In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/06 Report--

Three months later, Reading, which once revealed that it had been forced to falsify its performance, once again appeared in public view.

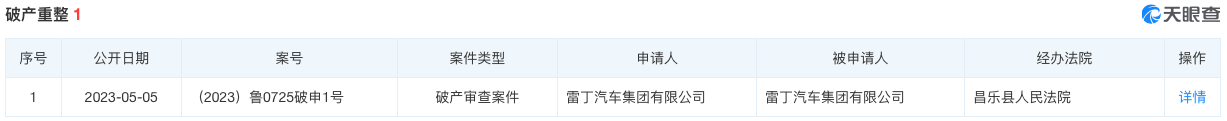

On May 5, "Automotive Industry concern" learned from Heaven that Reading Automobile Group Co., Ltd. added a piece of "bankruptcy reorganization" information, the case number is (2023) Lu 0725 Breshen No. 1, and the type of case is "bankruptcy examination case." both the applicant and the respondent are Reading Automobile Group Co., Ltd., and the handling court is the people's Court of Changle County, Weifang City, Shandong Province.

In response to the above news, Redding Automobile related sources told the media: "there is no response at present."

The so-called "bankruptcy review case" refers to the examination of whether the enterprise applying for bankruptcy is qualified for bankruptcy. The bankruptcy Law stipulates that the enterprise as a legal person cannot pay off its due debts, and the debtor cannot pay off its due debts, the creditor may apply to the people's court for reorganization or bankruptcy liquidation of the debtor. When an enterprise is unable to repay its due debts, its creditors have the right to apply to the court for reorganization or bankruptcy liquidation.

According to Tianyan check information, Reading Automobile Group Co., Ltd. is located in Weifang City, Shandong Province, and was established in October 2012. the legal representative is Wang Dejin, with a registered capital of 100 million yuan and paid-in capital of 100 million yuan. It is an enterprise mainly engaged in automobile manufacturing, which is controlled by Bidwen holding Group Co., Ltd. According to SkyEye, Li Guoxin, the sponsor of Reading Automobile Group Co., Ltd., stepped down as a legal person, executive director and general manager of Bidwen Holdings Group Co., Ltd in December 2020.

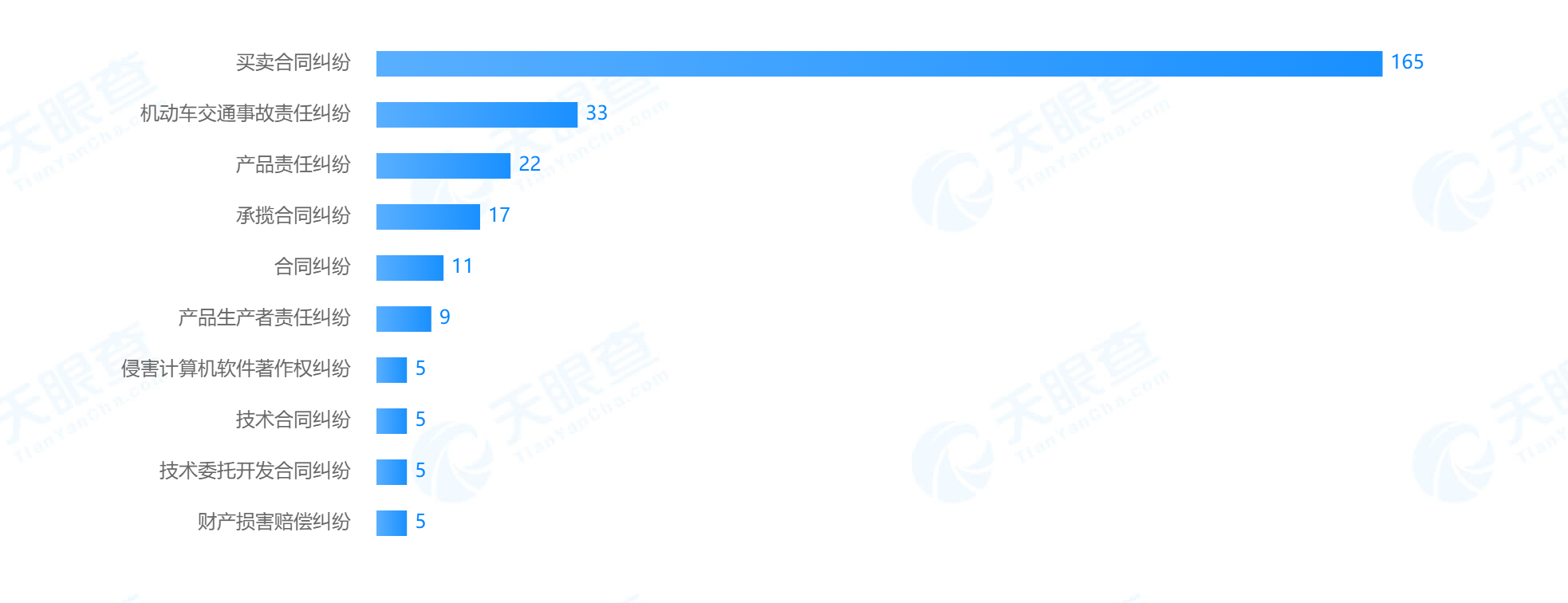

"Automotive Industry concern" found that Redding Motors was frequently involved in lawsuits in the past year when looking at the background information of "Reading Motor". At present, there are 822 judicial risks. Among them, the historical court notice is 171, and the hearing date is from May 1 to 30, 2023, a total of 21 announcements, the defendants include Reading Automobile Group Co., Ltd. And Bidwen holding Group Co., Ltd., most of the cases are sales contract disputes. Tianyan judicial analysis shows that of the 381 judicial interpretations involved in Redding, Redding accounted for 81.9% of the defendants; the cause of the case involved 165 sales contract disputes.

In addition, there are 190 legal proceedings, the total amount of the case is 206.2109203 million yuan, the total amount of the case is 129678.3 yuan for the plaintiff / appellant, 206.081242 million yuan for the defendant / appellee, 9 consumption restriction orders, 3 filing information, 4 final cases, the total amount of execution of the subject matter is 6.581055 yuan, the total amount of non-performance is 6577249 yuan, and the proportion of non-performance is 99.9%. There were 18 cases of execution, with a total amount of 40.938397 million yuan.

It should be noted that there are also a number of lawsuits in Reading's parent company, Bidwen Holdings Group Co., Ltd., including 27 court announcements, a total of 10 lawsuits from May 1 to 30, 2023, including private loan disputes, sales contract disputes, transport contract disputes, customized contract disputes, 44 legal proceedings, the total amount of the case is 174.6432321 million yuan, and the identity is 111190 yuan for the plaintiff / appellant. 174.5320421 million yuan for the defendant / appellee One consumption restriction order and one execution order with a total amount of 383448 yuan.

In February this year, an "Open letter from Jiangsu Dealers to the Joint investigation team of Reading Province and City" (hereinafter referred to as "Open letter"), signed and sealed by Reading car dealers, spread among Reading car dealers. The "open letter" listed many unreasonable operations of Reading cars in the course of operation, resulting in dealers losing millions of yuan. Read car dealers believe that, "Reading from the beginning is a fraud for the purpose of the company, every step of the operation is a well-planned scam." The dealers said, "the dealer is the victim of the Reading scam, and the Jiangsu dealer asked the joint investigation team to strictly investigate the matter and give them an explanation." But Reading did not respond at the time.

Reading is a domestic high-end independent research and development electric car brand, which entered the automobile manufacturing industry in 2008. At first, it mainly engaged in low-speed electric vehicles (commonly known as "Old Man Le"). According to the data, the sales of Reading cars reached 150000, 210000 and 285000 respectively from 2016 to 2018, topping the sales of low-speed electric vehicles for three consecutive years, with a market share of more than 30% and revenue of 12 billion yuan in 2018. In 2018, the Ministry of Industry and Information Technology and other six ministries jointly issued the "Circular on strengthening the Management of low-speed Electric vehicles". Since then, low-speed electric vehicles began to withdraw from the market. Under this background, Reading Motor has turned to enter the new energy vehicle market.

In April 2018, Reading Motor acquired the production qualification of new energy commercial vehicles and special vehicles through the acquisition of Shaanxi Qinxing Automobile Co., Ltd., and then invested 20 billion yuan to establish a reading Qinxing production base in Xianyang. In January 2019, Reading spent 1.45 billion yuan to acquire Sichuan Mustang Motor Co., Ltd. (hereinafter referred to as "Mustang") to obtain the production qualification of new energy vehicles, traditional oil passenger cars and passenger cars. Tianyan check information shows that Mustang is jointly owned by Reading Automobile Group Co., Ltd. and Bidwen holding Group Co., Ltd., of which Reading Motor is the major shareholder, with a shareholding ratio of 99.54%.

Through the above two acquisitions, Redding car manufacturing qualification was resolved. In 2019, Reading launched three I-series pure electric vehicles, including i3, i5 and i9, with a price range of 49800, 75800 and 115800, respectively. However, none of the three cars have been able to stir up waves in the car market.

Since then, Reading has launched a new car again, but the positioning of the new car has been changed to a subcompact, focusing on the A00-class pure electric minicar market. The Reading Mango, the first pure electric minicar with five doors and four seats, was launched in Changle in April 2021 and went on sale in May, with a price range of 2.98-54900 yuan, mainly competing with Hongguang MINIEV and Chery QQ ice cream. In December of the same year, the second model of the Reading mango series, the mango Pro, went on sale in March of the following year. The price range of the car is 3.98-56900 yuan, offering a total of 130km and 200km mileage, mainly competing with the Hongguang MINIEV macaron version.

With the advantage of high performance-to-price ratio, the mango series won 30, 000 orders in the first year of its launch. Retail data from the Federation of passengers show that Reading Mango sold 30467 units in 2021, making it into the top 15 of the list of new energy cars. This year, Reading also hit an ambitious sales target of 2 million vehicles by 2025. However, Redding's good days did not last long.

Since 2022, Reading has been frequently exposed to be caught in a negative storm. Among them, in May, the middle and senior levels of Reading began to apply for a voluntary pay cut, with a pay cut of 50% for middle-level cadres and 60% for vice ministers and ministers to tide over the crisis. In September, it was revealed that Reading was suspected of stopping production, and both upstream and downstream were launching a "debt recovery" against Reading. In October, Reading was listed as the person subject to enforcement by a number of courts for failing to meet its legal obligations on time. In December, Reading announced the completion of round A financing, with an amount of 3.2 billion yuan, but payments in arrears to dealers and related lawsuits also intensified, and it was even exposed that dealers in arrears could not get out of the car, and some dealers sought help online. In a dealer group chat, a "Reading arrears National Dealer payment Statistics" form showed that more than 30 registered dealers had accumulated arrears of more than 20 million yuan. But Reading responded to the media: "funds and production capacity are relatively tight this year, so the delivery of cars can only ensure key markets and key areas, which has indeed had an impact on some dealer partners." In order to get the car as soon as possible, some dealers can only choose to continue to trust Reading. A number of dealers have revealed to the media that under the circumstances that the dealer does not send the car and does not refund the car, the manufacturer still requires the dealer to continue to make money. Only if you continue to make a payment will you send the car.

At present, Reading's products include Reading Mango, Reading Mango Pro, Reading Mango Max and other models. New car traffic insurance data show that the cumulative sales of Reading cars in 2022 was 7042, down 47.29% from the same period last year, with a market share of only 0.13%. Of these, 7024 were sold in Reading Mango and 16 in Reading i3.

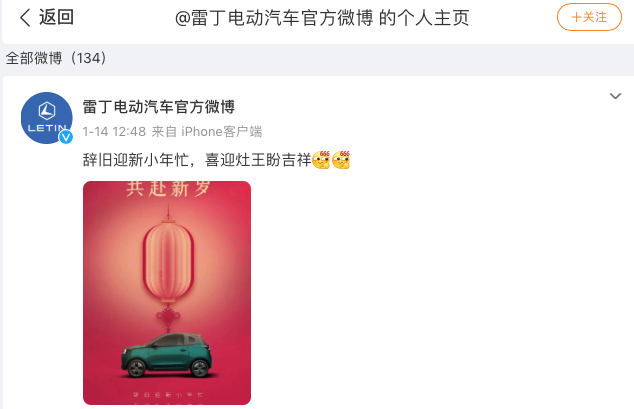

As of press time, the last update to Redding's official Wechat official account stayed on March 8, while the official Weibo stayed on January 14, while the official website could not be opened.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.