In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/29 Report--

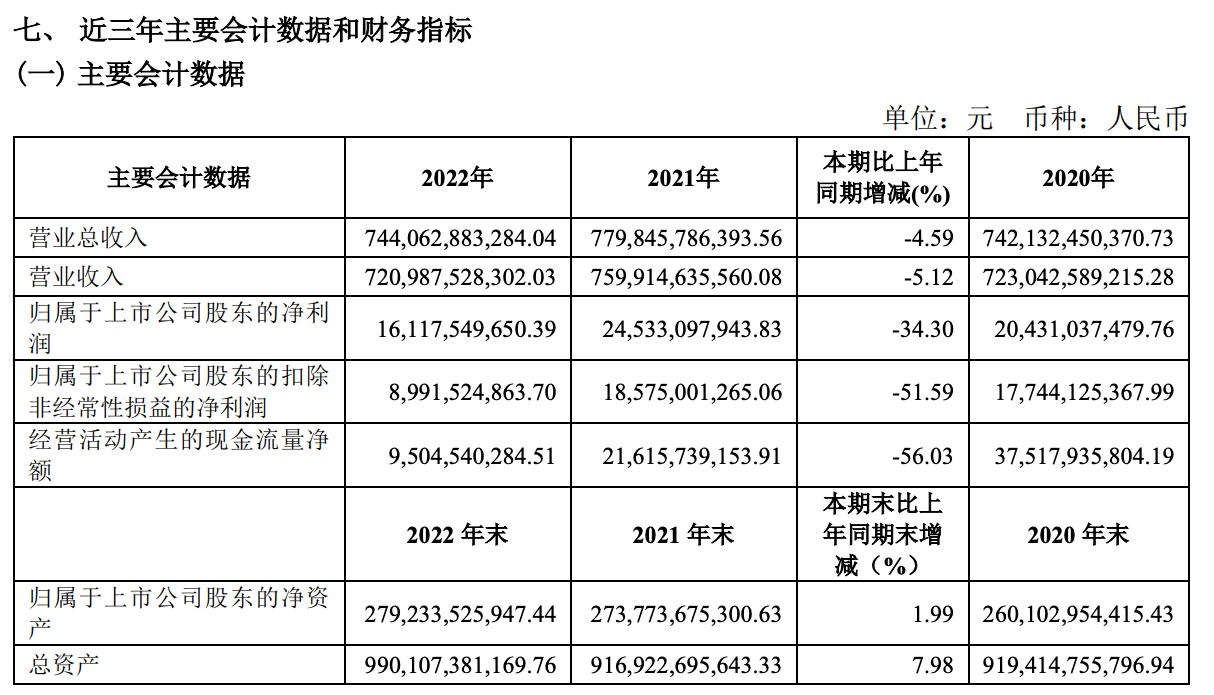

On the last working day of April, SAIC disclosed its annual financial report as scheduled. According to the data, the total operating income of SAIC in 2022 was 744.063 billion yuan, down 4.59% from the same period last year; the net profit belonging to shareholders of listed companies was 16.117 billion yuan, up 34.30% from the same period last year; and the net profit belonging to shareholders of listed companies after deducting non-recurring gains and losses was 8.99 billion yuan, down 51.59% from the same period last year.

SAIC said that in 2022, the operation of the industrial chain supply chain was blocked, the market fluctuated sharply, and the high price of raw materials and other higher-than-expected factors affected the company's performance. Especially in the first half of 2022, the operation of the automobile industry chain supply chain is blocked, the supply and demand ends are greatly under pressure, and the whole industry is extremely difficult.

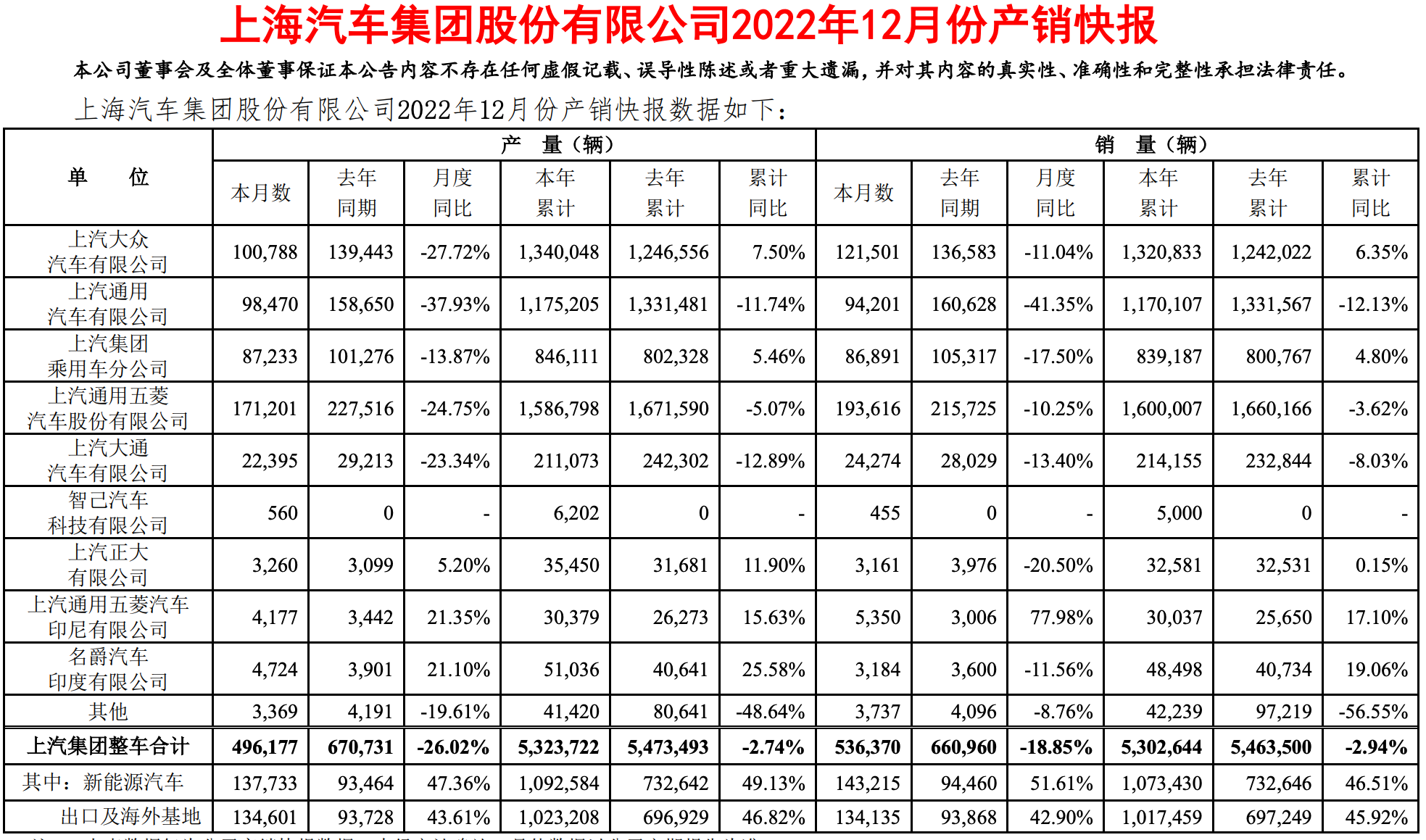

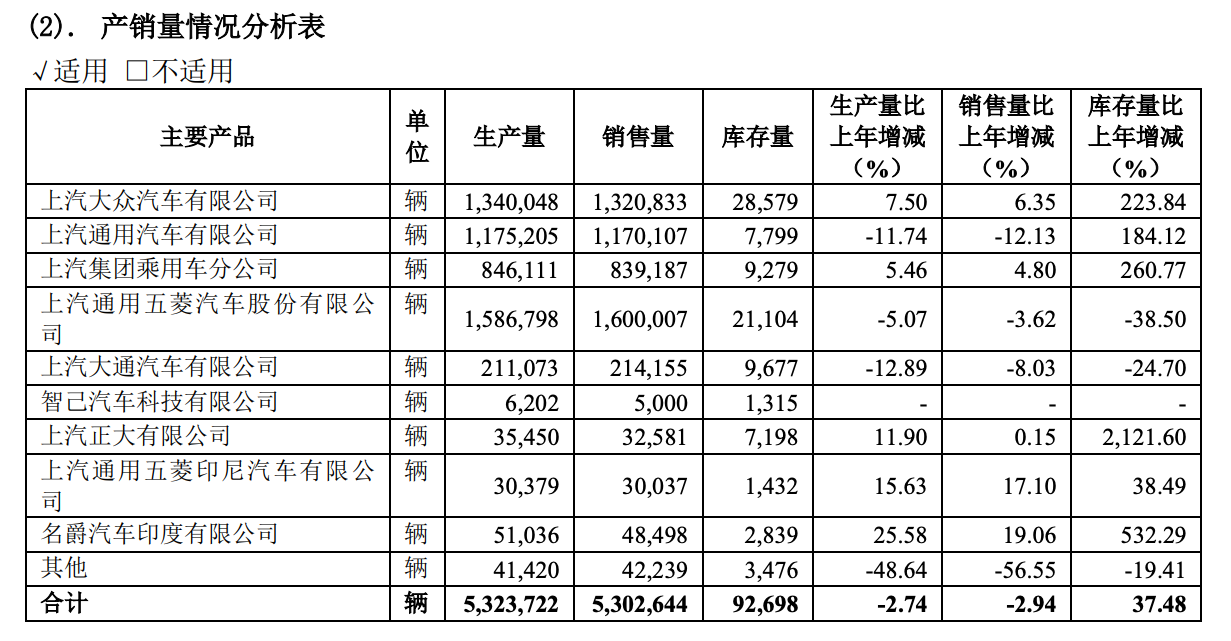

Data show that SAIC's wholesale sales during the reporting period were 5.3026 million vehicles, down 2.94% from the same period last year, and its annual sales target of 6 million vehicles was 88.4%. It is worth mentioning that this is the fourth year in a row that SAIC's sales have declined. SAIC sold 7.052 million vehicles in 2018, of which joint venture brands accounted for more than 86%. Since 2019, SAIC has gradually fallen below the 7 million and 6 million mark.

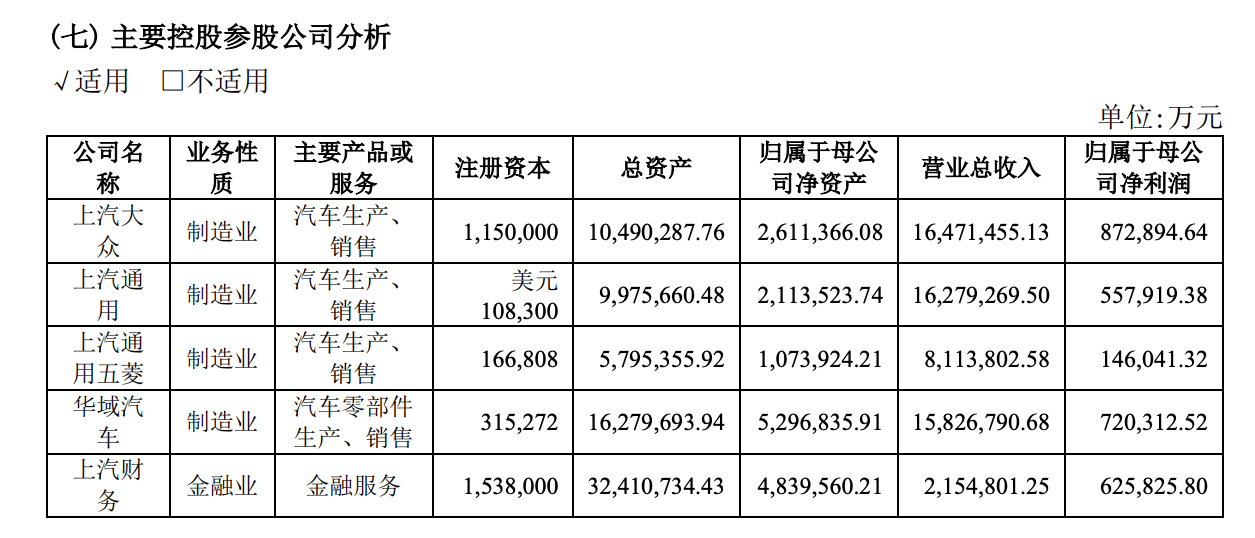

SAIC-Volkswagen and SAIC-GM are still the source of profits for the group, but the halo of the two joint ventures is gone. During the reporting period, SAIC-Volkswagen accumulated wholesale sales of 1.3208 million vehicles, up 6.35% from the same period last year, and its net profit was 8.729 billion yuan, down 14.30% from the same period last year. In addition, SAIC GM Wuling, which focuses on the low-end market, achieved growth, although year-on-year sales fell 3.62% to 1.6 million vehicles, but net profit increased by 28.64% to 1.135 billion yuan.

Under the cruel knockout stage of the industry, joint venture brands are losing their pricing power in the Chinese market. Class B models are subject to Tesla, and A-class cost-effective products are controlled by independent brands. The price of the champion version of BYD Qin PLUS has entered the price range of SAIC Volkswagen Lang Yi, whose fuel vehicle price system has been greatly affected. At the same time, the joint venture brand is ill-prepared for the transformation of new energy, which currently has a penetration rate of less than 5%. Industry insiders said that the joint venture car company has a long decision-making process, and the product definition used to be controlled by foreign parties. Once the foreign investment in resources is insufficient, it will be difficult to catch up with the fierce competition and fast iterative speed of the new energy vehicle market in China.

In addition, Zhiji and Feifan, the two major new energy brands of SAIC, have not yet gained a foothold in the middle and high-end new energy market. At the same time, the trend of new energy vehicles replacing fuel vehicles is irreversible, but at present, fuel vehicles still occupy more than 70% of the market share in China, and enterprises in transition have to face the embarrassing situation that "the growth of electric vehicles does not make money." the embarrassing situation that the fuel vehicles that make money do not grow.

In other words, joint venture brands can only maintain the market performance in the future, while SAIC can only rely on new energy vehicles for upward breakthroughs. Although Zhiji and Feifan brands have invested a lot of resources, there is still a long way to go to achieve blood recovery.

In 2023, SAIC set another sales target of 6 million vehicles, while SAIC sold 1.2206 million vehicles in the first quarter, down 26.99% from a year earlier, with a target completion rate of 20.3%. SAIC's sluggish sales are closely related to the decline of joint venture brands, including SAIC-Volkswagen down 31.67% year-on-year, SAIC GM Wuling down 40.96%, and self-branded automobiles and SAIC Chase both achieve year-on-year growth.

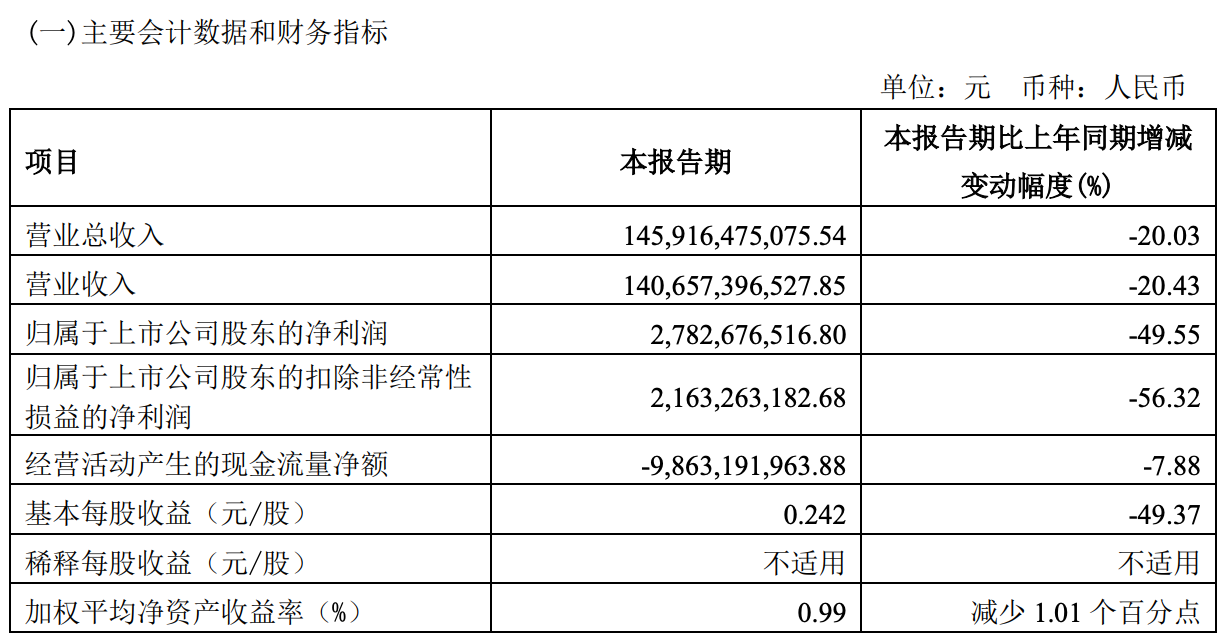

The first quarter results show that SAIC achieved operating income of 145.965 billion yuan, bluffing 20.03% compared with the same period last year; net profit belonging to shareholders of listed companies was 2.783 billion yuan, down 49.55% from the same period last year; net profit belonging to shareholders of listed companies after deducting non-recurring gains and losses was 2.163 billion yuan, down 56.32% from the same period last year

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.