In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/10 Report--

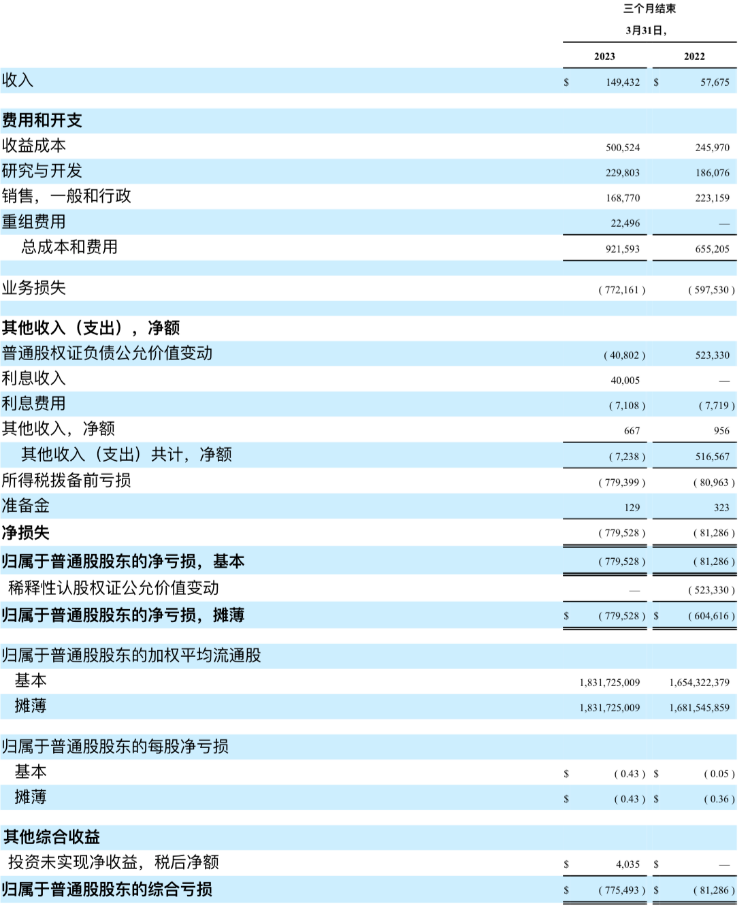

On May 8th, Lucid, the new force of American car building, announced its results for the first quarter of 2023. According to the financial report, the first-quarter revenue was 149.4 million US dollars, although the first-quarter revenue increased compared with the same period last year, but it was lower than the earlier market forecast of 197.8 million US dollars, compared with 57.675 million US dollars in the same period last year. Lucid posted a net loss of $779.5 million in the first quarter, a nearly tenfold increase over the same period last year, when the net loss was $81.28 million. Based on Lucid's total sales of 1406 cars in the first quarter, it loses $554000, or about 3.8386 million yuan, for each car it sells.

As of the first quarter, Lucid had cash reserves of $3.4 billion and total liquidity of $4.1 billion. At the earnings meeting, Sherry House, Lucid's chief financial officer, said the money would only last until the first half of next year. Or affected by the earnings data, as of press time, Lucid shares closed at $7.28, down 5.58%.

Judging from the cash reserves issued by Lucid, the current situation of Lucid is not optimistic. In order to reduce the company's operating costs, Lucid also had to start layoffs in March to cut costs. In March, according to media reports, Lucid plans to cut 1300 jobs in the coming months, covering the company's senior executives, with a layoff rate of 18%.

Lucid was founded in 2007 by Xie Jiapeng (Bernard Tse), a former vice president and director of Tesla, and Wen Shiming (Sam Weng), a former Oracle executive, formerly known as Atieva. In October 2016, Atieva changed its name to Lucid Motors and officially announced its entry into the luxury electric car market, and launched its first model, the Lucid Air, in the same year, but it was unable to achieve mass production due to lack of funds.

Lucid received a strategic investment of US $1 billion from the Saudi Arabian Public Investment Fund (PIF) in September 2018, followed by the construction of an Arizona plant in the United States and a resumption of the Lucid Air mass production program, which was completed and used to produce Lucid Air models in December 2019. In September 2020, Lucid launched its first production model, the Lucid Air Pure, with a starting price of $87400 for models such as the Standard Tesla Model S. According to official sources, the number of Lucid Air bookings has reached 30, 000.

Because the core characters are all from Tesla, Lucid has its own halo and has attracted much attention from the market since its establishment. It is even praised as one of the three new car-building forces in the United States and the strongest opponent of Tesla. After all, in addition to Xie Jiapeng, the Lucid team, Eric Bach, vice president of hardware engineering, Peter Hasenkamp, vice president of supply chain management, and Doreen Allen, sales director, are all from Tesla. However, the development of Lucid is not as good as that of Tesla, and there is even a big gap. As for Lucid, Mr Tesla Musk has said bluntly that unless Lucid can slash costs, it will go bankrupt.

2023 is a critical year for Lucid, and if the current loss is not reversed, it means that 2024 will not have enough money to sustain it. Lucid had expected to receive more than 28000 orders in 2023, but in the latest announcement, Lucid plans to produce more than 10, 000 cars this year. At present, Lucid does not provide the latest order quantity. However, LucidCEO Peter Rawlinson said: a company-wide effort will be made to enable Lucid to shift to higher production if market conditions permit.

Earlier, Lucid said it planned to enter the Chinese market in 2023. In December 2022, Lucid also posted job postings on Chinese social platforms for 14 positions in digital information, hardware engineering, law, logistics management, supply chain and retail. However, from the current domestic market analysis, it is not easy for Lucid to enter the Chinese market, because China is the world's largest new energy passenger car market, and the competition among local car companies is already fierce.

Taking the sales data of the top three companies in new energy vehicle sales last year as a reference, BYD, which ranked first in new energy vehicle sales in 2022, sold 1.7999 million new energy vehicles, accounting for 31.7% of domestic new energy sales. In second place is SAIC GM Wuling, with annual sales of 442100 vehicles and Tesla's annual sales of 439800 vehicles in China. That's a far cry from Lucid's sales last year, when Lucid delivered just 4369 vehicles. In addition, there is no shortage of new car-building forces in China, and Lucid will also face competition from local new power car companies such as Wei Xiaoli. Lucid is currently selling a single product, only the Lucid Air model. At this point, it may not be a good idea to enter the Chinese market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.