In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/02 Report--

Last night, Xilai released its 2022 results to the public. Due to the lower-than-expected results, Ulai US stocks fell 5.96% overnight, while Hong Kong stocks fell 11.95%.

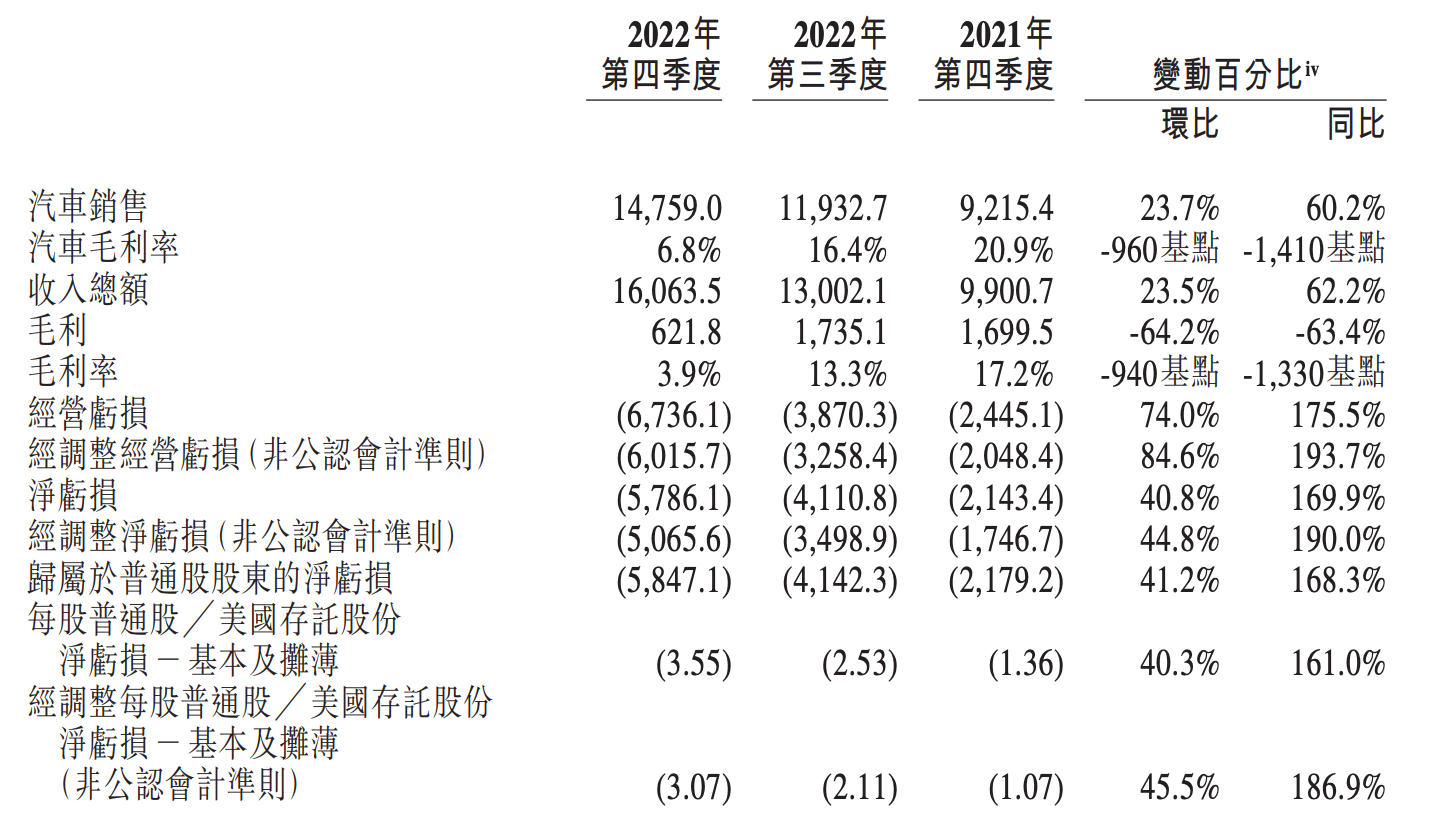

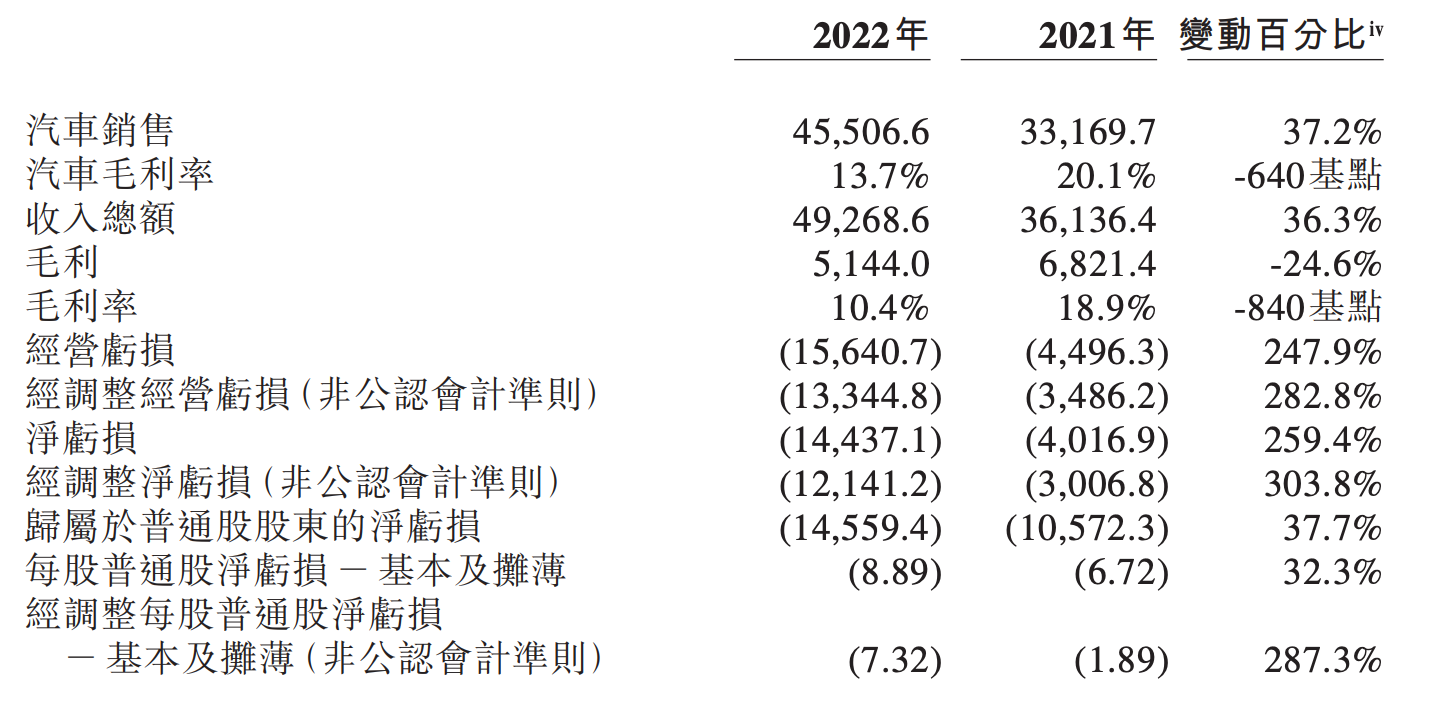

According to the financial report, a total of 122486 new cars were delivered in 2022, an increase of 34.0 percent over the same period last year, of which the delivery volume in the fourth quarter of 2022 reached 40052, an increase of 60.0 percent over the same period last year, the largest quarterly delivery in history. In terms of revenue, Lailai's total revenue for the whole year was 49.269 billion yuan, an increase of 36.3% over the same period last year, of which automobile sales were 45.507 billion yuan, an increase of 37.2% over the same period last year, mainly due to the growth of car delivery.

Although both delivery volume and revenue have increased, it still cannot hide the current situation of losses. According to the financial report, the net loss of NIO for the whole year of 2022 was 14.437 billion yuan, while the net loss of NIO in 2021 was 4.017 billion yuan, an increase of 259.4 percent over the same period last year. According to the simple calculation, the loss of each car sold by NIO is expected to exceed 100000 yuan. At the same time, NIO's gross profit margin also fell sharply, from 18.9% in 2021 to 10.4%, especially in the fourth quarter of 2022, when its car gross margin was only 3.9%.

Of course, it is not difficult to analyze the reasons for the substantial expansion of Xilai's losses. on the one hand, the new energy vehicle industry has experienced multiple challenges in 2022, including rising raw material prices, core shortage, supply chain pressure and increasingly fierce market competition, and on the other hand, enterprise development planning, including replacement station / charging pile construction, new model research and development, new brand planning and new business layout, etc. In 2022, it was revealed that Xilai had launched a new business layout with multiple lines, including new brand projects internally codenamed "Alps" and "Firefly", as well as R & D projects for core components such as batteries and chips, and even the upcoming sale of Lulai mobile phones.

According to the financial report, the R & D expenditure of NIO in 2022 was 10.836 billion yuan, an increase of 136.0% from 4.592 billion yuan in 2021, while the expenditure on sales and administrative expenses increased from 6.878 billion yuan in 2021 to 10.537 billion yuan in 2022, an increase of 57.6% over the same period last year. As the head of the new power, NIO is not stingy in spending on R & D and marketing, which is one of the reasons why its losses continue to expand.

The core business is facing profit pressure, coupled with the promotion of many new projects at the same time, people can not help but worry about the financial situation of NIO. However, although it has not yet made a profit, there will be no problems with its own operating conditions in the short term. As of December 31, 2022, the amount of cash and cash equivalents, restricted cash, short-term investments and long-term term deposits is 45.5 billion yuan.

For the next stage of development planning, NIO also explained in the financial report meeting. According to the plan, five new cars will be delivered this year, including the new ES8 and EC7, as well as the new ES6, new EC6 and ET5 hunting versions that will be launched in the first half of the year. Li Bin said the delivery of all five new cars was originally planned for the first half of the year, but considering that each new car has more time to better grasp the marketing pace, it is now planned to deliver the fifth new car in July.

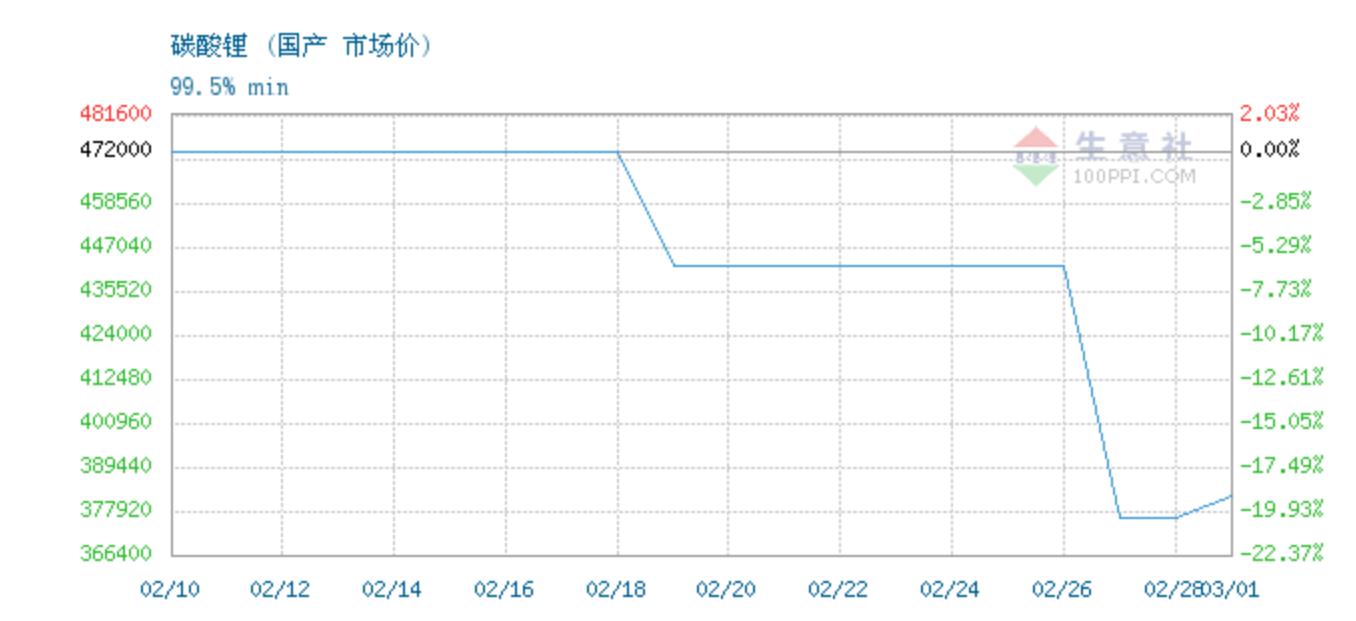

In addition, the price of battery-grade lithium carbonate has continued to decline recently, which will contribute to the growth of gross profit for Ulai. NIO CFO Fengwei said that if the price of lithium carbonate falls by 100000 yuan per ton, the gross profit margin of NIO cars will increase by 2%, and the price of lithium carbonate is expected to fall back to 200000 yuan per ton this year. The price of battery-grade lithium carbonate fell to 376000 yuan / ton on March 1, and rose to 600000 yuan / ton in November 2022.

Based on "886" and "775", Li Bin is confident about 2023, and he expects monthly sales to exceed 30,000 vehicles. He said that after all the products of the second-generation technology platform are on the market, the products of Xilai Automobile will become three clusters:

The first category is the major sales contribution models, including the ET5, the new ES6 and the ET5 hunting version, which can contribute 20, 000 vehicles per month. The second type of model product positioning, price range to go up some, including the ET7, ES7, the new ES8, the monthly sales contribution of these cars is in the range of 8000 to 10000. The third category is the pursuit of personalized style models, including the EC7 and the new EC6, which will be niche, with sales of about 1000 to 2000 vehicles a month.

Previously, Lexus's goal in 2023 was to overtake Lexus, but Lexus sales began to shrink and did not have much competitiveness, and during the conference call, Li Bin also made it clear that "the annual sales target will double compared with the same period last year." so it is expected that the target for 2023 will be about 250000 vehicles. In addition, Li Bin said, "We hope to achieve full-year profit in 2024, with the fourth quarter of 2023 as the quarterly break-even target."

According to the financial report, Lai expects to deliver 3.1-33000 new cars in the first quarter of 2023, an increase of 20.3% to 28.1% from a year earlier, of which 8506 new cars were delivered in January and 12157 in February. As a result, it is expected to deliver between 1.0 and 12000 vehicles in March. NIO said that in the first quarter of 2023, there was still some pressure on production capacity and delivery, mainly because the main selling models were switched from NT 1.0 platform to NT 2.0 platform, and the factory production line had to be adjusted and prepared, which affected production capacity and delivery.

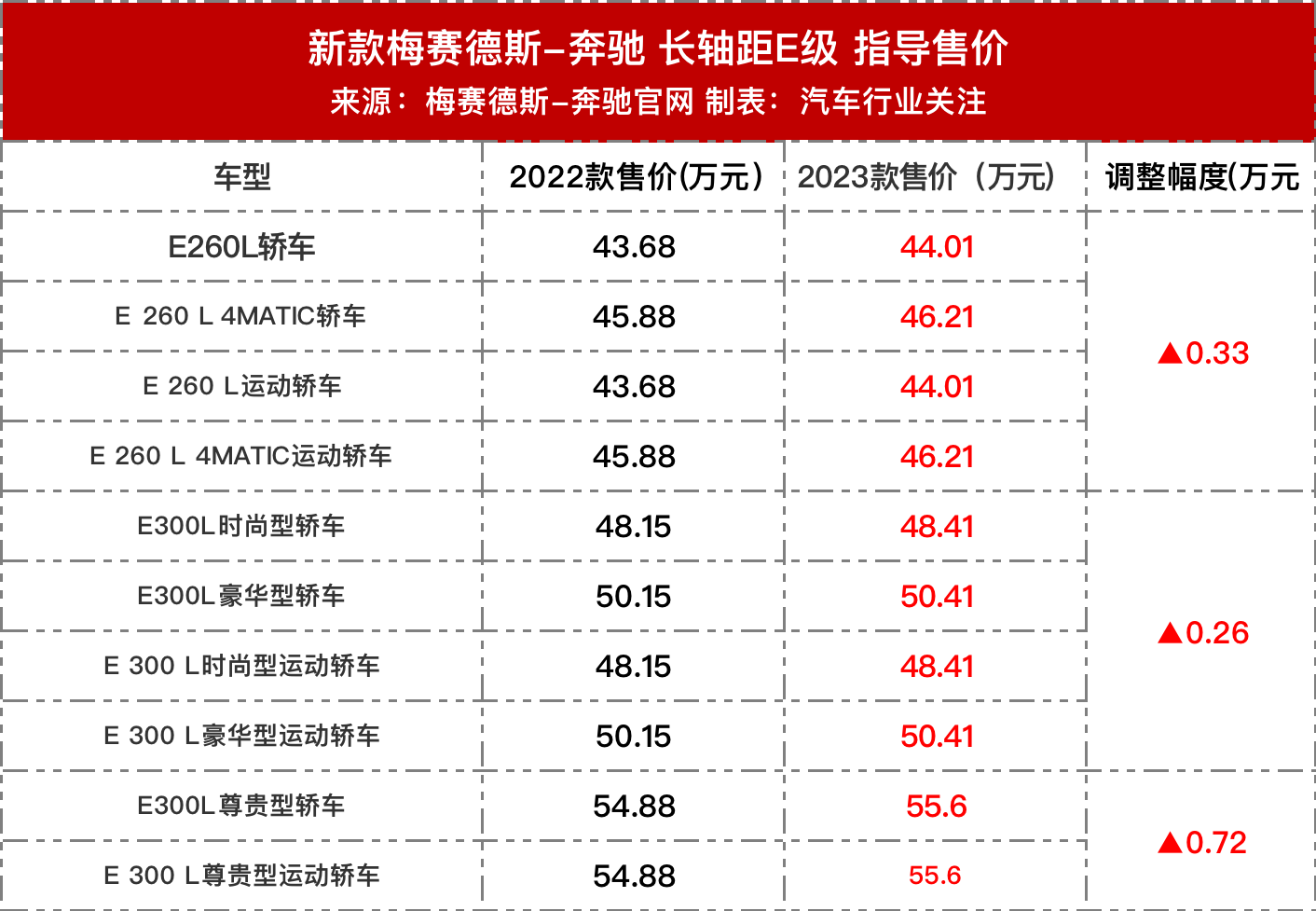

In recent years, Wei Xiaoli has survived the difficulties of life and death, and all he has got is a ticket to a more difficult game, and as the new energy industry matures, the market may not have much time for enterprises. The latest share price shows that the market capitalization of Xilai US stock is 14.591 billion US dollars, Xiaopeng 7.591 billion US dollars, and ideally 23.944 billion US dollars. In Wei Xiaoli's three new power enterprises, the sales of ideal cars have been ahead of NIO and Xiaopeng, and the current market capitalization is the sum of NIO and Xiaopeng.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.