In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/27 Report--

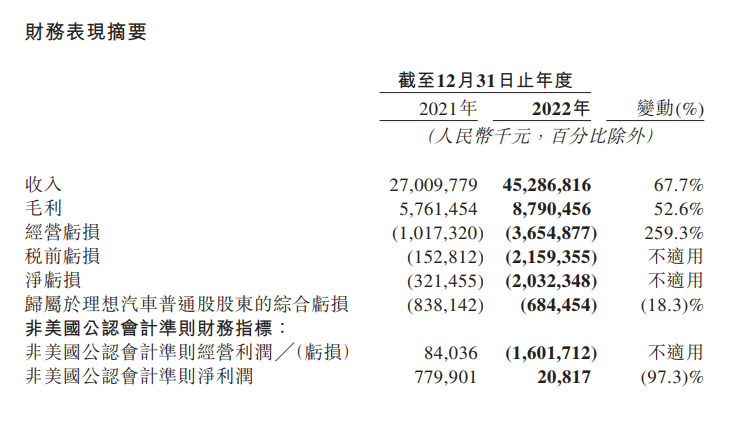

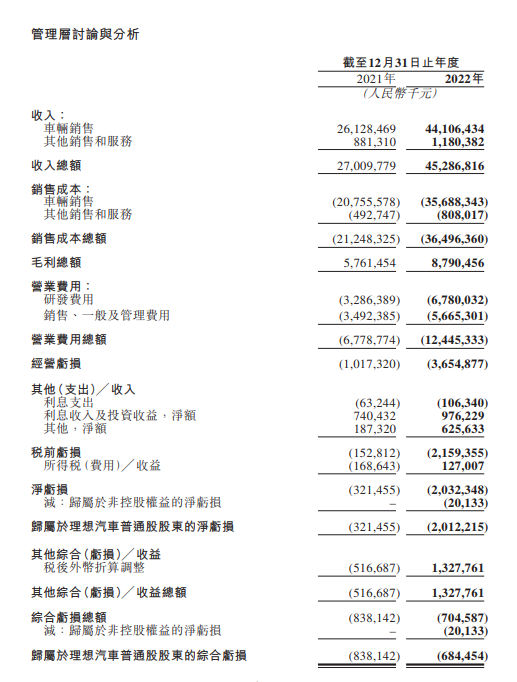

Today, ideal Motor announced its results for the fourth quarter of 2022 and the whole year of 2022. According to the financial report, ideal Motor had revenue of 17.65 billion yuan in the fourth quarter, an increase of 66.2 percent compared with 10.62 billion yuan in the fourth quarter of 2021. The cumulative revenue in 2022 was 45.29 billion yuan, an increase of 67.7% over the same period last year. Vehicle sales revenue in the fourth quarter of 2022 was 17.27 billion yuan, an increase of 66.4 percent compared with 10.38 billion yuan in the fourth quarter of 2021.

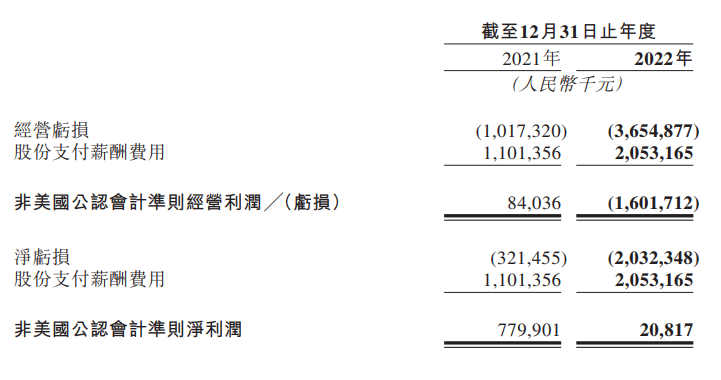

In terms of gross profit margin, the gross margin of the ideal car in the fourth quarter of 2022 is 20.2%, and the gross margin for the whole year is 19.4%, down from 21.3% in 2021. Officials said the decline in gross margin was mainly due to the loss of inventory provisions and purchase commitments related to ideal ONE in 2022, partially offset by higher gross margins for ideal L-series vehicles that began delivery in the third quarter of 2022. The operating loss of 3.65 billion yuan in 2022 increased by 259.3% compared with the operating loss of 1.02 billion yuan in 2021. The net loss in 2022 was 2.03 billion yuan, up nearly sevenfold from 321.5 million yuan in 2021. The total delivery volume of the ideal car in 2022 is 133246. Based on the delivery volume and the net loss, it is not difficult to calculate that for every ideal car sold, the loss will amount to 15200 yuan.

In the fourth quarter of 2022, the ideal car R & D expenditure is 2.07 billion yuan, accounting for 11.7%. In 2022, the R & D expenditure for the whole year was 6.78 billion yuan, accounting for 15.0% of the annual expenditure, an increase of 106.3% over the same period last year. Revenue from other sales and services in the fourth quarter of 2022 was 382 million yuan, an increase of 55.9 percent compared with 245 million yuan in the fourth quarter of 2021. It is understood that the increase in other sales and service revenue of ideal cars compared with the fourth quarter of 2021 and the third quarter of 2022 is mainly due to the increase in sales of accessories and services as a result of the increase in cumulative sales of cars. By the end of the fourth quarter, the ideal car cash reserve is 58.45 billion yuan.

Regarding ideal Motor's full-year 2022 and fourth-quarter results, ideal Motor Chief Financial Officer Li tie said: "despite continuing macroeconomic uncertainty, we are pleased to end 2022 with strong performance in the fourth quarter. Thanks to our excellent delivery performance, our total revenue in the fourth quarter reached 17.65 billion yuan, an increase of 66.2% over the same period last year, and the total revenue for the whole year of 2022 reached 45.29 billion yuan, an increase of 67.7% over the same period last year. Our fourth-quarter gross margin remained solid, at 20.2%, with a free cash flow of 3.26 billion yuan. Our cash flow and abundant cash reserves will continue to support future R & D investment and business expansion. "

Delivery volume in the first quarter of 2023, ideal Automobile said: delivery is expected to reach 52000 to 55000 vehicles in the first quarter of 2023, an increase of 64.0% to 73.4% over the same period last year; total revenue is expected to be 17.45 billion yuan to 18.45 billion yuan, an increase of 82.5% to 93.0%. Relevant data show that the ideal car delivery volume in January 2023 is 15141, up 23.4% from the same period last year. It is the only new power brand to deliver more than 10,000 cars in January, but the sales volume is down 28.69% from 21233 in December. If 52000 to 55000 vehicles are delivered in the first quarter according to the official plan, it also means that the monthly delivery of ideal cars needs to be more than 18000 units on average in the next two months to reach this target.

At present, the ideal car models on sale are L8, L9 and L7. The ideal L9 went on sale in June last year with a price of 459800 yuan. As a replacement of the ideal ONE, the ideal L8 launched two models on September 30 last year, with a price range of 35.98 yuan to 399800 yuan. The ideal L7 went on sale on February 8 this year with a total of three equipped models with a price range of 319800 to 379800 yuan.

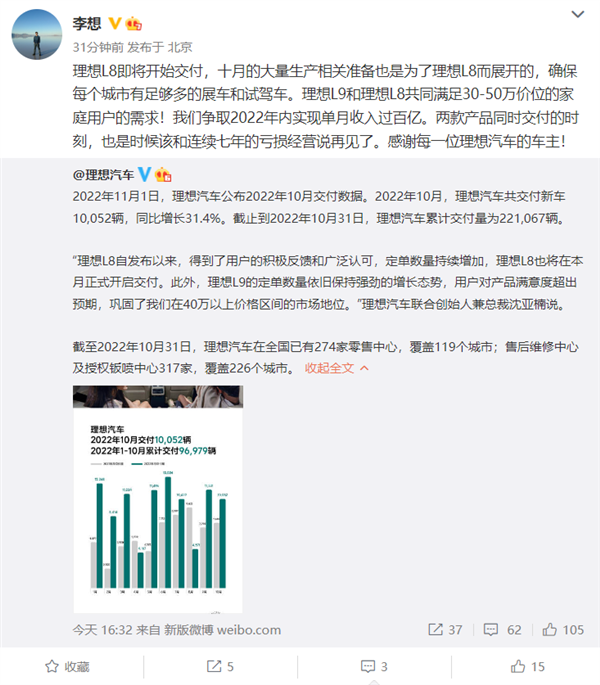

As we all know, car-building is recognized as a "money-burning" business, and ideal cars, like other new forces, are still at a loss stage. According to the financial report released by ideal Automobile, the net loss of ideal Automobile for the whole year in 2022 is 2.032 billion yuan. On the eve of the delivery of the ideal L8, ideal car CEO Li Xiang once said: the ideal L9 and the ideal L8 work together to meet the needs of household users with a price range of 30-500000, and strive to achieve a monthly income of more than 10 billion yuan in 2022. When the two products are delivered at the same time, it's time to say goodbye to seven consecutive years of loss-making operations.

At present, the ideal car still has a long way to go to get out of the loss state quickly. after all, it will also face a lot of R & D investment and cost pressure. Some industry insiders have pointed out that few new energy vehicle factories can make money, and most of them are in a state of loss. Zeng Qinghong, chairman of GAC GROUP, also said: at present, all new energy factories except Tesla are losing money because the cost of power batteries accounts for 40 per cent of the total cost of cars. 60 per cent.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.