In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/20 Report--

An entry about "Tesla's profit plummeted 20 per cent in the first quarter" went viral on Weibo today.

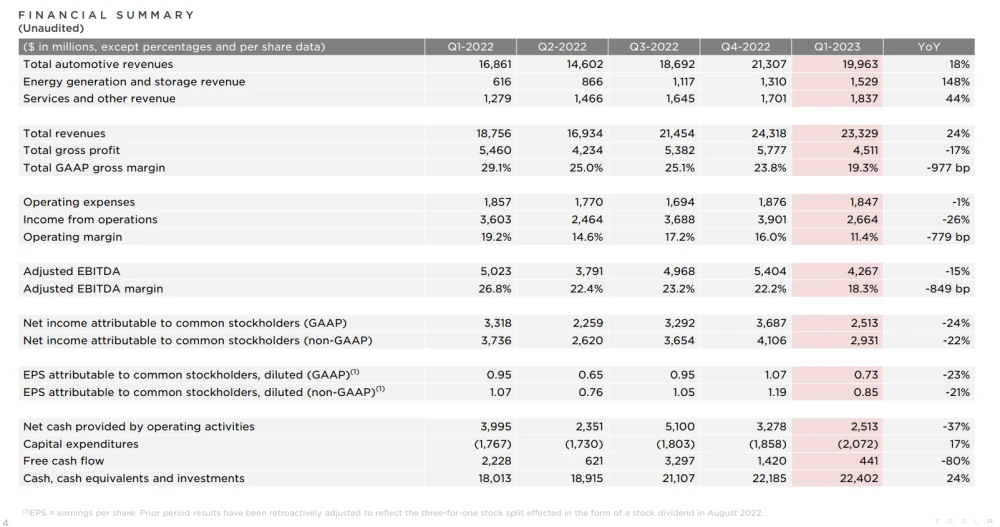

Tesla released its latest performance report on April 19, according to the report: in the first quarter of 2023, Tesla achieved revenue of US $23.329 billion, an increase of 24% over the same period last year, compared with US $18.756 billion in the same period last year. First-quarter net profit was $2.513 billion, down 24% from a year earlier and $3.318 billion in the same period last year. In terms of gross profit, Tesla's gross profit was 4.511 billion US dollars in the first quarter, down 17% from the same period last year. The total gross margin was 19.3%, down over 9.77% compared with 29.1% in the same period last year, compared with 23.8% in the previous quarter. Tesla's free cash flow was $441 million in the first quarter, down 80% from a year earlier, compared with $2.228 billion in the same period last year.

In terms of delivery volume, Tesla produced 440808 vehicles in the first quarter, up 44 per cent year-on-year and 2.5 per cent month-on-month. Delivery volume was 422875 in the first quarter, up 36 per cent year-on-year and 4 per cent month-on-month. Specific model production and sales are as follows: production of Model S and Model X was 19437, up 37 per cent year-on-year, delivery was 10695, down 27 per cent year-on-year, production of Model 3 and Model Y was 421371, an increase of 45 per cent, and delivery was 412180, an increase of 40 per cent.

Or affected by the news, as of April 19, Tesla's secondary market was at US $180 per share, down more than 2%, with a total market capitalization of US $572.3 billion.

With regard to the decline in gross profits in the first quarter, Tesla said that "underutilization by new factories" depressed profit margins, coupled with higher costs of raw materials, commodities, logistics and warranties, lower average selling prices of vehicles, higher production costs of 4680 batteries and lower revenue from selling carbon credits to traditional carmakers, all led to lower profitability compared with the same period last year. It said it had taken a series of measures to deal with market competition and rising costs. This includes improving product quality, reducing production costs and speeding up the research and development of new products. It is believed that the implementation of these measures will help Tesla to restore its profitability in the future.

At the same time, Tesla also said: "taking into account the potential life cycle value of Tesla cars through autonomous driving, fast charging, connection capacity and services, the recent pricing strategy takes into account the long-term profitability of the unit vehicle." The company's operating profit is in the forefront of the industry, and the cost of the vehicle produced is reducing. after the price reduction, the operating profit margin still decreases at a controllable rate, and further price increases or price reductions cannot be ruled out in the future. On the issue of price reduction, Tesla CEO Musk also said at the earnings meeting that Tesla's orders exceeded production, and the time has come to sell cars in more global markets, and it is best to ship large quantities at lower prices.

It is worth noting that since January this year, Tesla has launched a global price reduction. Tesla announced a price reduction in China on January 6, with the starting prices of its two domestic models reduced, including a drop of 2.0-36000 yuan for Model 3 and 2.9-48000 yuan for Model Y. Specifically, the price of Model 3 rear-drive version is reduced by 36000 yuan, the high-performance version by 20000 yuan, the Model Y rear-drive version by 29000 yuan, the long-lasting version by 48000 yuan, and the high-performance version by 38000 yuan. After that, in addition to the Chinese market, Tesla also made a big price reduction in overseas markets, and Japan, South Korea, Australia and other countries all started price cuts. Take the Japanese market as an example, Tesla Model 3 starts at 5.369 million yen, Tesla Model Y starts at 5.799 million yen, and the prices of the two models are reduced by about 10% each.

On April 18, Tesla again lowered the prices of Model Y and Model 3 models in the US market. It is understood that this reduction is Tesla's sixth price reduction in the United States this year. The specific reduction is as follows: Tesla Model Y dual-motor all-wheel drive board price reduced by $3000 (about 20000 yuan), the adjusted price is $46990, the long-range version of Model Y is reduced by $3000, the adjusted price is $49990, the price of Model Y high-performance version is reduced by $3000 to $53990, and the price of Model 3 rear wheel drive version is reduced by $2000, from $41990 to $39990.

Of course, Tesla started price reduction around the world, this price reduction strategy can indeed boost Tesla's sales, but at the same time, it is bound to have a certain impact on its gross profit margin. The purpose of Tesla's price reduction is to stimulate demand and improve sales figures. However, judging from the latest delivery volume announced by Tesla, the increase in delivery volume brought about by the price reduction is not obvious, from the decline in the secondary market, it may also mean that investors are worried about Tesla's profit margin.

Earlier, Zachary Kirkhorn, chief financial officer of Tesla, said Tesla could keep the gross profit margin above 20 per cent in 2023. However, for the car gross profit margin to remain above 20%, some industry insiders pointed out that it may be difficult to maintain. After all, the price reduction policy implemented by Tesla this year has generally dragged down Tesla's profitability. If price cuts continue, adding to the knock-on effects of the banking crisis on consumers, increased EV competition and slowing economic growth, Tesla's gross margin target of 20 per cent may not be met in the coming quarters.

However, some netizens said: Tesla's profit fell by 20%, indicating that Tesla is trading price for quantity to seize the market. Although it seems to have lost a little bit of profit now, when the time is ripe, it will be made up by the profits of autopilot or auxiliary driving services.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.