In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/18 Report--

According to the Tramway report, industrial and commercial changes have taken place in Guangzhou Orange Hong Zhizhong Automotive Technology Co., Ltd. Xia Heng stepped down as executive director and manager, which will be replaced by he Xiaopeng, and the legal representative will also be changed by Xia Heng. According to the data, Guangzhou Orange Line Zhizhong Automotive Technology Co., Ltd. was established in January 2015, is Xiaopeng automobile manufacturing entity company, headquartered in Guangzhou, founded by Xia Heng, he Tao, Yang Chunlei and others.

In 2014, Xiaopeng was founded by Xia Heng, he Tao and Yang Chunlei. Senior executives of well-known Internet companies such as he Xiaopeng, founder of UC, Li Xueling, founder of YY, and Fu Sheng, CEO of Cheetah Mobile, jointly invested in Xiaopeng. In August 2017, he Xiaopeng left from Ali and joined Xiaopeng Motor as chairman of Xiaopeng Motor. Before that, he Xiaopeng was only an investor, while Xia Heng was the head of the company.

In November 2022, Xiaopeng announced that Xia Heng resigned as executive director of Xiaopeng's board of directors, but still served as president of Xiaopeng. After entering 2023, Xia Heng has left many important positions such as Guangdong Xiaopeng Automotive Technology Co., Ltd., Guangzhou Xiaopeng Automotive Technology Co., Ltd., Guangzhou Orange Bank Zhizhong Automotive Technology Co., Ltd., and so on. After the above changes, Xiaopeng has only one executive director left on the board of Xiaopeng, and Xia Heng has left the top decision-making level of the company.

The Tramway report learned through Xiaopeng's official website that he Xiaopeng is chairman / CEO of Xiaopeng, Wang Fengying is president of Xiaopeng, and Xia Heng is co-founder / co-president of Xiaopeng. Although Xia Heng is still president, his authority has been greatly reduced, and Xia Heng's position appears extremely embarrassing after Wang Fengying officially became president.

Some media believe that Xia Heng has successively stepped down from the positions of Xiaopeng Automobile-related companies, and the trend of fading out of Xiaopeng Automobile is becoming more and more obvious, but in fact this is not the case. Wang Fengying's arrival is to make up for the shortcomings of Xiaopeng's automobile marketing system, and eventually have to feedback on the sales volume of the car. Xia Heng is better at technology and may not be interested in business operation.

Guangzhou Pengyue Power Battery Co., Ltd. was established in November 2022 with a registered capital of 5 billion yuan. On January 5th, Zhaoqing Xiaopeng Intelligent Manufacturing Research Institute Co., Ltd. was established with a registered capital of 1 million yuan. Guangzhou Penghui Automotive Technology Co., Ltd. was established on February 16, with a registered capital of 5 billion yuan. The company is an important layout under Xiaopeng's car charging network strategy. Xia Heng will focus on the technology platform and related parts needed for the next generation of models, and lead the self-research of Xiaopeng's core technology. It is understood that the legal representatives of these three companies are Xia Heng, Xiaopeng intends to master the core technology in their own hands.

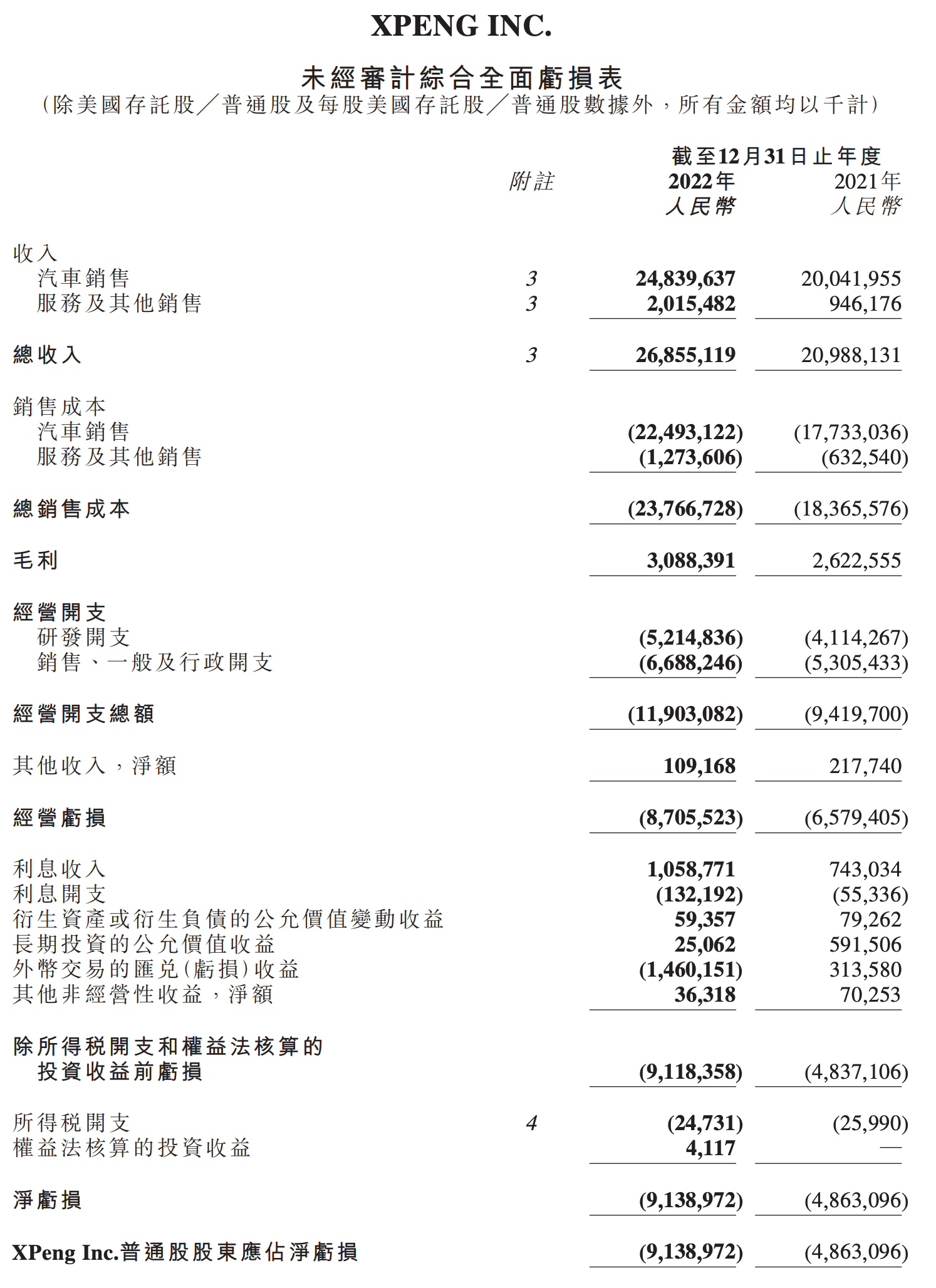

On March 17, Xiaopeng released its results for the fourth quarter and the whole year of 2022. According to the financial report, Xiaopeng's total revenue in 2022 was 26.86 billion yuan, an increase of 28 percent over the same period last year, of which revenue in the fourth quarter was 5.14 billion yuan, down 39.9 percent from the same period last year. The net loss in 2022 was 9.14 billion yuan, of which the net loss in the fourth quarter was 2.36 billion yuan.

While losses are widening, Xiaopeng's gross profit margin is also falling, from 12.5% in 2021 to 11.5% in 2022. The gross profit margin of cars is 9.4% in 2022 and 11.5% in the same period in 2021. Xiaopeng explained that the decline in gross profit margin was mainly due to the increase in sales discounts and the rising cost of materials. By the end of the fourth quarter, Xiaopeng had a cash reserve of 38.25 billion yuan.

Reviewing the overall sales trend of Xiaopeng Automobile in 2022, it shows a completely different development trend in the first half and the second half of the year. In the first half of 2022, Xiaopeng also became the top new car-building force with a delivery volume of 68900 vehicles, while in the second half of the year, Xiaopeng car sales began to decline, falling from 15295 in June to 5101 in October, four consecutive months of month-on-month decline. it wasn't until December that it returned to the 10,000-car delivery threshold. It is understood that the delivery target of Xiaopeng car in 2022 is 250000, while the actual delivery volume is only 120800, and the target completion rate is less than 50%. As a result, Xiaopeng has lost its annual sales title, and the year-on-year growth rate of delivery volume and delivery volume is not as good as that of Ulai. He Xiaopeng, chairman of Xiaopeng Motor, said that the macro environment and competition in the new energy vehicle industry brought many challenges last year, and Xiaopeng's performance was under pressure, which also made Xiaopeng see the challenges of the industry and the company's problems earlier.

In addition to the lower-than-expected delivery volume, Xiaopeng's share price is "plummeting from a height of 3,000 feet." According to statistics, in the past 2022, Wei Xiaoli's US stocks fell sharply, of which Xiaopeng Motor fell 80.25% for the whole year, making it the new power enterprise with the biggest decline, falling from US $50.33 to US $9.94, while Ulai and ideal fell by 69.22% and 36.45% respectively. According to the latest show, Xiaopeng's share price has fallen to $8.84, with a total market capitalization of $7.575 billion.

In this context, Xiaopeng Automobile made a substantial adjustment to the internal organizational structure on November 30, 2022, and set up five virtual committee organizations to open up the communication channels of all business lines of the company, so as to improve the efficiency of cooperation. At the same time, Xia Heng, co-founder of Xiaopeng Motor, resigned as executive director of the board of directors of the company. Li Pengcheng, former vice president of Xiaopeng Automobile, was appointed as assistant to Xiaopeng Automobile CEO and chose to leave, while Wang Fengying, former general manager of Great Wall Motor, joined Xiaopeng Motor as president.

In addition to the organizational structure, Xiaopeng is also constantly adjusting on the product side. According to media reports, Wang Fengying quickly deployed three major adjustments after joining Xiaopeng Motor: including postponing the online warm-up time of the new P7 from mid-February to early March, thus making the marketing and release rhythm more compact; naming the new P7 P7i and suspending the sales plan for the same period of new and old models; and integrating Xiaopeng's self-management and third-party sales system to set a unified new car listing KPI target according to the region and city.

The first model, P7i, launched after Wang Fengying joined Xiaopeng on March 10, was officially launched with a price range of 249900-339900 yuan, starting slightly higher than market expectations. As a medium-term modified model, the appearance and shape of the P7i has not changed much, mainly aimed at upgrading the configuration, and the SKU is also a lot simpler with the old model.

In addition, in the latest public list of new cars recently released by the Ministry of Industry and Information Technology, Xiaopeng's new product, the main sports style sedan SUV--G6, has been exposed, and the new car is expected to be officially launched in the middle of the year. In September 2022, Xiaopeng G9 was listed. As an important layout of Xiaopeng Automobile in the high-end market, G9 brought inestimable losses due to release mistakes, so the pricing and release strategy of G6 became particularly important. G6 is also considered to be the real "big test" after Wang Fengying joined Xiaopeng.

He Xiaopeng believes that the extremely aggressive price volume in the past two years is inevitable, especially fuel vehicles will face great challenges, and fuel vehicles will certainly fight back. When Xiaopeng makes autopilot in the forefront or even the first place in the future, Xiaopeng will also aggressively occupy a higher position in the relevant pricing market. In the future, with the gradual adjustment of Xiaopeng's organizational structure, it remains to be seen whether new cars such as P7i and G6 can help Xiaopeng reverse the decline under the leadership of he Xiaopeng and Wang Fengying.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.