In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/26 Report--

According to the Interface News, the BYD dynasty series has begun to reduce prices. Reported that Beijing, Shanghai and other BYD showrooms learned that the BYD dynasty series of products have started to reduce prices, delivery cycle than last year has been shortened to varying degrees.

A salesperson in a BYD dynasty showroom in Beijing said that he had just received an official notice of price adjustment and that most models had price concessions. Among them, the discount range of the old model is more than 10,000 yuan, and some popular cash products also have discounts of thousands of yuan. In addition to Beijing, there are also varying degrees of price cuts in Shanghai and Shenzhen, with the highest price adjustment of about 10,000 yuan.

According to the official website, BYD New Energy covers pure electric vehicles and plug-in hybrids, including the dynasty series composed of Qin, Han, Song, Tang, Yuan and other models, as well as the ocean series of dolphins, seals and destroyers 05. The product price covers the range of 10-300000 yuan. It is understood that the end market offer is only related to the dynasty net, the ocean series of models did not participate in the price reduction activities, there is no price change in the whole department at present. However, as of press time, BYD officially did not announce the price reduction message, nor did it respond to the rumors of dynastic model discounts.

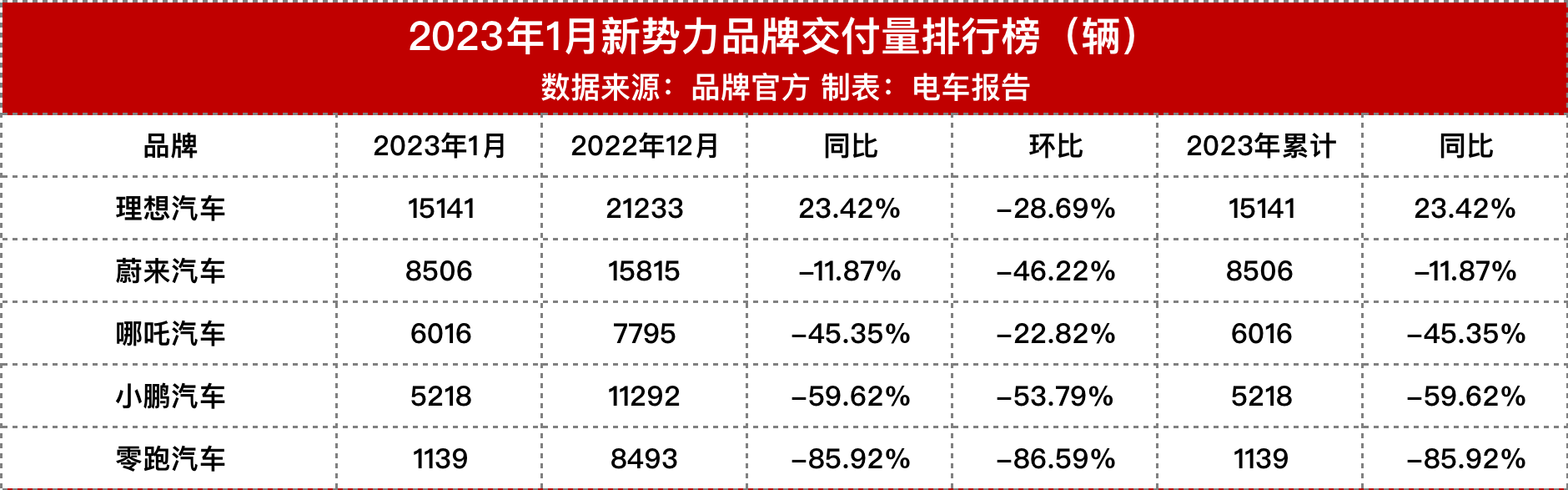

Why did BYD choose to cut prices? The market believes that the decline in sales in the short term and Tesla's price reduction pressure may become the main reasons for BYD's price reduction. Due to the impact of the Spring Festival holiday, the delivery volume of domestic new energy brands generally shrank in January. Among the new power brands, only the ideal car delivery volume exceeded 10,000, while Lulai Automobile, Nahan Automobile, Xiaopeng Automobile and Zero car all showed a significant month-on-month decline compared with the same period last year, among which Xiaopeng Automobile and Zero car all halved compared with the same period last year. Among the domestic new energy brands, including AION, AITO, smart, ZEEKR and other brands, BYD achieved year-on-year growth, but due to the impact of the Spring Festival holiday, the month-on-month decline also reached 37.12%. Tesla sold 66100 vehicles in China in January 2023, an increase of 10.3 percent over the same period last year and 18.4 percent month-on-month, including domestic sales of 26900 vehicles and exports of 39200 vehicles, according to the Federation of passengers.

Tesla's sales grew month-on-month, related to its massive price cuts in China and the global market. At the beginning of the year, Tesla announced adjustments to the prices of domestic Model 3 and Model Y. the starting prices of both domestic models hit record lows, with the adjusted starting prices of 229900 yuan and 259900 yuan, respectively, of which Model 3 was cut by 2.0-36000 yuan and Model Y by 2.0-48000 yuan. In addition to Chinese mainland, Tesla has also launched price cuts in Japan, South Korea, Australia, the United States, much, Norway, Spain, France, Portugal, the Netherlands and other countries. In the United States, for example, Model 3 is reduced by $3000 (about 20200 yuan) to $43990, and Model Y is reduced by $13000 (about 87500 yuan) to $52990.

In addition to Tesla, including Aito, Xiaopeng Automobile, Zero Motor, Guangzhou Automobile Toyota, Dongfeng Nissan and other manufacturers for their pure electric vehicles, through different purchase policies to achieve the purpose of price reduction. Take Aliya, a unit of Dongfeng Nissan, as an example. Under the superposition of government and enterprise subsidies, Aireya ARIYA offers a limited-time discount of 60, 000 yuan, covering all ARIYA models, with a price of 224800 after the discount.

A number of car companies have announced price cuts, which is an important reason for BYD's lower prices. Take Tesla as an example, the price of Tesla after the price reduction is between 20 yuan and 300000 yuan, competing with BYD's Han and Tang, while other car companies' price cuts have also increased the competitive pressure on other models. The sales introduction of the BYD Exhibition Hall in Shanghai said that the number of customers entering the store to choose cars declined after the year, and the inventory pressure was concentrated on the old models. A BYD showroom in Shenzhen said that during a recent phone return visit, a consumer who came to the store to consult on the purchase of Han EV before the Spring Festival had already bought a Model 3, while some customers had chosen other new power brands.

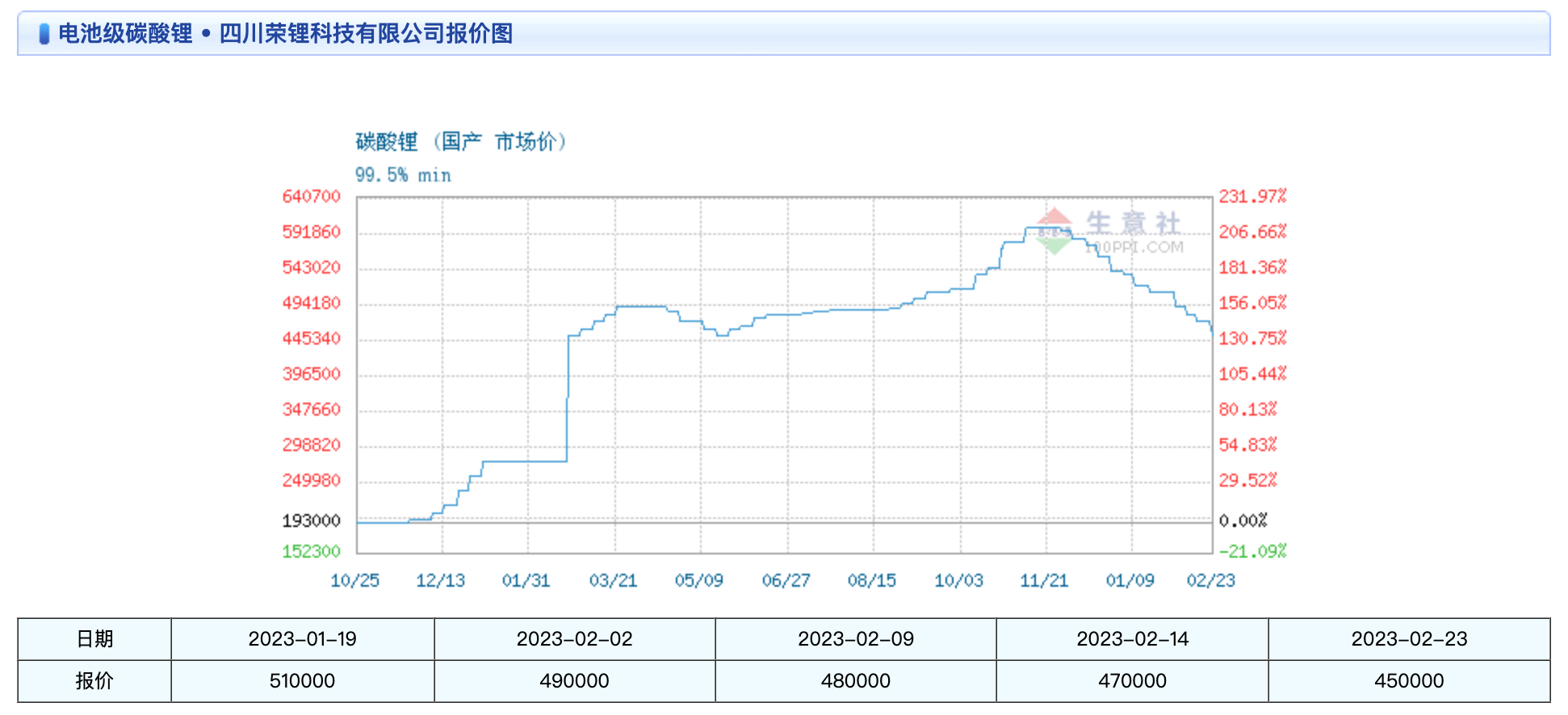

Tesla Model 3 down to 200000 yuan is just around the corner. According to data from Shanghai Iron and Steel Federation, battery-grade lithium carbonate (99.5% min) was quoted at 450000 yuan / ton, down 20000 yuan / ton from Feb. 14, 9.8% from 490000 yuan / ton at the beginning of the month, and more significant than the 600000 yuan / ton correction in the fourth quarter of last year.

Industry insiders said that the price of battery-grade lithium carbonate continued to decline for two reasons: first, the previous high price stimulated a lot of capital entry and capacity increase, thus increasing market supply; second, the sustained rise in the price of battery-grade lithium carbonate spawned alternative materials such as sodium ions, which curbed demand growth and led to a change in the relationship between supply and demand of lithium carbonate. In the view of industry insiders, the price of lithium carbonate has not yet bottomed out, and as the production capacity of lithium carbonate continues to be released and prices continue to decline, the relationship between supply and demand of lithium carbonate will be further improved. For new energy car companies, the decline in the cost of power batteries will help to expand profit margins and then increase product sales and market share. At that time, new energy vehicle manufacturers will usher in a wave of price cuts, and Tesla, who is priced at cost, may be the first to open the situation of price reduction.

Of course, Tesla also has the strength to reduce prices. According to the financial report, Tesla's quarterly gross profit margin declined in 2022, from 29.1% in the first quarter to 23.8% in the fourth quarter. However, Tesla's net profit is on the rise, with Tesla's total revenue rising 51.4 per cent year-on-year to $81.46 billion in 2022 and his mother's net profit rising 127.5 per cent to $12.56 billion. This is the highest annual profit in Tesla's history. In other words, the more Tesla sells, the more he earns. Tesla can sacrifice part of his gross profit margin in exchange for market share. For Tesla, price reduction is just less money, and the decline in the cost side will also directly prompt Tesla to reduce prices. Therefore, if Tesla starts a new round of price cuts in the future, if the price of Model 3 goes down to about 200000 yuan, catfish will generally exist, which will be a new blow to domestic new energy car manufacturers.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.