In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-25 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/06 Report--

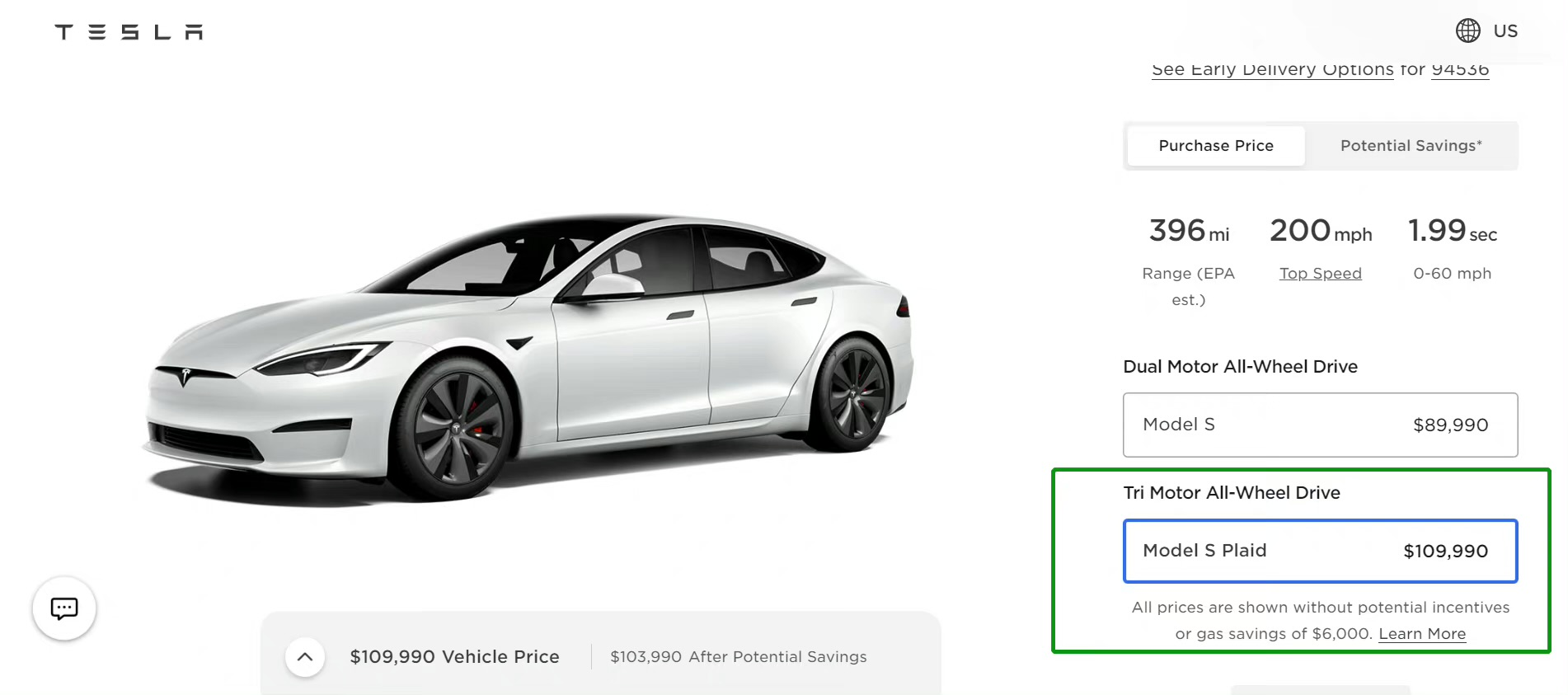

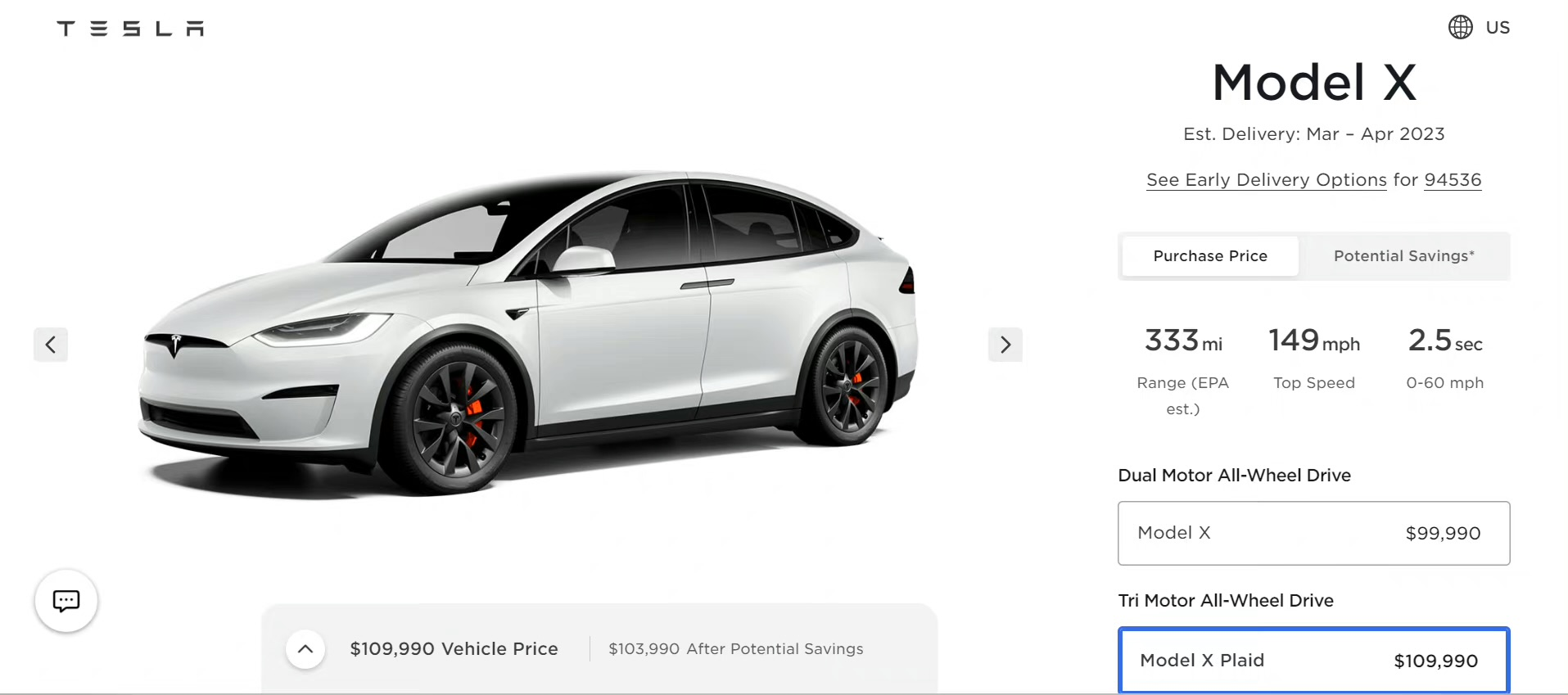

Today, the prices of Model S and Model X models have been reduced by between $5000 and $10000, or up to 69000 yuan, according to Tesla's US website. Specifically, Model S fell from $94990 to $89990, Model S Plaid from $114990 to $109990, Model X from $109990 to $99990, and Model X Plaid from $119990 to $109990. As of press time, there has been no price adjustment for Model S and Model X models in the Chinese market.

It is worth noting that since January this year, Tesla has greatly adjusted the price of his models in the United States. On January 12th, Tesla slashed the models on sale in the US market, including the Model 3 by $3000, or 6 per cent, from $46990 to $43990. Model Y fell by $13000, or 20 per cent, to $52990 from $65990. Model S was cut by $10000, or 10 per cent, from $104990 to $94990. Model X was cut by $11000, or 9 per cent, from $109990 to $109990.

Of course, Tesla another price reduction may also be expected, after all, Tesla mainly self-sales, the rise and fall of raw material prices have a direct impact on Tesla's price. Recently, the price of lithium carbonate has continued to decline, and the price of lithium carbonate has dropped from a peak of 600000 yuan / ton in 2022 to 390000 yuan / ton recently. In terms of gross profit margin, Tesla's gross profit margin is much higher than that of the world's major automakers, with Tesla's gross profit margin reaching 25.6% in 2022.

At the same time, manufacturing costs are also constantly being compressed. According to Tesla recently revealed at the investor day event that the next generation of model platform will reduce the use of silicon carbide by 75%, the next generation of permanent magnet motors will not use rare earth materials at all, and the total manufacturing cost will be reduced by 1000 US dollars. At the same time, Tesla says its goal is that the next generation of cars can be assembled by more people at the same time, reducing assembly costs by 50 per cent. In terms of production capacity: with the expansion of Tesla's Shanghai super factory, Tesla has a total annual global production capacity of more than 1.9 million vehicles. When production capacity exceeds demand, price reduction is understandable.

Earlier, Tao Lin, vice president of foreign affairs of Tesla, said: "behind Tesla's price adjustment, there are numerous engineering innovations." in essence, it is a unique excellent law of cost control: including not limited to vehicle integrated design, production line design, supply chain management, and even millisecond optimization of robotic arm coordination route. Proceed from the "first principle" and insist on pricing at cost. " In this regard, there are many industry insiders pointed out that Tesla may want to cost-oriented down to explore the price range to occupy a higher market share.

The sales data brought by Tesla after the big price reduction in January is also very considerable. Take the Chinese market as an example, Tesla's wholesale sales in China reached a new high after the big price reduction. Related data show that Tesla's wholesale sales in China were 66501 in January, and Tesla's wholesale sales in February were 74402. As for the effect of the price reduction, Tesla CEO Musk also said: Tesla's demand in January was about twice as much as output. Without external interference, Tesla's sales could reach 2 million in 2023. And pointed out that Tesla is indeed worried about economic uncertainty and will "accelerate the cost-cutting roadmap and promote higher productivity" in the short term.

In the final analysis, Tesla's strength to cut prices frequently stems from its relatively flexible supply system. Secondly, high gross profit margin is the key factor that Tesla can reduce prices to seize the market. Of course, the rise or fall of product prices is a normal business behavior, but frequent price adjustments are also easy to cause user dissatisfaction and reduce user loyalty.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.