with the help of the state's policy support for new energy vehicles. At the beginning of its establishment, it is a mixed-ownership new energy vehicle manufacturing enterprise through the investment of state-owned funds at two levels in Fujian Province, the participation of listed companies and the shareholding of management.

With the identity of the "national team", Yundu Automobile obtained the new energy vehicle production license issued by the National Development and Reform Commission in January 2017, becoming the tenth domestic enterprise to obtain the qualification for the production of new pure electric vehicles. and became the second new energy passenger vehicle manufacturer approved by the Ministry of Industry and Information Technology.

While other new forces are still soliciting sponsorship through "PPT", Yundu Automobile has completed the process of "research and development, delivery and after-sale". In February 2017, Yundu launched the Yundu new energy vehicle brand; in October 2017, the first model, Yundu π 1, went on sale at a price of 13.89 yuan to 197500 yuan; and in March 2018, Yundu π 3 officially went on sale at a price of 17.08 yuan to 186800 yuan. Statistics show that the first model, Yundu π 1, sold 7343 vehicles in 2018, and this report card was definitely a leader in the new field of car building at that time.

Unfortunately, due to the lack of stamina, with the rise of mainstream electric cars, Yundu Motors' products do not have obvious competitive advantages in terms of service life, sports and configuration, coupled with the singleness of the products. Yundu's brilliance is as short-lived as a flash in the pan. In 2019, Yundu Motor has fallen into difficulties such as frequent turnover of workers and compulsory leave of employees.

In August 2020, Yundu held a grand strategy conference. Yundu Motors said it plans to become one of the top three domestic pure electric car brands in 2025. Although Yundu Motor has a state-owned background, it seems it is difficult to go bankrupt and delisted, and it also hopes to achieve brand promotion through a new strategic layout, but Yundu Automobile no longer has a sense of existence in the market, and its market influence is in vain. Only by shouting slogans to encourage yourself.

The data show that the net losses of Yundu Motor from 2017 to 2020 were 95 million yuan, 138 million yuan, 177 million yuan and 204 million yuan respectively, with a net loss of 213 million yuan in 2021 and another 55.7136 million yuan in the first quarter of 2022. After that, with the withdrawal of shareholders such as Fujian Automotive Industry Group Co., Ltd., Jiangxi Haiyuan Composite Technology Co., Ltd., as well as the entry of new shareholders, the ownership structure of Yundu Automobile has changed obviously. the current shareholders are Putian State-owned assets Investment Group Co., Ltd., Fujian leading Industry Equity Investment Fund Partnership (Limited Partnership) and Zhuhai Yucheng. The shareholding ratio is about 8.7%, 6.0% and 85.3% respectively.

Today, Yundu Motor, which is in deep trouble, has ushered in Junyao Group. Data show that Junyao Group was founded in July 1991 and has now formed five major business sectors: air transport, financial services, modern consumption, educational services, and scientific and technological innovation. It has four listed companies: auspicious Airlines, Aijian Group, Great Oriental and Junyao Health. Of course, although the business is extensive, it has to be admitted that Junyao Group is not as good as its competitors in all major areas. In terms of capital strength, Junyao Group does have the ability to invigorate Yundu Motors, but judging from the previous market performance of Yundu Motors, it is still doubtful whether only capital injection can keep Yundu Motors healthy and stable.

It is understood that, as a new starting point for "auspicious travel", Yundu Yun Rabbit will be officially listed on February 28. After that, Junyao Group will also work with Yundu Motors to focus on building a variety of national versions of new energy smart cars. Wang Junjin also said: Junyao Group, together with Yundu Automobile, also wants to build a century-old store belonging to the automobile sector, not to spend more money than anyone, but to live a long time. "auspicious travel" is not a new force in building cars, but a "version 2.0" model of new energy vehicles, which is intended to be a profit model, not a model in which a car loses tens of thousands of yuan.

The racing track of new energy vehicles is becoming more and more crowded, and the competition is becoming more intense. As Wang Chuanfu said, the new energy car market is a market where "fast fish eat slow fish". If newcomers do not have absolute strength, it will not only be very difficult to catch up with the dividends of the new energy vehicle era, but also likely to be dragged down by building cars. in the end, we can only find a "knight in white."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.