In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/24 Report--

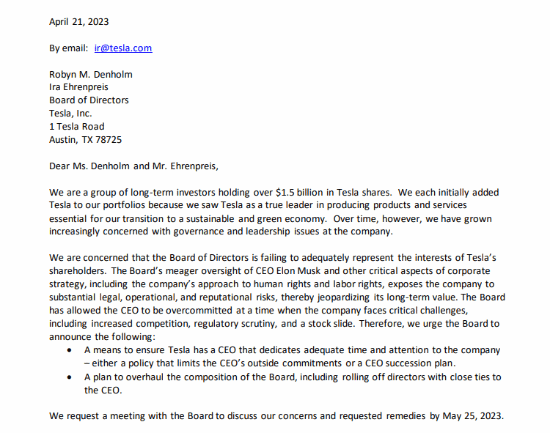

Recently, an open letter from 17 Tesla institutional investors was published online, which is believed to show that these institutional investors believe that Tesla CEO Musk has been distracted by other companies and must be controlled. It is hoped that the board will come up with a solution plan to limit Mr Musk's distraction from managing outside companies or propose a succession plan for CEO, as well as requiring the replacement of directors who are too close to Mr Musk. It is understood that the 17 institutional investors who issued the open letter hold more than 1.5 billion US dollars worth of Tesla shares.

To the dissatisfaction of many investors, Mr Musk is paying too much attention to the operations of other companies, according to one investor who published the letter. It pointed out that when Tesla's share price plummeted last week, Mr Musk was watching the first test of a new generation of heavy carrier rocket Starship from another company, SpaceX. In addition, Musk has spent a lot of time and energy on Twitter operation since he bought Twitter and served as CEO in 2022. It hopes that Musk can focus on Tesla, so that he can cope with the increasingly fierce market competition and the pressure of US regulatory review.

Relevant data show that SpaceX is an American space exploration technology company, founded by Musk in 2002. SpaceX's main business is to launch satellites and provide freight services to the International Space Station. In the 20 years since its founding, SpaceX has made a number of breakthroughs. In 2006, SpaceX announced that it was awarded a contract for NASA's commercial orbital transport service, which also means that SpaceX has evolved into an option to transport cargo to the International Space Station. In 2008, SpaceX won a contract for commercial resupply services worth $1.6 billion from NASA, guaranteeing a resupply mission for the International Space Station after the shuttle was decommissioned in 2010. In 2012, SpaceX successfully put the Dragon capsule into orbit, the first time a SpaceX cargo spacecraft officially undertook the task of transporting goods to the International Space Station.

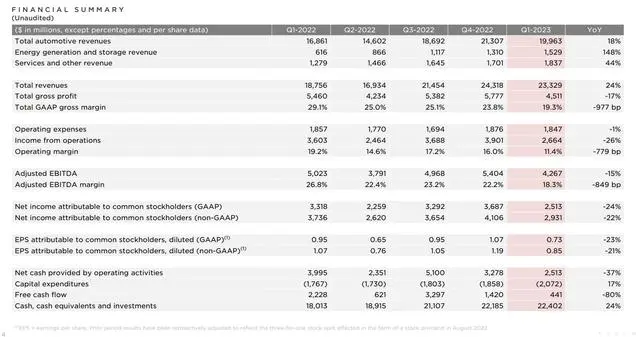

It is worth noting that the release of the open letter by investors has something to do with the recent collapse in Tesla's market value. On April 19th, Tesla released his financial results for the first quarter of 2023. According to the financial report, Tesla achieved revenue of US $23.329 billion in the first quarter of 2023, an increase of 24% over the same period last year, compared with US $18.756 billion in the same period last year. First-quarter net profit was $2.513 billion, down 24% from a year earlier and $3.318 billion in the same period last year. Gross profit in the first quarter was $4.511 billion, down 17% from a year earlier.

Since the beginning of October last year, Tesla has launched price reduction activities frequently, but the price reduction strategy is a double-edged sword. Although it can boost Tesla's sales, it also makes Tesla's gross profit margin decline. In addition, according to the latest first-quarter delivery volume announced by Tesla, the increase in delivery volume brought about by the price reduction is not obvious, and it is not difficult to see investors' concern about Tesla's profit margin from the decline in the secondary market. In response to falling profits, Mr Musk said Tesla could sacrifice his industry-leading profit margins to achieve growth during the recession and keep pace with competitors in the Chinese market. At the same time, he said: "before we improve our self-driving technology, it is best to sell more cars with lower profit margins and reap profits in the future."

Of course, apart from Tesla's announcement of first-quarter results that affected his market value, another reason is that on April 20, a super heavy rocket designed by Musk's SpaceX lifted off in Texas, USA. Four minutes later, the rocket exploded and disintegrated in the air, resulting in a failed launch. Or affected by these factors, Tex Latin American stocks fell more than 5% after trading last Wednesday. As of press time, Tesla was quoted at $165.08 per share, with a total market capitalization of $523.2 billion, losing more than $70 billion in a week.

As for Tesla's recent performance in the secondary market, Wall Street analyst David Trenner said: Tesla's target price should be $28. It pointed out that Tesla's delivery growth has been lower than the earlier target of 50 per cent for four consecutive quarters. If Tesla fails to achieve his growth target, he will be reassessed in many ways. Even if Tesla's sales increase by another 3.5 times, Tesla's share price still has more than 85 per cent downside. However, the founder of the Ark Fund said: Tesla's autopilot technology is about to mature, the prospect is attractive.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.