In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/08 Report--

On April 7, an entry about "Tesla's price reduction" rushed to the popular search site on Weibo.

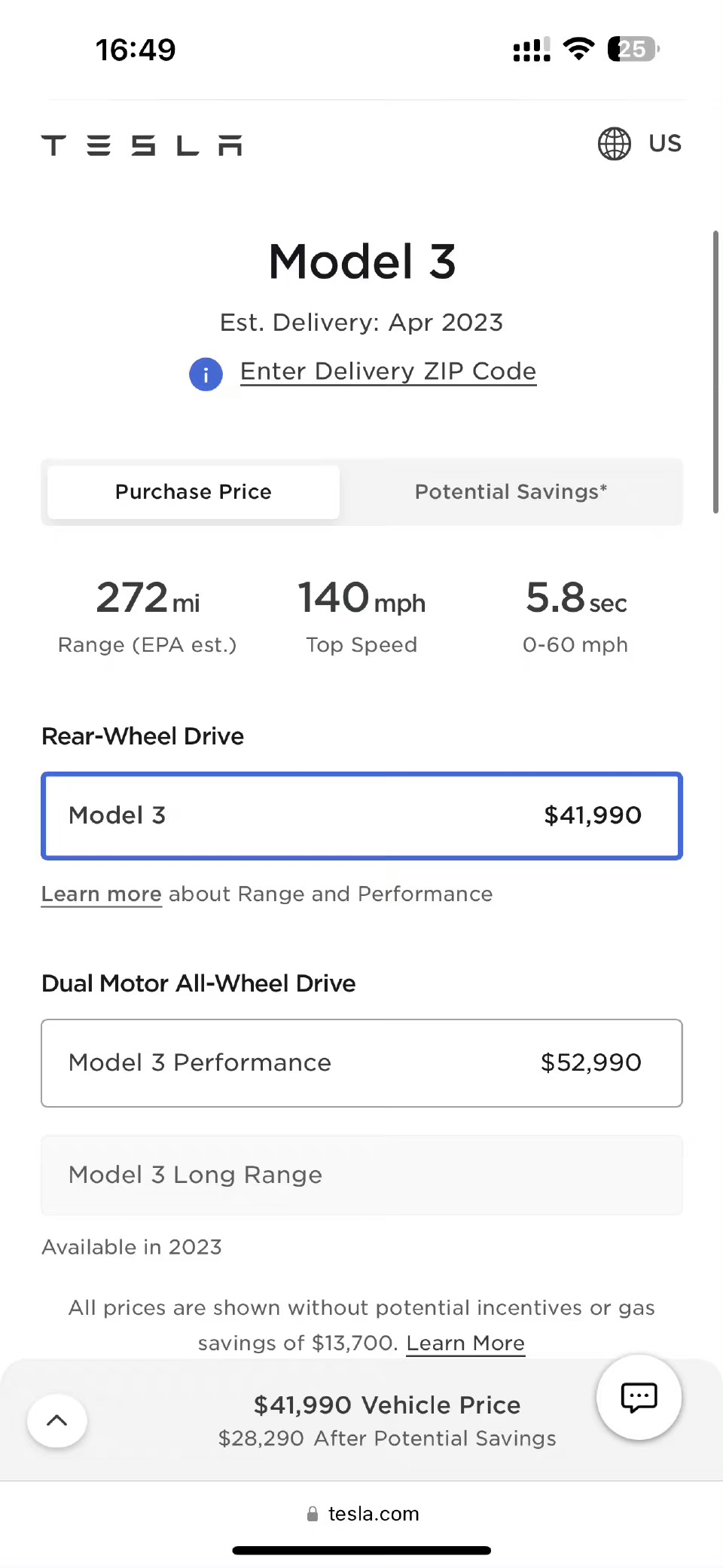

According to Tesla's US official website, Tesla has reduced the prices of all its products in the US market by 2-6 per cent. Among them, the starting price of the Model 3 rear wheel drive version and performance version has been reduced by $1000 (about RMB 6870), the basic Model 3 rear wheel drive model is now priced at $41990 (RMB 288000), and the Model 3 performance version is priced at $52990 (RMB 364000).

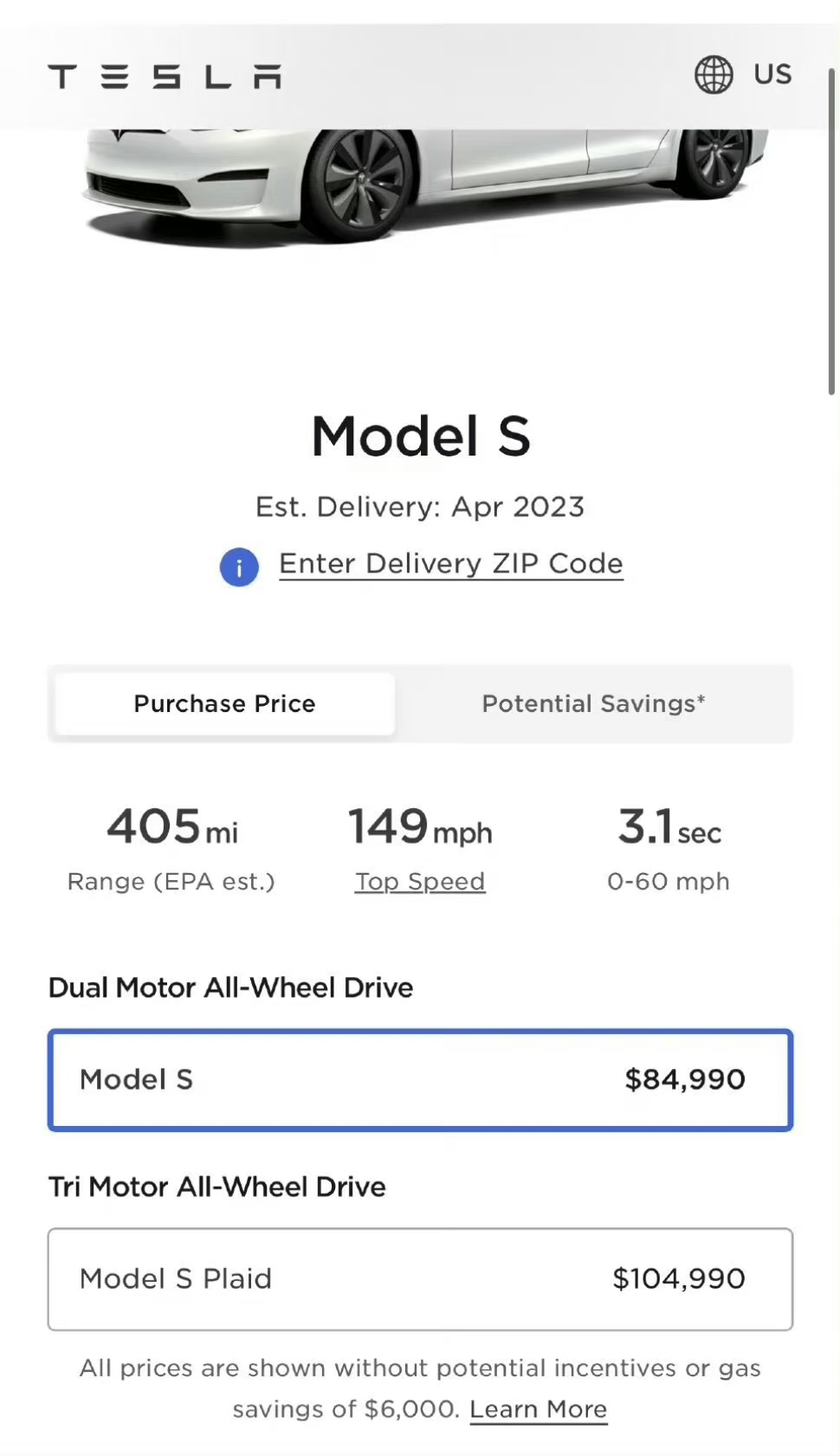

The price of the basic version of the basic Model S and Model X both fell by $5000 (about 34000 yuan). Of this total, the starting price of Model S is reduced to $84990 (584000 yuan) from $89990, and the starting price of Model X is reduced to $94990 (652000 yuan) from $99990. The price of Tesla Model Y long-lasting version and performance version has been reduced by $2000 respectively. The long-lasting version is now priced at $52990 (about 364000 yuan) and the performance version is priced at $56990 (392000 yuan). With regard to the price of Model Y, Tesla also pointed out that all Model Y models comply with the new IRS regulations and can enjoy a tax credit of up to $7500 (about 52000 yuan).

For the price reduction of Tesla in the US market, Tesla CEO Musk subsequently responded on the social platform: the reason for the price reduction is not that there is no demand for Tesla, but that everyone has no money and cannot afford it. Only by lowering the car price can the demand be truly met. At the same time, Musk said: "many wealthy critics do not understand that large-scale demand is limited by affordability. We have a lot of demand for our products, but if the price is more than the money people have, then the demand doesn't matter. "

It is worth noting that this is Tesla's third price reduction in the US market this year. In January this year, Tesla significantly adjusted the price of his models in the United States. On January 12th, Tesla slashed the models on sale in the US market, including the Model 3 by $3000, or 6 per cent, from $46990 to $43990. Model Y fell by $13000, or 20 per cent, to $52990 from $65990. Model S was cut by $10000, or 10 per cent, from $104990 to $94990. Model X was cut by $11000, or 9 per cent, from $109990 to $109990.

On March 6th, Tesla cut the price of models in the US market again. Model S fell from $94990 to $89990, Model S Plaid from $114990 to $109990, Model X from $109990 to $99990, and Model X Plaid from $119990 to $109990.

Of course, Tesla's price reduction in the U. S. market may be related to falling car-building costs, falling lithium carbonate prices in North America and high gross margins. At the recent Tesla Investor Day, Tesla said: the next generation platform will reduce the use of silicon carbide by 75 per cent, the next generation of permanent magnet motors will not use rare earth materials at all, and the total manufacturing cost will be reduced by 1000 US dollars. the goal is that the next generation of cars can be assembled by more people at the same time, reducing assembly costs by 50 per cent. The collapse in the price of lithium carbonate in North America has also further reduced the cost of battery production for Tesla's vehicles. According to the CBC metal net, the average price of lithium carbonate in North America on April 7 was 36700 US dollars per ton, which was nearly double the average price of 60000 US dollars per ton on March 7.

In addition, as we all know, Tesla's ability to reduce prices has something to do with his high gross profit margin. According to the latest financial report released by Tesla, Tesla achieved operating income of US $81.462 billion in 2022, an increase of 51.4% over the same period last year, including auto sales revenue of US $67.21 billion, an increase of 52.32% over the same period last year, and net profit of US $12.556 billion, an increase of 127.8% over the same period last year. Tesla's gross profit margin reached 25.6% in 2022, much higher than that of the world's major automakers. In other words, as long as Tesla wants to reduce the price, he only needs to sacrifice part of the profit in exchange for sales, and there is a lot of room for price reduction.

The price of the Tesla model in the US market has been cut all over the country, and the question of whether the Chinese market will follow suit has also sparked a heated debate on the Internet. In this regard, Tesla, a relevant person in charge of China, revealed to the media that "no price reduction notice has been received yet." However, as to whether the Chinese market will reduce prices, many industry insiders said: judging from Tesla's price reduction trend in 2022, there is still a lot of room for price reduction, and there is a good chance that it will. In fact, with the continuous expansion of the scale effect of Tesla vehicle production and the reduction of supply chain costs, Tesla still has a lot of room for price decline, and it is not ruled out that he will continue to raise the price butcher's knife.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.