In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/19 Report--

As of March 19, ideal, NIO and Xiaopeng have released the 2022 Q4 and 2022 financial results one after another, but in terms of time, the ideal is obviously faster than that of Lai and Xiaopeng, whether the sales volume or the annual report is usually the first to be announced. Can show more confidence.

There are more and more products, the price is getting more and more expensive, but making money is getting harder and harder, and the loss is also getting bigger and bigger, which is a true portrayal reflected in the ideal automobile financial report.

The ideal biggest change is the replacement of the model. In September 2022, ideal car announced that it would stop production of ideal ONE, and in September and November, ideal L9 and ideal L8 were delivered one after another. The former is the largest SUV under the ideal car, while the latter is the replacement of ideal ONE.

After the delisting of ideal ONE, ideal L9 and L8 take over successfully. In the first month of delivery, the ideal L9 delivery volume exceeded 10,000, making it the top seller in the large SUV market for two months in a row. The delivery performance of the ideal L8 is also good. In December, both the ideal L9 and the ideal L8 achieved delivery of more than 10,000 vehicles, helping the ideal to become the brand with the fastest monthly delivery of more than 20,000 cars among the new car-building brands. In terms of sales volume, the launch of ideal L9 and ideal L8 is successful.

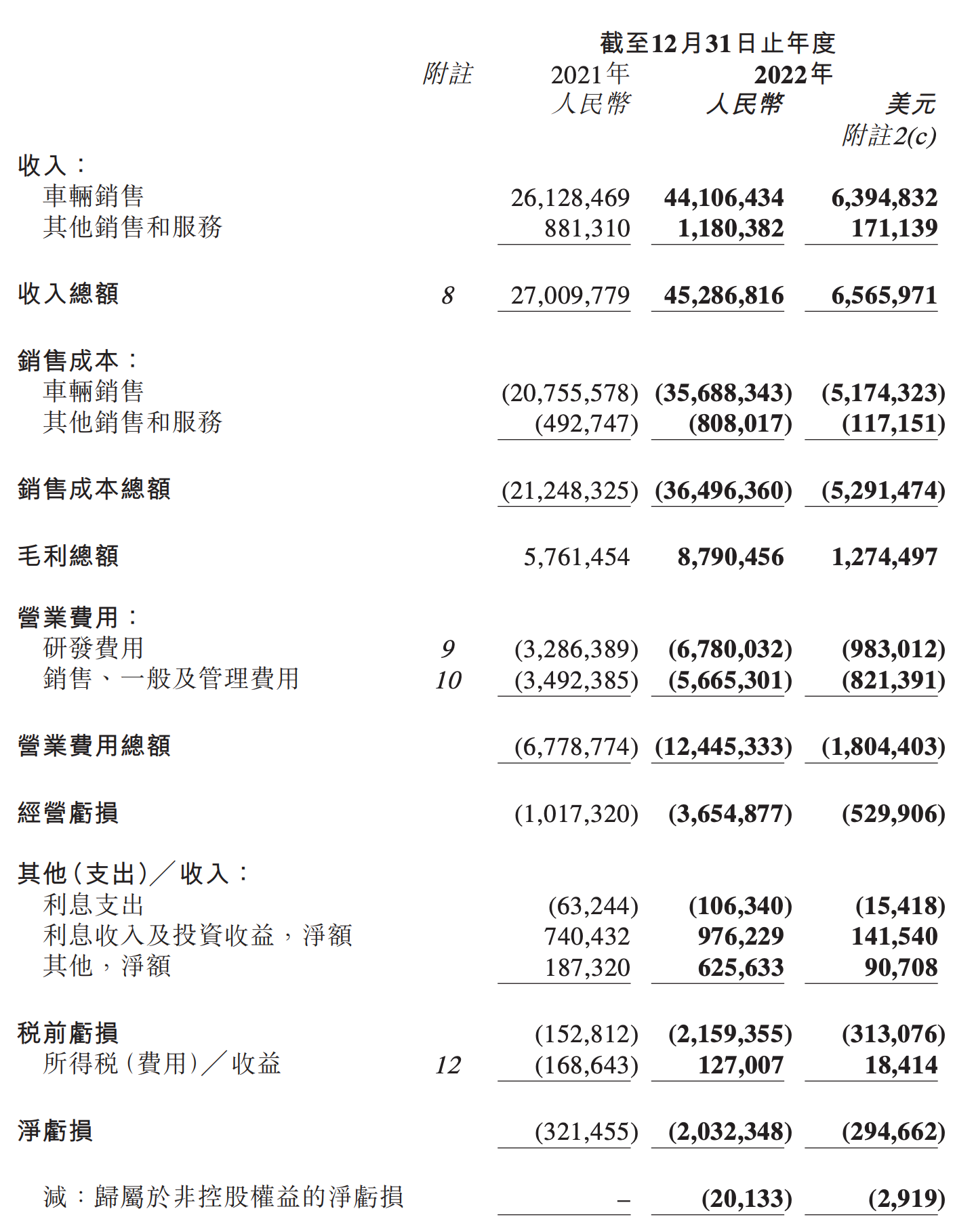

The product line is getting richer and richer, and the development of the ideal car is relatively stable, but the challenge that the ideal faces is not small. In terms of operating profit, the net loss of ideal car in 2022 was 2.03 billion yuan, an increase of 534.21% over the same period last year.

As mentioned above, 2022 is the product year of the ideal car, and higher-end products mean higher added value and higher profit margins. According to the data released by ideal car, the ideal L9 insured 40151 vehicles in 2022, but in fact, the ideal L9 did not achieve the desired effect in driving up the gross profit margin. Even though the gross profit margin of vehicle sales has rebounded sharply, it is still lower than the 22.3% in 2021. As a result, the net profit of Q4 in 2022 shrank, from 296 million yuan in 2021 to 257 million yuan.

In addition, due to new product development, ideal car R & D spending increased by 106.3% to 6.78 billion yuan in 2022 compared with the same period last year, due to an increase in the number of employees, higher overall salaries, and increased spending on new models and technology R & D activities. As for marketing and administrative expenses, it has also increased from 3.49 billion yuan in 2021 to 5.67 billion yuan.

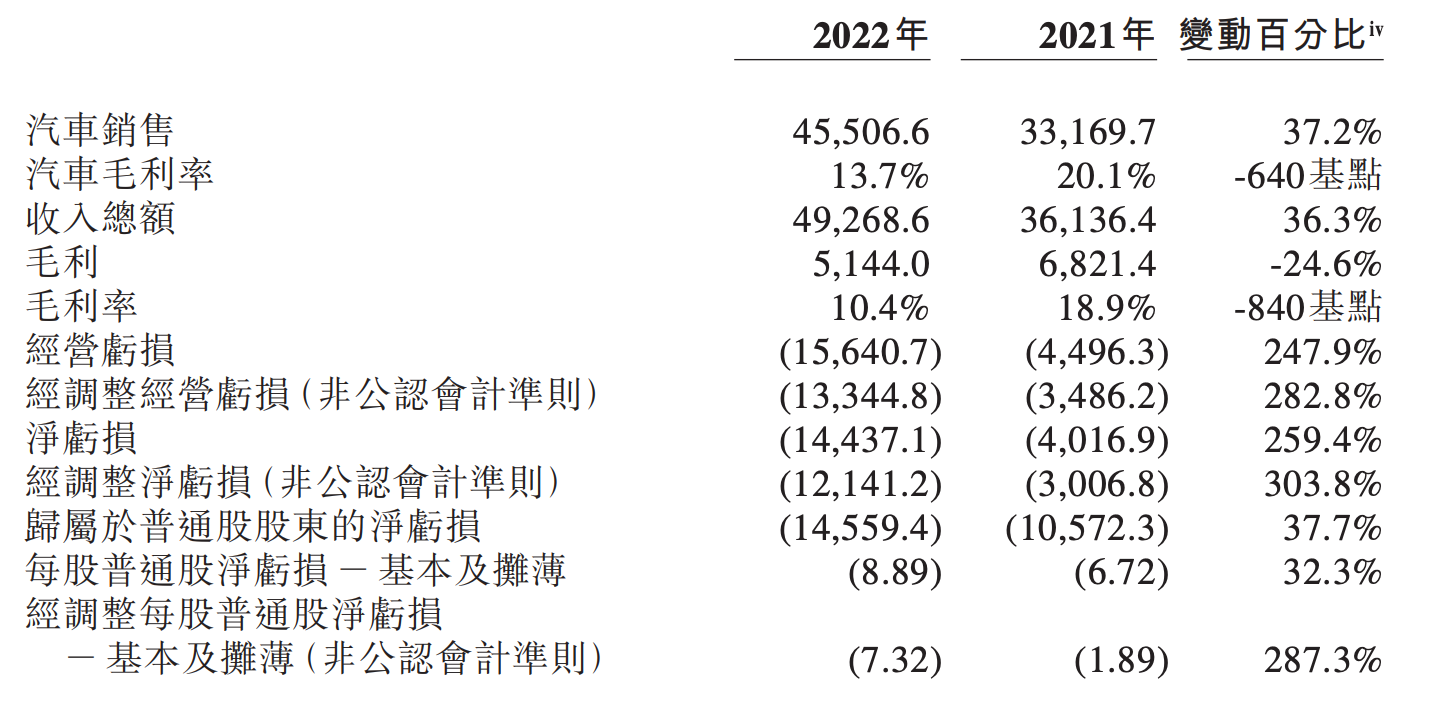

The situation of Xilai Automobile is roughly the same as the ideal, with an increase in delivery volume and operating income, but it also cannot cover up the current situation of losses. In 2022, the net loss of NIO for the whole year was 14.437 billion yuan, while the net loss of NIO in 2021 was 4.017 billion yuan, an increase of 259.4% over the same period last year. At the same time, NIO's gross profit margin also fell sharply, from 18.9% in 2021 to 10.4%, especially in the fourth quarter of 2022, when its car gross margin was only 3.9%.

Of course, it is not difficult to analyze the reasons for the substantial expansion of Xilai's losses. on the one hand, the new energy vehicle industry has experienced multiple challenges in 2022, including rising raw material prices, core shortage, supply chain pressure and increasingly fierce market competition, and on the other hand, enterprise development planning, including replacement station / charging pile construction, new model research and development, new brand planning and new business layout, etc. In 2022, it was revealed that Xilai had launched a new business layout with multiple lines, including new brand projects internally codenamed "Alps" and "Firefly", as well as R & D projects for core components such as batteries and chips, and even the upcoming sale of Lulai mobile phones.

According to the financial report, the R & D expenditure of NIO in 2022 was 10.836 billion yuan, an increase of 136.0% from 4.592 billion yuan in 2021, while the expenditure on sales and administrative expenses increased from 6.878 billion yuan in 2021 to 10.537 billion yuan in 2022, an increase of 57.6% over the same period last year. As the head of the new power, NIO is not stingy in spending on R & D and marketing, which is one of the reasons why its losses continue to expand.

On the earnings call, Li Bin gave himself a shot of chicken blood: the sales target for 2023 is double that of 2022. In other words, at least 240000 vehicles will be delivered in the new year, but it may not be easy to finally achieve this goal. After all, after the rapid growth in the past few years, the new energy vehicle industry as a whole has entered a bottleneck period.

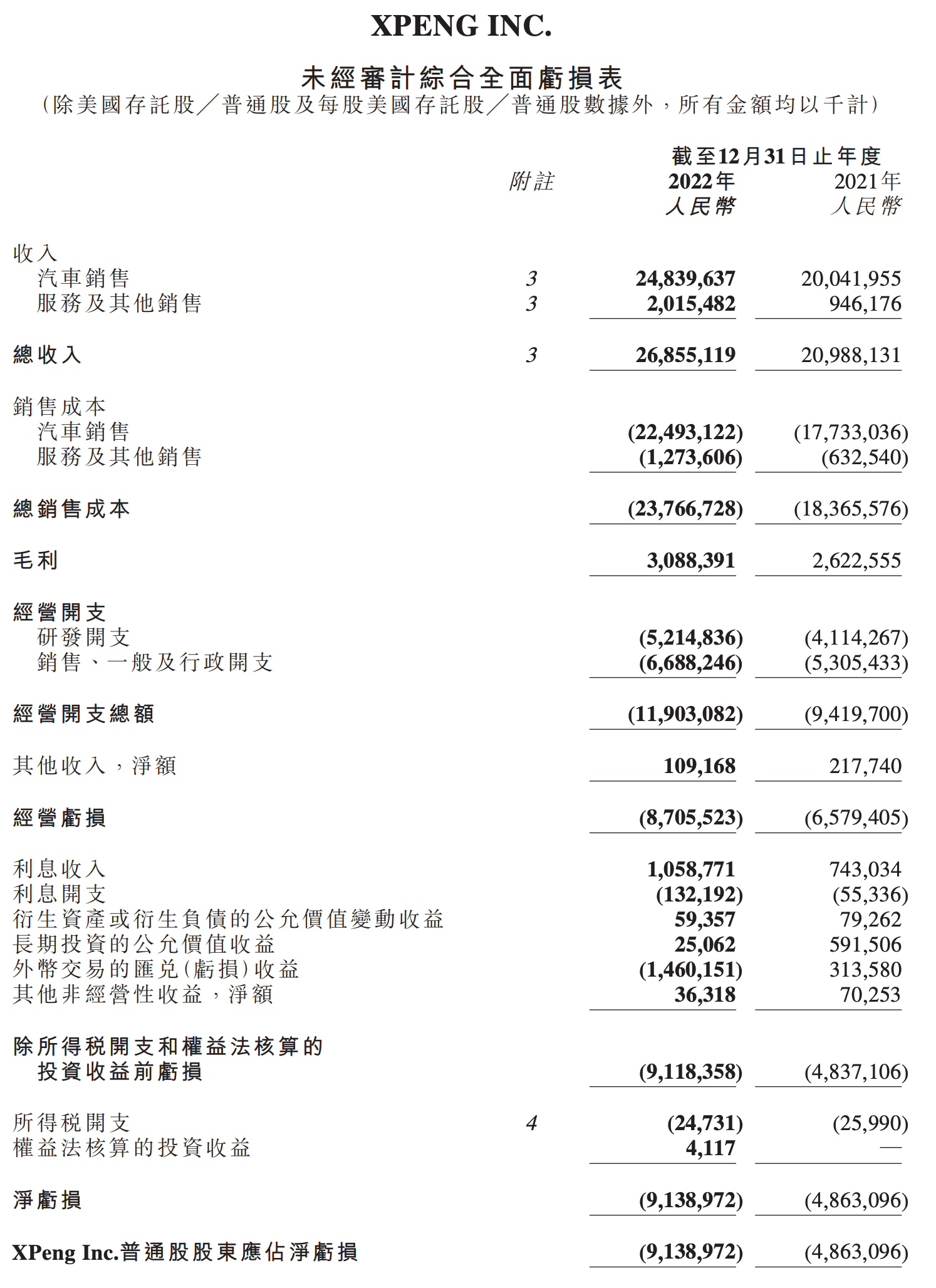

Compared with the ideal and NIO, Xiaopeng is more like an alternative, and the development trend is completely different. In 2022, Xiaopeng made a net loss of 9.14 billion yuan, including a net loss of 2.36 billion yuan in the fourth quarter. While losses are widening, Xiaopeng's gross profit margin is also falling, from 12.5% in 2021 to 11.5% in 2022. Xiaopeng explained that the decline in gross profit margin was mainly due to the increase in sales discounts and the rising cost of materials.

Reviewing the overall sales trend of Xiaopeng Automobile in 2022, it shows a completely different development trend in the first half and the second half of the year. In the first half of 2022, Xiaopeng also became the top new car-building force with a delivery volume of 68900 vehicles, while in the second half of the year, Xiaopeng car sales began to decline, falling from 15295 in June to 5101 in October, four consecutive months of month-on-month decline. it wasn't until December that it returned to the 10,000-car delivery threshold. It is understood that the delivery target of Xiaopeng car in 2022 is 250000, while the actual delivery volume is only 120800, and the target completion rate is less than 50%. As a result, Xiaopeng has lost its annual sales title, and the year-on-year growth rate of delivery volume and delivery volume is not as good as that of Ulai.

In addition to the lower-than-expected delivery volume, Xiaopeng's share price is "plummeting from a height of 3,000 feet." According to statistics, in the past 2022, Wei Xiaoli's US stocks fell sharply, of which Xiaopeng Motor fell 80.25% for the whole year, making it the new power enterprise with the biggest decline, falling from US $50.33 to US $9.94, while Ulai and ideal fell by 69.22% and 36.45% respectively. According to the latest show, Xiaopeng's share price has fallen to $8.84, with a total market capitalization of $7.575 billion.

In this context, Xiaopeng Automobile made a substantial adjustment to the internal organizational structure on November 30, 2022, and set up five virtual committee organizations to open up the communication channels of all business lines of the company, so as to improve the efficiency of cooperation. At the same time, Xia Heng, co-founder of Xiaopeng Motor, resigned as executive director of the board of directors of the company. Li Pengcheng, former vice president of Xiaopeng Automobile, was appointed as assistant to Xiaopeng Automobile CEO and chose to leave, while Wang Fengying, former general manager of Great Wall Motor, joined Xiaopeng Motor as president.

The first model, P7i, launched after Wang Fengying joined Xiaopeng on March 10, was officially launched with a price range of 249900-339900 yuan, starting slightly higher than market expectations. As a medium-term modified model, the appearance and shape of the P7i has not changed much, mainly aimed at upgrading the configuration, and the SKU is also a lot simpler with the old model. In addition, this year, Xiaopeng will also launch a medium-sized SUV-- Xiaopeng G6, as well as the first MPV model, these CX can get a place in the market, is particularly critical.

Among the three enterprises of Wei Xiaoli, ideal is the most likely to be the first to achieve profits, while NIO has always focused on high-end, made some achievements in service, coupled with the layout of power stations, has been in high asset investment, and the loss is also much higher than that of other new power companies. As for Xiaopeng, it is the least optimistic in the current market, and it is also the enterprise with the heaviest sense of crisis, whose products cover a wide range of products, but the actual best-selling model is only P7.

According to the latest statistics, the total market capitalization of ideal cars in the United States is $22.068 billion, while that of Xilai Motor is $13.649 billion, and that of Xiaopeng Motor is $7.575 billion. Yes, the market value of the ideal car has exceeded the sum of Xilai Motors + Xiaopeng cars.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.