In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/09 Report--

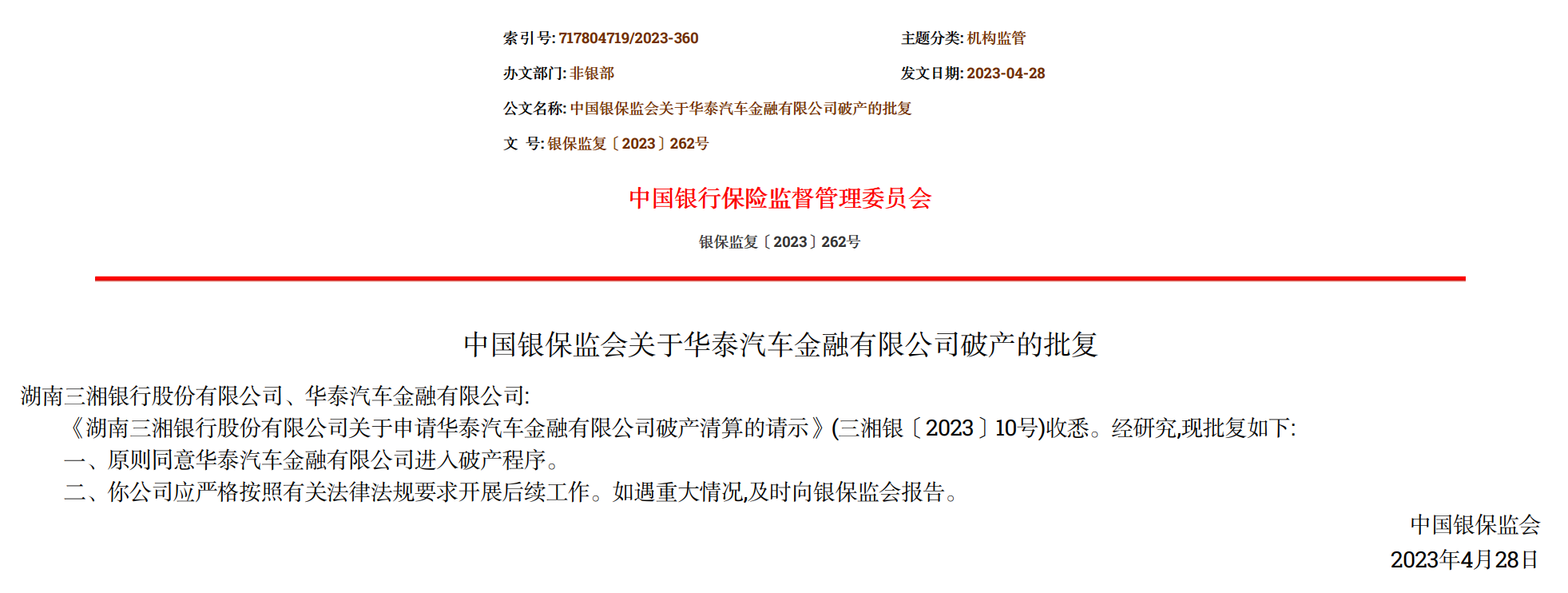

On May 6, the official website of the Bancassurance Regulatory Commission published the "reply on the bankruptcy of Huatai Auto Finance Co., Ltd." According to the reply, Huatai Auto Finance was filed for bankruptcy liquidation, which was filed by Hunan Sanxiang Bank. The CBIC said that it agreed in principle that Huatai Auto Finance should enter the bankruptcy procedure and required it to carry out follow-up work in strict accordance with the requirements of relevant laws and regulations.

Data show that Huatai Auto Finance is a non-bank financial institution specializing in auto finance business approved by the regulatory authorities. It officially opened in February 2015. At the beginning of its establishment, Huatai Automobile and Bohai Bank were the shares. Huatai Automobile holds 90% of the shares and is the largest shareholder. Later, because Huatai Automobile fell into a debt crisis, Huatai Auto Finance shares suffered a series of operations such as equity pledge and judicial auctions, and the shares also fell into the hands of the relevant debtors. 90% of the shares it once held have been transferred to: Kyushu Securities Co., Ltd. (40%), Xiamen International Bank Co., Ltd. (30%), Pacific Securities Co., Ltd. (20%). At present, Huatai Automobile has withdrawn from the list of shareholders of Huatai Auto Finance, and the largest shareholder is Kyushu Securities.

According to Huatai Auto Finance website, the company's main business scope includes: personal and institutional car purchase loans, inventory financing, spare parts financing and dealer shop financing and other auto finance business. After Huatai Automobile fell into the debt crisis, Huatai Auto Finance also had a large number of debt disputes, and repeatedly became the person who broke its promise and issued a "restriction order", with a total amount of 2.32 billion yuan currently being executed.

The bankruptcy of Huatai Auto Finance has something to do with the collapse of Huatai Automobile.

In 2000, Zhang Xiuwei acquired Shandong Rongcheng Automobile Factory from FAW Group and changed its name to Rongcheng Huatai Automobile Co., Ltd., which was the starting point of Huatai Automobile. In 2005, Huatai Motor reached an agreement with Hyundai Motor of South Korea to win the domestic qualification of "Santa Fe". Huatai Motor quickly became popular in the car circle relying on Hyundai's technology. In the same year, Huatai Automobile won more than 6000 mu of land in Ordos to establish a production base at a price of 60 million yuan. This year, Zhang Xiuhei also appeared on the Forbes China Rich list.

The prosperity of Huatai Motor has undoubtedly relied on the dividend of the rapid development of the domestic automobile market and the endorsement of Korean Hyundai Motor, but since then Huatai Automobile, which does not want to make progress, does not have its own core technology. Hyundai automobile resources are gradually tilted to the joint venture Beijing Hyundai, Huatai Motor is naturally marginalized.

At that time, Huatai was faced with two tasks, one was to complete the research and development of independent technology, and the other was to enter the car market. The two tasks overlap to some extent, but they are not easy to implement. It was not until 2010 that Huatai's first autonomous car, the Santa Fe C9, was launched, and in the same year, the autonomous car Huatai B11 came off the line.

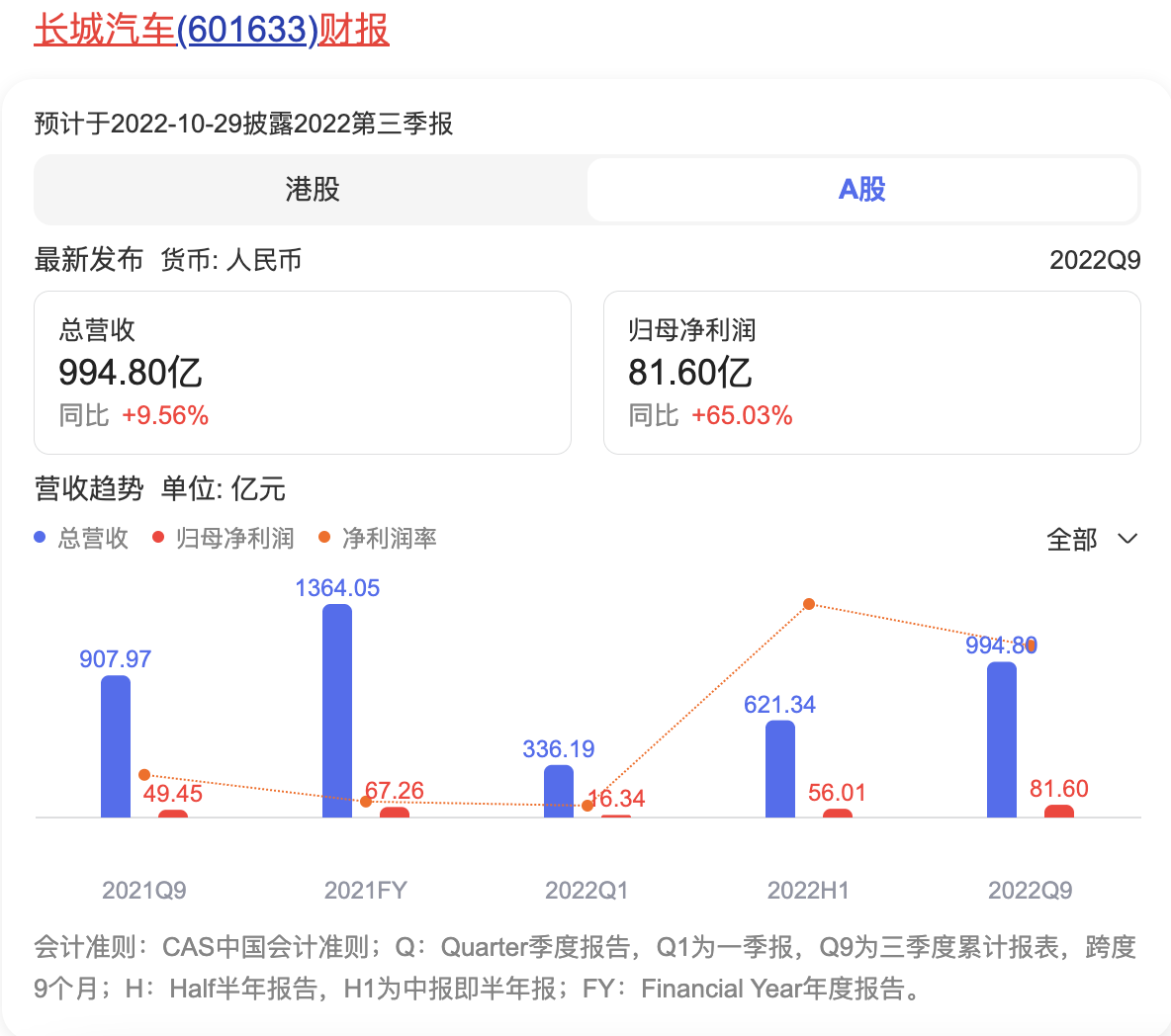

It was a decade of rapid automobile growth in China, and domestic independent brands Chery, Geely, Chang'an, Great Wall and so on rose one after another, but due to the lack of product spectrum and technical supplies, Huatai fell behind in the fierce market competition, and in 2011 even exposed a sales fraud scandal. At one time, the CAA did not accept the data reported by Huatai Automobile, but in order to maintain the integrity of the data, it replaced its sales data with "0".

In the following years, Huatai's performance has been lukewarm. Like almost all independent brands at that time, Huatai was well aware of its technological shortcomings and made up for it through acquisitions and other means, but the technical "wide net" layout failed to turn it around.

According to the relevant data of Huatai Automobile, since 2006, the company has introduced the development technology of diesel engine, gasoline engine and automatic transmission, and set up supporting factories. In addition, Huatai was involved in the acquisition of Swedish carmaker Saab in 2011, with the same focus on its technology, but the deal ended unexpectedly a few days after it was struck.

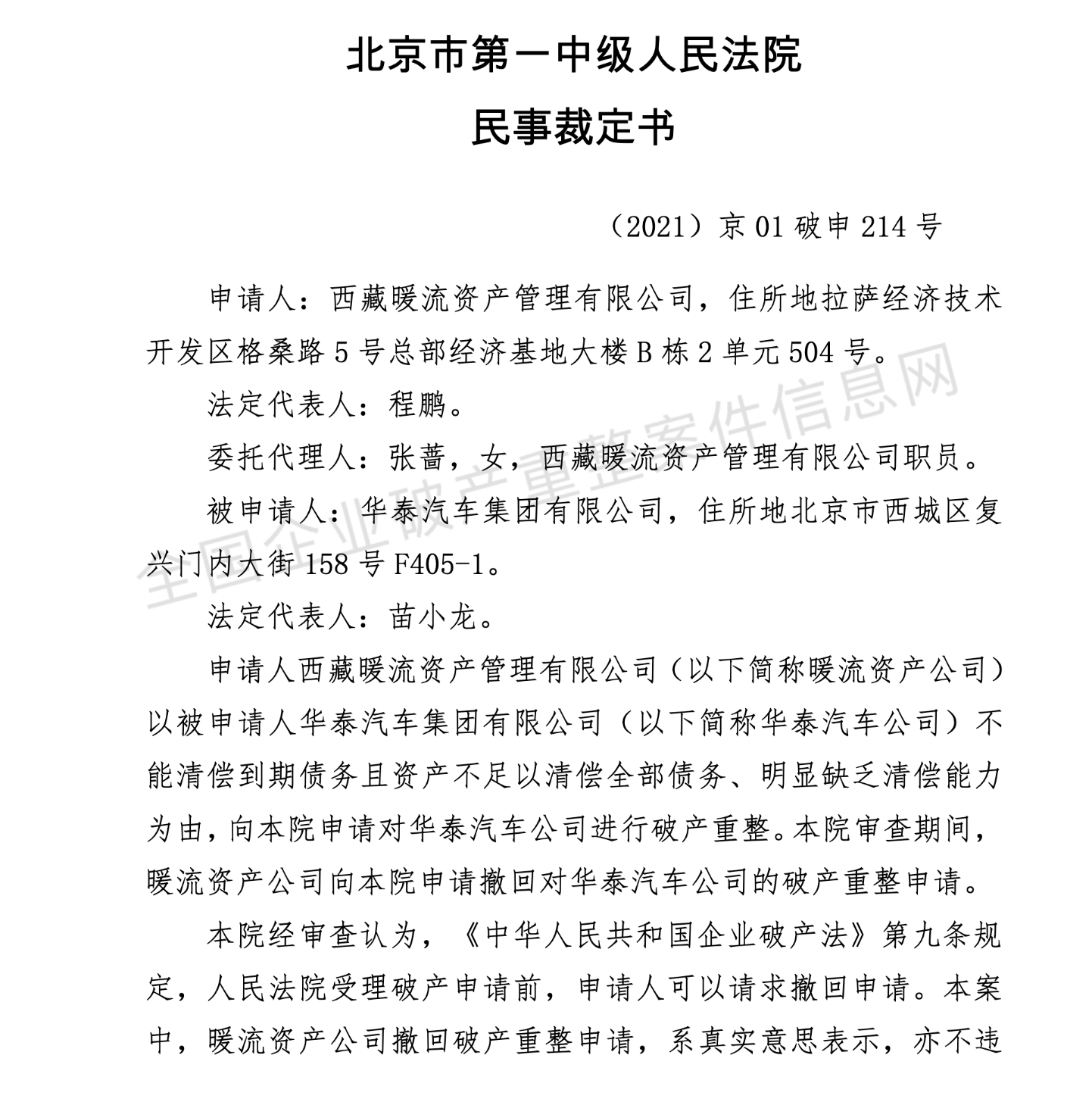

Tianyan investigation showed that Huatai Motor was involved in 413 cases of various types, of which 99% were defendants. Huatai Motor received a total of 129 restrictions on consumption orders, a total of 23 times were listed as unfaithful executors, all failed to perform, 209 times in history, with a total execution target of 3.138 billion yuan. In addition, Huatai Motor was twice filed for bankruptcy reorganization review, namely Xizang warm current Asset Management Co., Ltd. and China Europe Shengshi Asset Management (Shanghai) Co., Ltd., but both companies withdrew their bankruptcy liquidation applications for Huatai Motor during the period of court review.

Although Huatai Motor has not declared bankruptcy liquidation, it is actually no different from bankruptcy. Since 2019, Huatai Automobile has been successively reported to be in arrears of employees' wages, the departure of R & D personnel, the suspension of production base, debt default and other news, and its cooperation with R & F Real Estate finally fell through. Due to the shortage of funds, Huatai Motor and many of its companies were sued by debtors, and related shares also frequently landed at judicial auctions.

In September 2022, ST Dawn announced that Zhang Xiugen, the actual controller of the company, was detained by the Tianjin Binhai New area Public Security Bureau on July 5, 2022 on suspicion of "illegal transfer and reselling of land use rights." Zhang Xiugen was arrested on August 10, 2022 for the above-mentioned transfer of land use rights.

In November 2022, ST Dawn announced again that the Tianjin Binhai New area Public Security Bureau was investigating the case of illegal transfer and resale of land use rights, and decided to release the suspect Zhang Xiugen on bail pending trial, starting from November 9, 2022.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.