In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/09 Report--

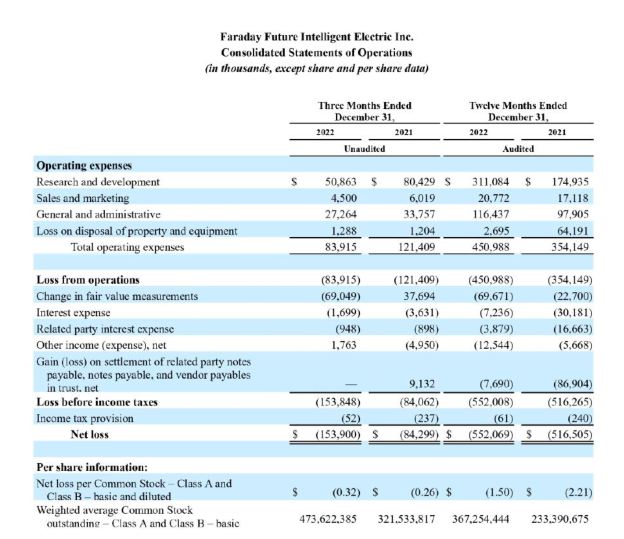

Today, Faraday Future Weibo released its fourth quarter and full-year results for 2022, according to relevant data: the net loss of FF in the fourth quarter of 2022 was $153.9 million, compared with $84.3 million in the same period in 2021, an increase of $69.6 million. The reason for the loss: due to the increase in the fair value of certain notes payable and share option liabilities that should be included in fair value during the three months ending December 31, 2021, and the gains due at settlement in related parties' notes payable, notes payable and supplier trusts, the net value recorded the company's 9.1 million principal relief for salary protection loans, which did not occur in the same period this year.

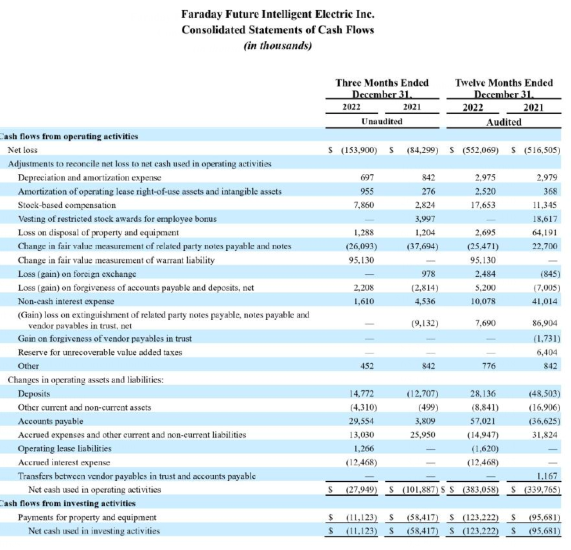

Faraday's net loss for the next fiscal year in 2022 was $552.1 million (about 3.8 billion yuan), an increase of $35.6 million compared with a net loss of $516.5 million in fiscal year 2021. For the increase in net loss in 2022, officials said: this is mainly due to the increase in the cost of ED&T in 2022 and the increase caused by changes in the fair value measurement of some notes payable and option liabilities measured at fair value. As of the fourth quarter of 2022, Faraday's future cash reserves are approximately $18.5 million in cash and restricted cash. As of March 3, 2023, Faraday's future cash reserves are $37.5 million, including $2.1 million in restricted cash.

This time, in addition to announcing the fourth quarter and full-year results of 2022, Faraday also explained the production and delivery situation. Officials said that after receiving funds from the company's investors in time and the suppliers meet the requirements of the supply chain, FF 91 Futurist will start production at the manufacturing plant "FF ieFactory California" in Hanford, California, on March 30, 2023, and the first cars will be offline in early April 2023. And delivered to the customer by the end of April 2023.

It is worth noting that the FF91, the first model of Faraday's future, was unveiled in Las Vegas as early as January 2017, and has postponed the mass production of the first model for the fourth time. However, in 2023, Faraday is also speeding up the mass production process of the first model, first resolving high-level conflicts within FF, enabling Jia Yueting to regain control of FF and completing another $135 million in financing. In addition, it has also reached a cooperation with the Huanggang municipal government to locate the FF China headquarters in Huanggang City.

It remains to be seen whether FF91 Futurist will be offline in early April. After all, Faraday's future financial situation has not been ideal. Judging from the official cash reserves, Faraday is still very short of funds in the future. In addition, according to Faraday's future filings with the Securities and Exchange Commission (SEC), Faraday's future net losses from 2019 to 2021 are $142 million, $147 million and $517 million, respectively. FF said in the first quarter of 2022: "the company is expected to continue to generate significant operating losses for the foreseeable future and will continue to incur expenses until material revenue is generated." If we follow the "money-burning" speed of Faraday in the future, the current capital reserves of FF are not enough.

In the secondary market, or affected by the reported losses in the fourth quarter and full year of 2022, Faraday fell 8.04% to 0.51 per share as of March 8, with a total market capitalization of $354 million, which has fallen by $4.181 billion compared with the market value of Faraday when it was listed in the future.

It is understood that in 2021, Faraday Future (Faraday Future) was officially listed on the NASDAQ Stock Exchange in the United States, and began official public trading under the stock symbol "FFIE". The offering price of FFIE was $13.78, up 1.45% on the first day, closing at $13.98, with a total market capitalization of $4.535 billion. However, by the close of trading on March 8, Faraday's future shares had fallen 91.24%. Faraday's share price continues to plummet in the future, or the market is disappointed with FF 91's mass production plan. after all, the annual loss of $550 million is still at the "PPT" stage.

In general, with the increasing number of new car-building companies, the competition will become more and more fierce, but in the end, only a small number of them will survive. At present, the research and development of new energy vehicles has gradually matured, and the manufacturing supply chain, sales channels and consumers also tend to be stable after sale. For Faraday's future, or has missed the best period of development of the golden eight years, according to the current level of new energy vehicle technology, FF obviously has no advantage, or even lags behind other brands. At present, Faraday may only have time to accelerate mass delivery in the future, and there may still be a chance of survival.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.