In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/02 Report--

Recently, domestic automobile companies have released their 2022 annual financial reports for the sixth time. In the annual reports of 20 A/H listed automobile enterprises counted in "Automobile Industry Concern," including SAIC Group, Jianghuai Automobile, Dongfeng Motor, Brilliance China and Zotye Automobile, revenue and profits have fallen, especially SAIC Group. Although it owns SAIC Volkswagen and SAIC GM, it is no longer the most profitable automobile enterprise in China. Its net profit has been overtaken by BYD.

From the financial report to see, the differentiation between each big car enterprise is very obvious. As the automobile enterprise with the largest market value in China, BYD's performance is also the most outstanding. In 2022, BYD's annual operating income was 424.061 billion yuan, with a year-on-year growth of 96.20%; net profit was 16.622 billion yuan, with a year-on-year growth of 445.86%; According to the data, although BYD's operating income is far less than SAIC Group, it is the most profitable automobile enterprise in China, surpassing SAIC Group's net profit of 16.118 billion yuan by a slight advantage of 500 million yuan.

It should be noted that BYD's profit source is not only in the automobile business, but also includes mobile phone parts and assembly business, secondary rechargeable batteries and photovoltaic, but the automobile business is the source of BYD's profit growth. In April 2022, BYD announced that it would officially stop production of fuel vehicles and focus on pure electric and plug-in hybrid vehicles in the future. Cui Dongshu, secretary-general of the Association, said that with the technological breakthrough of blade battery and DMI hybrid technology, coupled with its strong vertical integration capability, BYD's move will accelerate the effective replacement of international brand fuel vehicles.

According to the data of the Passenger Association, BYD sold 1.805 million narrow passenger cars in 2022, with a year-on-year growth of 149.4%, overtaking FAW-Volkswagen as the top passenger car market in China, which sold 1.779 million vehicles in 2022, basically the same as 2021. In addition, BYD beat Tesla (1.31 million units sold in 2022) to become the world's top seller of new energy vehicles with outstanding sales performance. Before that, Tesla had been the world's new energy vehicle sales champion for three consecutive years.

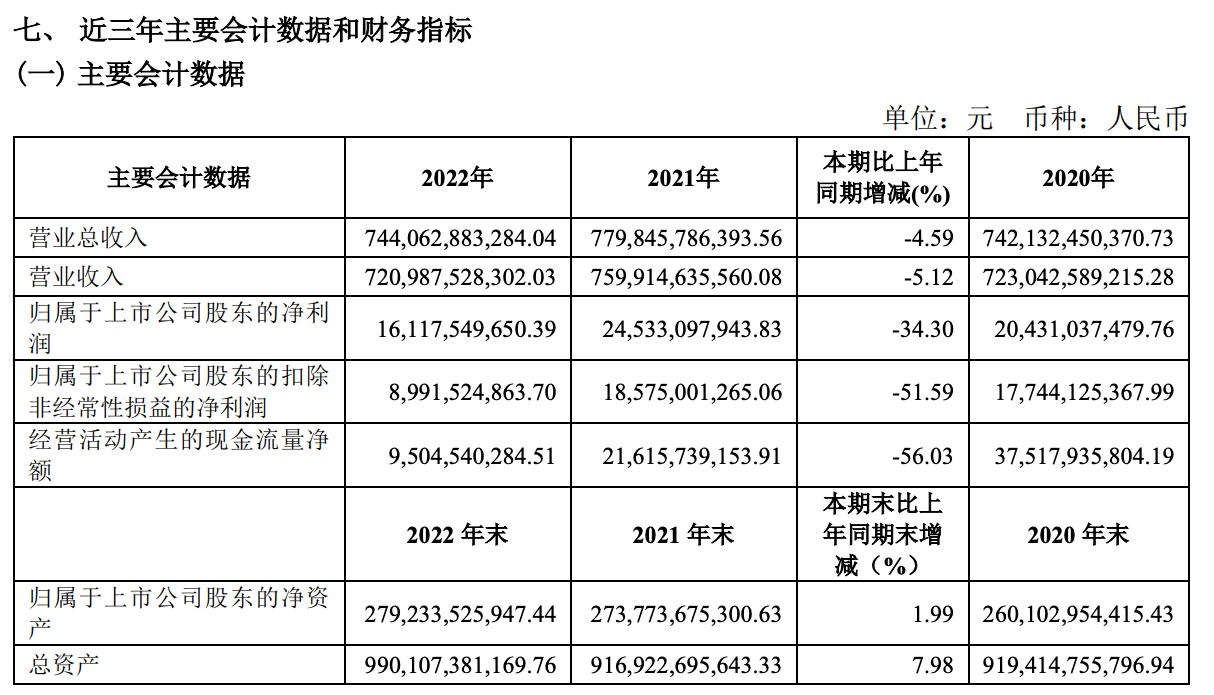

SAIC remains the largest automaker in China, but that doesn't mean it's the most profitable. In 2022, SAIC Group's operating revenue was 744.063 billion yuan, down 4.59% year-on-year; net profit was 16.117 billion yuan, down 34.30% year-on-year; SAIC Group said that in 2022, the supply chain operation of the industrial chain was blocked, the market fluctuated greatly, the raw material price was high and other unexpected factors had an impact on the company's performance. Especially in the first half of 2022, the operation of the supply chain of the automobile industry chain was blocked, and both ends of supply and demand were greatly under pressure, so the whole industry was extremely difficult.

According to the data, the wholesale sales volume of SAIC Group during the reporting period was 5.3026 million vehicles, down 2.94% year-on-year, and the completion rate of its annual sales target of 6 million vehicles was 88.4%. It is worth mentioning that this is the fourth consecutive year of decline in sales volume of SAIC Group. In 2018, SAIC Group sold 7.052 million vehicles in the whole year, among which joint venture brands accounted for more than 86%. Since 2019, SAIC Group gradually fell below 7 million vehicles and 6 million vehicles.

Under the cruel industry knockout competition, joint venture brands are losing pricing power in the Chinese market. SAIC owns SAIC Volkswagen and SAIC GM, but its development in the domestic market has been weak, among which SAIC Volkswagen's net profit was 8.729 billion yuan, down 14.30% year-on-year. Industry insiders said that the decision-making process of joint venture automobile companies is long, and the product definition was mostly controlled by foreign parties in the past. Once the foreign resources are insufficient, it will be difficult to catch up with the fierce competition and rapid iteration speed of the new energy automobile market in China.

In addition to BYD, the manufacturers that achieved profit double increase also included Beijing Automobile, Geely Automobile, Great Wall Automobile, Chang 'an Automobile, Guangzhou Automobile Group, Lifan Technology, Great Wall Automobile, Chang' an Automobile and Guangzhou Automobile Group. Although their revenues lagged behind Beijing Automobile and Geely Automobile, they showed strong profitability with net profits of 8.266 billion yuan, 7.798 billion yuan and 8.068 billion yuan respectively.

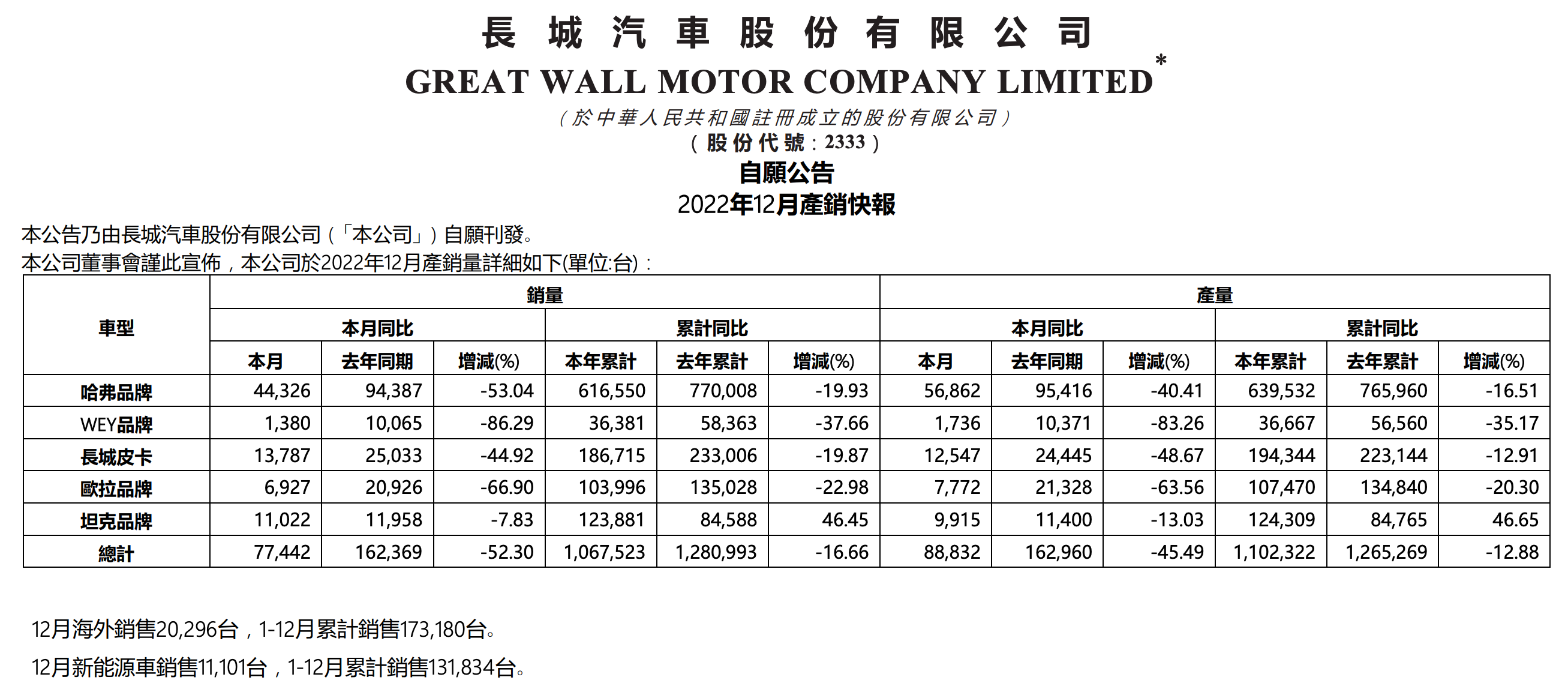

From the perspective of profitability, Great Wall Motor belongs to the middle and upper level. In 2022, the total sales volume of Great Wall Motors was 1,067,500 vehicles, down 16.67% year-on-year. According to the data released by Great Wall Motor, the total sales volume of Great Wall pickup truck, Haval and Wei brand last year was 186,700 vehicles, 616,600 vehicles and 36,400 vehicles respectively, down 19.87%, 19.92% and 37.24% year-on-year respectively. Only tank brand realized growth. The brand sold 123,900 new vehicles in 2022, with a year-on-year growth of 45.76%. However, although the sales volume of Great Wall Motors has fallen sharply, it has achieved double profit increase. Great Wall Motor said that the increase in net profit was due to the company's optimization of product structure, gross profit growth due to rising bicycle prices, and increased exchange rate gains.

New energy enterprises, including NIO, Ideal, Xiaopeng, Zero Run, Beiqi Blue Valley and Selis, are still unable to escape the "magic spell" of losses when the head enterprises earn a lot of money.

In 2022, the revenues of NIO, Xiaopeng, Ideal and Zero Run reached 49.269 billion yuan, 26.86 billion yuan, 45.29 billion yuan and 12.38 billion yuan respectively, with year-on-year growth of 36.34%, 27.95%, 67.67% and 295.4% respectively. At the same time, the losses are also expanding synchronously, with losses of 14.437 billion yuan, 9.14 billion yuan, 2.032 billion yuan and 5.108 billion yuan respectively, among which NIO and Xiaopeng have both set the largest annual losses since vehicle delivery in 2018. "Automobile Industry Concern" believes that the continuous expansion of losses of NIO and Xiaopeng is the result of large-amount R & D investment to improve the long-term competitiveness of enterprises. The new force of car building needs to reach the annual delivery scale of about 300,000 vehicles before it is expected to turn around.

Affected by the epidemic situation, SAIC Group, located in the Yangtze River Delta region, has a somewhat ugly half-year performance. Financial report shows, In the first half of 2022 SAIC Group operating income 315.993 billion yuan, Year-on-year decline 13.69%; Net profit 6.91 billion yuan, Year-on-year decline 48.10%; For net profit, Deducted non-net profit year-on-year decrease, SAIC Group said, The main reason is the epidemic rebound on the automobile industry chain supply chain caused serious impact, Cause the company sales revenue reduction. At the same time, the chip supply is tight, the price of raw materials such as power batteries rises sharply, which adversely affects the gross profit margin of products.

Beiqi Blue Valley and Celis have lost money for three consecutive years. Among them, Beiqi Blue Valley net loss of 5.465 billion yuan, before 2020 and 2021 respectively lost 6.482 billion yuan, 5.244 billion yuan, three years accumulated loss of more than 17.2 billion yuan; during the reporting period, Selis net loss of 3.832 billion yuan, 2020 - 2021 losses of 1.729 billion yuan, 1.824 billion yuan, four years Selis has lost more than 7.3 billion yuan.

As for the reasons for the pre-loss of performance, Beiqi Blue Valley and Selis both said that, on the one hand, the rising cost of power battery and other parts caused by the rising price of upstream raw materials squeezed the profit space of the company; on the other hand, the sales volume of products did not reach the expectation, the scale effect was not obvious, the investment in fixed assets in the early stage was large, and the depreciation and amortization expenses were relatively high.

In addition, Dongfeng Motor Co., Ltd., Jianghuai Automobile, Jiangling Automobile, Zotye Automobile, Haima Automobile and Brilliance China further expanded their losses.

Dongfeng Motor shares in the automobile industry volume is not small, 2022 annual sales of 2.4645 million vehicles, covering passenger cars and commercial vehicles, but net profit is only 5.529 billion yuan, a year-on-year decline of 35.93%. In the passenger car market, Dongfeng Motor shares own Dongfeng Nissan, Dongfeng Honda, Shenlong three joint ventures, but the performance is not optimistic, among which Dongfeng Nissan sales fell 14.04% year-on-year, Dongfeng Honda fell 13.20%.

Haima Automobile is one of the listed automobile companies with the most serious performance decline, with a net loss of 1.571 billion yuan in 2022, with a year-on-year decline of 1059.77%; similarly, the whole vehicle business is in the recovery stage of Zhongtai Automobile, with a net loss of 908 million yuan in 2022, with a year-on-year decline of 28.38%.

According to the data of the National Bureau of Statistics, in 2022, the automobile manufacturing industry realized operating income of 928.999 million yuan, with a year-on-year growth of 6.8%, exceeding the overall growth rate of 41 major industrial industries by 0.9%; the total profit was 53.196 million yuan, with a year-on-year growth of 0.6%, 4.6% higher than the overall; and the profit margin of automobile manufacturing industry was 5.7%, 0.4% lower than that of 2021.

In terms of production and sales scale, thanks to the continuous growth of the new energy vehicle market and the continuous drive of the purchase tax halving policy for fuel vehicles in the second half of the year, China's automobile production and sales in 2022 were 27.021 million and 26.864 million respectively, with a slight increase of 3.4% and 2.1% year-on-year.

Although there are still challenges in the overall automobile industry, there are new impetus for the growth of multiple industries hidden in the financial reports of listed automobile enterprises: the rapid development of new energy vehicles promotes the rapid growth of automobile enterprises 'performance; the increase of R & D investment and the improvement of intelligent level drive the increase of single vehicle gross profit; the vertical integration of self-developed chips and batteries is accelerated to relieve the pressure of parts supply; automobile exports become the new increase of listed automobile enterprises, etc.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.